Name

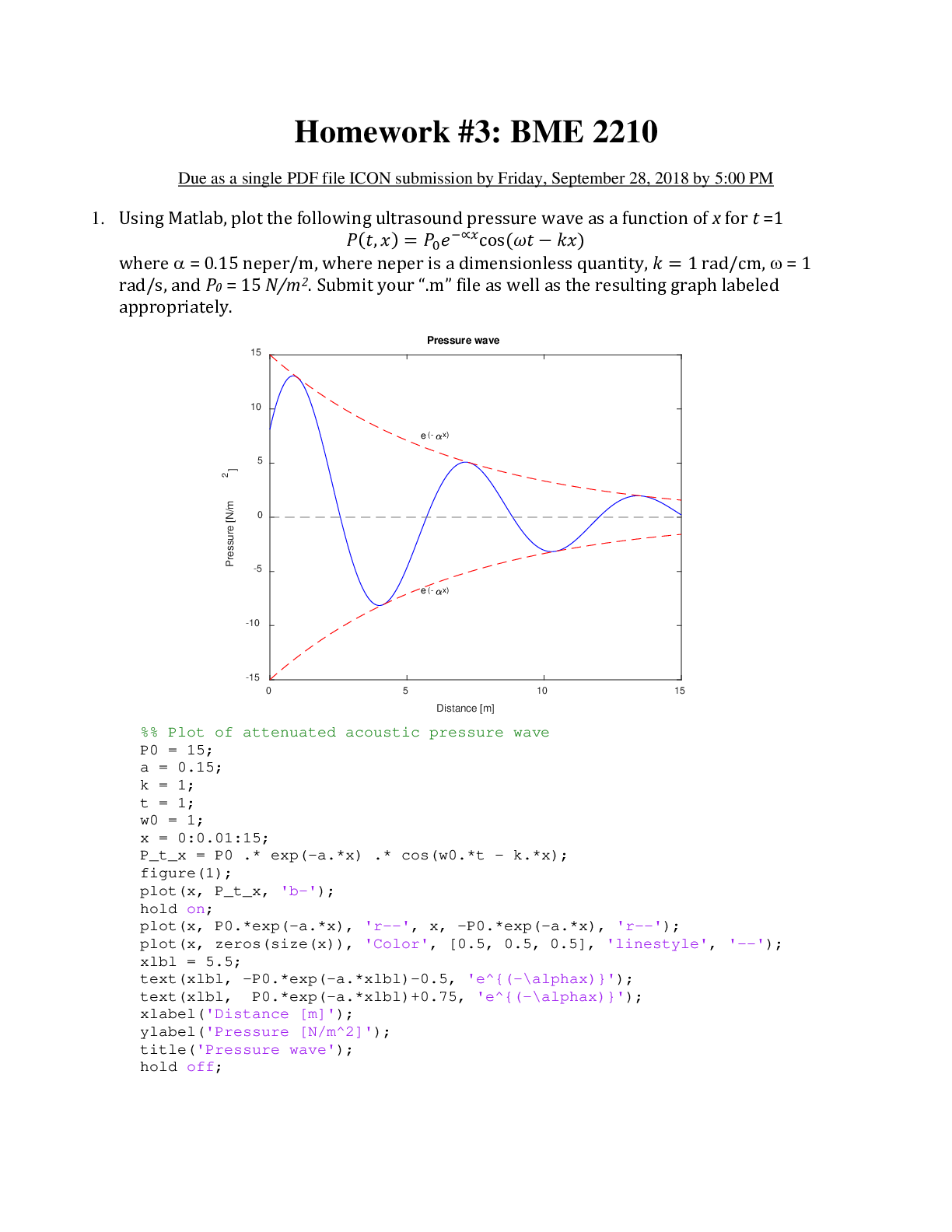

MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question.

The total dollar return on a share of stock is defined as the:

change in the stock price divided by th

...

Name

MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question.

The total dollar return on a share of stock is defined as the:

change in the stock price divided by the original stock price.

annual dividend income received.

change in the price of the stock over a period of time.

dividend income divided by the beginning price per share.

capital gain or loss plus any dividend income.

The dividend yield is defined as the annual dividend expressed as a percentage of the:

average stock price.

capital gain.

initial stock price.

totalannualreturn.

ending stock price.

The capital gains yield is equal to:

(Pt + 1 - Pt)/Pt.

B) (Pt + 1 - Pt)/Pt + 1.

C) (Pt - Pt + 1 + Dt + 1)/Pt + 1.

Dt + 1/Pt.

(Pt + 1 - Pt +Dt)/Pt.

When the total return on an investment is expressed on a per-year basis it is called the:

effective annual return.

initial return.

capital gains yield.

dividend yield.

holding period return.

The risk-freerate is:

another term for the dividend yield.

defined as the total of the capital gains yield plus the dividend yield.

the rate of return on a riskless investment.

the rate of return earned on an investment in a firm that you personally own.

defined as the increase in the value of a share of stock over time.

The rate of return earned on a U.S. Treasury bill is frequently used as a proxy for the:

deflated rate of return.

risk premium.

expected rate of return.

market rate of return.

risk-free rate.

The risk premium is defined as the rate of return on:

a U.S. Treasury bill.

a risky asset minus the risk-free rate.

a riskless investment.

the overall market.

a risky asset minus the inflation rate.

The additional return earned for accepting risk is called the:

real return.

inflated return.

riskless rate.

risk premium.

capital gains yield.

The standard deviation is a measure of:

total return.

changes in the capital gains rate.

volatility.

changes in dividend yields.

capital gains.

