Question #1

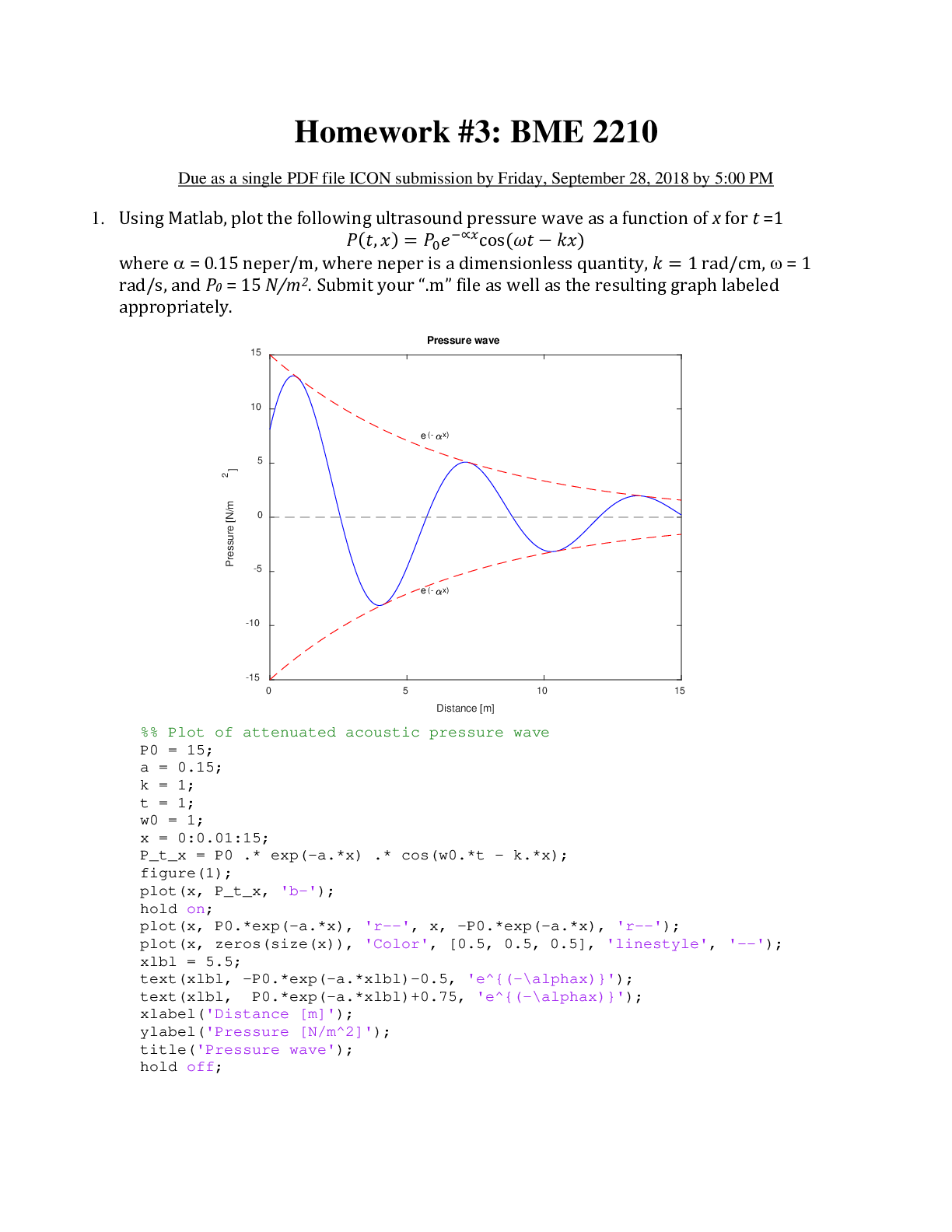

a. Depreciation on the company's equipment for 2017 is computed to be $14,000.

b. The Prepaid Insurance account had a $7,000 debit balance at December 31, 2017, before adjusting for the costs of any expired

...

