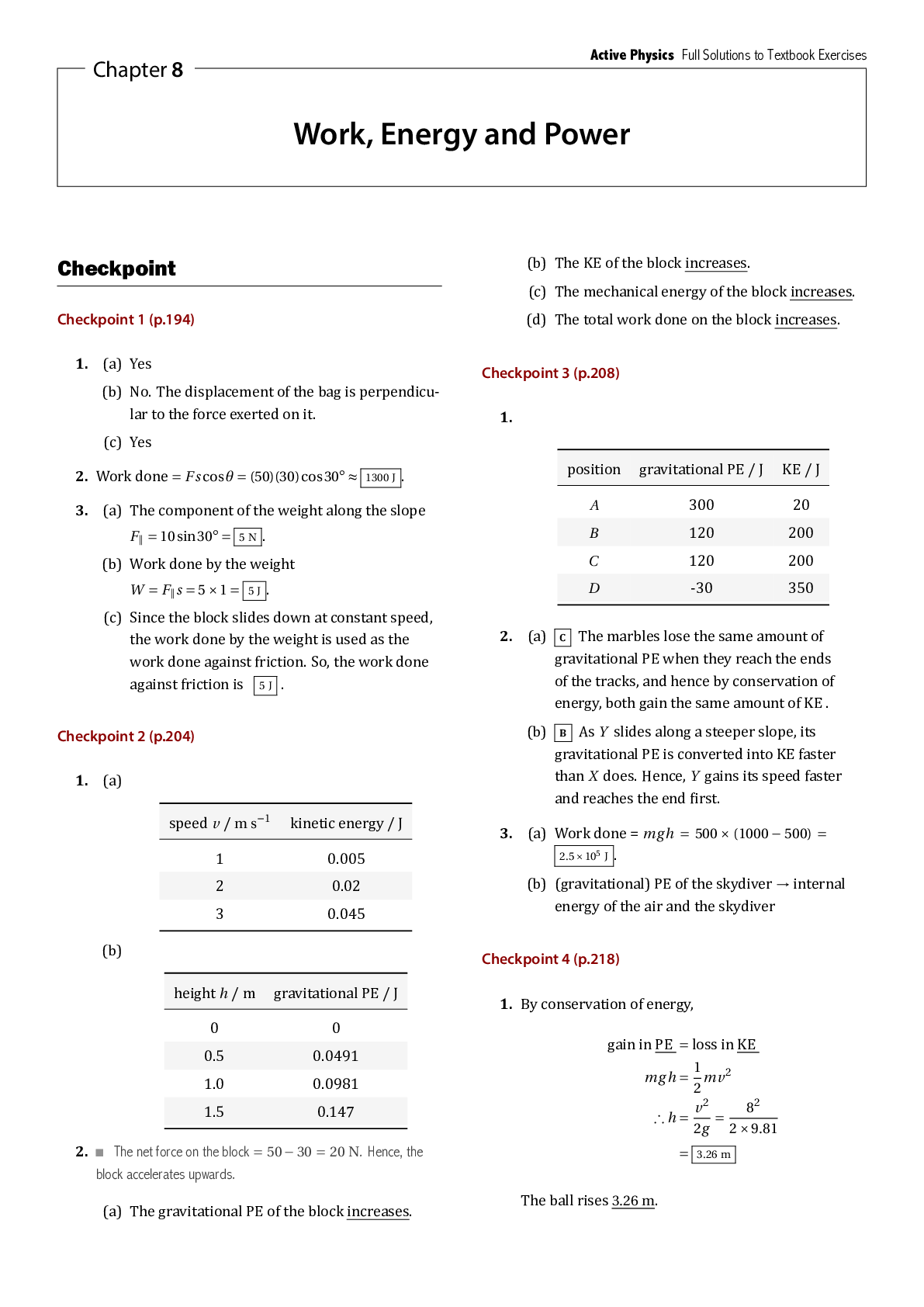

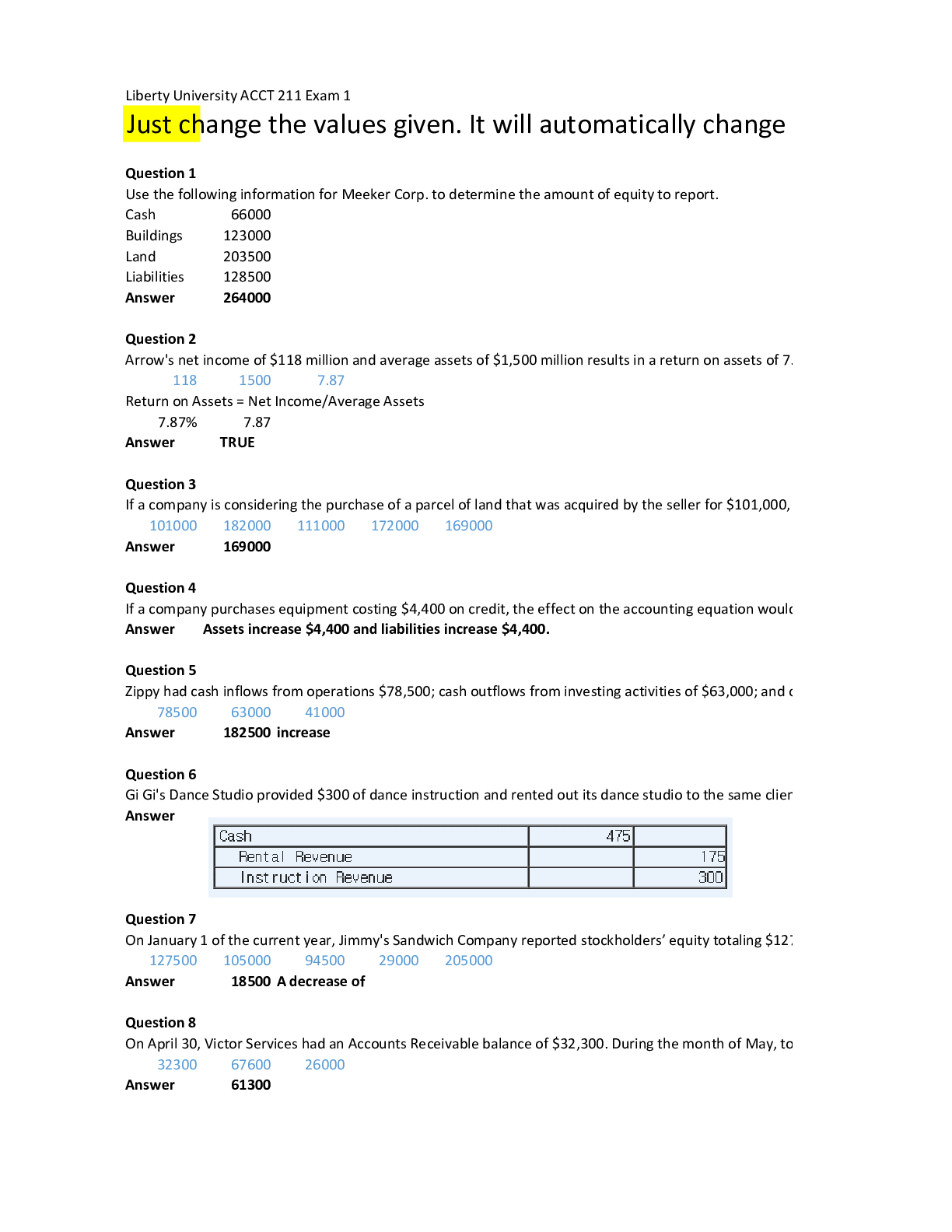

1. Use the following information for Meeker Corp. to determine the amount of equity to report.

Cash 66000

Buildings 123000

Land 203500

Liabilities 128500

Question 2

2. Arrow's net income of $118 million and ave

...

