Due Week 2 and worth 100 points

Directions: Answer the following questions on a separate document. Explain how you reached the answer or show your work if a mathematical calculation is needed, or both. Submit your assig

...

Due Week 2 and worth 100 points

Directions: Answer the following questions on a separate document. Explain how you reached the answer or show your work if a mathematical calculation is needed, or both. Submit your assignment using the assignment link above.

A. In your own words, please identify two different stock exchanges in the United States. Describe the similarities and differences between the two stock exchanges. Identify one stock from each of the two stock exchanges.

Two different stock exchanges in the United States include the New York Stock Exchange (NYSE) and theNational Association of Securities Dealer Automated Quotation (NASDAQ). Both are public stock exchanges located in New York City, however the NASDAQ exchange operates mainly through automated trading as dealer’s market while the NYSE has specialized floor traders in an auction market that complete stock exchanges. Both were launched within a year from one another with the NASDAQ launching in ’71 and the NYSE launching in ’72. The two are the largest stock exchanges in the world with a total of approximately 4700 listed companies between the them. Fees are a bit higher with the NYSE in comparison to the NASDAQ and you will see more well-established companies listed on the NYSE such as Ford Motor Company, while “high-tech stocks that are more growth oriented and potentially volatile” are listed on the NASDAQ such as Apple Inc. (Diffen, 2017).

B. Using the two stocks you identified, determine the free cash flow from 2013 & 2014. What inference can you draw from the companies’ free cash flow?

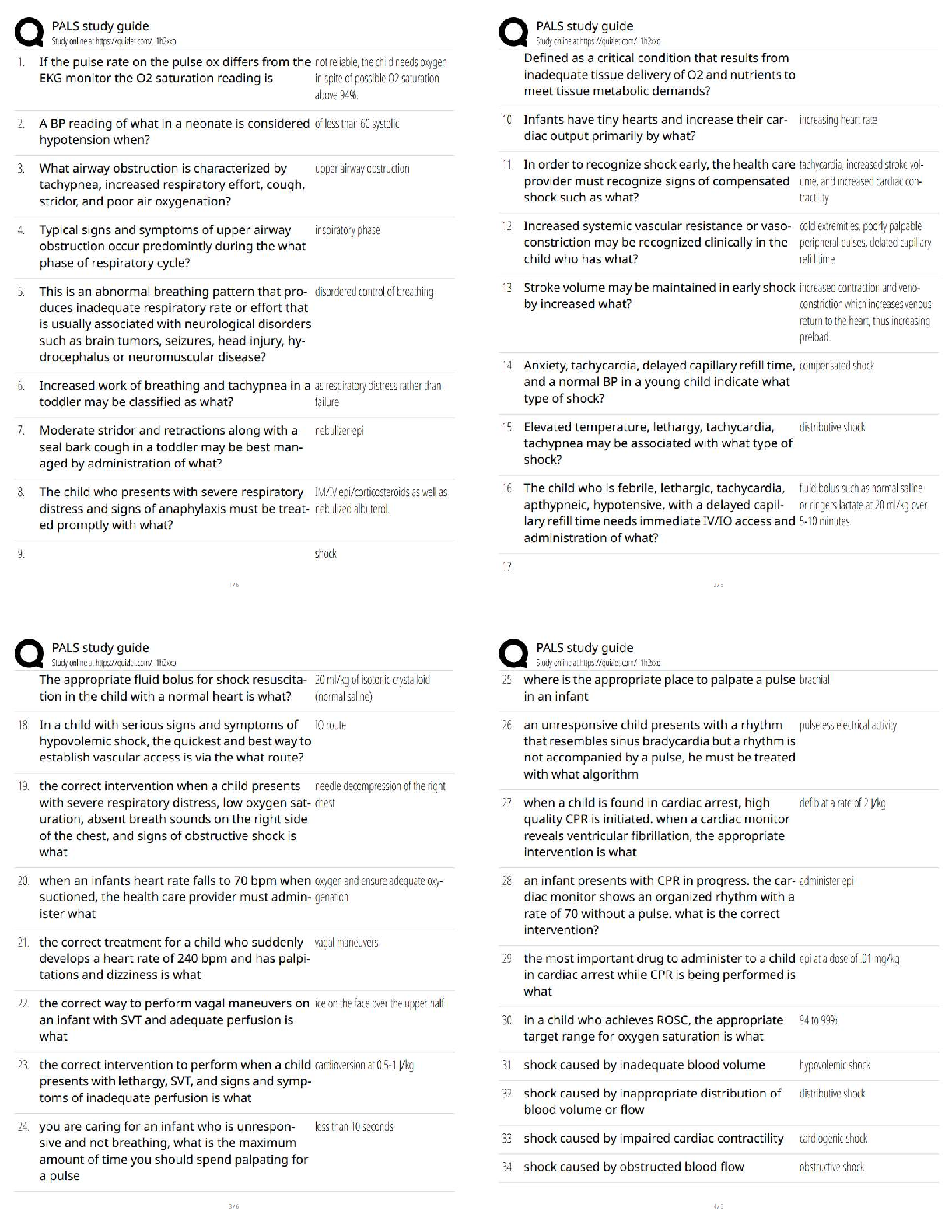

(NYSE) Ford Motor Company Free Cash Flow: 2013 (in millions)

Cash Flow from Operations - Capital Expenditures = Free Cash Flow

10,444 –6,597 = 3,847(2013annualreport.ford.com, p.70)

Ford Motor Company Free Cash Flow: 2014 (in millions)

14,507 – 7,463 = 7,044(2014annualreport.ford.com, p. FS-6)

The free cash flow tells us that Ford had more money coming in from operations and could spend more on capital expenditures such as buildings, office equipment, patents, land, machinery etcetera, while still increasing the amount of cash necessary to both maintain their business as well as expand. The increase in free cash flow is a small indicator of Ford’s financial performance and with the increase in free cash flow Ford can “pursue opportunities that enhance shareholder value” (Investopedia, 2017).

[Show More]

.png)

.png)

.png)