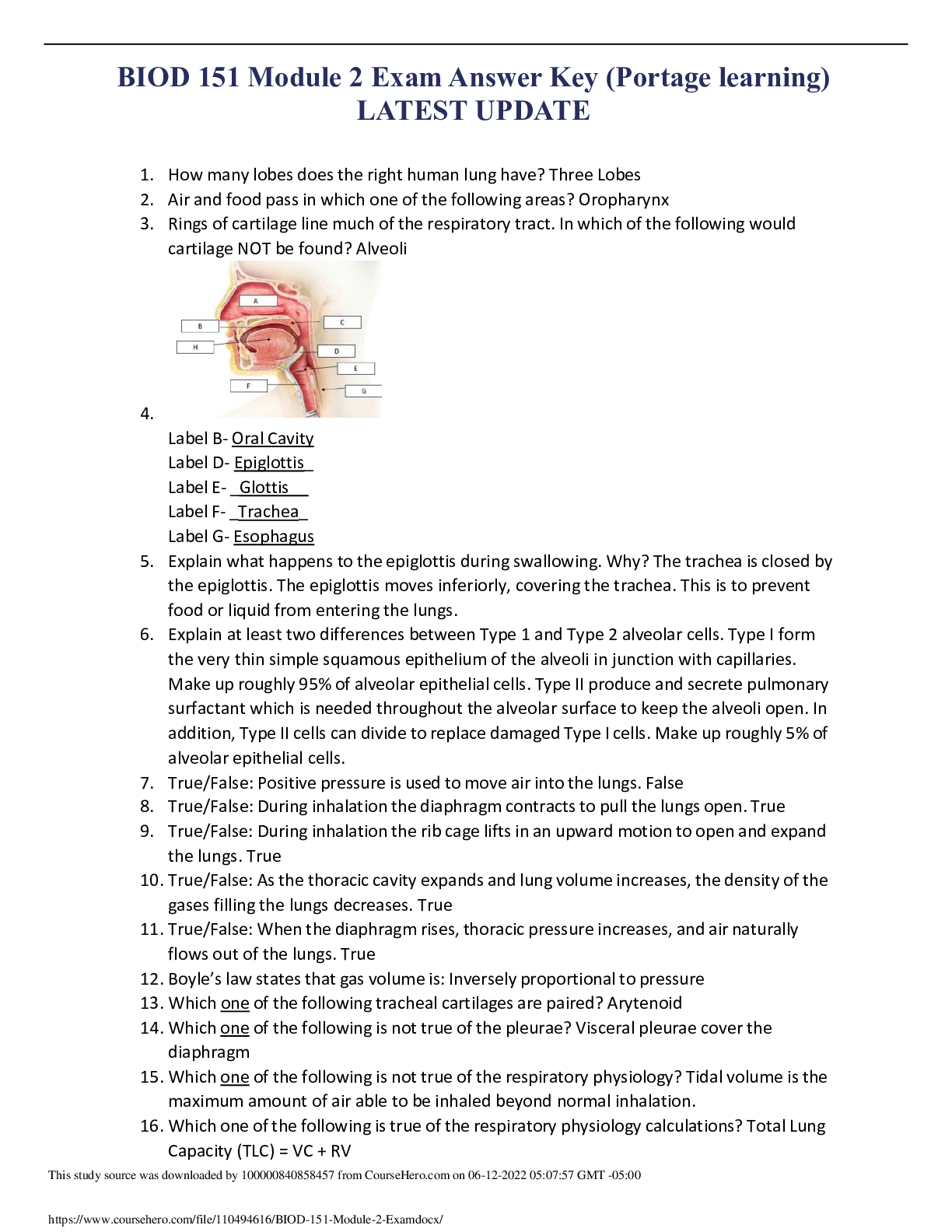

Question #1

a. Depreciation on the company's equipment for 2017 is computed to be $14,000.

b. The Prepaid Insurance account had a $7,000 debit balance at December 31, 2017, before adjusting for the costs of any expired

coverage. An analysis of the company's insurance policies showed that $1,250 of unexpired insurance coverage remains.

c. The Office Supplies account had a $300 debit balance on December 31, 2016; and $2,680 of office supplies were purchased during

the year. The December 31, 2017, physical count showed $354 of supplies available.

d. Three-fourths of the work related to $13,000 of cash received in advance was performed this period.

e. The Prepaid Insurance account had a $5,000 debit balance at December 31, 2017, before adjusting for the costs of any expired

coverage. An analysis of insura nee policies showed that $3,750 of coverage had expired.

f. Wage expenses of $4,000 have been incurred but are not paid as of December 31, 2017.

Prepare adjusting journal entries for the year ended (date of) December 31, 2017, for each of these separate situations.

