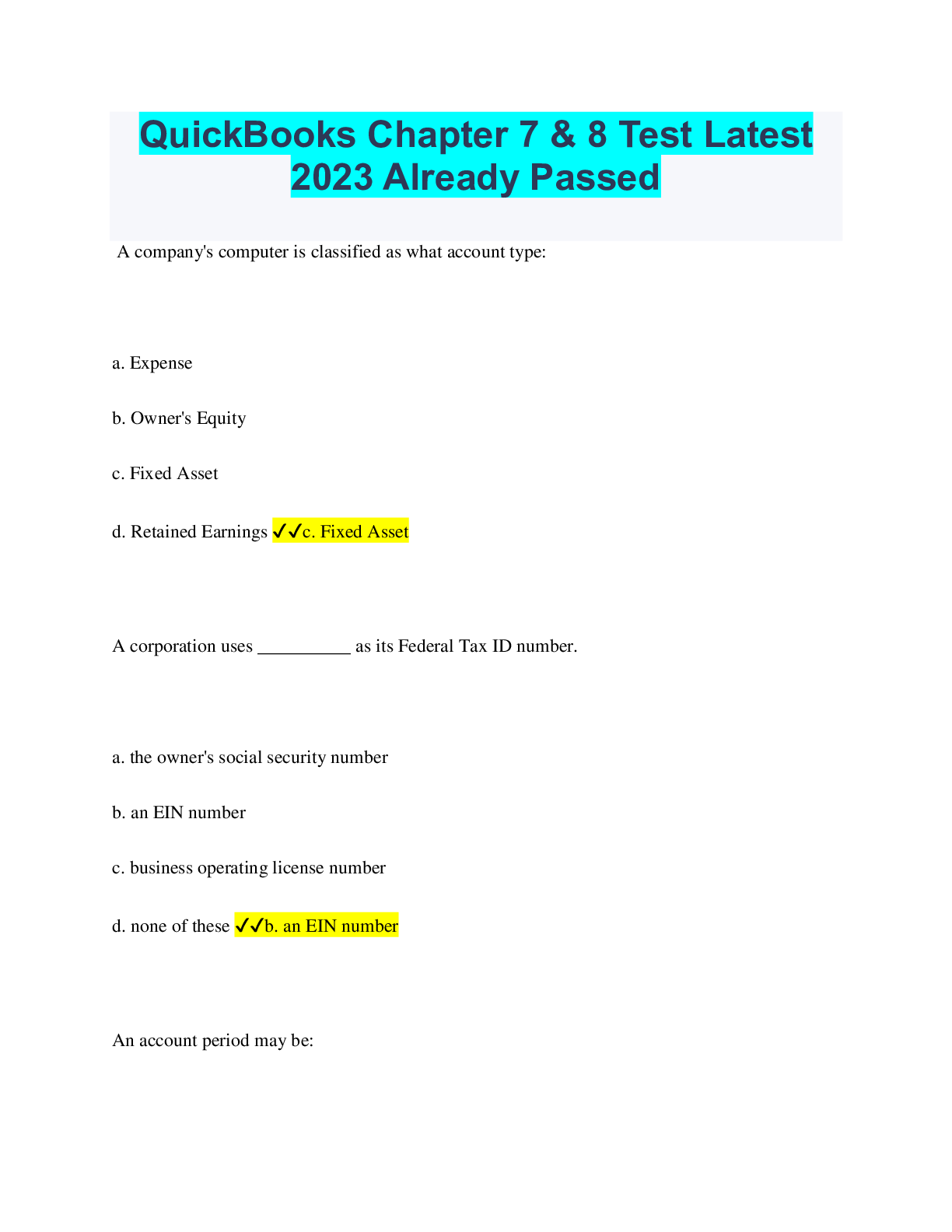

QuickBooks Chapter 7 & 8 Test Latest

2023 Already Passed

A company's computer is classified as what account type:

a. Expense

b. Owner's Equity

c. Fixed Asset

d. Retained Earnings ✔✔c. Fixed Asset

A corporation use

...

