Education > SOLUTIONS MANUAL > SOLUTION MANUAL FOR Taxation for Decision Makers 2024 Edition by Shirley Dennis- Escoffier, Karen A. (All)

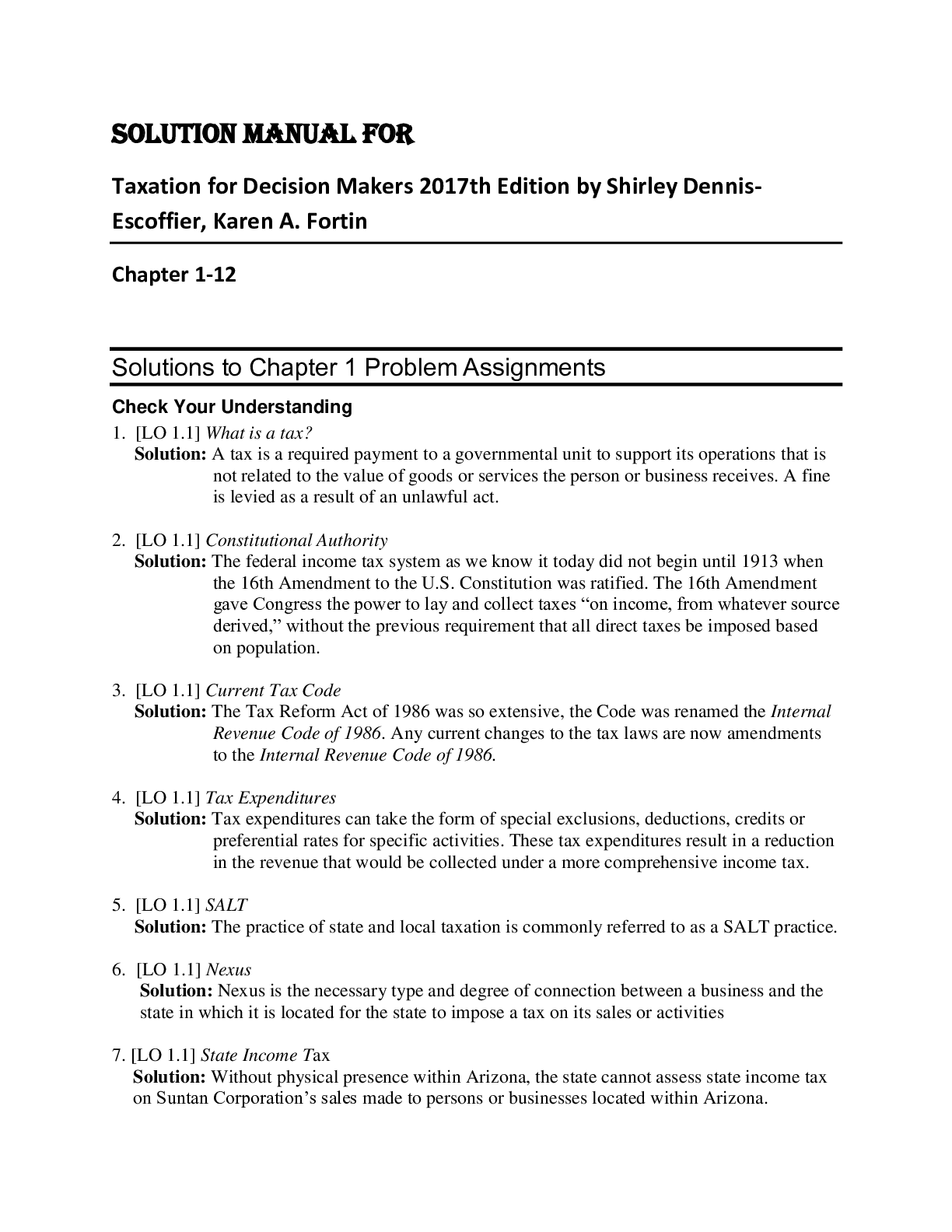

SOLUTION MANUAL FOR Taxation for Decision Makers 2024 Edition by Shirley Dennis- Escoffier, Karen A. Fortin