Question #2

Following are two income statements for Alexis Co. for the year ended December 31. The left number column is prepared before any

adjusting entries are recorded, and the right column includes the effects of adjusting entries. The company records cash receipts and

payments related to unearned and prepaid items in balance sheet accounts. The middle column shows a blank space for each income

statement effect of the e ight adjusting entries a through g (the balance sheet part of the entries is not shown here)

Analyze the statements and prepare the eight adjusting entries a through g that likely were recorded. Note: Answer for a has two

entries 30% of (i) the $6,600 adjustment for Fees Earned has been earned but not billed, and (ii) the other 70% has been earned by

performing services that were paid for in advance.

The following is the adjusted trial balance of Wilson Trucking Company.

Account Title Debit Credit

Cash $ 5,500

Accounts receivable 16,500

Office supplies 2,000

Trucks 199,000

Accumulated depreciation-Trucks $ 40,994

Land 75,000

Accounts payable 9,500

I nterest payable 3,000

Long -term notes payable 52,000

Common stock 18,000

Retained earnings 173,039

Di vidends 19,000

Trucking fees earned 133,500

Depreciation expense-Trucks 26,441

Salaries expense 62,611

Office supplies expense 12,500

Repairs expense-Trucks 11,481

Totals $430,033 $430,033

The Retained Earnings account balance is $173,039 at December 31, 2016.

(1) Prepare the income statement for the year ended December 31, 2017.

(2) Prepare the statement of retained earnings for the year ended December 31, 2017.

Following are Nintendo's revenue and expense accounts for a recent March 31 fiscal year-end (yen in millions). (Enter answers in

millions.)

Net sales

Cost of sales

Advertisi ng expense

Other expense, net

¥1,858,622

1,174,981

119,108

397,544

Prepare the company's closing entries for its revenues and its expenses.

Question #5

Following are Nintendo's revenue and expense accounts for a recent March 31 fiscal year-end (yen in millions). (Enter answers in

millions.)

Net sales

Cost of sales

Advertisi ng expense

Other expense, net

¥1,858,622

1,174,981

119,108

397,544

Prepare the company's closing entries for its revenues and its expenses.

No Date I General Journal

1 March 31 Net sales

Income summary

2 March 31 Income summary

Cost of sales

Advertising expense

Other expense, net

Account Title Debit Credit

Cash $ 8,800

Accounts receivable 24,500

Office supplies 6,848

Trucks 157,000

Accumulated depreciation-Trucks $ 32,342

Land 45,000

Accounts payable 12,800

Interest payable 11,000

Long-term notes payable 45,000

Common stock 19,000

Retained earnings 112,965

Dividends 20,000

Trucking fees earned 129,000

Depreciation expense-Trucks 20,861

Salaries expense 58,391

Office supplies expense 10,000

Repairs expense-Trucks 10,707

Totals $362,107 $362, 107

Use the above adjusted trial balance to prepare Wilson Trucking Company's classified balance sheet as of December 31, 2017.

Use the following information to compute profit margin for each separate company a through e. (Round your answers to 1 decimal

place.)

Which of the five companies is the most profitable according to the profit margin ratio?

Company a

Company b

• Company c

Company d

Comput e t he current rat io for each of the following companies. (Round your answers to 2 decima l places.)

2 . Identify the company w ith the strongest liqL1idity position. (These cornpanies represent cornpetitors in the sarne industry.)

Analysis: Edison is in the s trongest liquidity position. It has about $2.92 of current assets for each $1 of current liabilities. The only potential concern is

t hat Edison may be c a rryi ng too muc h in c u rre nt assets that could b e better spent on more productive asset s (note that its remaining competit ors'

c urrent ratios range from 1.61 to 0 .7 1).

Arnez Company's annual accounting period ends on December 31, 2017. The following information concerns the adjusting entries to

be recorded as of that date.

a. The Office Supplies account started the year with a $4,400 balance. During 2017, the company purchased supplies for $18,172,

which was added to the Office Supplies account. The inventory of supplies available at December 31, 2017, totaled $3,872.

b. An analysis of the company's insurance policies provided the following facts.

