Economics > Class Notes > Remittances and Financial Openness cesifo1_wp3090 (All)

Remittances and Financial Openness cesifo1_wp3090

Document Content and Description Below

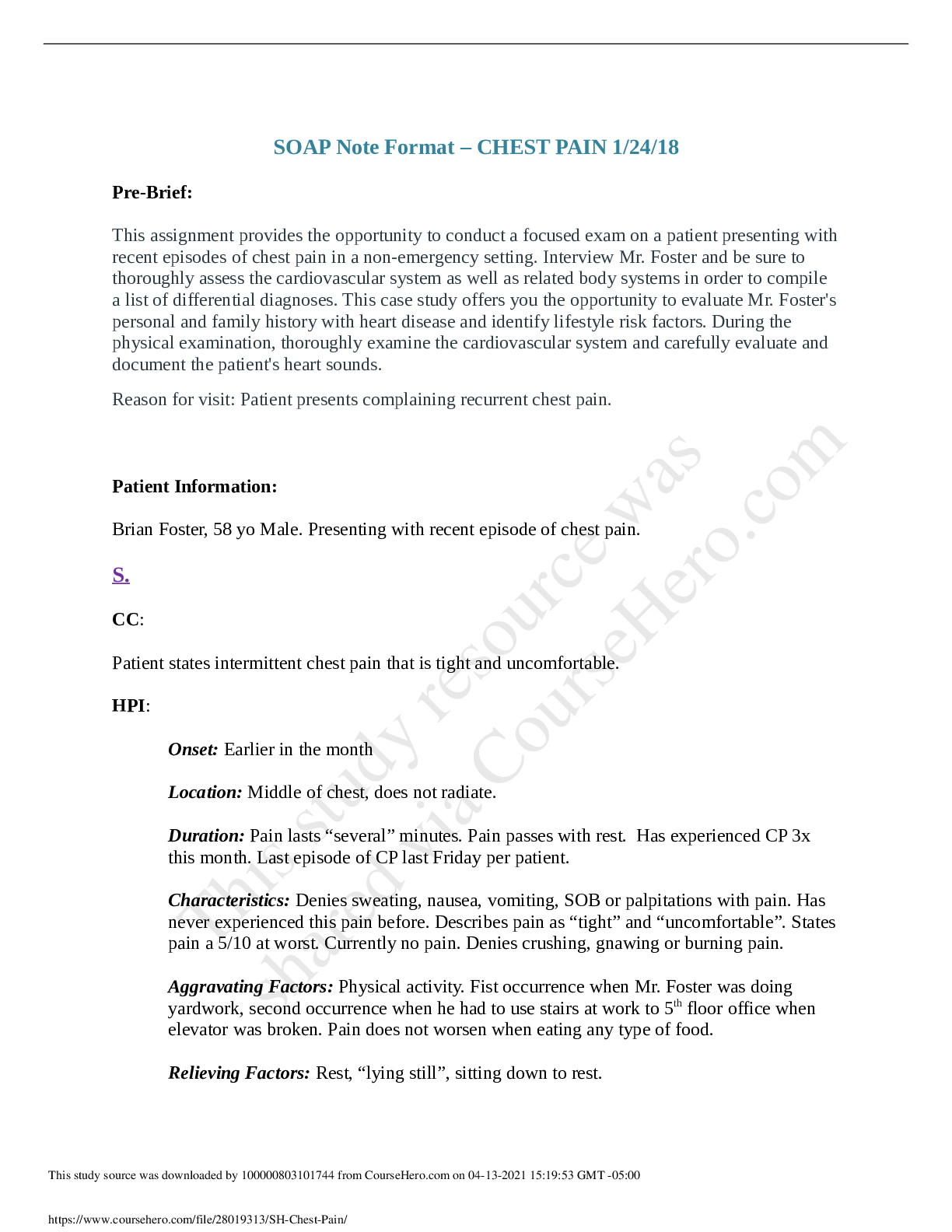

Remittances and Financial Openness Abstract Remittances have greatly increased during recent years, becoming an important and reliable source of funds for many developing countries. Therefore, ther ... e is a strong incentive for receiving countries to attract more remittances, especially through formal channels that turn to be either less expensive or less risky. One way of doing so is to increase their financial openness, but this policy option might generate additional costs in terms of macroeconomic volatility. In this paper we investigate the link between remittance receipts and financial openness. We develop a small model and statistically test for the existence of such a relationship with a sample of 66 mostly developing countries from 1980-2005. Empirically we use a dynamic generalized ordered logit model to deal with the categorical nature of the financial openness policy. We apply a two-step method akin to two stage least squares to deal with the endogeneity of remittances and potential measurement errors. We find a strong positive statistical and economic effect of remittances on financial openness. JEL-Code: E60, F24, F41, O10. Keywords: remittances, financial openness, government policy. Michel Beine CREA / University of Luxembourg [email protected] Elisabetta Lodigiani CREA / University of Luxembourg [email protected] Robert Vermeulen CREA / University of Luxembourg [email protected] June 2010 We would like to thank Michael Binder, Herbert Brucker, Alessandra Casarico, Yin-Wong Cheung, Paul de Grauwe, Frédéric Docquier, Giovanni Facchini, Marcel Fratzscher, Frank Heinemann, Kajal Lahiri, Concetta Mendolicchio, Joan Muysken, Gianni Toniolo, Jean-Pierre Urbain, Timo Wollmershauser, participants of the 3rd TOM conference in Hamburg, 3rd MIFN workshop in Luxembourg, macro-lunch seminar at IRES Louvain-la-Neuve, the internal seminar in Luxembourg, the seminar at IAB in Nurnberg, the APPAM conference in Maastricht and the CES-Ifo annual workshop in international macroeconomics in Munich for helpful comments. The authors gratefully acknowledge support by the Fonds National de Recherche Luxembourg under grant FNR/VIVRE/06/30/10. All errors remain ours. 1 Introduction Official global remittances sent to developing countries have reached 300 billion US dollar in 2008 and have become a significant source of income for many of these developing countries. In fact, for quite a few countries remittance receipts exceed 20% of GDP (e.g. Guyana, Honduras, Jordan and several more). These remittances appear to be a stable source of income over time , compared to e.g. foreign direct investment, and their value quite often exceeds official development aid. The importance of remittances has been recognized by policy makers, global institutions, such as the World Bank, and academics alike.1 A growing academic literature has been devoted to analyze the microeconomic and macroeconomic effects of remittances in developing countries (see Schiff and Ozden, 2006, 2007, for a synthesis). The effects of remittances on receiving countries seem indeed numerous. At a microeconomic level, remittances have been found to boost investment in human capital and educational attainments, thereby reducing poverty in many developing countries. Furthermore, there is significant evidence that remittances increase not only consumption but tend to also raise health levels and investment in public infrastructure. At a macroeconomic level, the existence of a positive relationship between remittances and growth is more controversial. While remittances tend to favor the accumulation of important production factors such as physical capital and education, they exert detrimental effects in terms of labor market incentives. They also create ’Dutch disease’ effects through the appreciation of domestic currencies, leading to further deindustrialization in the receiving country. Nevertheless, the recent literature shows that appropriately used migrant remittances, combined with sound government policies, have a positive net effect on economic growth. The growing importance of remittances and their positive