TAX 655: Final Exam

Notes

Complete the problems as presented in this document. You may create a new document and/or spreadsheet as needed. Any memo should be no more than 3 pages in length. Please state any assumpt

...

TAX 655: Final Exam

Notes

Complete the problems as presented in this document. You may create a new document and/or spreadsheet as needed. Any memo should be no more than 3 pages in length. Please state any assumptions used if problems are not clear.

Problem 1

Your client, a physician, recently purchased a yacht on which he flies a pennant with a medical emblem on it. He recently informed you that he purchased the yacht and flies the pennant to advertise his occupation and thus attract new patients. He has asked you if he may deduct as ordinary and necessary business expenses the costs of insuring and maintaining the yacht. In search of an answer, consult RIA’s CHECKPOINT TAX available on-line through the SNHU Shapiro Library. Explain the steps taken to find your answer.

In searching RIA’s CHECKPOINT United States Tax Reporter (USTR) under Editorial Materials, the keyword “Yacht” was then utilized in the search field. Upon doing so, the annotation ¶1625.356(13) populated. Next, the hyperlinked citation was selected and the case of Robert Lee Henry v. Commissioner (1961) 36 TC 879 was found. In this case, the Court denied a claim for the deduction of depreciation, costs of insurance, and maintenance of a yacht, which flew a pennant with the number ‘1040’ on it. Apparently, the use of the yacht was alleged for the promotion Henry’s Tax Business; however, Henry failed to display how the boating activities contributed to producing a single fee. Additionally, Henry did not prove that the yacht was not in fact utilized for personal reasons. After reviewing this case, the Citator button was selected and a list of cases citing R.L. Henry was revealed. Some of these cited cases included:

• Cited favorably: Danville Plywood Corp. v U.S., 63 AFTR 2d 89-1045, 16 Cl Ct 595 (Cl Ct, 3/31/1989) [See 36 TC 883]

• Reasoning followed: Carroll, James A. & Isabelle, 51 TC 218, 51 PH TC 153 (10/31/1968) [See 36 TC 884]

• Cited favorably: Bakken, Lawrence H., 51 TC 610, 51 PH TC 428 (1/13/1969) [See 36 TC 884]

• Cited favorably: Bradley, Burke W., Jr. & Karen E., 54 TC 220, 54 PH TC 155 (2/9/1970) [See 36 TC 884]

It was noted the majority was these cases favorably cited R.L. Henry, which means it is good case law to utilize for the client since it involves a very similar situation.

Based upon the Court’s ruling in Robert Lee Henry v. Commissioner (1961) 36 TC 879, it has been determined the costs of maintaining and insuring the physician’s yacht would not be deductible as ordinary and necessary business expenses.

References

Robert Lee Henry v. Commissioner (1961) 36 TC 879. Retrieve on April 10, 2019, from:

https://checkpoint.riag.com/app/main/popupPreviewReturnLink?usid=39b3c1odc536&DocID=i47b649e4331711dda252c7f8ee2eaa77&SrcDocId=T0ANNOS%3A6373.5-1&feature=tcheckpoint&lastCpReqId=1306041&tlltype=12

Problem 2

Stacey Small has a small salon that she has run for a few years as a sole proprietorship. The proprietorship uses the cash method of accounting and the calendar year as its tax year. Stacey needs additional capital for expansion and knows two people who might be interested in investing. One would like to practice hairdressing in the salon. The other would only invest.

Stacey wants to know the tax consequences of incorporating the business. Her business assets include a building, equipment, accounts receivable and cash. Liabilities include a mortgage on the building and a few accounts payable, which are deductible when paid.

Write a memo to Stacey explaining the tax consequences of the incorporation. As part of your memo examine the possibility of having the corporation issue common and preferred stock and debt for the shareholders’ property and money.

Problem 3

Five years ago, Lacey, Kaylee, and Doug organized a software corporation, DLK, which develops and sells Online Meetings software for businesses. DLK is a C corporation. Each individual contributed $10,000 to the company in exchange for 1,000 shares of DLK stock (for a total of 3,000 shares). The corporation also borrowed $250,000 from ACME Venture Capital to finance operating costs and capital expenditures.

Because of intense competition, DLK struggled for the first few years of operation and the corporation sustained chronic losses. This year, Lacey, DLK’s president, decided to seek additional funds to finance DLK’s working capital.