Months of

Policy Date of Purchase Coverage Cost

A April 1, 2015 24 $11,640

B April 1, 2016 36 10,440

C August 1, 2017 12 9,240

The total premium for each policy was paid in full (for all months) at the purchase date, and the Prepa id Insurance account was debited

for the full cost. (Year-end adjusting entries for Prepaid Insurance were properly recorded in all prior years.)

c. The company has 15 employees, who earn a total of $2,950 in salaries each working day. They are paid each Monday for their work

in the five-day workweek ending on the previous Friday. Assume that December 31, 2017, is a Tuesday, and all 15 employees

worked the first two days of that week. Because New Year's Day is a paid holiday, they will be paid salaries for five full days on

Monday, January 6, 2018.

d. The company purchased a building on January 1, 2017. It cost $640,000 and is expected to have a $45,000 salvage value at the

end of its predicted 40-year life. Annual depreciation is $14,875.

e. Since the company is not large enough to occupy the entire building it owns, it rented space to a tenant at $3,400 per month,

starting on November 1, 2017. The rent was paid on time on November 1, and the amount received was credited to the Rent Earned

account. However, the tenant has not paid the December rent. The company has worked out an agreement with the tenant, who

has promised to pay both December and January rent in full on January 15. The tenant has agreed not to fall behind again.

f. On November 1, the company rented space to another tenant for $3,080 per month. The tenant paid five months' rent in advance

on that date. The payment was recorded with a credit to the Unearned Rent account.

Required:

1. Use the information to prepare adjusting entries as of December 31, 2017.

2. Prepare journal entries to record the first subsequent cash transaction in 2018 for parts c and e.

Wells Technical Institute (WTI), a school owned by Tristana Wells, provides training to individuals who pay tuition directly to

the school. WTI also offers training to groups in off-site locations. Its unadjusted trial balance as of December 31, 2017,

follows. WTI initially records prepaid expenses and unearned revenues in balance sheet accounts. Descriptions of items a

through h that require adjusting entries on December 31, 2017, follow.

Additional Information Items

a. An analysis of WTl's insurance policies shows that $2,807 of coverage has expired.

b. An inventory count shows that teaching supplies costing $2,433 are available at year-end 2017.

c. Annual depreciation on the equipment is $11,227.

d. Annual depreciation on the professional library is $5,614.

e. On November 1, WTI agreed to do a special six-month course (starting immediately) for a client. The contract calls for a

monthly fee of $2,800, and the client paid the first five months' fees in advance. When the cash was received, the

Unearned Training Fees account was credited. The fee for the sixth month will be recorded when it is collected in 2018.

f. On October 15, WTI agreed to teach a four-month class (beginning immediately) for an individual for $2,719 tuition per

month payable at the end of the class. The class started on October 15, but no payment has yet been received. (WTl's

accruals are applied to the nearest half-month; for example, October recognizes one-half month accrual.)

g. WTl's two employees are paid weekly. As of the end of the year, two days' salaries have accrued at the rate of $100 per

day for each employee.

h. The balance in the Prepaid Rent account represents rent for December.

WELLS TECHNICAL INSTITUTE

Unadjusted Tri al Balance

Cash

Accounts recei vable

Teaching suppl ies

Prepaid insurance

Prepaid rent

Professional l ibrary

De c embe r 31, 2017

Accumu l ated depreciation- Professional l ibrary

Equipment

Accumulated depreciation-Equipment

Accounts payable

Salaries payable

Unearned training fees

Common stock

Retai ned earni ngs

Dividends

Tuition fees earned

Training fees earned

Deprec i ation expense-Professional library

Deprec i ation expense- Equipment

Salaries expense

I nsurance expense

Rent expense

Teaching suppl ies expense

Advertising expense

Utili t i es expense

Totals

$

$

Debit Credit

27,396

0

10,536

15,806

2,108

31,610

$ 9,484

73,751

16,861

35,522

0

14,000

15,000

52,016

42,149

107,477

40,040

0

0

50,579

0

23,188

0

7,376

5,901

290,400 $290,400

Required information

[The following information applies to the questions displayed below.]

Wells Technical Institute (WTI), a school owned by Tristana Wells, provides training to individuals who pay tuition directly to

the school. WTI also offers training to groups in off-site locations. Its unadjusted trial balance as of December 31, 2017,

fol lows. WTI initially records prepaid expenses and unearned revenues in balance sheet accounts. Descriptions of items a

through h that require adjusting entries on December 31, 2017, follow.

Additional Information Items

a. An analysis of WTl's insurance policies shows that $2,807 of coverage has expired.

b. An inventory count shows that teaching supplies costing $2,433 are available at year-end 2017.

c. Annual depreciation on the equipment is $11,227.

d. Annual depreciation on the professional library is $5,614.

e. On November 1, WTI agreed to do a special six-month course (starting immediately) for a client. The contract calls for a

monthly fee of $2,800, and the client paid the first five months' fees in advance. When the cash was received, the

Unearned Training Fees account was credited. The fee for the sixth month will be recorded when it is collected in 2018.

f. On October 15, WTI agreed to teach a four-month class (beginning immediately) for an individual for $2,719 tuition per

month payable at the end of the class. The class started on October 15, but no payment has yet been received. (WTl's

accruals are applied to the nearest half-month; for example, October recognizes one-half month accrual.)

g. WTl's two employees are paid weekly. As of the end of the year, two days' salaries have accrued at the rate of $100 per

day for each employee.

h. The balance in the Prepaid Rent account represents rent for December.