impact on the economic conditions in receiving countries create for their governments strong incentives to facilitate the attraction of those flows. In some countries such as Mexico and the Philippines, explicit programs have been set up to increase the flows of the received remittances. Among the possible schemes aimed at boosting these receipts, the opening of financial borders is a possible policy instrument of governments. By decreasing the cost of the remittances sent through the official way or by relaxing the restriction of financial flows coming from abroad, governments can significantly boost the total amount of the received funds. Financial openness creates, however, new costs and risks for the receiving countries. One of the most important costs is the increased exposure to financial crises and to 1 In particular, given the importance of the remittances for a large set of countries, the World Bank devoted substantial efforts to monitor, understand and forecast remittance flows. See website link www.go.worldnak.org/ssw3DDNL. 2 macroeconomic instability. Therefore, the final decision to open the financial borders is likely to result from a trade-off between the various benefits drawn from the attracted remittances and the increased macroeconomic risk. In turn, those benefits will depend on the initial size of the incoming remittances, which depend on a set of factors unrelated to financial openness. Those factors include among others the size of the existing diaspora and their location. In this paper, we proceed to a political economy investigation of the choice of the degree of financial openness by government with respect to their situation in terms of incoming remittances. We first develop a small model that expresses the trade off faced by government in their decision to open the financial borders. We show that the optimal degree of openness depends on the initial size of the incoming remittances which in turn depends on factors that are exogenous for the government, such as the size the total diaspora, its location or the economic conditions of the destination countries. Then, we investigate empirically that link for a sample of 66 mostly developing countries from 1980-2005. Financial openness is classified according to three regimes (closed, neutral or open) based on the KAOPEN financial openness indicator of Chinn and Itˆo (2008). In addition to remittances we account for institutional quality, trade openness and domestic financial development. Empirically we use a dynamic generalized ordered logit model to establish the link between remittances and financial openness. This framework is attractive because it is well suited to deal with the ordinal nature of the financial openness indicator. Moreover, it is possible to take unobserved heterogeneity into account. In addition, we apply a two-step method akin to two stage least squares to deal with the endogeneity of remittance receipts and potential measurement errors. To preview our results, we find a strong positive effect of remittances on financial openness. The more remittances a country receives, the more likely it will be financially open. The positive effect of remittances on financial openness is robust to instrumentation of remittances, both in a balanced and unbalanced sample. A counterfactual analysis shows that remittances have an important effect on country’s financial openness policy. Results indicate that large remittance receiving countries have a much larger probability of being financially closed when they do not receive remittances anymore. The paper is organized as follows. We first review the existing related literature and provide some stylized facts(Section 2). In Section 3 we introduce a theoretical model that captures the trade-off between the benefits and the costs of opening the financial borders and hence the determinants of the government’s decision. The empirical model and results are discussed in Section 4. In Section 5 we study two counterfactual scenarios to assess the economic importance of [Show More]

Last updated: 3 years ago

Preview 1 out of 50 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Feb 25, 2021

Number of pages

50

Written in

All

Additional information

This document has been written for:

Uploaded

Feb 25, 2021

Downloads

0

Views

158

.png)

.png)