eBook [PDF] The Art of SEO Mastering Search Engine Optimization 4th Edition By Eric Enge, Stephan Spencer, Jessie Stricchiola

$ 29

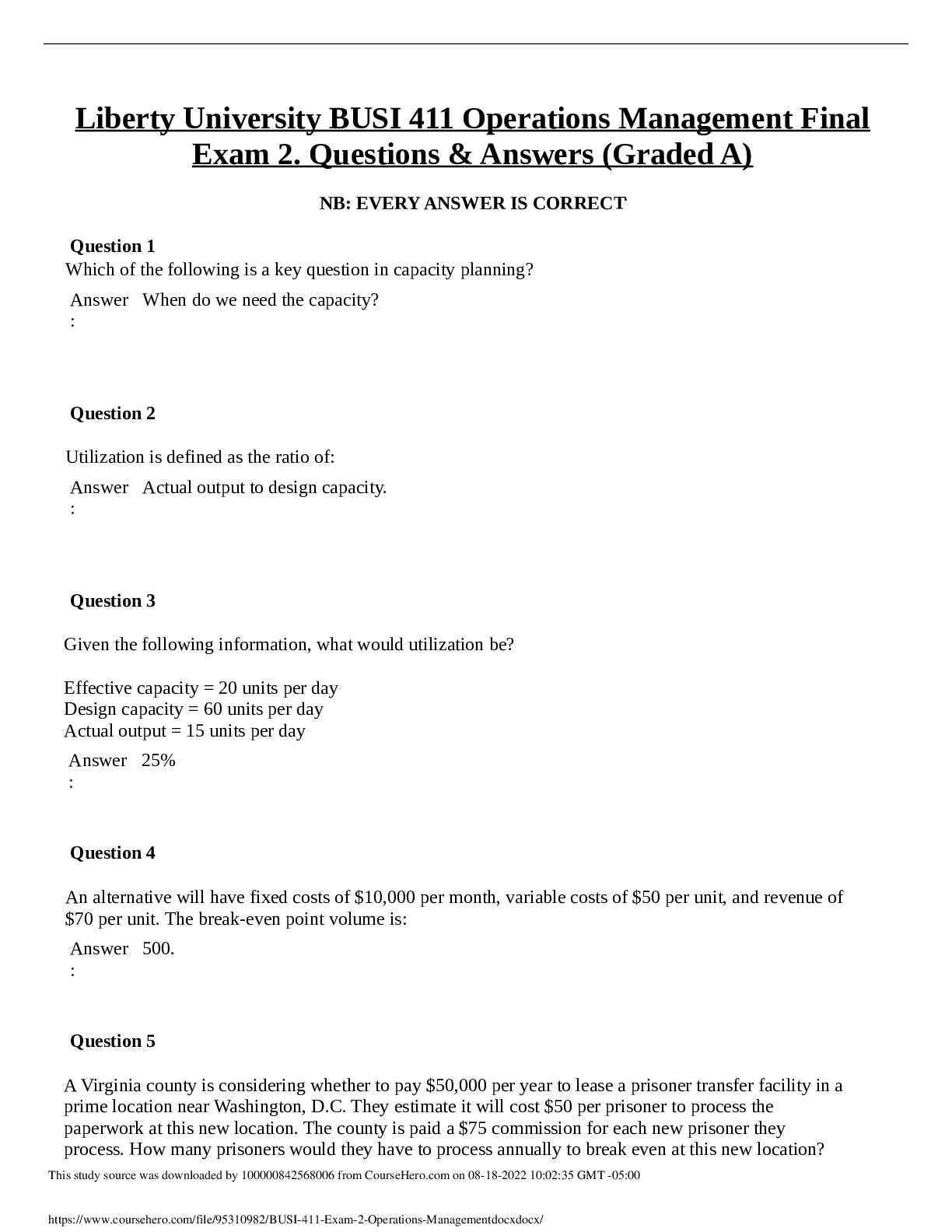

Liberty University BUSI 411 Operations Management Final Exam 2. Questions & Answers (Graded A)

$ 10.5

HESI A2: BIOLOGY. From the Test v1 and v2. 100 Of the most exam-essential and tested Q&A. See questions list in the Description

$ 9

NR 601 Week 5 Case Study Assignment: Mr Jones (Latest, 2021) Updated Version