QuickBooks Chapter 7 & 8 Test Latest

2023 Already Passed

A company's computer is classified as what account type:

a. Expense

b. Owner's Equity

c. Fixed Asset

d. Retained Earnings ✔✔c. Fixed Asset

A corporation uses __________ as its Federal Tax ID number.

a. the owner's social security number

b. an EIN number

c. business operating license number

d. none of these ✔✔b. an EIN number

An account period may be:

a. One quarter

b. One month

c. One year

d. All of these ✔✔d. All of these

Examples of management reports for internal decision making include all of the following

except:

a. 1120S Report

b. Cash Budget

c. Cash Forecast

d. Accounts Receivable Aging Summary ✔✔a. 1120S Report

In the Easy Step Interview, you must identify:

a. Type of Industry

b. Company name

c. Company address

d. All of these ✔✔d. All of these

Income tax reports in QuickBooks include all of the following except:

a. Income Tax Preparation

report

b. Income Tax Detail report

c. Income Tax Summary report

d. Income Tax Mapping report ✔✔d. Income Tax Mapping report

Providing information to external users' decision making is the purpose of which of the

following?

a. Management Reports

b. Tax forms

c. Financial statements

d. Inventory reports ✔✔c. Financial statements

Providing information to internal users' decision making is the purpose of which of the

following?

a. Management Reports

b. Tax forms

c. Financial statements

d. Vendor list ✔✔a. Management Reports

Sales are recorded under cash basis accounting when:

a. The goods or services are provided regardless of whether the cash is collected from the

customers

b. The bookkeeper has time to record the transactions

c. The cash is collected from the customers

d. The costs are incurred to earn the revenue ✔✔c. The cash is collected from the customers

Sole Proprietorships use __________ as its Federal Tax ID number.

a. the owner's social security number

b. an EIN number

c. business operating license number

d. none of these ✔✔a. the owner's social security number

The Balance Sheet lists:

a. Assets, Liabilities, and Owner's Equity

b. Gains, Losses, and Net Income

c. Operating, Investing, and Financing Activity

d. Income, Expenses, and Liabilities ✔✔a. Assets, Liabilities, and Owner's Equity

The Customer List contains information about:

a. The quantity of non-inventory parts on hand

b. The credit rating of the vendors

c. Vendors from whom the company buys products and services

d. Customer addresses, contacts and phone numbers ✔✔d. Customer addresses, contacts and

phone numbers

The Doing Business As name identifies a company for:

a. Bank accounts

b. Sales

c. Patents

d. None of these ✔✔b. Sales

The Income Statement lists:

a. Net Income and Owner's

Equity

b. Income and Expenses

c. Assets and Liabilities

d. Assets and Expenses ✔✔b. Income and Expenses

The Legal Name identifies a company for:

a. Advertising

b. Sales

c. Patents

d. All of these ✔✔c. Patents

The order of the steps in the accounting cycle includes:

a. Adjusted trial balance, financial reports, adjusting entries, trial balance

b. Adjusted trial balance, adjusting entries, financial reports, trial balance

c. Trial balance, adjusting entries, adjusted trial balance, financial reports

d. Trial balance, financial reports, adjusting entries, adjusted trial balance ✔✔c. Trial balance,

adjusting entries, adjusted trial balance, financial reports

The Profit & Loss Statement lists:

a. Assets and Expenses

b. Assets and Liabilities

c. Net Income and Owner's Equity

d. Income and Expenses ✔✔d. Income and Expenses

The QuickBooks Setup window allows you to enter __________ information.

a. Vendor

b. Customer

c. Banking

d. All of these ✔✔d. All of these

The Statement of Cash Flows lists:

a. Operating, Investing, and Financing Activity

b. Assets, Liabilities, and Owner's Equity

c. Income, Expenses, and Liabilities

d. Gains, Losses, and Net Income ✔✔a. Operating, Investing, and Financing Activity

The steps to set up a new service company in QuickBooks with no employees are:

a. Easy Step Interview > Customer List > Vendor List > Item List

b. Setup Chart of Accounts > Easy Step Interview > Customer List > Vendor List >

Item List

c. Easy Step Interview > Customize Chart of Accounts > Customer List > Vendor List

