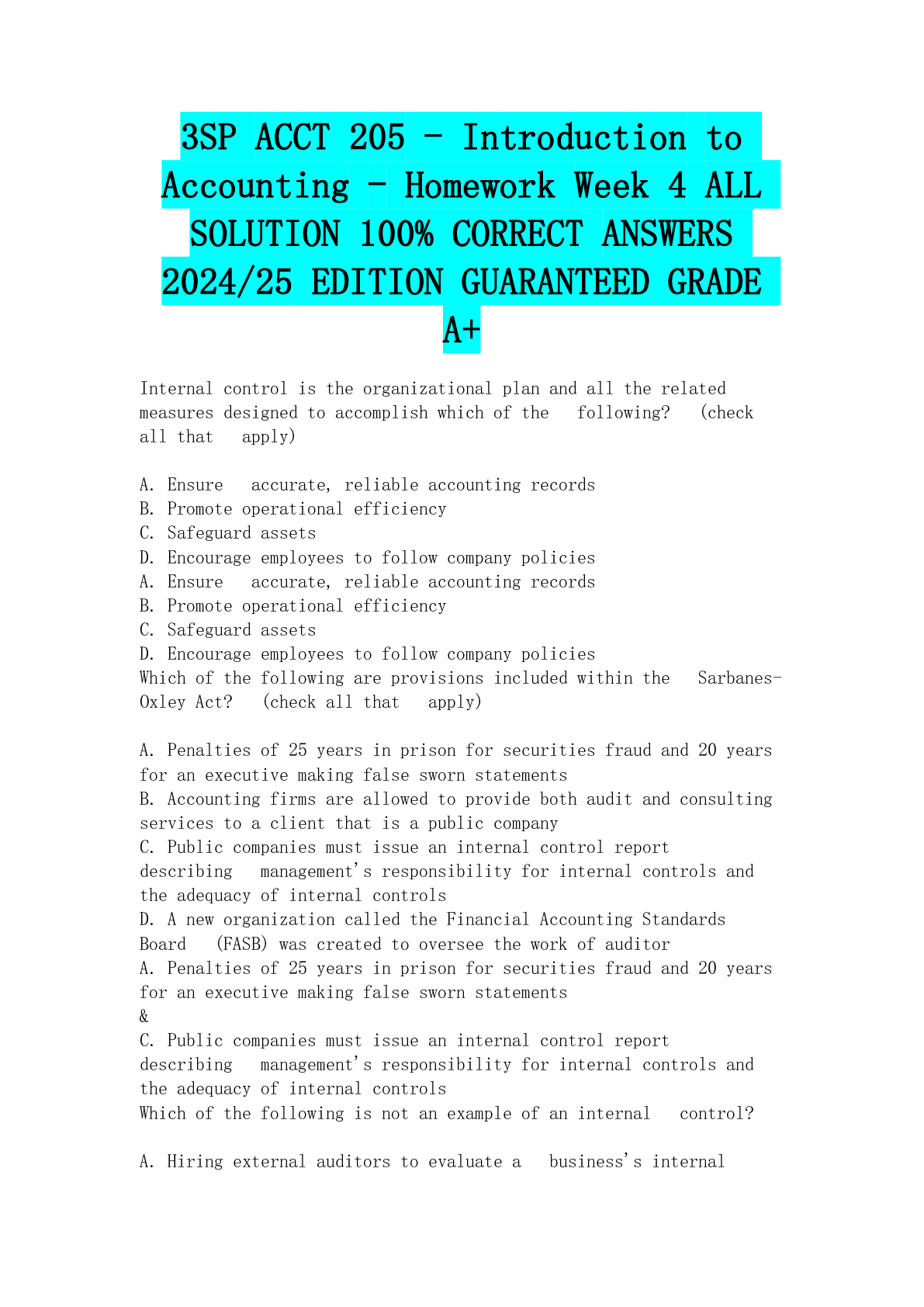

Finance > EXAM PROCTORED > 23SP ACCT 205 - Introduction to Accounting - Homework Week 4 (All)

