Finance > SOLUTIONS MANUAL > SOLUTION MANUAL FOR Fundamentals of Corporate Finance, 4th Edition Robert Parrino, Hue Hwa Au Yong, (All)

SOLUTION MANUAL FOR Fundamentals of Corporate Finance, 4th Edition Robert Parrino, Hue Hwa Au Yong, Nigel Morkel-Kingsbury, Jennifer James, Paul Mazzola, James Murray, Lee Smales, Xiaoting Wei

Document Content and Description Below

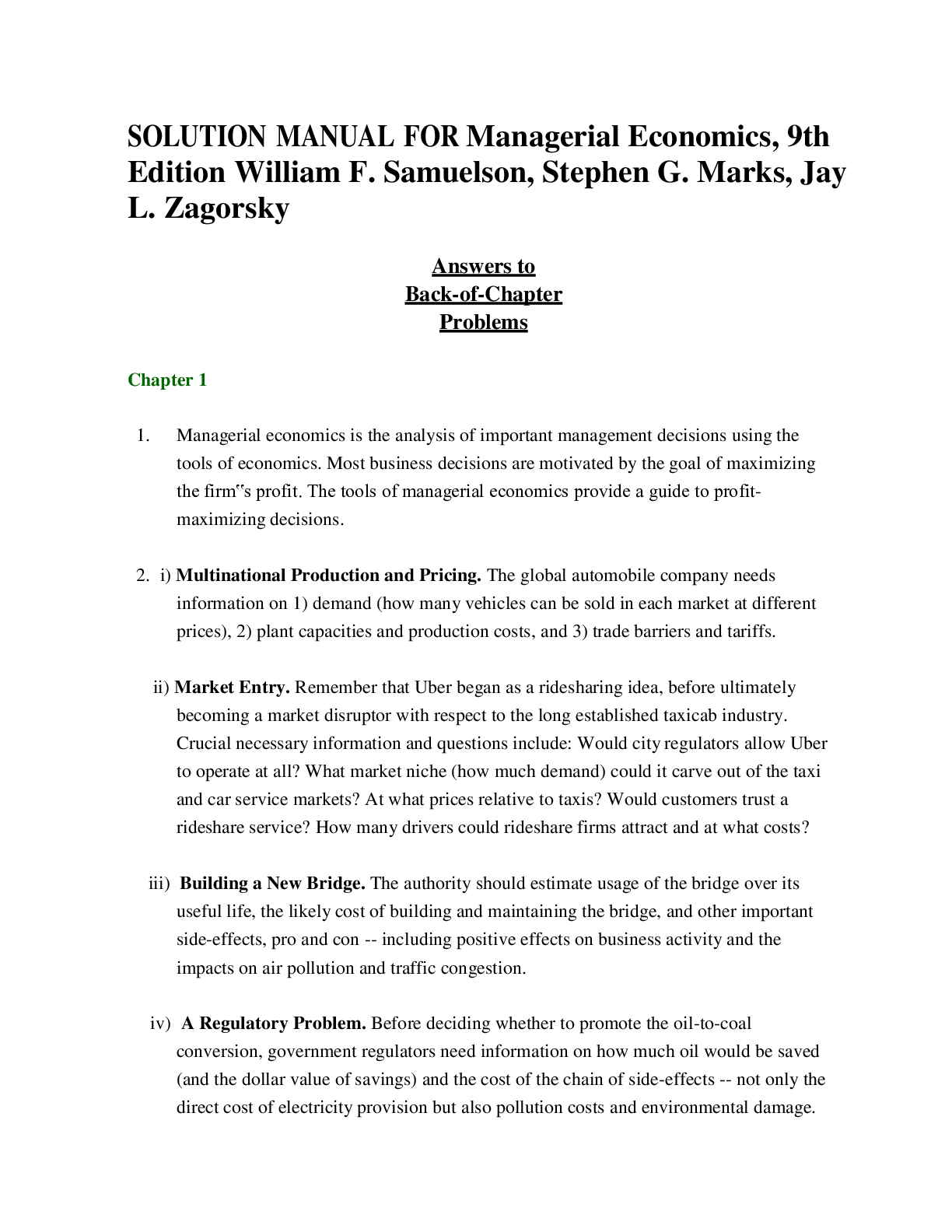

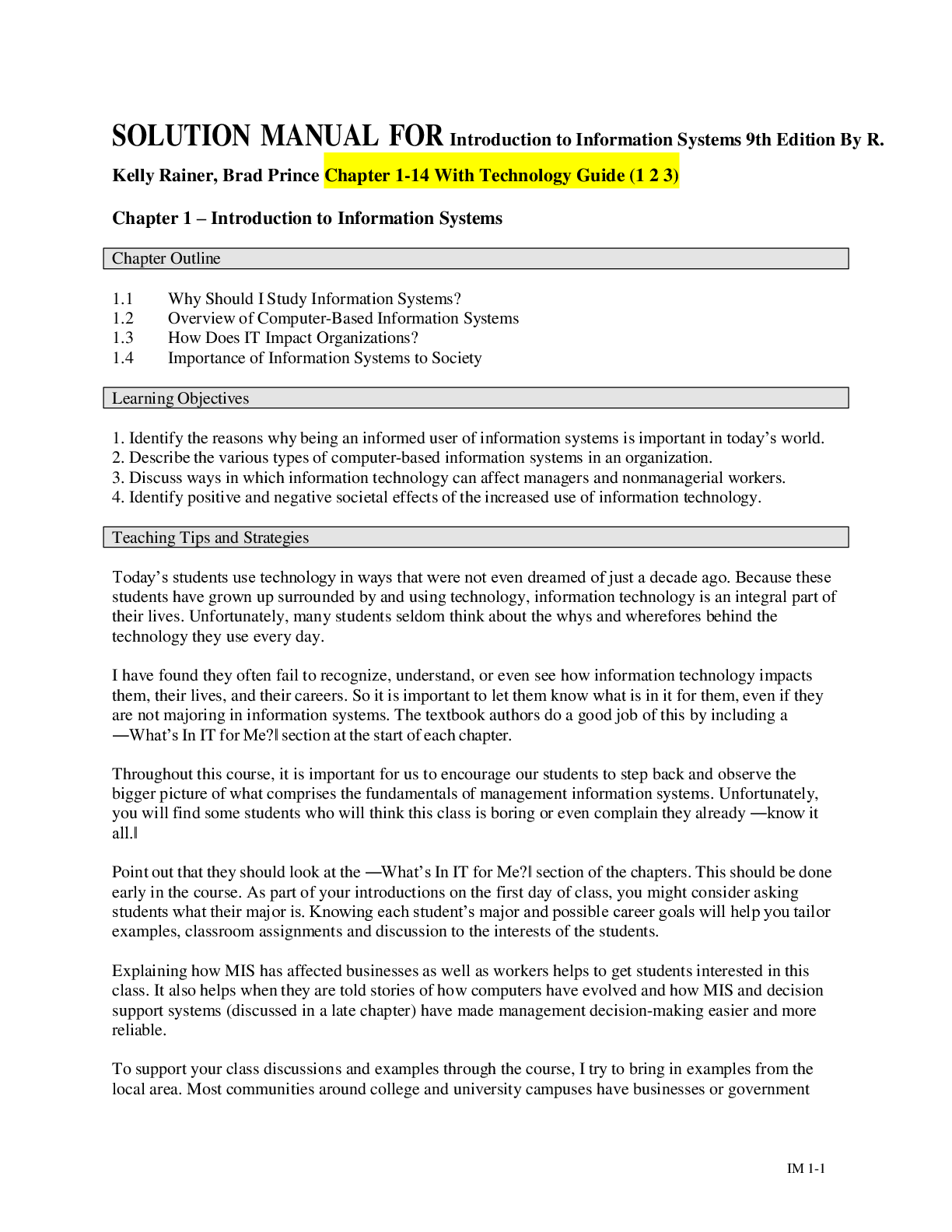

SOLUTION MANUAL FOR Fundamentals of Corporate Finance, 4th Edition Robert Parrino, Hue Hwa Au Yong, Nigel Morkel-Kingsbury, Jennifer James, Paul Mazzola, James Murray, Lee Smales, Xiaoting Wei -1. Wha... t are the three most basic types of financial decisions managers must make? The three most basic decisions each business must make are the capital budgeting decision, the financing decision, and the working capital management decision. These decisions determine which productive assets to buy, how to pay for or finance these purchases, and how to manage the day-to-day financial matters so the company can pay its bills. 2. Explain why you would make an investment if the value of the expected cash flows exceeds the cost of the project. You would accept an investment project whose cash flows exceed the cost of the project because such projects will increase the value of the firm, making the owners wealthier. Most people start a business to increase their wealth. 3. Why are capital budgeting decisions among the most important decisions in the life of a firm? The capital budgeting decisions are considered the most important in the life of the firm because these decisions determine which productive assets the firm purchases and these assets generate most of the firm’s cash flows. Furthermore, capital decisions are long-term decisions and if you make a mistake in selecting a productive asset, you are stuck with the decision for a long time. Section 1.2 1. Why are many businesses operated as sole proprietorships or partnerships? SM 19-2 Many businesses elect to operate as sole proprietorships or partnerships because of the small operating scale and capital base of their firms. Both of these forms of business organization are fairly easy to start and impose few regulations on the owners. 