CME declined to extend additional funds because of the money already invested in DLK. High Tech Venture Capital Inc. proposed to lend DLK $100,000, but at a 10% premium over the prime rate. (Other software manufacturers in the same market can borrow at a 3% premium.) First Round Capital proposed to invest $50,000 of equity capital into DLK, but on the condition that the investment firm be granted the right to elect five members to DLK’s board of directors. Discouraged by the “high cost” of external borrowing, Lacey decides to approach Kaylee and Doug.

Lacey suggests to Kaylee and Doug that each of the three original investors contribute an additional $25,000 to DLK in exchange for five 20-year debentures. The debentures will be unsecured and subordinate to ACME’s debt. Annual interest on the debentures will accrue at a floating 5% premium over the prime rate. The right to receive interest payments will be cumulative; that is each debenture holder is entitled to past and current interest payments before DLK’s board can declare a common stock dividend. The debentures would be both nontransferable and noncallable. Lacey, Kaylee and Doug have asked you, their tax accountant, to advise them on the tax implications of the proposed financing agreement. After researching the issue, issue your advice in a tax research memo. At a minimum, you should consult the following authorities:

• IRC. Sec 385

• Rudolph A. Hardman, 60 AFTR 2d 87-5651, 82-7 USTC ¶9523 (9th Cir., 1987)

• Tomlinson v. The 1661 Corporation, 19 AFTR 2d 1413, 67-1 USTC ¶9438 (5th Cir., 1967)

