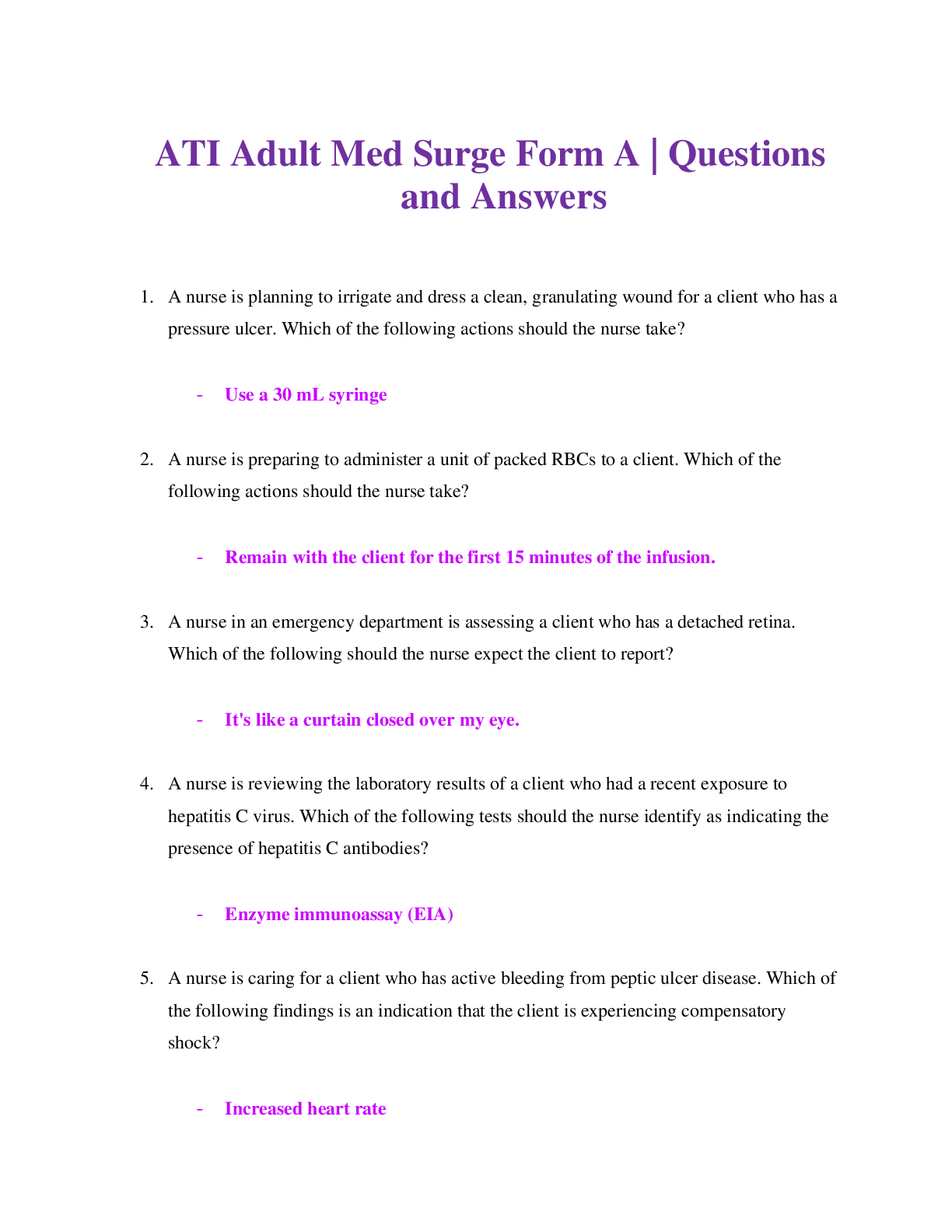

Business > CASE SOLUTIONS > Case Notes & Answer for Midland Energy Resources, Inc., by Timothy Luehrman & Joel Heilprin (All)