WELLS TECHNICAL INSTITUTE

Unadjusted Trial Balance

Cash

Accounts receivable

Teaching supplies

Prepaid insurance

Prepaid rent

Professional library

December 31, 2017

Accumulated depreciation- Professional library

Equipment

Accumul ated depreciation-Equipment

Accounts payable

Salaries payable

Unearned training fees

Common stock

Retai ned earnings

Di vidends

Tuition fees earned

Training fees earned

Depreciation expense-Professional library

Depreciation expense-Equipment

Sala ries expense

Insurance expense

Rent e xpense

Teaching supplies expense

Adverti si ng expens e

Utilities expense

Total s

Debit

$ 27,396

0

10,536

15,806

2,108

31,610

73,751

42,149

0

0

50,579

0

23,188

0

7,376

5,901

$ 290,400

Credit

$ 9,484

16,861

35,522

0

14,000

15,000

52,016

107,477

40,040

$290,400

Wells Technical Institute (WTI), a school owned by Tristana Wells, provides training to individuals who pay tuition directly to

the school. WTI also offers training to groups in off-site locations. Its unadjusted trial balance as of December 31, 2017,

follows. WTI initially records prepaid expenses and unearned revenues in balance sheet accounts. Descriptions of items a

through h that require adjusting entries on December 31, 2017, follow.

Additional Information Items

a. An analysis of WTl's insurance policies shows that $2,807 of coverage has expired.

b. An inventory count shows that teaching supplies costing $2,433 are available at year-end 2017.

c. Annual depreciation on the equipment is $11,227.

d. Annual depreciation on the professional library is $5,614.

e. On November 1, WTI agreed to do a special six-month course (starting immediately) for a client. The contract calls for a

monthly fee of $2,800, and the client paid the first five months' fees in advance. When the cash was received, the

Unearned Training Fees account was credited. The fee for the sixth month will be recorded when it is collected in 2018.

f. On October 15, WTI agreed to teach a four-month class (beginning immediately) for an individual for $2,719 tuition per

month payable at the end of the class. The class started on October 15, but no payment has yet been received. (WTl's

accruals are applied to the nearest half-month; for example, October recognizes one-half month accrual.)

g. WTl's two employees are paid weekly. As of the end of the year, two days' salaries have accrued at the rate of $100 per

day for each employee.

h. The balance in the Prepaid Rent account represents rent for December.

Cash

Accounts receivable

Teaching suppl ies

Prepaid insurance

Prepaid rent

Professional l ibrary

WELLS TECHNICAL I NSTITUTE

Unadjusted Trial Balance

December 31, 2017

Accumulated depreciation- Professional library

Equipment

Accumulated depreciation- Equipment

Accounts payable

Salaries payable

Unearned training fees

Common stock

Retained earnings

Dividends

Tuition fees earned

Training fees earned

Depreciation expense- Professional library

Depreciation expense-Equipment

Salaries expense

Insurance expense

Rent expense

Teaching supplies expense

Advertising expense

Utilities expense

Totals

$

$

Debit Credit

27,396

0

1,0, 536

15,806

2,108

31,610

$ 9,484

73,751

16,861

35,522

0

14,000

15,000

52,016

42,149

107,477

40,040

0

0

50,579

0

23,188

0

7,376

5,901

290,400 $290,400

Required information

[The following information applies to the questions displayed below.]

A six-column table for JKL Company follows. The first two columns contain the unadjusted trial balance for the company

as of July 31, 2017. The last two columns contain the adjusted trial balance as of the same date.

