Taxation of Business Entities Questions - Answered with Rationales

Document Content and Description Below

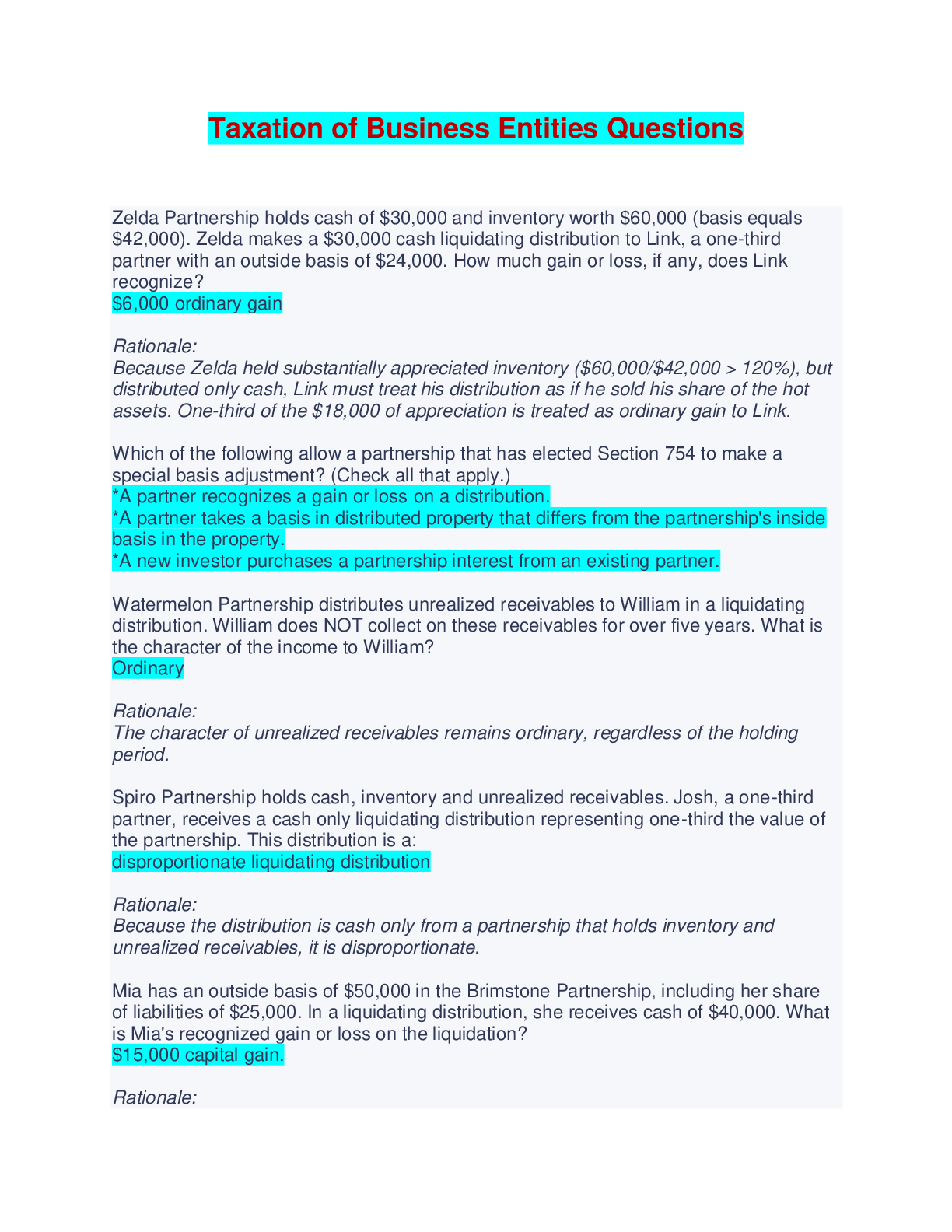

Taxation of Business Entities Questions - Answered with Rationales Zelda Partnership holds cash of $30,000 and inventory worth $60,000 (basis equals $42,000). Zelda makes a $30,000 cash liquidating ... distribution to Link, a one-third partner with an outside basis of $24,000. How much gain or loss, if any, does Link recognize? $6,000 ordinary gain Rationale: Because Zelda held substantially appreciated inventory ($60,000/$42,000 > 120%), but distributed only cash, Link must treat his distribution as if he sold his share of the hot assets. One-third of the $18,000 of appreciation is treated as ordinary gain to Link. Which of the following allow a partnership that has elected Section 754 to make a special basis adjustment? (Check all that apply.) *A partner recognizes a gain or loss on a distribution. *A partner takes a basis in distributed property that differs from the partnership's inside basis in the property. *A new investor purchases a partnership interest from an existing partner. Watermelon Partnership distributes unrealized receivables to William in a liquidating distribution. William does NOT collect on these receivables for over five years. What is the character of the income to William? Ordinary Rationale: The character of unrealized receivables remains ordinary, regardless of the holding period. Spiro Partnership holds cash, inventory and unrealized receivables. Josh, a one-third partner, receives a cash only liquidating distribution representing one-third the value of the partnership. This distribution is a: disproportionate liquidating distribution Rationale: Because the distribution is cash only from a partnership that holds inventory and unrealized receivables, it is disproportionate. Mia has an outside basis of $50,000 in the Brimstone Partnership, including her share of liabilities of $25,000. In a liquidating distribution, she receives cash of $40,000. What is Mia's recognized gain or loss on the liquidation? $15,000 capital gain. Rationale: Mia's basis after adjusting for the debt relief is $25,000. She received cash of $40,000 generating a $15,000 gain. Under which of the following circumstances MUST a partnership make a special basis adjustment? (Check all that apply.) *The partnership has a substantial basis reduction as a result of a distribution. *The partnership has a substantial built-in loss at the time of the sale of a partnership interest. Gerald's interest (outside basis = $75,000) in the Nixon Partnership is liquidated, and Nixon distributes $62,000 cash to Gerald. What is Gerald's gain or loss (if any) on the liquidating distribution? $13,000 loss Rationale: Because Gerald receives only money and his outside basis ($75,000) exceeds the sum of the adjusted bases of distributed assets ($62,000), Gerald recognizes a capital loss of $13,000 ($75,000 - $62,000). General Partnership distributes investments that it has held for two years to Major, an individual partner in a liquidating distribution. What is the character of the investments to Major? Capital Rationale: Generally, the character of distributed property is determined by the manner in which the distributee partner holds the property. Stump Grinders Partnership holds cash and inventory (basis $50,000, market value = $55,000) and makes a liquidating distribution of only cash to Ginny. This distribution is a proportionate distribution. Rationale: The inventory is NOT more than 120% appreciated; therefore, Ginny did not receive less than her fair share of hot assets (not substantially appreciated) and the distribution is proportionate. Match the liquidating distribution condition with the tax result. Gain: Partnership distribution of money exceeds partner's outside basis Loss: Partnership distributes only money or hot assets and the partner's outside basis is greater than the bases of the distributed property Macrohard Partnership distributes some of its software inventory to partner Jill in a liquidating distribution. Jill intends