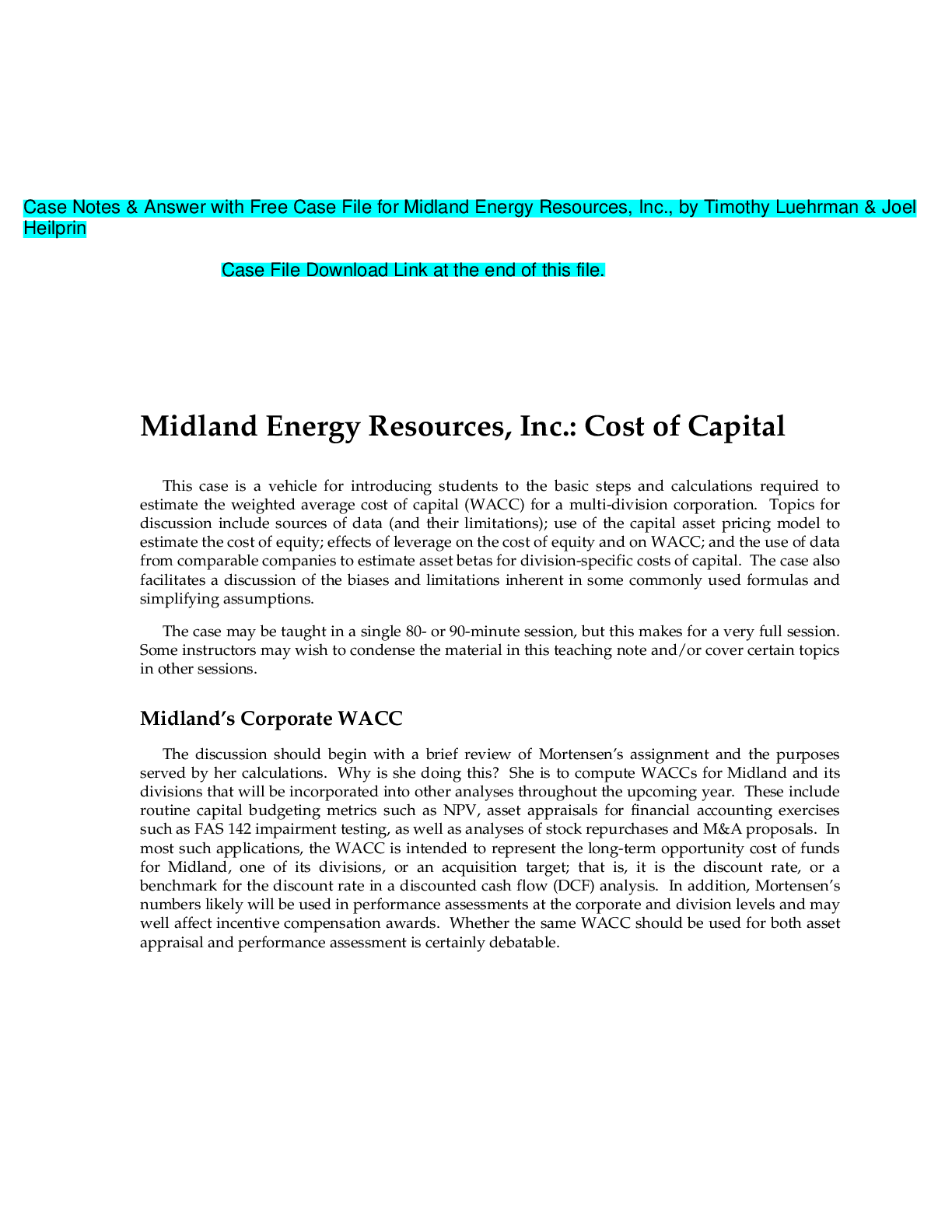

Case Notes & Answer for Midland Energy Resources, Inc., by Timothy Luehrman & Joel Heilprin

Document Content and Description Below

he senior vice president of project finance for a global oil and gas company must determine the weighted average cost of capital for the company as a whole and each of its divisions as part of the ann ... ual capital budgeting process. The case uses comparable companies to estimate asset betas for each operating division, and employs the Capital Asset Pricing Model to determine the cost of equity. Students are required to un-lever and re-lever betas and, choose an appropriate risk-free rate, and compute costs of debt and equity. he senior vice president of project finance for a global oil and gas company must determine the weighted average cost of capital for the company as a whole and each of its divisions as part of the annual capital budgeting process. The case uses comparable companies to estimate asset betas for each operating division, and employs the Capital Asset Pricing Model to determine the cost of equity. Students are required to un-lever and re-lever betas and, choose an appropriate risk-free rate, and compute costs of debt and equity. [Show More]

Last updated: 2 years ago

Preview 1 out of 19 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$15.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 11, 2023

Number of pages

19

Written in

All

Additional information

This document has been written for:

Uploaded

Aug 11, 2023

Downloads

0

Views

107