Accounting > TEST BANK > Test Bank For Accounting Principles 6th Canadian Edition (Volume 2) Weygandt Kieso Kimmel Trenholm K (All)

Test Bank For Accounting Principles 6th Canadian Edition (Volume 2) Weygandt Kieso Kimmel Trenholm Kinnear Barlow

Document Content and Description Below

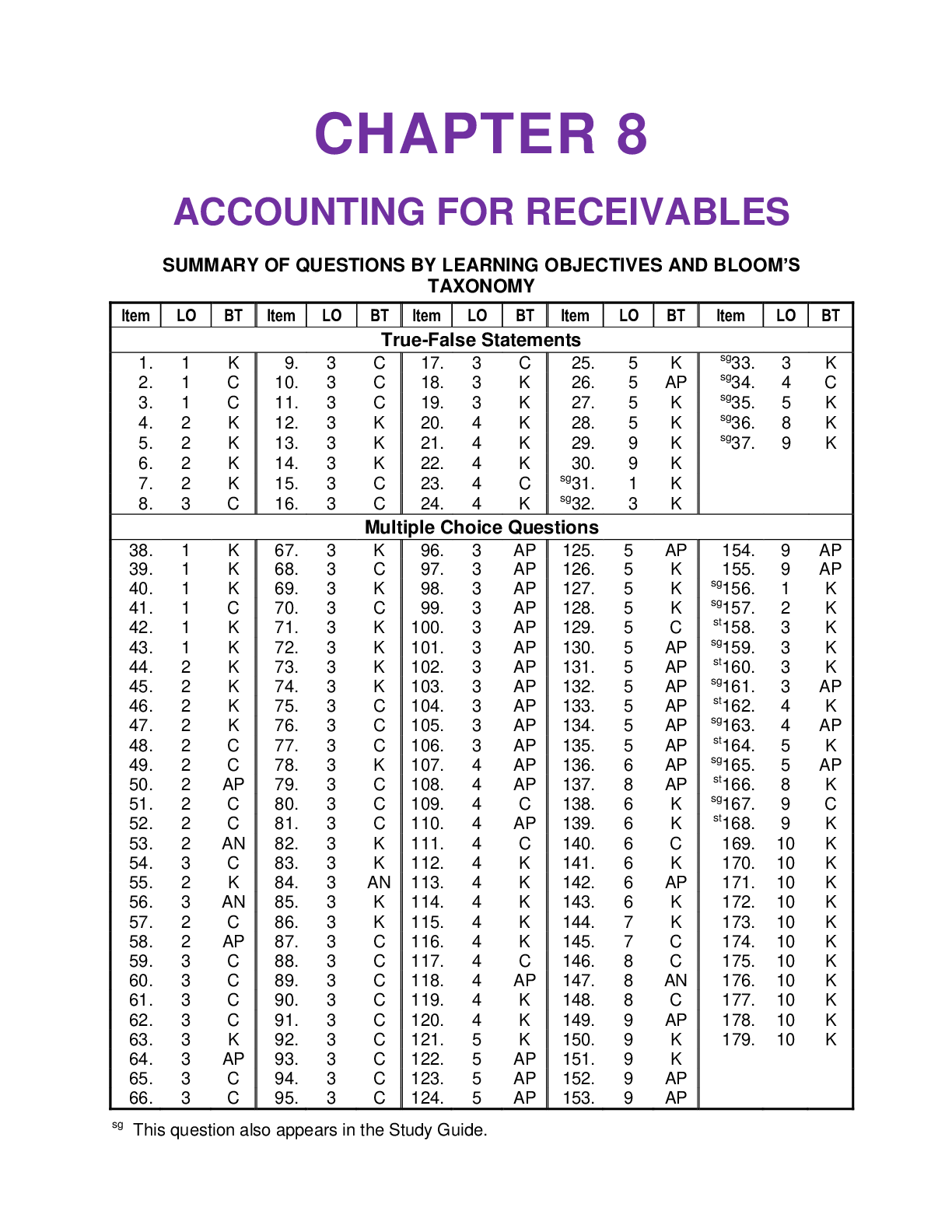

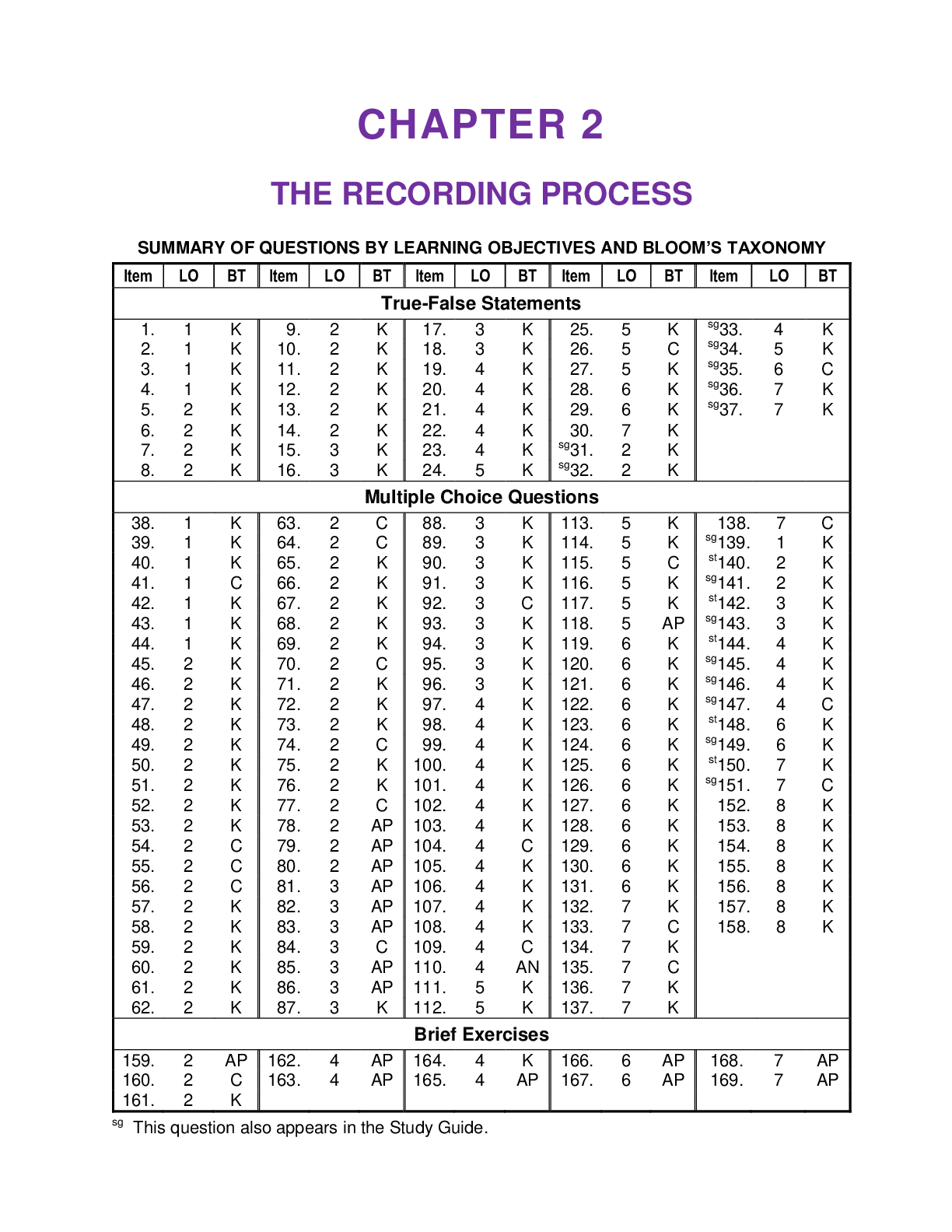

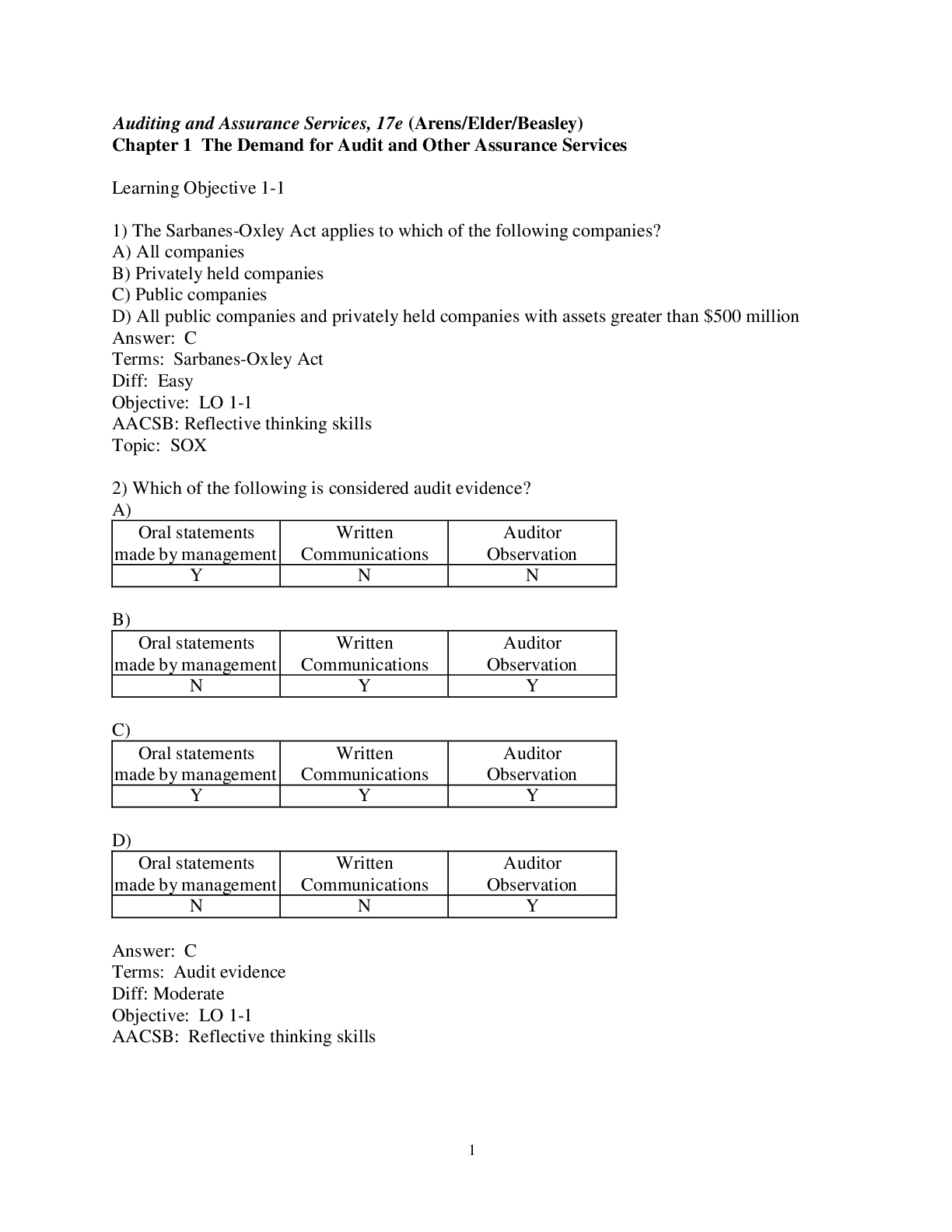

Test Bank For Accounting Principles 6th Canadian Edition (Volume 2) Weygandt Kieso Kimmel Trenholm Kinnear Barlow-1. Determine the cost of property, plant, and equipment. The cost of property, plant, ... and equipment includes all costs that are necessary to acquire the asset and make it ready for its intended use. All costs that benefit future periods (that is, capital expenditures) are included in the cost of the asset. When applicable, cost also includes asset retirement costs. When multiple assets are purchased in one transaction, or when an asset has significant components, the cost is allocated to each individual asset or component using their relative fair values. 2. Explain and calculate depreciation. After acquisition, assets are accounted for using the cost model or the revaluation model. Depreciation is recorded and assets are carried at cost less accumulated depreciation. Depreciation is the allocation of the cost of a long-lived