Document Content and Description Below

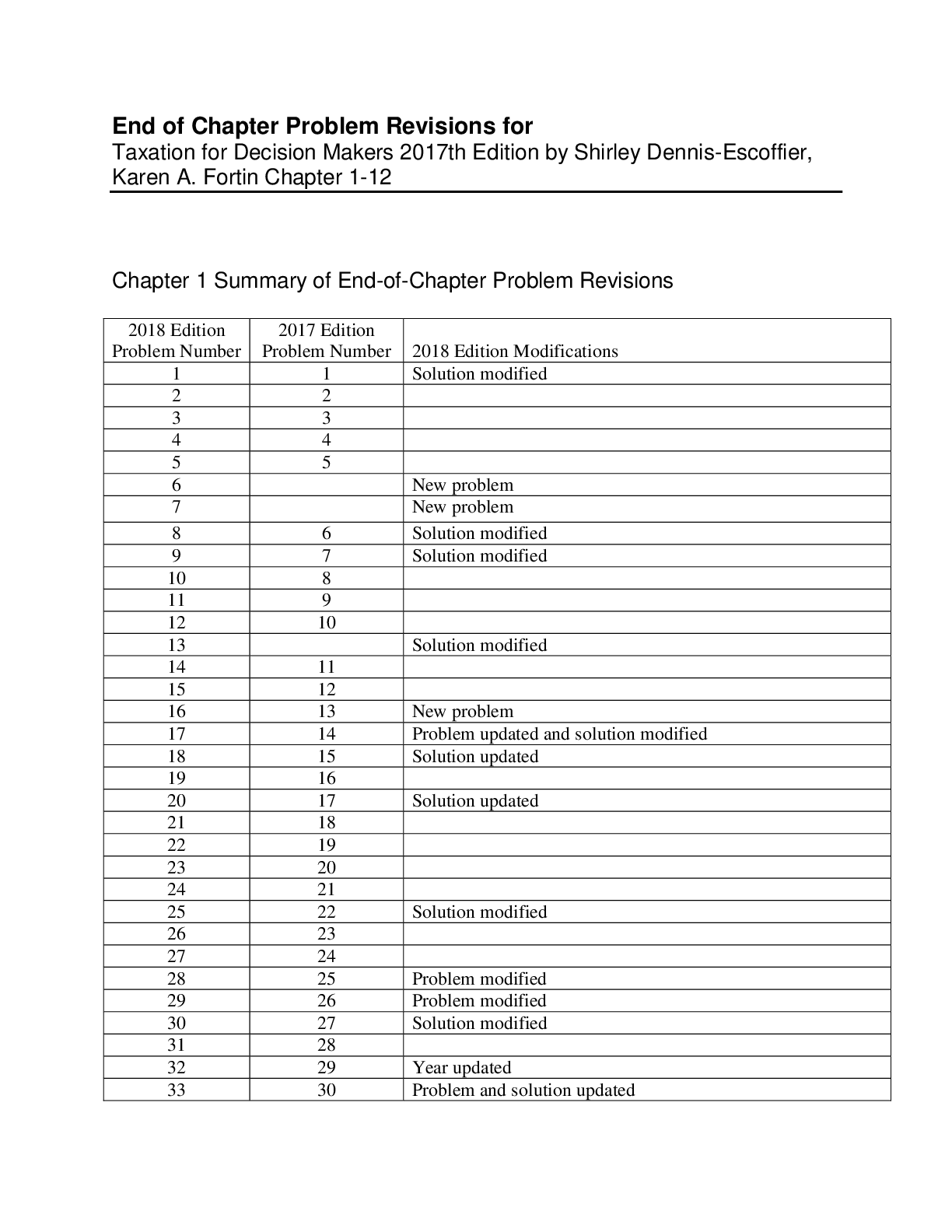

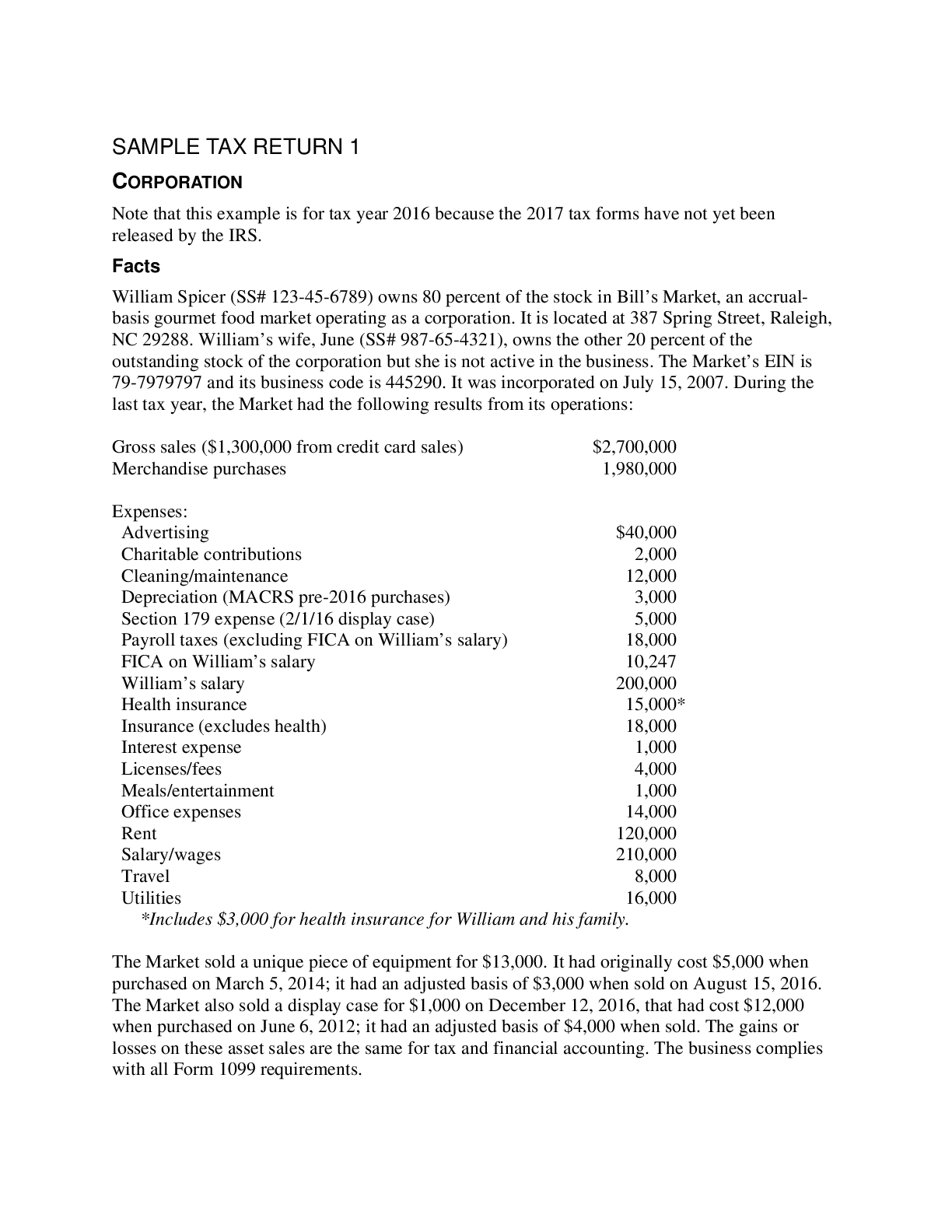

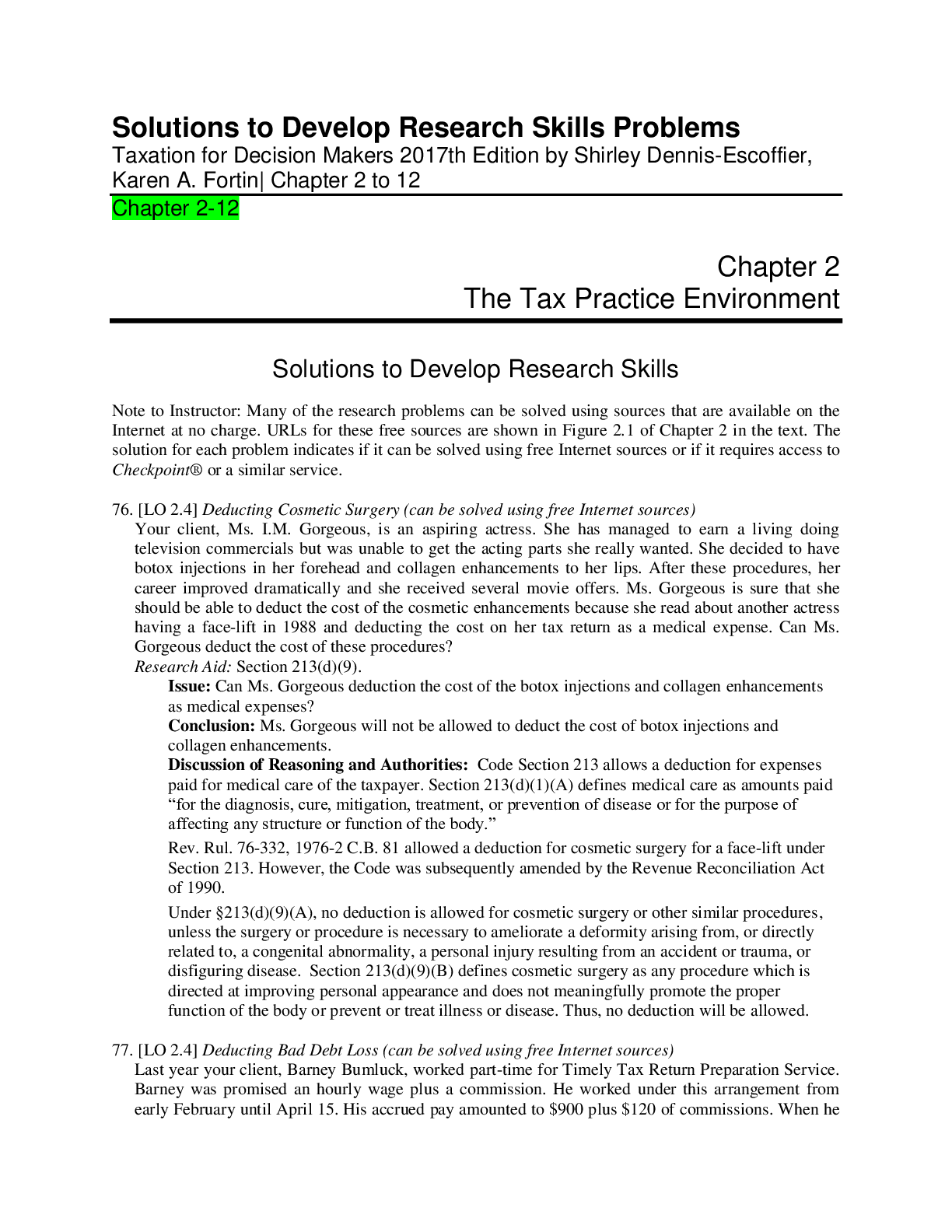

SOLUTION MANUAL FOR Taxation for Decision Makers 2024 Edition by Shirley Dennis- Escoffier, Karen A. Fortin-1. [LO 1.1] What is a tax? Solution: A tax is a required payment to a governmental unit to ... support its operations that is not related to the value of goods or services the person or business receives. A fine is levied as a result of an unlawful act. 2. [LO 1.1] Constitutional Authority Solution: The federal income tax system as we know it today did not begin until 1913 when the 16th Amendment to the U.S. Constitution was ratified. The 16th Amendment gave Congress the power to lay and collect taxes ―on income, from whateversource derived,‖ without the previous requirement that all direct taxes be imposed based on population. 3. [LO 1.1] Current Tax Code Solution: The Tax Reform Act of 1986 was so extensive, the Code was renamed the Internal Revenue Code of 1986. Any current changes to the tax laws are now amendments to the Internal Revenue Code of 1986. 