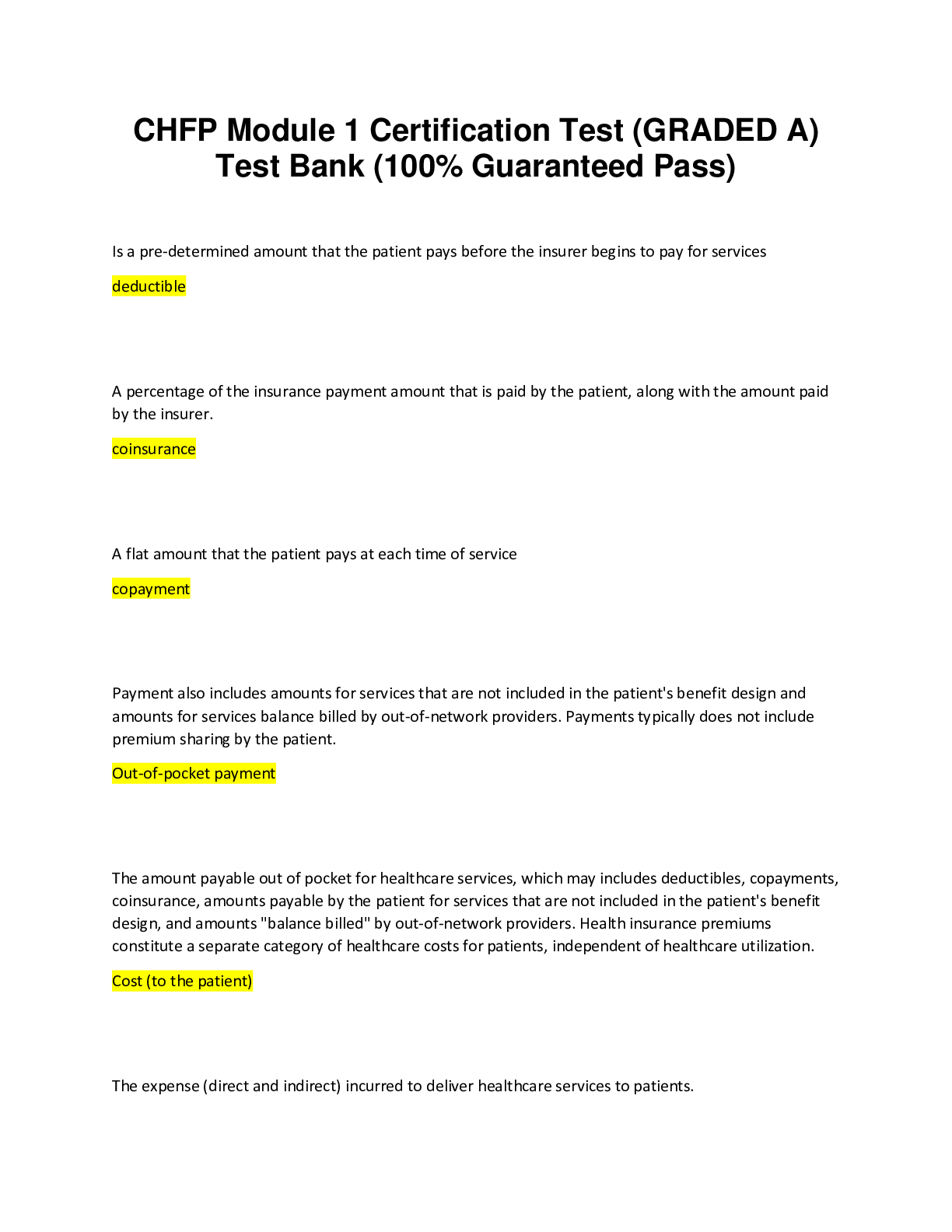

healthcare > EXAM > CHFP Module 1 Certification Test (GRADED A) Test Bank (100% Guaranteed Pass) (All)

CHFP Module 1 Certification Test (GRADED A) Test Bank (100% Guaranteed Pass)

Document Content and Description Below