23SP ACCT 205 - Introduction to Accounting - Homework Week 4

Document Content and Description Below

Internal control is the organizational plan and all the related measures designed to accomplish which of the following? (check all that apply) A. Ensure accurate, reliable accounting re ... cords B. Promote operational efficiency C. Safeguard assets D. Encourage employees to follow company policies A. Ensure accurate, reliable accounting records B. Promote operational efficiency C. Safeguard assets D. Encourage employees to follow company policies Which of the following are provisions included within the Sarbanes-Oxley Act? (check all that apply) A. Penalties of 25 years in prison for securities fraud and 20 years for an executive making false sworn statements B. Accounting firms are allowed to provide both audit and consulting services to a client that is a public company C. Public companies must issue an internal control report describing management's responsibility for internal controls and the adequacy of internal controls D. A new organization called the Financial Accounting Standards Board (FASB) was created to oversee the work of auditor A. Penalties of 25 years in prison for securities fraud and 20 years for an executive making false sworn statements & C. Public companies must issue an internal control report describing management's responsibility for internal controls and the adequacy of internal controls Which of the following is not an example of an internal control? A. Hiring external auditors to evaluate a business's internal controls and ensure that the financial statements are fairly presented in accordance with GAAP B. Allowing the entire management team to have access to the accounting records so it is more convenient for them to change any information needed C. Receiving adequate approvals for business transactions before they are recorded in a business's information system D. Only allowing authorized users access to a business's information systems B. Allowing the entire management team to have access to the accounting records so it is more convenient for them to change any information needed Which of the following is not an example of a control procedure? A. Combining the responsibilities of two or more people into the responsibility of one individual for efficiency reasons B. Having adequate documentation for business transactions C. Hiring competent, reliable, and ethical personnel D. Providing each employee with carefully defined responsibilities A. Combining the responsibilities of two or more people into the responsibility of one individual for efficiency reasons What is the term used to describe the dividing of responsibilities between two or more people to limit fraud and promote accuracy of accounting records? A. Division of Tasks B. Assignment of Responsibilities C. Job accountability D. Segregation of Duties D. Segregation of Duties A system in which customers send their checks to a post office box that belongs to a bank is called a ________ system. A. Lock-box B. Cash collection C. Post office D. Mail A. Lock-box The controller or treasurer reviews which documents in the "payment packet" for a purchase of goods? (check all that apply) A. Receiving Report B. Purchase Order C. Deposit Ticket D. Invoice A. Receiving Report B. Purchase Order & D. Invoice By reviewing the payment packet, the treasurer or controller can answer which of the following questions? (check all that apply) A. What is our current inventory level? B. Are we paying the correct amount to the supplier? C. Did we receive the goods we ordered? D. Are we paying only for the goods received and authorized? B. Are we paying the correct amount to the supplier? C. Did we receive the goods we ordered? D. Are we paying only for the goods received and authorized? A process called ____________ bypasses paper documents because the computers of the customer communicate directly with the computers of suppliers to automate routine business transactions. A. E-Commerce B. Electronic Data Interchange C. Point-of-Sale D. Payment packets B. Electronic Data Interchange If a business decides to decrease the amount in the petty cash fund from $200 to $100, what account is credited in the journal entry to record this change? A. Petty Cash B. Cash C. Cash Short & Over D. Accounts Receivable A. Petty Cash Which of the following statements is false regarding using credit cards and debit cards for sales of merchandise? A. When customers pay a credit card, the business normally receives the funds from the sale within a few days. B. An advantage of accepting credit cards and debit cards is the business does not need to maintain accounts receivable records for these transactions. C. A disadvantage of accepting credit cards from customers is that the business needs to wait to receive the cash from the sale until the customers pay their credit card bills. D. A disadvantage of accepting credit cards and debit cards from customers it that a third-party processor will normally charge the business processing fees for these transactions. C. A disadvantage of accepting credit cards from customers is that the business needs to wait to receive the cash from the sale until the customers pay their credit card bills. Smart Touch Learning sold merchandise to Jules Electronics for $6,500 and accepted a credit card for payment. The processor charges a 1% fee and Smart Touch Learning uses the net method to record these fees. Which of the following would be included in the journal entry to record this transaction? A. Credit Sales Revenue, $6,435 B. Debit Accounts Receivable, $6,435 C. Debit Credit Card Expense, $65 D. Debit Cash, C. Debit Credit Card Expense, $65 Smart Touch Learning sold merchandise to Jules Electronics for $7,000 and accepted a credit card for payment. The processor charges a 1% fee and Smart Touch Learning uses the gross method to record these fees. Which of the following would be included in the journal entry to record this transaction? A. Debit Credit Card Expense, $70 B. Debit Cash, $7,000 C. Debit Accounts Receivable, $6,930 D. Credit Sales Revenue, $6,930 B. Debit Cash, $7,000 The asset of a business that is the most liquid and the most susceptible to theft is A. Merchandise Inventory B. Cash C. Supplies D. None of the above B. Cash Which of the following is considered a control applied to a bank account? (check all that apply) A. The use of a bank statement that is sent to a business once a year that reports activity in a customer's account B. The use of a signature card to help protect against check