Canadian Income Taxation 2022/2023 > TEST BANKS > McGraw-Hill's Taxation of Individuals and Business Entities 2023 Edition 14th Edition by Brian Spilk (All)

McGraw-Hill's Taxation of Individuals and Business Entities 2023 Edition 14th Edition by Brian Spilker Benjamin Ayers John Barrick Troy Lewis John Robinson

Document Content and Description Below

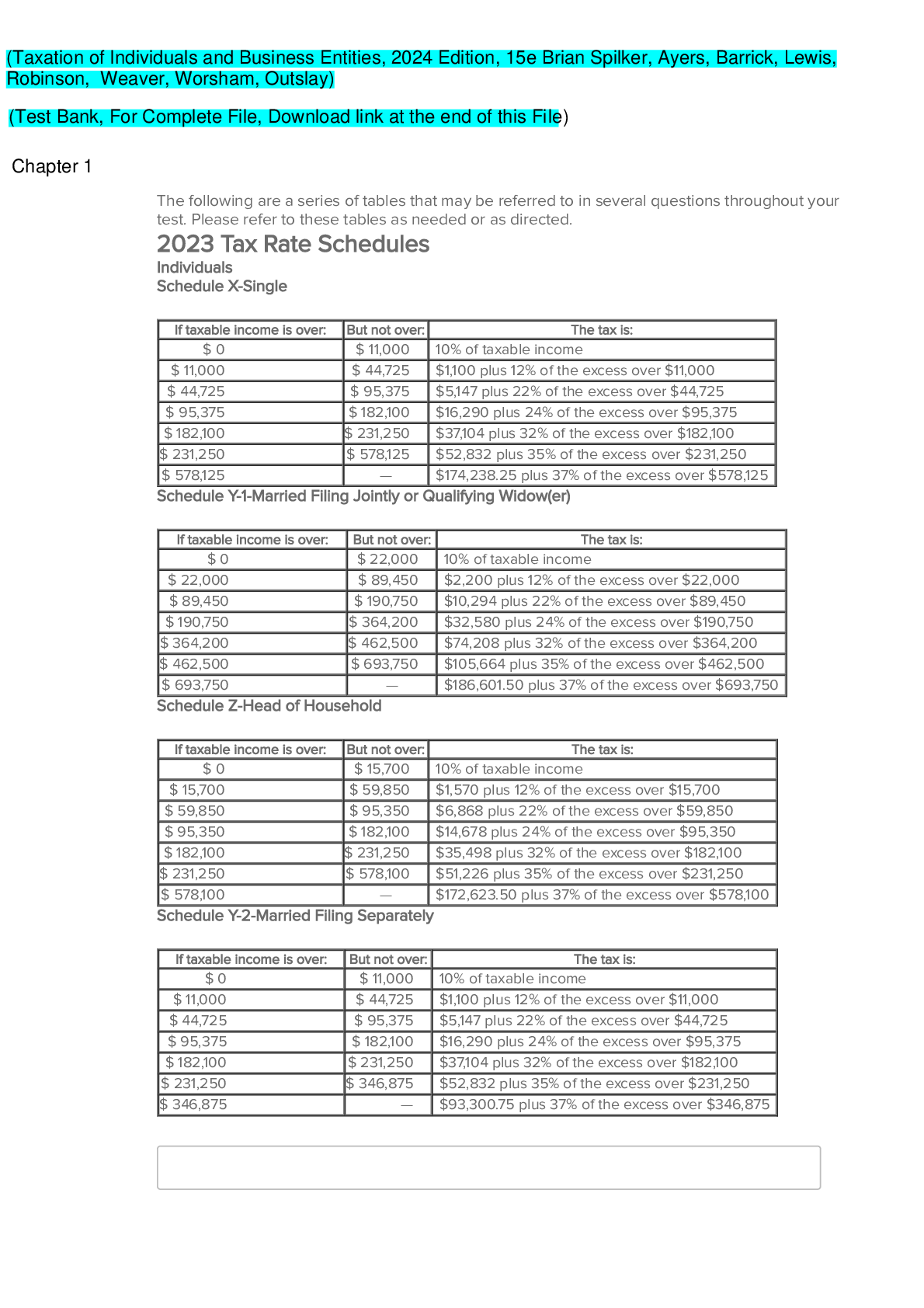

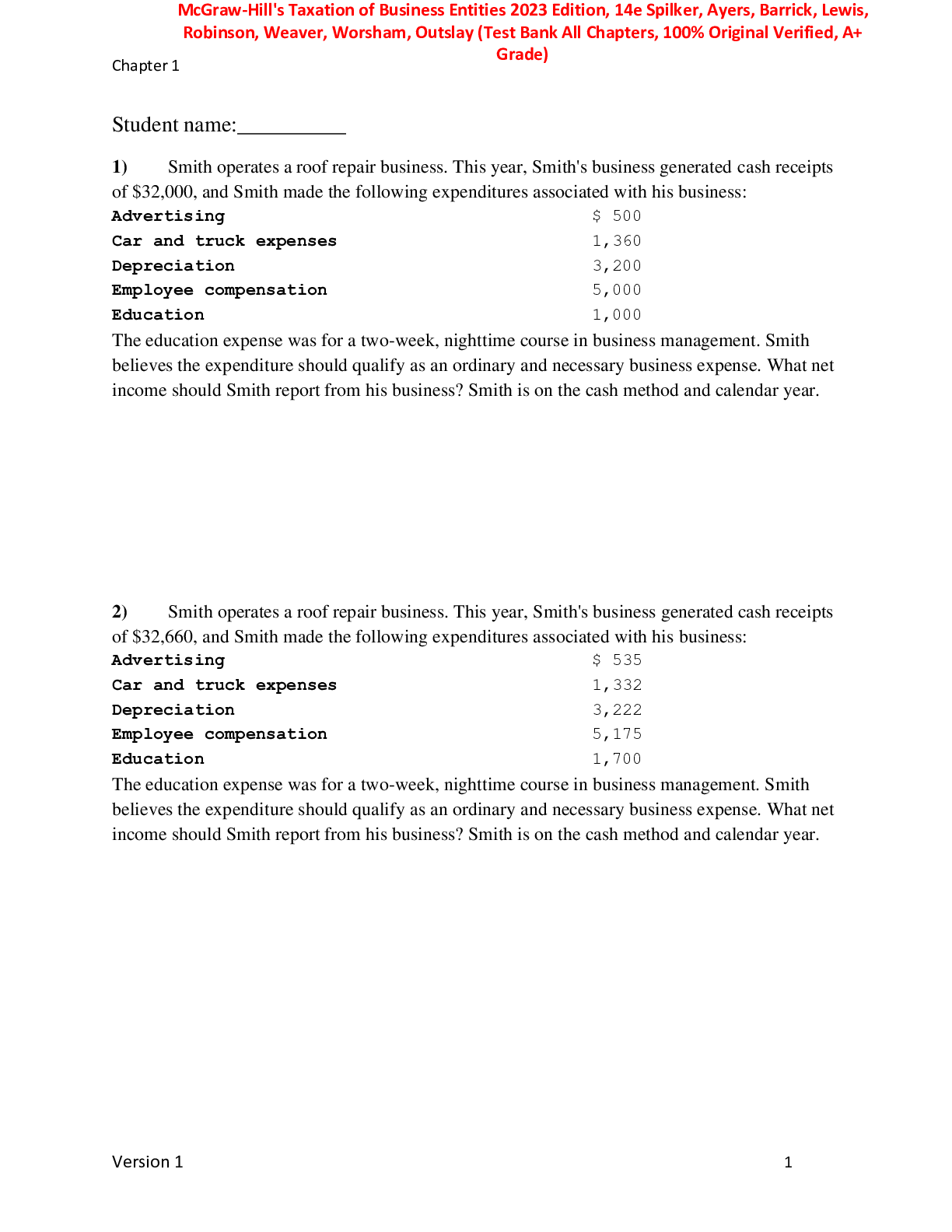

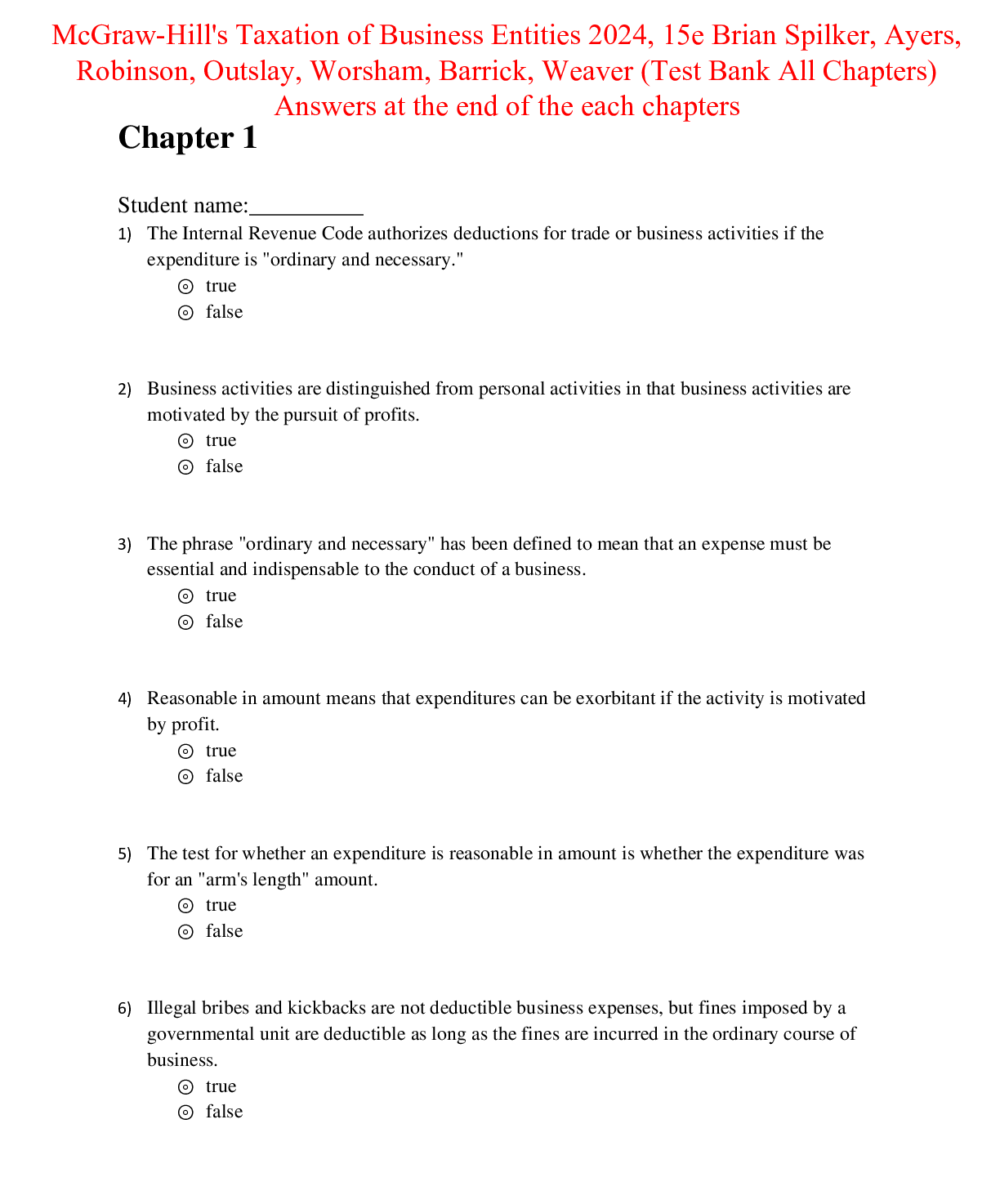

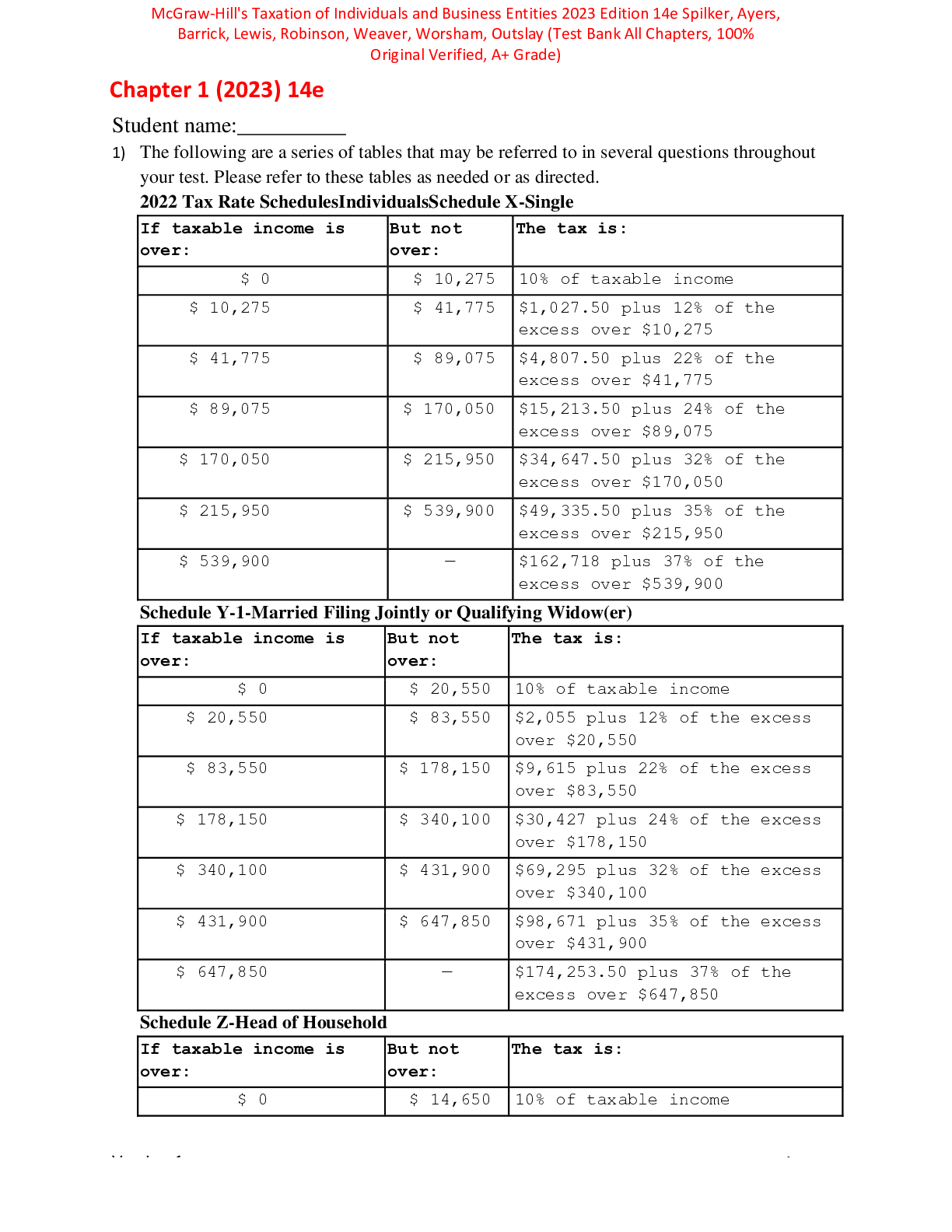

TRUE/FALSE - Write 'T' if the statement is true and 'F' if the statement is false. 