A Level Business H431/02 The UK business environment Resource Booklet OCT 2021

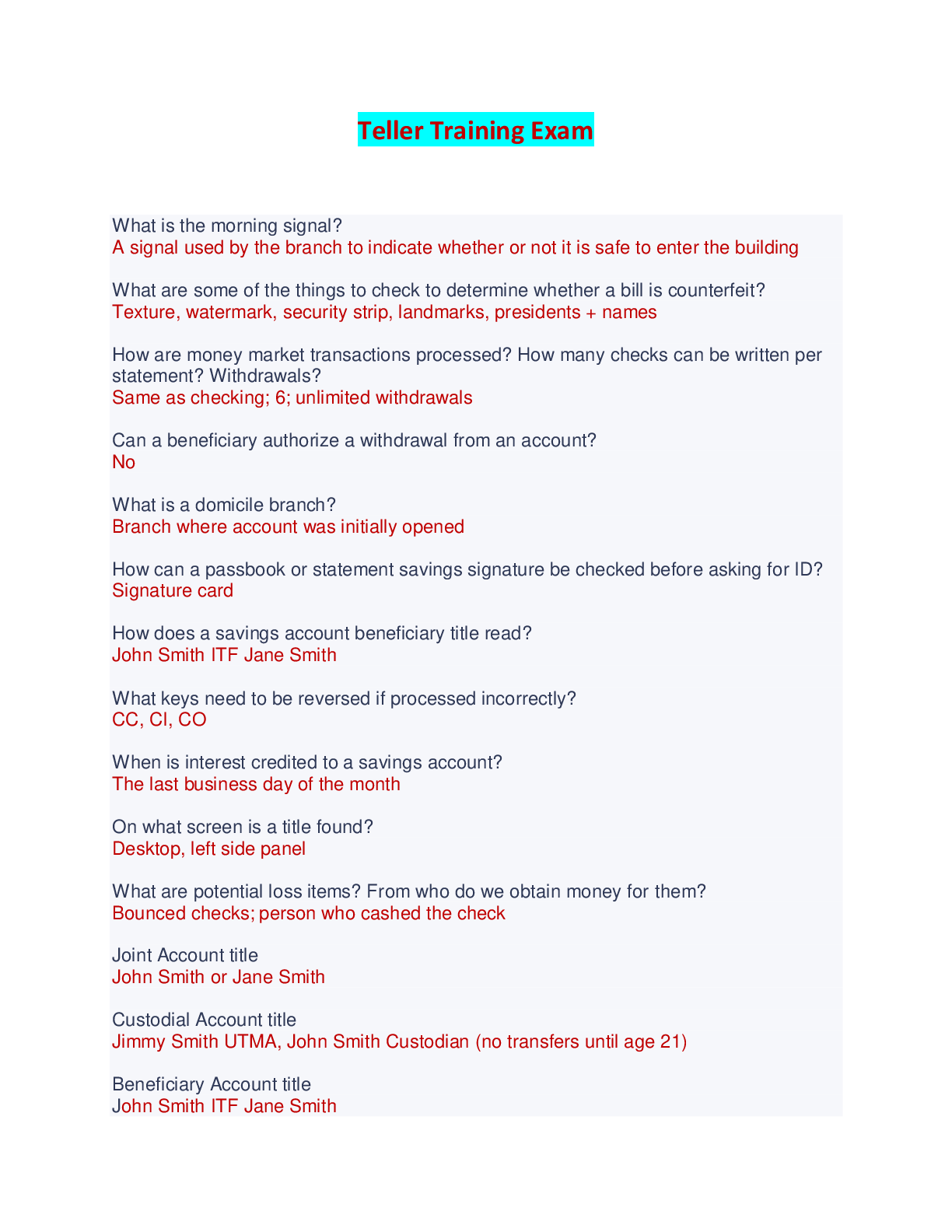

Teller Training Exam - Answered with Complete Solutions What is the morning signal? A signal used by the branch to indicate whether or not it is safe to enter the building What are some of the things ... to check to determine whether a bill is counterfeit? Texture, watermark, security strip, landmarks, presidents + names How are money market transactions processed? How many checks can be written per statement? Withdrawals? Same as checking; 6; unlimited withdrawals Can a beneficiary authorize a withdrawal from an account? No What is a domicile branch? Branch where account was initially opened How can a passbook or statement savings signature be checked before asking for ID? Signature card How does a savings account beneficiary title read? John Smith ITF Jane Smith What keys need to be reversed if processed incorrectly? CC, CI, CO When is interest credited to a savings account? The last business day of the month On what screen is a title found? Desktop, left side panel What are potential loss items? From who do we obtain money for them? Bounced checks; person who cashed the check Joint Account title John Smith or Jane Smith Custodial Account title Jimmy Smith UTMA, John Smith Custodian (no transfers until age 21) Beneficiary Account title John Smith ITF Jane Smith POA Account title (Power of Attorney) John Smith, Jane Smith (POA) legal rights to account Business Account title John Smith DBA Smith Corporation Estate Account title Estate of Mary Smith, John Smith, Executor Transfer procedure on desktop Transfer option, then application transfer Situations that require OFAC Non-customer cashing check on us $1,000+, Trustco customer purchasing a bank check $5,000 or more What is important to verify before stamping savings bonds? Always be sure customer knows what the redemption value is first Third party check check made payable to one person, but another person cashes it with "pay to the order of" as endorsement; third party MUST be a Trustco customer Double endorsed check Made payable to two people, linked by "and"; both individuals must be present with ID to cash check; can be deposited in joint account Annual Percentage Yield (APY) amount of interest account accrues (bank pays customer) Annual Percentage Rate (APR) annual fees charged by the bank (customer pays bank) Vacation club/Holiday club accounts Duration is 50 weeks, minimum debit per week $5 Hometown student checking ages 15-23; parent needed for all under 18 Currency Transaction Report (CTR) Used for any cash transaction in excess of $10,000 in a single business day Suspicious Activity Report (SAR) Used for unusual and suspicious transactions Information needed for a customer cashing a check not on us customer account #, available balance, date [Show More]

Last updated: 2 years ago

Preview 1 out of 7 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Can't find what you want? Try our AI powered Search

Connected school, study & course

About the document

Uploaded On

Aug 09, 2023

Number of pages

7

Written in

All

This document has been written for:

Uploaded

Aug 09, 2023

Downloads

0

Views

118

Scholarfriends.com Online Platform by Browsegrades Inc. 651N South Broad St, Middletown DE. United States.

We're available through e-mail, Twitter, Facebook, and live chat.

FAQ

Questions? Leave a message!

Copyright © Scholarfriends · High quality services·