forgery C. The preparation of a bank reconciliation to show the reasons for any differences between the cash balance according to the bank and the cash balance according to a business's accounting records D. The use of a bank deposit ticket to provide proof for a deposit transaction B. The use of a signature card to help protect against check forgery C. The preparation of a bank reconciliation to show the reasons for any differences between the cash balance according to the bank and the cash balance according to a business's accounting records D. The use of a bank deposit ticket to provide proof for a deposit transaction The party who issues the check is called the _______ while the party to whom the check is paid is called the _______. A. Payee; maker B. Payer; maker C. Maker; payee D. Depositor; payer C. Maker; payee A document explaining the reasons for the difference between a depositor's cash records and the depositor's cash balance in its bank account is called a A. Memorandum B. Bank Reconciliation C. Bank Statement D. Deposit Ticket B. Bank Reconciliation A cash equivalent is a highly liquid investment that can be converted into cash within A. Three days or less B. Three years or less C. Three weeks or less D. Three months or less D. Three months or less Use the following data to calculate the cash ratio: Cash = $200,000; Cash Equivalents = $50,000; Current Liabilities = $500,000; Total Liabilities = $1,000,000. A. 0.20 B. 0.40 C. 0.50 D. 0.25 C. 0.50 Which of the following statements are true regarding receivables? (check all that apply) A. Receivables involve two parties—a creditor and a debtor B. A receivable can include a loan of money to another party C. A receivable can be listed as either a current asset or a long-term asset D. A receivable is an obligation to pay money to another party in the future A. Receivables involve two parties—a creditor and a debtor B. A receivable can include a loan of money to another party C. A receivable can be listed as either a current asset or a long-term asset With good internal controls, the person who handles cash can also A. Record cash payments B. Approve customers for credit sales C. Record cash receipts D. None of the above D. None of the above Which of the following statements is false regarding using credit cards and debit cards for sales of merchandise? A. An advantage of accepting credit cards and debit cards is the business does not need to maintain accounts receivable records for these transactions B. When customers pay a credit card, the business normally receives the funds from the sale within a few days C. A disadvantage of accepting credit cards from customers is that the business needs to wait to receive the cash from the sale until the customers pay their credit card bills D. A disadvantage of accepting credit cards and debit cards from customers it that a third-party processor will normally charge the business processing fees for these transactions. C. A disadvantage of accepting credit cards from customers is that the business needs to wait to receive the cash from the sale until the customers pay their credit card bills ______________ is the cost that arises when a business is unable to collect from a credit customer. A. Credit Expense B. Write-Off Expense C. Bad Debts Expense D. Accounts Receivable Expense C. Bad Debts Expense When a business records bad debts expense using the direct write-off method, the journal entry to record the write-off includes A. A debit to the customer's accounts receivable account B. A debit to Sales Revenue C. A credit to Bad Debts Expense D. A credit to the customer's accounts receivable account D. A credit to the customer's accounts receivable account Which of the following are true regarding the allowance method for recording uncollectibles? (check all that apply) A. Bad debts expense is recorded when a customer's account is written off B. A contra asset account related to accounts receivable is used to hold the estimated amount of uncollectible accounts C. Customer accounts are never written off because the direct write-off method is not being used D. Bad debts expense for the period is estimated by recording an adjusting entry at the end of the period B. A contra asset account related to accounts receivable is used to hold the estimated amount of uncollectible accounts D. Bad debts expense for the period is estimated by recording an adjusting entry at the end of the period The net amount a business expects to collect from its accounts receivable is called the A. Factoring Value of Receivables B. Net Realizable Value C. Net Collection Value D. Allowance for Bad Debts B. Net Realizable Value When writing off a customer's account using the allowance method A. Bad Debts Expense is increased with a credit B. The Allowance for Bad Debts account is decreased with a debit C. The customer's account is decreased with a debit D. Bad Debts Expense is increased with a debit B. The Allowance for Bad Debts account is decreased with a debit Under the allowance method, bad debts expense is not recorded when a customer's account is written off because A. Customer accounts are not written off under the allowance method B. Bad debts expense is not recorded under the allowance method C. Bad debts expense is only estimated and the estimate is recorded only at the end of an accounting period D. The allowance method is not accepted under Generally Accepted Accounting Principles C. Bad debts expense is only estimated and the estimate is recorded only at the end of an accounting period When bad debts expense is estimated and recorded at the end of the period using the allowance method A. Bad Debts Expense is increased with a debit B. Customer accounts are written off with a credits C. The Allowance for Bad Debts account is increased with a debit D. Accounts Receivable is decreased with a credit A. Bad Debts Expense is increased with a debit On December 31, Smart Touch Learning's ending accounts receivable balance is $210,000. Smart Touch Learning estimates that 5% of its accounts receivable balance will be uncollectible. As of December 31, the unadjusted balance in its Allowance for Bad Debts account is a $2,600 credit balance. What is bad debts expense for the year? A. $7,900 [Show More]

Last updated: 1 year ago

Preview 4 out of 11 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$12.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jul 16, 2024

Number of pages

11

Written in

All

Additional information

This document has been written for:

Uploaded

Jul 16, 2024

Downloads

0

Views

56