1) Taxes influence many types of business decisions but generally do not influence personal decisions. ⊚ true ... ⊚ false 2) Taxes influence business decisions such as where a business should locate or how a business should be structured. ⊚ true ⊚ false 3) Tax policy rarely plays an important part in presidential campaigns. ⊚ true ⊚ false 4) Margaret recently received a parking ticket. This is a common example of a local tax. ⊚ true ⊚ false Version 1 3 5) George recently paid $50 to renew his driver's license. The $50 payment is considered a tax. ⊚ true ⊚ false 6) A 1 percent charge imposed by a local government on football tickets sold is not considered a tax if all proceeds are earmarked to fund local schools. ⊚ true ⊚ false 7) One key characteristic of a tax is that it is a required payment to a governmental agency. ⊚ true ⊚ false 8) Common examples of sin taxes include the taxes imposed on airline tickets and gasoline. ⊚ true ⊚ false Version 1 4 9) One benefit of a sin tax (e.g., a tax on cigarettes) is that it should increase the demand for the products being taxed. ⊚ true ⊚ false 10) In addition to raising revenues, specific U.S. taxes may have other objectives (e.g., economic or social objectives). ⊚ true ⊚ false 11) The two components of the tax calculation are the tax rate and the taxpayer's status. ⊚ true ⊚ false 12) The tax base for the federal income tax is taxable income. ⊚ true ⊚ false Version 1 5 13) A flat tax is an example of a graduated tax system. [Show More]

Last updated: 6 months ago

Preview 5 out of 1826 pages

Loading document previews ...

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$33.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Dec 03, 2024

Number of pages

1826

Written in

Additional information

This document has been written for:

Uploaded

Dec 03, 2024

Downloads

0

Views

27