1) Cash flows during the first year of operations for the Harman-Kardon Consulting Company were as follows: Cash collected from customers,

$345,000; Cash paid for rent, $41,000; Cash paid to employees for services rende

...

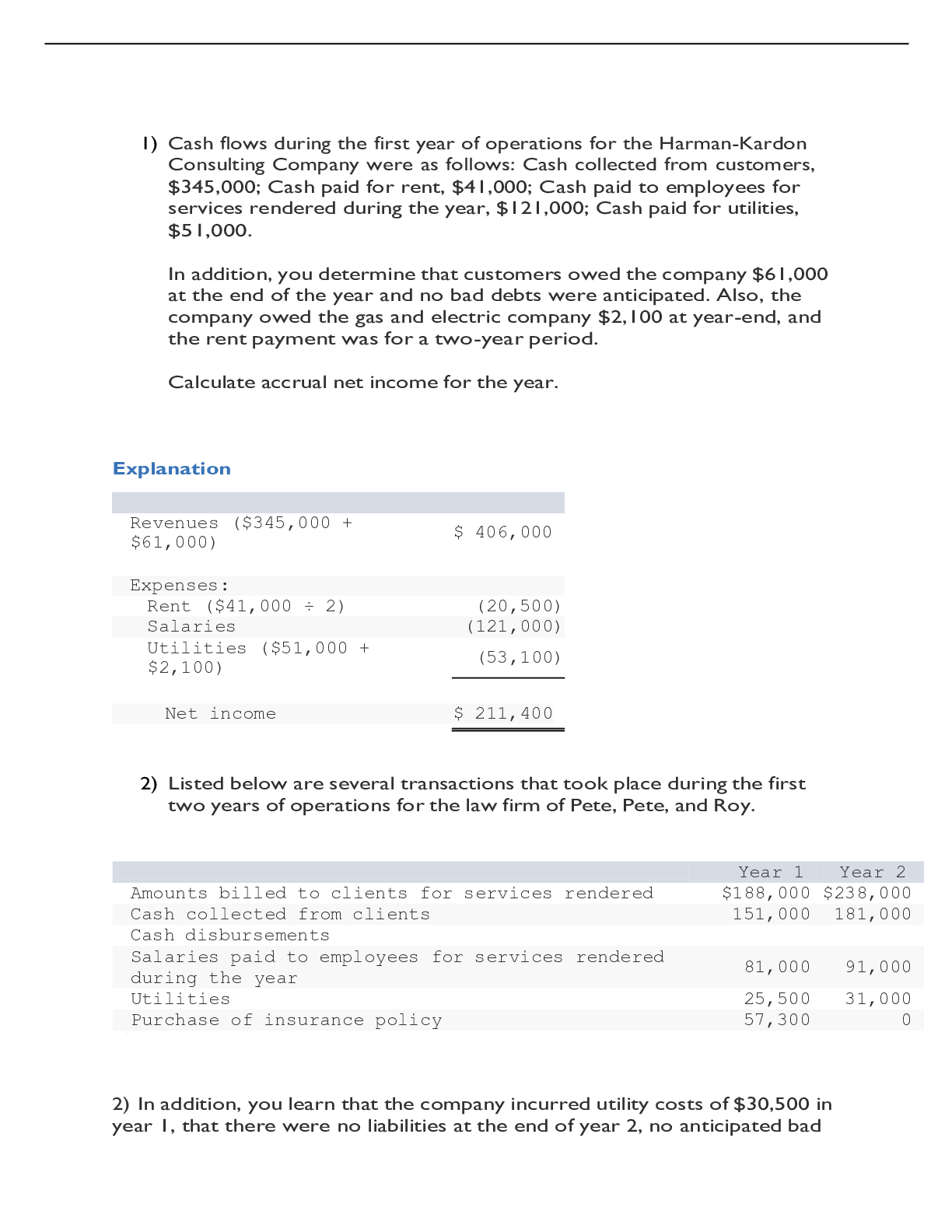

1) Cash flows during the first year of operations for the Harman-Kardon Consulting Company were as follows: Cash collected from customers,

$345,000; Cash paid for rent, $41,000; Cash paid to employees for services rendered during the year, $121,000; Cash paid for utilities,

$51,000.

