.png)

WGU - C483 Principles of Management 2021/2022 (Full)

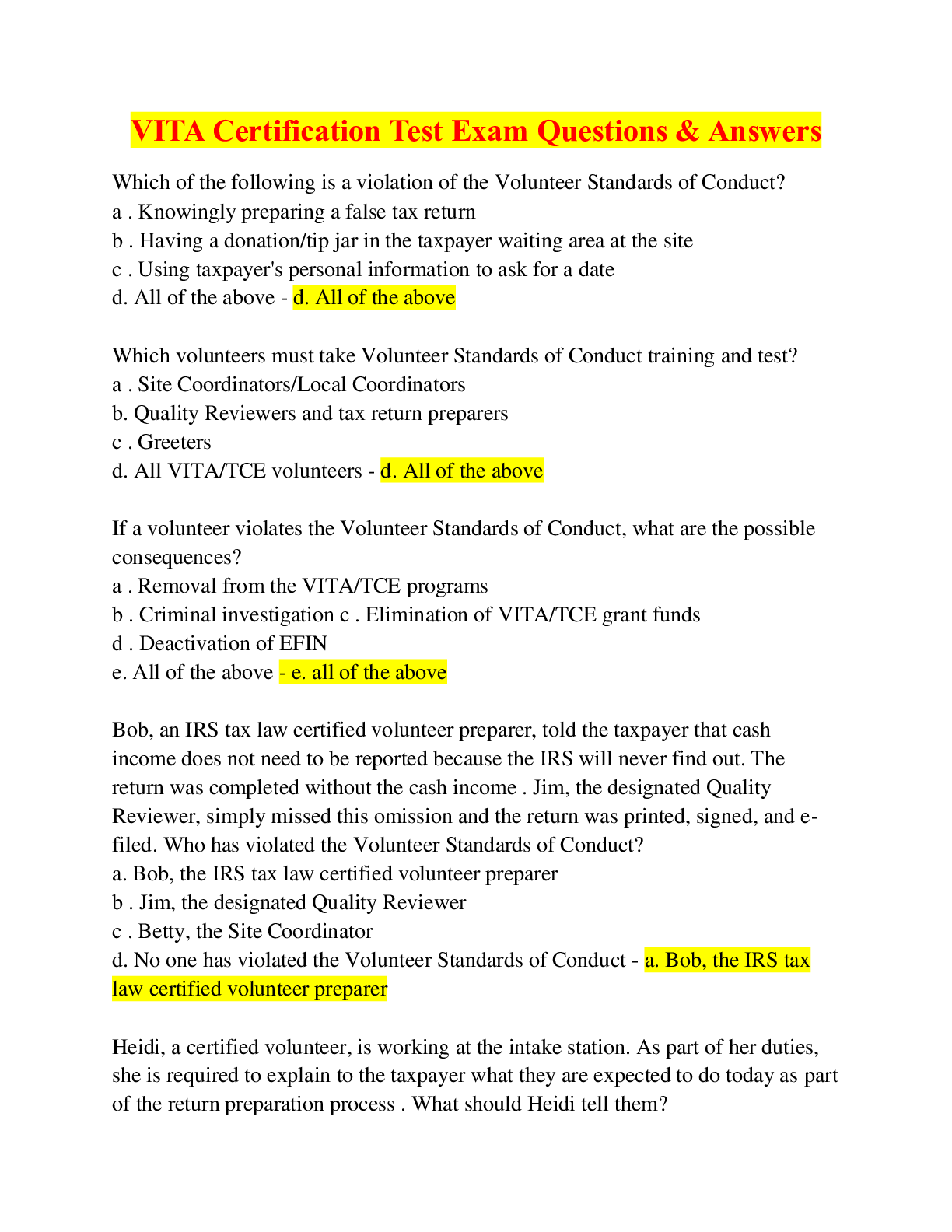

VITA Certification Test Exam Questions & Answers-Which of the following is a violation of the Volunteer Standards of Conduct? a . Knowingly preparing a false tax return b . Having a donation/tip jar ... in the taxpayer waiting area at the site c . Using taxpayer's personal information to ask for a date d. All of the above - d. All of the above Which volunteers must take Volunteer Standards of Conduct training and test? a . Site Coordinators/Local Coordinators b. Quality Reviewers and tax return preparers c . Greeters d. All VITA/TCE volunteers - d. All of the above If a volunteer violates the Volunteer Standards of Conduct, what are the possible consequences? a . Removal from the VITA/TCE programs b . Criminal investigation c . Elimination of VITA/TCE grant funds d . Deactivation of EFIN e. All of the above - e. all of the above Bob, an IRS tax law certified volunteer preparer, told the taxpayer that cash income does not need to be reported because the IRS will never find out. The return was completed without the cash income . Jim, the designated Quality Reviewer, simply missed this omission and the return was printed, signed, and e-filed. Who has violated the Volunteer Standards of Conduct? a. Bob, the IRS tax law certified volunteer preparer b . Jim, the designated Quality Reviewer c . Betty, the Site Coordinator d. No one has violated the Volunteer Standards of Conduct - a. Bob, the IRS tax law certified volunteer preparer Heidi, a certified volunteer, is working at the intake station. As part of her duties, she is required to explain to the taxpayer what they are expected to do today as part of the return preparation process . What should Heidi tell them? a . Form 13614-C must be completed prior to having the return prepared b . You will be interviewed by the return preparer and asked additional questions as needed c. You need to participate in a quality review of your tax return by someone other than the return preparer d. All of the above - d. All of the above Volunteers must verify the taxpayer has the following items as soon as possible: a. Photo identification b. Social security number documents c. All income statements, including Forms W-2, 1099-R, etc . d. All of the above - d. All of the above True or False: The taxpayer should be informed of their responsibility for the information on the tax return during the quality review process . - True True or False: Volunteers who refuse to use the intake/interview process are violating the Standards of Conduct. - True True or False: Mary, the Greeter, identifies the taxpayer's tax return requires Advanced IRS tax law certification. Therefore, the certified tax preparer must be certified to the Advanced level but the Quality Reviewer can be certified to any level, including Basic . - False Yes or No: Is having a donation/tip jar in the waiting area at the VITA/TCE site a violation of the Volunteer Standards of Conduct? - Yes [Show More]

Last updated: 11 months ago

Preview 1 out of 15 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

BUNDLE: VITA Advanced Test EXAMS With 100% Solutions

By PROF 2 years ago

$15.5

2

Can't find what you want? Try our AI powered Search

Connected school, study & course

About the document

Uploaded On

Dec 14, 2023

Number of pages

15

Written in

All

This document has been written for:

Uploaded

Dec 14, 2023

Downloads

0

Views

48

Scholarfriends.com Online Platform by Browsegrades Inc. 651N South Broad St, Middletown DE. United States.

We're available through e-mail, Twitter, Facebook, and live chat.

FAQ

Questions? Leave a message!

Copyright © Scholarfriends · High quality services·