Unadjusted Adjusted

Trial Balance Trial Balance

Cash $ 95,550 $ 95,550

Accounts rece i vable 8,000 20,500

Office supplies 18,400 4,500

Prepaid insurance 6,340 2,760

Office equipment 81,000 81,000

Accum. Depreciation--Office equip. $ 24,000 $ 34,000

Accounts payable 9,100 20,000

Interest payable 0 1,500

Salaries payable 0 11,000

Unearned consulting fees 20,000 16,000

Long-term notes payable 48,000 48,000

Common stock 26,400 26,400

Retai ned earnings 17,600 17,600

Dividends 9,500 9,500

Consulting fees earned 169,000 185,500

Depreciation expense--Office equip. 0 10,000

Salaries expense 67,290 78,290

Interest expense 1,290 2,790

Insurance expense 0 3,580

Rent expense 14,520 14,520

Office supplies expense 0 13,900

Advertising expense 12,210 23,110

Totals $ 314,100 $314,100 $ 360,000 $360,000

Required information

[The following information applies to the questions displayed below.]

The adjusted trial balance for Chiara Company as of December 31, 2017, follows.

Cash

Accounts recei vable

I nterest recei vable

Notes receivable (due in 90 days)

Office supplies

Automobiles

Accumu lated depreciation-Automobiles

Equipment

Accumu lated depreciation-Equipment

Land

Accounts payable

I nterest payable

Salaries payable

Unearned fees

Long-term notes payable

Common stock

Retained earnings

Dividends

Fees earned

I nterest earned

Depreciation expense-Automobiles

Depreciation expense-Equipment

Salaries expense

Wages expense

I nterest expense

Office supplies expense

Advertising e xpense

Repairs expense-Automobiles

Totals

Required:

$

Debit

186,800

54,500

22,600

170,500

16,000

168,000

144,000

85,000

51,000

25,500

20,000

188,000

39,000

35,200

34,000

58,500

26,200

$1,324,800

Credit

$ 85,000

20,000

95,000

50,000

21,000

42,000

142,000

28,580

257,220

564,000

20,000

$1,324,800

1(a) Prepare the income statement for the year ended December 31, 2017.

1(b) Prepare the statement of retained earnings for the year ended December 31, 2017.

1(c) Prepare Chiara Company's balance sheet as of December 31, 2017.

On April 1, 2017, Jiro Nozomi created a new travel agency, Adventure Travel. The following transactions occurred during the company's

first month.

April 1

2

Nozomi invested $49,000 cash and computer equipment worth $20,000 in the company in exchange for common stock.

The company rented furnished office space by paying $1,800 cash for the first month's (April) rent.

3 The company purchased $1,000 of office supplies for cash.

10 The company paid $2,300 cash for the premium on a 12-mont h insurance policy. Coverage begins on April 11.

14 The company paid $1,700 cash for two weeks' salaries earned by employees.

24 The

28 The

company

company

collected $17,000 cash on commissi ons from airlines on tickets obtained for customers.

paid $1,700 cash for t wo weeks' salaries earned by employees.

29 The company paid $400 cash for minor repairs to t he company's computer.

30 The company paid $1,050 cash for this month's telephone bill.

30 The company paid $2,200 cash in dividends.

The company's chart of accounts follows:

101 Cash 405 Commissions Earned

106 Accounts Receivable 612 Depreciation Expense-Computer Equip.

124 Office Supplies 622 Salaries Expense

128 Prepaid Insurance 637 Insurance Expense

167 Computer Equipment 640 Rent Expense

168 Accumulated Depreciation- Computer Equip. 650 Office Supplies Expense

209 Salaries Payable 684 Repairs Expense

307 Common Stock 688 Telephone Expense

318 Retained Earnings 901 Income Summary

319 Dividends

Use the following information:

a. Two-thirds (or $128) of one month's insurance coverage has expired.

b. At the end of the month, $800 of office supplies are still available.

c. This month's depreciation on the computer equipment is $400.

d. Employees earned $320 of unpaid and unrecorded salaries as of month-end.

e. The company earned $2,400 of commissions that are not yet billed at month-end.

Required:

1. & 2. Prepare journal entries to record the transactions for April and post them to the ledger accounts in Requirement 6b. The

company records prepaid and unearned items in balance sheet accounts.

3. Using account balances from Requirement 6b, prepare an unadjusted trial balance as of April 30.

4. Journalize and post the adjusting entries for the month and prepare the adjusted trial balance.

Sa. Prepare the income statement for the month of April 30, 2017.

Sb. Prepare the statement of retained earnings for the month of April 30, 2017.

Sc. Prepare the balance sheet at April 30, 2017.

Ga. Prepare journal entries to close the temporary accounts and then post to Requirement 6b.

6b. Post the journal entries to the ledger.

7. Prepare a post-closing trial balance.

[Show More]

.png)

HESI VI EXIT EXAM.png)