> Item List

d. Easy Step Interview > Customer List > Vendor List > Item List > Customize

Chart of Accounts ✔✔c. Easy Step Interview > Customize Chart of Accounts > Customer

List > Vendor List > Item List

The Trial Balance:

a. Lists all the company's accounts and ending balances

b. Is printed before and after making adjustments

c. Verifies the accounting system balances

d. All of these ✔✔d. All of these

The Vendor List contains information about:

a. Addresses, contacts and phone numbers of customers

b. Addresses, contacts and phone numbers for suppliers

c. Quantities and prices of items on hand

d. All of these ✔✔b. Addresses, contacts and phone numbers for suppliers

To complete company setup you must complete all of the following except:

a. Add customers

b. Add payroll forms

c. Add products and services as items

d. Add vendors ✔✔b. Add payroll forms

To create a new company data file in QuickBooks, use the:

a. Company menu > New Company

b. Company section of the Home page > New Company

c. File menu > Open or Copy Company

d. File menu > New Company ✔✔d. File menu > New Company

To display account numbers in the chart of accounts choose:

a. Edit > Options

b. Edit > Preferences

c. Company > Financial

d. Company > Accounts ✔✔b. Edit > Preferences

To export reports to Excel:

a. With the Report window open, click the Excel button

b. With the Report window open, click the Export button

c. With the Report window open, click the Print button

d. All of these ✔✔b. With the Report window open, click the Export button

To print the General Ledger:

a. Select Chart of Accounts icon > Print Report

b. From the Company section of the Home page > select Trial Balance icon

c. Select Report Center > Accountant & Taxes, General Ledger

d. Select Company Center > Print General Ledger ✔✔c. Select Report Center >

Accountant & Taxes, General Ledger

To record adjusting journal entries in QuickBooks, select:

a. Company Center, Journal Entry icon

b. Accountant menu, Make General Journal Entries

c. Banking section of the Home page, Journal Entry icon

d. Company section of the Home page, Journal Entry icon ✔✔b. Accountant menu, Make

General Journal Entries

What information does the Balance Sheet provide?

a. A summary of cash inflows and outflows over a specific time period

b. A company's financial position on a specific date

c. Sales and expenses for a specific time period

d. None of these ✔✔b. A company's financial position on a specific date

What is an asset?

a. What is left after the liabilities are satisfied

b. What a company owns

c. What a company owes

d. None of these ✔✔b. What a company owns

What is owner's equity?

a. What a company owes

b. What is left after the liabilities are satisfied

c. What a company owns

d. None of these ✔✔b. What is left after the liabilities are satisfied

What options do you have when adding the "People You Do Business With" section of the

QuickBooks Setup Window:

a. Importing from Outlook

b. Importing from Yahoo or Gmail

c. Pasting from Excel or entering manually

d. All of these ✔✔d. All of these

When setting up a new company, QuickBooks automatically creates:

a. Chart of Accounts

b. Vendor List

c. Customer List

d. None of these ✔✔a. Chart of Accounts

Which icon does not appear in the Vendors section for service companies that do not sell

inventory?

a. Receive Inventory

b. Pay Bills

c. Enter Bills

d. All of these ✔✔a. Receive Inventory

Which of the following determines if the account appears classified properly on the balance

sheet?

a. Tax-Mapping Line

b. Account Number

c. Item Number

d. None of these ✔✔b. Account Number

Which one of the following classifications is found on the Statement of Cash Flows?

a. Cash Flows from Financing Activities

b. Cash Flows from Purchasing Activities

c. Cash Flows from Owner's Activities

d. Cash Flows from Selling Activities ✔✔a. Cash Flows from Financing Activities

Which tax form would you select for a Corporation?

a. Form 1120

b. Form 1120S

c. Form 1065

d. Form 1040S ✔✔a. Form 1120

Which tax form would you select for a Partnership?

a. Form 1120

b. Form 1120S

c. Form 1065

d. Form 1040S ✔✔c. Form 1065

Which tax form would you select for a Subchapter S corporation?

a. Form 1120

b. Form 1120S

c. Form 1040

d. Form 1040S ✔✔b. Form 1120S

[Show More]