Problem 4

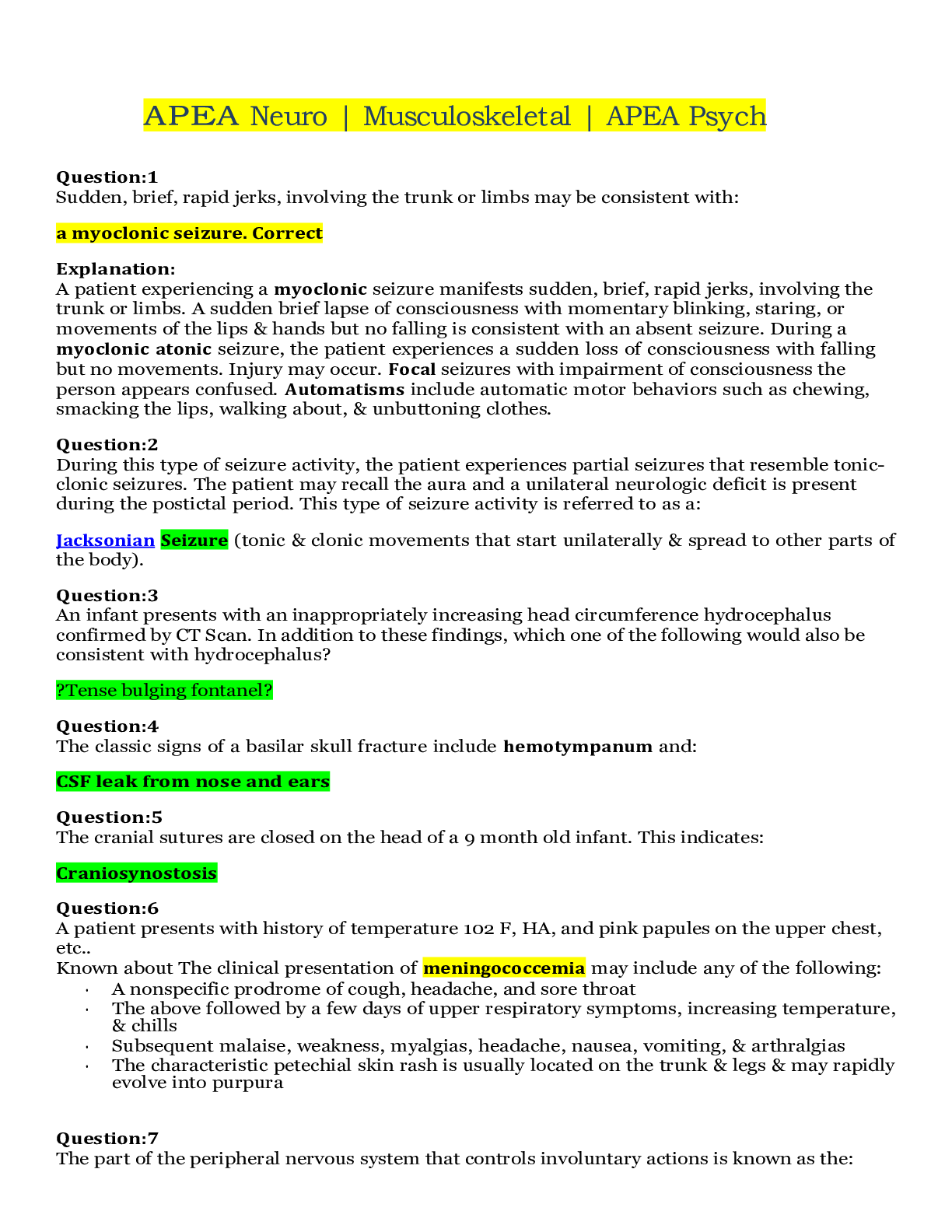

Which of the following groups constitute a controlled group? (Any stock not listed below is held by unrelated individuals each owning less than 1% of the outstanding stock.) For brother-sister corporations, which definition applies?

a. Mark owns 90% of the single classes of stock of Hot and Ice Corporations.

b. Johnson and Carey Corporations each have only a single class of stock outstanding. The two controlling individual shareholders own the stock as follows:

Stock Ownership Percentages

Shareholder Johnson Corp. Carey Corp

David 60% 80%

Kelly 30% 0%

c. Red, Blue and ABC Corporations each have a single class of stock outstanding. The stock is owned as follows:

Stock Ownership Percentages

Shareholder Blue Corp. ABC Corp

Red 80% 50%

Blue 40%

Red Corporation’s stock is widely held by over 1,000 shareholders, none of whom owns directly or indirectly more than 1% of Red’s stock.

d. Helm, Oak, Walnut and Zinnia Corporations each have a single class of stock outstanding. The stock is owned as follows:

Stock Ownership Percentages

Shareholder Helm Corp. Oak Corp Walnut Corp Zinnia Corp

James 100% 90%

Helm 80% 30%

Walnut 60%

a. A brother-sister group under either the 50% only definition or 50%-80% definition.

b. Johnson Corp and Carey Corp are a brother-sister group under the 50% only definition; however, not a controlled group under the 50%-80% definition. As a result of Kelly not owning stock in the Carey Corp, the 80% test is failed. Additionally, David owns more than 50% of the Johnson Corp and Carey Corp stock.

c. A parent-subsidiary group. Red Corp is 80% parent of Blue Corp. Additionally, Red Corp and Blue Corp together own 90% of ABC Corp.

d. A Combined Controlled Group. Helm Corp and Oak Corp are brother-sister corporations under either the 50% only definition or 50%-80% definition. Helm Corp is the parent of Walnut Corp. Zinnia Corp is a group member since Helm and Walnut together own 90% of Zinnia Corp. With this being said, the Helm-Walnut-Zinnia group is a parent-subsidiary group. Furthermore, since Helm belongs to both groups, all four of the corporations are a combined controlled group.

Problem 5

Eric and Denise are partners in ED Partnership. Eric owns a 60% capital, profits and loss interest. Denise owns the remaining interest. Both materially participate in the partnership activities. At the beginning of the current year, ED’s only liabilities are $50,000 in accounts payable, which remain outstanding at year-end. In August, ED borrowed $120,000 on a nonrecourse basis from Delta Bank. The loan is secured by property with a $230,000 FMV. These are ED’s only liabilities at year-end. Basis for the partnership interest at the beginning of the year is $40,000 for Denise and $60,000 for Eric before considering the impact of liabilities and operations. ED has a $200,000 ordinary loss during the current year. How much loss can Eric and Denise recognize?

Eric (60% General Partner Denise (40% General Partner)

Tax Basis At-Risk Basis Tax Basis At-Risk Basis

Beginning Basis without Debt $60,000 $60,000 $40,000 $40,000

Recourse Debt (Accounts Payable) 30,000 30,000 20,000 20,000

Non-Recourse Debt 72,000 - 48,000 -

Basis before Losses $162,000 $90,000 $108,000 $60,000

Operating Loss (120,000) (60,000) (80,000) (40,000)

Ending Basis $42,000 $30,000 $28,000 $20,000

Problem 6

Linda pays $100,000 cash for Jerry’s ¼ interest in the JILL Partnership. The partnership has a Sec. 754 election effect. Just before the sale of Jerry’s interest, JILL’s balance sheet appears as follows:

Partnership’s Basis FMV

Assets:

Cash $75,000 $75,000

Land $225,000 $325,000

Total $300,000 $400,000

Partners' capital

Jerry $75,000 $100,000

Instrument Corp $75,000 $100,000

Logo Corp $75,000 $100,000

Lighthouse Corp $75,000 $100,000

Total $300,000 $400,000

a. What is Linda’s total optional basis adjustment?