asset to expense over its useful life (its service life) in a rational and systematic way. Depreciation is not a process of valuation and it does not result in an accumulation of cash. There are three commonly used depreciation methods: Method Effect on Annual Depreciation Calculation Straight-line Constant amount (Cost − residual value) ÷ estimated useful life (in years) Diminishingbalance Diminishing amount Carrying amount at beginning of year × diminishing-balance rate Units-ofproduction Varying amount (Cost − residual value) ÷ total estimated units of production × actual activity during the year Each method results in the same amount of depreciation over the asset’s useful life. Depreciation expense for income tax purposes is called capital cost allowance (CCA). The single diminishing-balance method is required and depreciation rates are prescribed. 3. Explain the factors that cause changes in periodic depreciation and calculate revisions. A revision to depreciation will be required if there are (a) capital expenditures during the asset’s useful life, (b) impairments in the asset’s fair value, (c) changes in the asset’s fair value when using the revaluation model, and/or (d) changes in the appropriate depreciation method, estimated useful life, or residual value. An impairment loss must be recorded if the recoverable amount is less than the carrying amount. Only under IFRS can impairment losses be reversed in future periods if the recoverable amount increases. Revisions of periodic depreciation are made in present and future periods, not retroactively. The new annual depreciation is determined by using the depreciable amount (carrying amount less the revised residual value), and the remaining useful life, at the time of the revision. 4. Account for the disposal of property, plant, and equipment. The accounting for the 9 - 4 Exercises for Accounting Principles, Sixth Canadian Edition disposal of a piece of property, plant, or equipment through retirement or sale is as follows: (a) Update any unrecorded depreciation for partial periods since depreciation was last recorded. (b) Calculate the carrying amount (cost – accumulated depreciation). (c) Calculate any gain (proceeds > carrying amount) or loss (proceeds < carrying amount) on disposal. (d) Remove the asset and accumulated depreciation accounts at the date of disposal. Record the proceeds received and the gain or loss, if any. An exchange of assets is recorded as the purchase of a new asset and the sale of an old asset. The new asset is recorded at the fair value of the asset given up plus any cash paid (or less any cash received). The fair value of the asset given up is compared with its carrying amount to calculate the gain or loss. If the fair value of the new asset or the asset given up cannot be determined, the new long-lived asset is recorded at the carrying amount of the old asset that was given up, plus any cash paid (or less any cash received). 5. Calculate and record depreciation of natural resources. The units-of-production method of depreciation is generally used for natural resources. The depreciable amount per unit is calculated by dividing the total depreciable amount by the number of units estimated to be in the resource. The depreciable amount per unit is multiplied by the number of units that have been extracted to determine the annual depreciation. The depreciation and any other costs to extract the resource are recorded as inventory until the resource is sold. At that time, the costs are transferred to cost of resource sold on the income statement. Revisions to depreciation will be required for capital expenditures during the asset’s useful life, for impairments, and for changes in the total estimated units of the resource [Show More]

Last updated: 7 months ago

Preview 5 out of 560 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$16.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 16, 2024

Number of pages

560

Written in

Additional information

This document has been written for:

Uploaded

Oct 16, 2024

Downloads

0

Views

19

.png)