1. Use the following information for Meeker Corp. to determine the amount of equity to report.

Cash 66000

Buildings 123000

Land 203500

Liabilities 128500

Question 2

2. Arrow's net income of $118 million and average assets of $1,500 million results in a return on assets of 7.87%.

Return on Assets = Net Income/Average Assets

7.87% 7.87

3. If a company is considering the purchase of a parcel of land that was acquired by the seller for $101,000, is offered for sale at $182,000, is assessed for tax purposes at $111,000, is recognized by the purchaser as easily being worth $172,000, and is purchased for $169,000, the land should be recorded in the purchaser's books at:

101000 182000 111000 172000 169000

4. If a company purchases equipment costing $4,400 on credit, the effect on the accounting equation would be:

5. Zippy had cash inflows from operations $78,500; cash outflows from investing activities of $63,000; and cash inflows from financing of $41,000. The net change in cash was:

78500 63000 41000

6. Gi Gi's Dance Studio provided $300 of dance instruction and rented out its dance studio to the same client for another $175. The client paid immediately. Identify the general journal entry below that Gi Gi's will make to record the transaction.

7. On January 1 of the current year, Jimmy's Sandwich Company reported stockholders’ equity totaling $127,500. During the current year, total revenues were $105,000 while total expenses were $94,500. Also, during the current year paid $29,000 in cash dividends. No other changes in equity occurred during the year. If, on December 31 of the current year, total assets are $205,000, the change in total stockholders’ equity during the year was:

127500 105000 94500 29000 205000

8. On April 30, Victor Services had an Accounts Receivable balance of $32,300. During the month of May, total credits to Accounts Receivable were $67,600 from customer payments. The May 31 Accounts Receivable balance was $26,000. What was the amount of credit sales during May? 32300 67600 26000

9. A $28 credit to Sales was posted as a $280 credit. By what amount is the Sales account in error? 28 280

10. On May 31, the Cash account of Bottle's R US had a normal balance of $5,300. During May, the account was debited for a total of $12,500 and credited for a total of $11,800. What was the balance in the Cash account at the beginning of May? 5300 12500 11800

11. Gi Gi's Bakery has total assets of $451 million. Its total liabilities are $123 million. Its equity is $328 million. Calculate the debt ratio. 451 123 328

12. At year-end, a trial balance showed total credits exceeding total debits by $5,100. This difference could have been caused by:

13. At the end of its first month of operations, Michael's Consulting Services reported net income of $32,500. They also had account balances of: Cash, $23,000; Office Supplies, $3,250 and Accounts Receivable $12,500. The sole stockholder’s total investment in exchange for common stock for this first month was $6,250. There were no dividends in the first month. 32500 23000 3250 12500 6250

14. A company earned $3,645 in net income for October. Its net sales for October were $13,500. Its profit margin is:

15. If a company has current assets of $15,600 and current liabilities of $10,400. Its current ratio is 1.5. 15600 10400 1.5

16. Use the information in the adjusted trial balance presented below to calculate current assets for Taron Company:

Account Title Dr. Cr.

Cash 62000

Accounts receivable 29000

Prepaid insurance 11800

17. Sanborn Company has 10 employees, who earn a total of $3,800 in salaries each working day. They are paid on Monday for the five-day workweek ending on the previous Friday. Assume that year ended on December 31 which is a Wednesday and all employees will be paid salaries for five full days on the following Monday. The adjusting entry needed on December 31 is: 3800

18. A company pays each of its two office employees each Friday at the rate of $130 per day for a five-day week that begins on Monday. If the monthly accounting period ends on Tuesday and the employees worked on both Monday and Tuesday, the month-end adjusting entry to record the salaries earned but unpaid is: 130

19. The correct adjusting entry for accrued and unpaid employee salaries of $8,200 on December 31 is:

20. After preparing and posting the closing entries for revenues and expenses, the income summary account has a debit balance of $30,000. The entry to close the income summary account will be:

21. Tiptoe Shoes had annual revenues of $197,000, expenses of $109,700, and dividends of $22,800 during the current year. The retained earnings account before closing had a balance of $309,000. The entry to close the Income Summary account at the end of the year, after revenue and expense accounts have been closed, is:

22. Temporary accounts include all of the following except:

23. The following information is available from the adjusted trial balance of the Harris Vacation Rental Agency. After closing entries are posted, what will be the balance in the Retained earnings account?