b. If JILL Partnership sells the land for its $325,000 FMV immediately after Linda purchases her interest, how much gain or loss will the partnership recognize?

c. How much gain will Linda report as a result of the sale?

a. Cash Purchase Price $100,000

Minus: Linda’s Share of Partnership

In Assets ($300,000 x 1/4) (75,000)

Optional Basis Adjustment $ 25,000

b. $325,000 - $225,000 = $100,000 Gain

c. Linda’s share of the gain is $25,000 ($100,000 x 1/4 = $25,000); however, she will not recognize any of this gain as a result of her $25,000 optional basis adjustment.

Problem 7

Monte and Allie each own 50% of Raider Corporation, an S corporation. Both individuals actively participate in Raider’s business. On January 1, Monte and Allie have adjusted bases for their Raider stock of $80,000 and $90,000 respectively. During the current year, Raider reports the following results:

Ordinary loss $175,000

Tax-exempt interest income 20,000

Long-term capital loss 32,000

Raider’s balance sheet at year-end shows the following liabilities: accounts payable, $90,000; mortgage payable, $30,000; and note payable to Allie, $10,000.

a. What income and deductions will Monte and Allie report from Raider’s current year activities?

b. What is Monte’s stock basis on December 31?

c. What are Allie’s stock basis and debt basis on December 31?

d. What loss carryovers are available for Monte and Allie?

e. Explain how the use of the losses in Part a would change if instead Raider were a partnership and Monte and Allie were partners who shared profits, losses and liabilities equally.

A.

Monte Allie

Allocation to Shareholders:

Ordinary Loss $87,500 $87,500

Tax-Exempt Interest Income 10,000 10,000

Long-Term Capital Loss (LTCL) 16,000 16,000

Loss Limitation:

Beginning Stock Basis $80,000 $90,000

Plus: Tax-Exempt Interest 10,000 10,000

Stock Basis Before Losses $90,000 $100,000

Plus: Debt Basis - 10,000

Loss Limitation $90,000 $110,000

Loss Deduction:

Ordinary Loss $76,087 $87,500

Capital Loss $13,913 $16,000

Calculations:

[$87,500/($87,500 + $16,000)] x $90,000 = $76,087

[$16,000/($87,500 + $16,000)] x $90,000 = $13,913

$87,500 + $16,000 = $103,500 - Note: No loss limitation applies since the total loss is below Allie's loss limitation of $110,000.

B. Monte’s stock basis on December 31st is $0 ($90,000 - $90,000).

C. Allie’s stock basis on December 31st is $0 ($100,000 - $100,000).

Allie’s debt basis on December 31st is $6,500 ($10,000 - $3,500).

D. Monte has an ordinary loss carryover of $11,413 ($87,500 - $76,087) and capital loss carryover of $2,087 ($16,000 - $$13,913) to the next year. However, Allie has no loss

carryovers.

E.

Monte Allie

Allocation to Partners:

Ordinary Loss $87,500 $87,500

Tax-Exempt Interest Income 10,000 10,000

Long-Term Capital Loss (LTCL) 16,000 16,000

Loss Limitation:

Beginning Basis in Partnership Interest $80,000 $90,000

Plus: Tax-Exempt Interest 10,000 10,000

Note Payable to Allie - 10,000

Accounts Payable 45,000 45,000

Mortgage Payable 15,000 15,000

Total $150,000 $170,000

Deduction:

Ordinary Loss $87,500 $87,500

Capital Loss $16,000 $16,000

Note: According to Treas. Reg. 1.752-2(c)(1), a partner bears the economic risk of loss upon lending money to the partnership if no other partner bears the economic risk for the loan. With this being, the $10,000 liability above is allocated to Allie.

Furthermore, it should be noted that the larger bases under the partnership rules permit individuals to deduct any ordinary or capital losses in full.

References

Treas. Reg. 1.752-2(c)(1)

Problem 8

Tom Hughes died in 2009 with a gross estate of $3.9 million and debt of $30,000. He made post-1976 taxable gifts of $100,000, valued at $80,000 when he died. His estate paid state death taxes of $110,200. What is his estate tax base?

Gross Estate $3,900,000

Minus: Debts (30,000)

State Death Taxes (110,200)

Taxable Estate $3,759,800

Plus: Adjusted Taxable Gifts 100,000

Estate Tax Base $3,859,800

[Show More]