In addition, you determine that customers owed the company $61,000 at the end of the year and no bad debts were anticipated. Also, the company owed the gas and electric company $2,100 at year-end, and the rent payment was for a two-year period.

Calculate accrual net income for the year.

Explanation

2) Listed below are several transactions that took place during the first two years of operations for the law firm of Pete, Pete, and Roy.

Year 1 Year 2

Amounts billed to clients for services rendered $188,000 $238,000

Cash collected from clients 151,000 181,000

Cash disbursements

Salaries paid to employees for services rendered during the year 81,000 91,000

Utilities 25,500 31,000

Purchase of insurance policy 57,300 0

2) In addition, you learn that the company incurred utility costs of $30,500 in year 1, that there were no liabilities at the end of year 2, no anticipated bad

debts on receivables, and that the insurance policy covers a three-year period.

Required:

1. & 3. Calculate the net operating cash flow for years 1 and 2 and determine the amount of receivables from clients that the company would show in its year 1 and year 2 balance sheets prepared according to the accrual accounting model.

2. Prepare an income statement for each year according to the accrual accounting model.

3) Listed below are several transactions that took place during the second and third years of operations for RPG Company.

Year 2 Year 3

Amounts billed to customers for services rendered $270,000 $370,000

Cash collected from credit customers 180,000 320,000

Cash disbursements:

Payment of rent 72,000 0

Salaries paid to employees for services rendered during the year 132,000 152,000

Travel and entertainment 22,000 32,000

Advertising 11,000 27,000

In addition, you learn that the company incurred advertising costs of $17,000 in year 2, owed the advertising agency $4,200 at the end of year 1, and there were no liabilities at the end of year 3. Also, there were no anticipated bad debts on receivables, and the rent payment was for a two-year period, year 2 and year 3.

Required:

1. Calculate accrual net income for both years.

2. Determine the amount due the advertising agency that would be shown as a liability on RPG’s balance sheet at the end of year 2.

17000 + 4200 = 21200 21200 – 11000 = 10200

4) Three groups that participate in the process of establishing GAAP are users, preparers, and auditors. These groups are represented by various organizations. For each organization listed below, indicate which of these groups it primarily represents.

5) For each of the items listed below, identify the appropriate financial statement element.

6) Listed below are several terms and phrases associated with the FASB’s conceptual framework. Pair each item from List A with the item from List B that is most appropriately associated with it.

7) The conceptual framework indicates the desired fundamental and enhancing qualitative characteristics of accounting information. Several constraints impede achieving these desired characteristics. Answer each of the following questions related to these characteristics and constraints.

8) Listed below are several terms and phrases associated with basic assumptions, broad accounting principles, and constraints. Pair each item from List A with the item from List B that is most appropriately associated with it.

9) For each of the following situations, indicate whether you agree or disagree with the financial reporting practice employed and state the basic assumption, component, or accounting principle that is applied (if you agree) or violated (if you disagree).

a. Wagner Corporation adjusted the valuation of all assets and

liabilities to reflect changes in the purchasing power of the dollar.

b. Spooner Oil Company changed its method of accounting for oil and gas exploration costs from successful efforts to full cost. No mention of the change was included in the financial statements. The change had a material effect on Spooner's financial statements.

c. Cypress Manufacturing Company purchased machinery having a five-year life. The cost of the machinery is being expensed over the life of the machinery.

d. Rudeen Corporation purchased equipment for $180,000 at a liquidation sale of a competitor. Because the equipment was worth

$230,000, Rudeen valued the equipment in its subsequent balance sheet at $230,000.

e. Davis Bicycle Company received a large order for the sale of 1,000 bicycles at $100 each. The customer paid Davis the entire amount of $100,000 on March 15. However, Davis did not record any revenue until April 17, the date the bicycles were delivered to the customer.

f. Gigantic Corporation purchased two small calculators at a cost of

$32.00. The cost of the calculators was expensed even though they had a three-year estimated useful life.

g. Esquire Company provides financial statements to external users every three years.

10) Identify the assumption, principle, or concept that relates to each statement or phrase below

[Show More]

HESI VI EXIT EXAM.png)