to use the software for personal use and does so for seven years. After that time, Jill sells the software at a gain. What is the character of the gain to Jill? Capital Rationale: Because Jill uses the software as a capital asset for more than five years, the taint of ordinary treatment is lifted. Belinda receives an operating distribution from the GoGo Partnership. Her basis just prior to the distribution is $100,000. Which of the following distributions is likely to result in a gain to Belinda? Distribution of $150,000 cash Rationale: Gain will be recognized only when any cash distributed exceeds the partner's outside basis in the partnership immediately prior to the distribution. Which of the following methods is an acceptable way for partners to allocate income or loss when their interests change during the year? (Check all that apply.) Treat the change in interest as an interim closing of the books Prorate income or loss based on the partners' varying interests The expected future tax recovery from a taxable deductible difference is recognized as a: deferred tax liability The two steps in the process to determine if a tax benefit can be recognized are (in order): recognition and measurement The current income tax expense is calculated using the______ tax law. Enacted True or false: A company must consider ONLY negative evidence in determining whether a valuation allowance is needed. False----a company needs to consider negative and positive evidence in determining whether a valuation allowance is needed. Topham, Inc. has pretax income of $100,000 for the current year. Included in that amount is $3,000 of tax-exempt income, $8,000 of meals expenses, and $10,000 of depreciation expense (depreciation is $15,000 under tax rules). Topham also paid $21,000 in estimated income tax payments during the year. After adjusting for permanent items (only), Topham's taxable income is: $101,000---Pretax income $100,000 - $3,000 (tax-exempt income included for book) + $4,000 (50% add-back of non-deductible meals) = $101,000. Deferred tax assets and liabilities are calculated using the ______ tax rate that is expected to apply when the temporary difference is received or settled. Enacted ASC requires a two-step process to evaluate tax positions. Select the first of those two steps. Determine if it is more likely than not as to whether the position will be sustained The application of enacted tax law against the taxable income for the year is the: current income tax expense Deferred income tax expense Deferred tax expenses are the tax effects of temporary differences in the book and tax basis of assets and liabilities. Deferred tax assets Deferred tax assets represent the tax effect of a future recovery. When determining whether a tax position will be sustained upon examination, a company ______ consider the likelihood that the taxing jurisdiction will examine the position. cannot---A company must assume that the position will be examined with full knowledge of all relevant information Joshuantic, Inc. has cumulative unfavorable temporary differences of $80,000 and, thus, records a $16,800 deferred tax asset. However, Joshuantic believes that it may NOT be able to realize that asset. As a result, Joshuantic will record a gross deferred tax asset and a valuation allowance as a contra account. Lower Texas, Inc. (LTI) took a tax position to treat $100,000 of income as tax-exempt. However, LTI is not certain that the treatment will be sustained. After analyzing the position, LTI determines that the there is a 40% chance that $80,000 will be treated as tax-exempt and a 75% chance that $40,000 will be treated as tax-exempt. Assuming a 35% tax rate, and if the more likely than not threshold is met, what is the uncertain tax liability associated with this position? [Show More]

Last updated: 1 year ago

Preview 1 out of 29 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$17.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Nov 21, 2023

Number of pages

29

Written in

Additional information

This document has been written for:

Uploaded

Nov 21, 2023

Downloads

0

Views

56