Total revenues 125000

Total expenses 60000

Retained earnings 80000

Dividends 15000

24. The total amount of depreciation recorded against an asset over the entire time the asset has been owned:

25. On January 1 of the current year, Jimmy’s Sandwich Company reported stockholders’ equity totaling $122,500. During the current year, total revenues were $96,000 while total expenses were $85,500. Also, during the current year paid $20,000 in cash dividends. No other changes in equity occurred during the year. If, on December 31 of the current year, total assets are $196,000, the change in total stockholders’ equity during the year was:

26. An account used to record stockholders’ investments in a business is called a(n):

27. A simple tool that is widely used in accounting to represent a ledger account and to understand how debits and credits affect an account balance is called a:

28. Which of the following accounts is not included in the liability section of the balance sheet?

29. Ethical behavior requires that:

30. If the liabilities of a company increased $92,000 during a period of time and equity in the company decreased $28,000 during the same period, what was the effect on the assets?

31. Speedy has net income of $34,955, and assets at the beginning of the year of $216,000. Assets at the end of the year total $262,000. Compute its return on assets.

32. A company's balance sheet shows: cash $41,000, accounts receivable $47,000, equipment $84,000, and equity $89,000. What is the amount of liabilities?

410Zapper has beginning equity of $277,000, net income of $61,000, dividends of $50,000 and stockholder investments of $16,000. Its ending equity is:

277000 61000 50000 16000 00 47000 84000 89000

33. During the month of March, Harley's Computer Services made purchases on account totaling $45,300. Also during the month of March, Harley was paid $10,700 by a customer for services to be provided in the future and paid $37,800 of cash on its accounts payable balance. If the balance in the accounts payable account at the beginning of March was $78,200, what is the balance in accounts payable at the end of March?

45300 10700 37800 78200

34. At the beginning of January of the current year, Little Mikey's Catering ledger reflected a normal balance of $62,000 for accounts receivable. During January, the company collected $16,800 from customers on account and provided additional services to customers on account totaling $13,500. Additionally, during January one customer paid Mikey $6,000 for services to be provided in the future. At the end of January, the balance in the accounts receivable account should be: 62000 16800 13500 6000

35. A bookkeeper has debited an asset account for $6,900 and credited a liability account for $3,700. Which of the following would be an incorrect way to complete the recording of this transaction:

36. Smiles Entertainment had the following accounts and balances at December 31:

Account Debit Credit

Cash 10200

Accounts Receivable 2040

Prepaid Insurance 2480

Supplies 1040

37. Using the information in the table, calculate the company's reported net income for the period.

38. On July 1, a company paid the $5,880 premium on a one-year insurance policy with benefits beginning on that date. What will be the insurance expense on the annual income statement for the first year ended December 31? 7 5880 1

39. On October 1, Goodwell Company rented warehouse space to a tenant for $2,800 per month and received $14,000 for five months’ rent in advance on that date, with the lease beginning immediately. The cash receipt was credited to the Unearned Rent account. The company’s annual accounting period ends on December 31. The Unearned Rent account balance at the end of December, after adjustment, should be: 10 2800 14000

40. On January 1, a company purchased a five-year insurance policy for $2,100 with coverage starting immediately. If the purchase was recorded in the Prepaid Insurance account, and the company records adjustments only at year-end, the adjusting entry at the end of the first year is: 5 2100

41. Canopy Services paid K. Canopy, the sole shareholder of Canopy Services, $5,100 in dividends during the current year. The entry to close the dividends account at the end of the year is:

42. The following information is available for the Noir Detective Agency. After closing entries are posted, what will be the balance in the Retained earnings account?

Net Loss $ 20600

Retained earnings 290500

Dividends 33200

43. Reversing entries:

44. Sanborn Company rents space to a tenant for $2,200 per month. The tenant currently owes rent for November and December. The tenant has agreed to pay the November, December, and January rents in full on January 15 and has agreed not to fall behind again. The adjusting entry needed on December 31 is:

45. Which of the following accounts could not be classified as a current liability?

46. While in the process of posting from the journal to the ledger, a company failed to post a $500 debit to the Equipment account. The effect of this error will be that:

47. The numbering system used in a company's chart of accounts:

48. A credit entry:

49. All of the following are true regarding ethics except:

50. The conceptual framework that the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) are attempting to converge and enhance includes the following broad areas to guide standard setting except:

51. The statement of cash flows reports all of the following except:

[Show More]

.png)

A+ GRADED.png)

HESI VI EXIT EXAM.png)