Industrial Chemistry > Solutions Guide > North Arkansas College FIN FIN 145 1.Table 8.4 reproduces John's notes on Pioneer Gypsum and Glob (All)

North Arkansas College FIN FIN 145 1.Table 8.4 reproduces John's notes on Pioneer Gypsum and Global Mining. Calculate the expected return, risk premium, and standard deviation of a Share Question

Document Content and Description Below

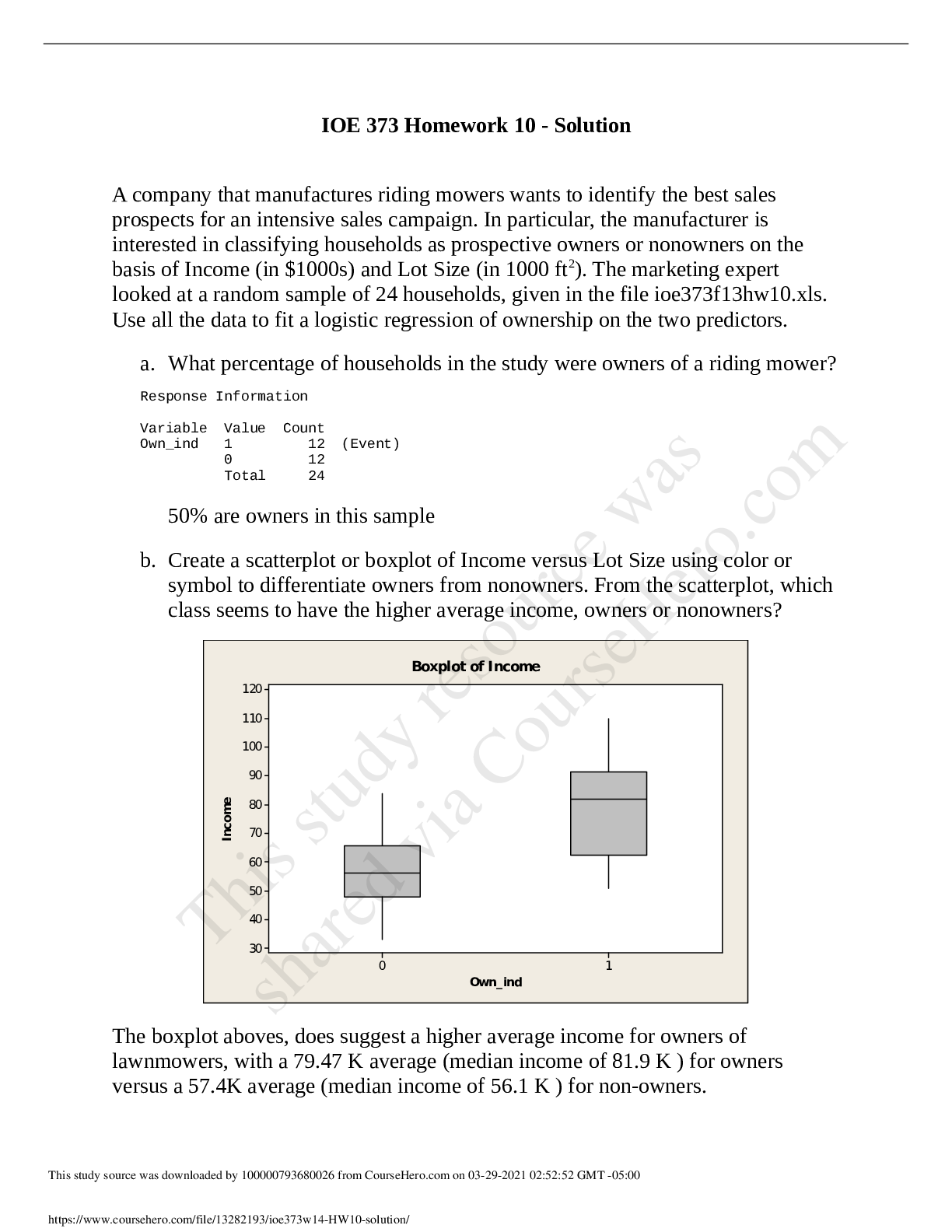

Question 1. Table 8.4 reproduces John's notes on Pioneer Gypsum and Global Mining. Calculate the expected return, risk premium, and standard deviation of a portfolio invested partly in the market and... partly in Pioneer. (You can calculate the necessary inputs from the betas and standard deviations given in the table.) Does adding Pioneer to the market benchmark improve the Sharpe ratio? How much should John invest in Pioneer and how much in the market? 2. Repeat the analysis for Global Mining. What should John do in this case? Assume that Global accounts for .75% of the S&P index. (Assume a market standard deviation of 16%.) Pioneer Gypsum: Expected return 11% Standard deviation 32% Beta .65 Stock Price $87.50 Global Mining: Expected Return 12.9% Standard Deviation 24% Beta 1.22 Stock Price $105 [Show More]

Last updated: 2 years ago

Preview 1 out of 2 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$7.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Mar 08, 2021

Number of pages

2

Written in

Additional information

This document has been written for:

Uploaded

Mar 08, 2021

Downloads

0

Views

149