Assumption College - ACCOUNTING 101REVIEW-APC004_Problem_Cases_Individual_Taxpayers

Document Content and Description Below

TAXATION PROF. R.E. HERMOSILLA

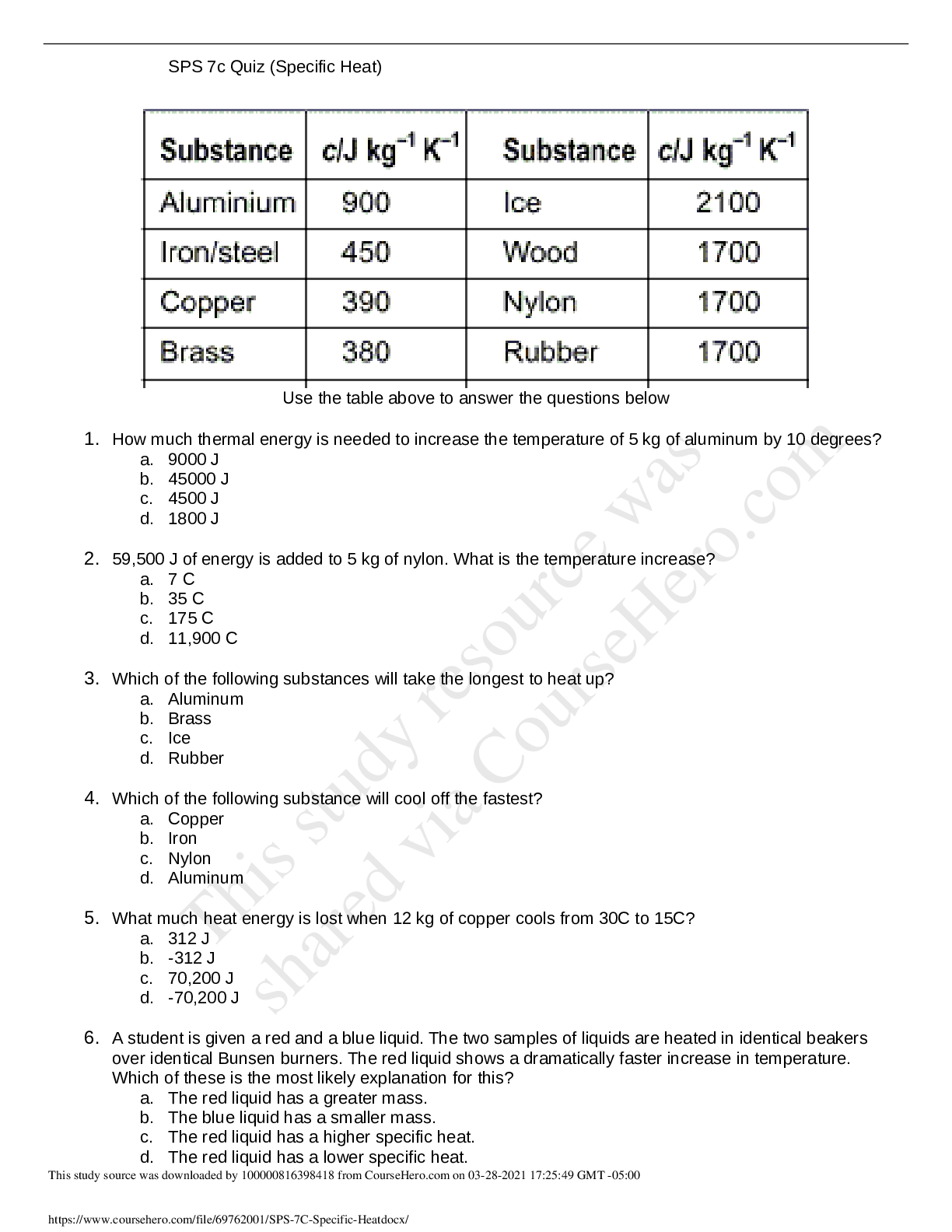

PROBLEM / CASES – INDIVIDUAL TAXPAYERS

1. The taxpayer is a resident citizen

Selling price of land and building in the Philippines held as capital

asset

P 6,200,0

...

00

Fair market value of land and building at the time of sale 6,500,000

Expense on the sale 500,000

• How much as the capital gain tax?

2. The taxpayer is a resident citizen

Selling price of Land and Building No.1 in the Philippines (ZV is

90%)

P 5,000,000

Selling price of Land and Building No.2 in the Philippines (ZV is

150%)

4,000,000

Cost of Land and Building 1 4,000,000

Cost of Land and Building 2 4,200,000

How much was the capital gain tax;

• On Land and Building 1

• On Land and Building 2

3. The taxpayer is a resident citizen

Selling price on a direct sale to a buyer of shares of stock of a

domestic corporation

P 500,000

Fair market value of the shares of stock at the time of sale 450,000

Expense on the sale 5,000

Purchase price of the shares of stock at the time of sale 200,000

Expense on the acquisition of the shares 2,000

• How much was the capital gain tax?

4. The taxpayer is a resident citizen

Selling price at prevailing market value, on a direct sale to a buyer,

of shares of stock of Co. X, a domestic corporation

P 700,000

Selling price at prevailing market value, on a direct sale to a buyer,

of shares of stock of Co. Y, a domestic corporation

600,000

Cost of Co. X shares of stock 500,000

Cost of Co. Y shares of stock 650,000

• How much was the capital gain tax on the sale of Co. X shares?

• How much was the capital gain tax on the sale of Co. Y shares?

5. An individual taxpayer owns several pieces of land which are classified as capital assets.

During the current year, he has the following data:

[Show More]

Last updated: 3 years ago

Preview 1 out of 9 pages

.png)

.png)