2. What are some advantages and disadvantages of operating as a public corporation? The main advantages of operating as a public corporation are the access to the public securities markets, which makes it easier to raise large amounts of capital, and the ease of ownership transfer. All the shareholders have to do is to call their broker to buy or sell shares of stock. And because a public corporation usually has many shares outstanding, large blocks of securities can be purchased or sold without an appreciable impact on the price of the stock. The major disadvantage of corporations is the tax situation. Not only must the corporation pay taxes on its income, but the owners of the corporation get taxed again when dividends are paid to them. This is referred to as double taxation. 3. Explain why professional partnerships such as physicians’ groups organize as limited liability partnerships. Professional partnerships such as physicians’ groups desire to organize as limited liability partnerships (LLPs) to take advantage of the tax arrangements of partnerships combined with the advantages of the limited liability of a corporation. By operating as an LLP, the partnership is able to avoid a potential financial disaster resulting from the misconduct of one partner. Section 1.3 1. What are the major responsibilities of the CFO? The major responsibilities of a CFO are recommendation and financial analysis of financial decisions. Although all top managers in a firm participate in these decisions, the final report and analysis is ultimately the responsibility of the CFO. 2. Identify three financial officers who typically report to the CFO and describe their duties. SM 19-3 The financial officers discussed in the chapter who report to the CFO are the controller, the treasurer, and the internal auditor. The controller is the firm’s chief accounting officer, and thus prepares the financial statements and taxes. This position also requires close cooperation with the external auditors. The treasurer’s responsibility is the collection and disbursement of cash, investing excess cash, raising new capital, handling foreign exchange, and overseeing the company’s pension fund management. He also assists the CFO in handling important Wall Street relationships. Finally, the internal auditor is responsible for conducting risk assessment and for performing audits of high-risk areas. [Show More]

Last updated: 7 months ago

Preview 5 out of 945 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$19.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 23, 2024

Number of pages

945

Written in

Additional information

This document has been written for:

Uploaded

Oct 23, 2024

Downloads

0

Views

25