4. [LO 1.1] Tax Expenditures Solution: Tax expenditures can take the form of special exclusions, deductions, credits or preferential rates for specific activities. These tax expenditures result in a reduction in the revenue that would be collected under a more comprehensive income tax. 5. [LO 1.1] SALT Solution: The practice of state and local taxation is commonly referred to as a SALT practice. 6. [LO 1.1] Nexus Solution: Nexus is the necessary type and degree of connection between a business and the state in which it is located for the state to impose a tax on its sales or activities 7. [LO 1.1] State Income Tax Solution: Without physical presence within Arizona, the state cannot assess state income tax on Suntan Corporation’s sales made to persons or businesses located within Arizona. 2 8. [LO 1.1] Franchise Tax Solution: A franchise tax is an excise tax based on the right to do business or own property in a state. It is usually determined based on corporate income, however, so would, in effect, simply be another name for an income tax. 9. [LO 1.1] State Income Allocation Solution: The three-factor allocation formula uses a percentage of corporate sales, payroll costs, and tangible property allocated to the state. 10. [LO 1.1] Employment Taxes Solution: An employee pays the Social Security and Medicare (FICA) tax; the employer also pays an equivalent Social Security and Medicare (FICA) tax, but the employer also may have to pay an unemployment tax. 11. [LO 1.1] Wealth Taxes Solution: The most common wealth tax is the real property tax based on the fair market value of property owned by an individual or a business. 12. [LO 1.1] Intangible Tax Solution: The intangible tax is levied on intangible property such as receivables, stocks, bonds, and other forms of investment instruments owned by businesses and individuals. 13. [LO 1.1] Estate and Gift Tax Solution: Property that is given away during a lifetime that exceeds an annual allowance per donee is subject to a gift tax; however, the lifetime exemption prevents most gifts from being subject to this tax. Once, however, taxable gifts exceed the lifetime exemption, gifts are subject to the gift tax. When the person passes away, the remaining property owned at death (not previously given away) is now subject to the estate tax. Any gift tax exemption not used previously by the decedent is then available as an exemption from the estate tax. Thus, a decedent’s estate escapes taxation unless his or her total lifetime taxable gifts plus taxable transfers at death exceed the lifetime exemption. 14. [LO 1.1] Consumption vs Income Tax Solution: A consumption tax is levied on purchases of goods or services that are going to be used or consumed. The most common consumption tax is the sales tax, but the value-added tax is another form used in many countries outside the United States. The income tax is based on the value of money or goods that are received, whether it is spent or saved. An income tax will tax money that is going to be saved rather than spent while the consumption tax only taxes money that is spent. The consumption tax is thought to encourage savings. 15. [LO 1.1] Wealth Taxes Solution: A wealth tax is based on the value of wealth that a person has at a particular poin [Show More]

Last updated: 9 months ago

Preview 5 out of 208 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$15.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 23, 2024

Number of pages

208

Written in

Additional information

This document has been written for:

Uploaded

Oct 23, 2024

Downloads

0

Views

20