A frequency distribution, which is completely defined by its average (mean) and variance or standard deviation, is referred to as a(n):

expected rate of return.

average geometric return.

average arithmetic return.

normal distribution.

variance distribution.

The arithmetic average return is the:

average compound return earned per year over a multi-year period.

return earned in an average year over a multi-year period.

summation of the returns for a number of years, t, divided by (t -1).

average squared return earned in a single year.

compound total return for a period of years, t, divided by t.

The average compound return earned per year over a multi-year period is called the:

average capital gains yield

arithmetic average return

total return

variance

geometric average return

The average compound return earned per year over a multi-year period when inflows and outflows are considered is called the:

total return.

average capital gains yield.

geometric average return.

arithmetic average return.

dollar-weighted average return.

Which one of the following statements is correct concerning the dividend yield and the total return?

The total return plus the capital gains yield is equal to the dividend yield.

The dividend yield can be zero while the total return must be a positive value.

The total return must be greater than the dividend yield.

The dividend yield exceeds the total return when a stock increases in value.

The total return can be negative but the dividend yield cannot be negative.

An annualized return:

is computed as (1 + holding period percentage return)m, where m is the number of holding periods in a year.

is computed as (1 + holding period percentage return)m, where m is the number of months in the holding period.

is expressed as the summation of the capital gains yield and the dividend yield on an investment.

is less than a holding period return when the holding period is less than one year.

is expressed as the capital gains yield that would have been realized if an investment had been held for a twelve-month period.

Stacey purchased 300 shares of Coulter Industries stock and held it for 4 months before reselling it. What is the value of "m" when computing the annualized return on this investment?

A) 0.33 B) 0.25 C) 4.00 D) 3.00 E) 0.40

13)

Capital gains are included in the return on an investment: 17)

when either the investment is sold or the investment has been owned for at least one year.

only if the investment incurs a loss in value or is sold.

whether or not the investment is sold.

whenever dividends are paid.

only if the investment is sold and the capital gain is realized.

When we refer to the rate of return on an investment, we are generally referring to the: 18)

effective annual rate of return.

capital gains yield.

dividend yield.

annualized dividend yield.

total percentage return.

Which one of the following should be used to compare the overall performance of three different investments?

effective annual return

holding period dollar return

holding period percentage return

dividend yield

capital gains yield

If you multiply the number of shares outstanding for a stock by the price per share, you are computing the firm's:

equity ratio.

total book value.

time value.

market share.

market capitalization.

Which one of the following is considered the best method of comparing the returns on various-sized investments?

real dollar return

percentage return

totaldollar return

absolute dollar return

variance return

19)

20)

21)

Which one of the following had the highest average return for the period 1926-2016? 22)

small-company stocks

long-term government bonds

long-term corporate bonds

large-company stocks

U.S. Treasury bills

Which one of the following statements is correct based on the historical returns for the period 1926-2016?

Small-company stocks outperformed large-company stocks every year during the period.

The inflation rate exceeded the rate of return on Treasury bills during some years.

For the period, large-company stocks outperformed small-company stocks.

For the period, Treasury bills yielded a higher rate of return than long-term government bonds.

Bond prices, in general, were more volatile than stockprices.

Which category(ies) of investments had an annual rate of return that exceeded 100 percent for at least one year during the period 1926-2016?

only small-company stocks

No category earned an annual return in excess of 100 percent for any given year during the period

both large-company and small-company stocks

only large-company stocks

corporate bonds, large-company stocks, and small-company stocks

23)

24)

For the period 1926-2016, the annual return on large-company stocks: 25)

was unpredictable based on the prior year's performance.

was negative following every three-year period of positivereturns.

was only negative for two or more consecutive years during the Great Depression.

remained negative for at least two consecutive years anytime that it was negative.

never exceeded a positive 30 percent nor lost more than 20 percent.

Which one of the following had the highest risk premium for the period 1926-2016? 26)

small-company stocks

intermediate-term government bonds

U.S. Treasury bills

large-company stocks

long-term government bonds

Based on the period 1926-2016, the risk premium for U.S. Treasury bills was: 27)

2.4 percent.

1.2 percent.

2.0 percent.

0.0 percent.

2.7 percent.

Based on the period of 1926-2015, the risk premium for small-company stocks averaged:

17.4 percent.

12.3 percent.

13.9 percent.

16.8 percent.

15.0 percent.

28)

The averagerisk premium on large-company stocks for the period 1926-2015 was: 29)

8.5 percent.

6.7 percent.

12.3 percent.

13.6 percent.

8.3 percent.

The average risk premium on long-term corporate bonds for the period 1926-2015 was: 30)

2.4 percent.

2.9 percent.

3.7 percent.

3.9 percent.

3.3 percent.

Which one of the following had the narrowest bell curve for the period 1926-2015? 31)

large-company stocks

long-term corporate bonds

small-company stocks

U.S. Treasury bills

long-term government bonds

Which one of the following had the greatest volatility of returns for the period 1926-2015?

long-term government bonds

long-term corporate bonds

U.S. Treasury bills

small-company stocks

large-company stocks

32)

Which one of the following had the smallest standard deviation of returns for the period 1926-2015?

intermediate-term government bonds

long-term corporate bonds

small-company stocks

long-term government bonds

large-company stocks

For the period 1926-2015, long-term government bonds had an average return that

the average return on long-term corporate bonds while having a standard deviation that the standard deviation of the long-term corporate bonds.

was less than; was less than

exceeded; exceeded

exceeded; was less than

was less than; exceeded

exceeded; equaled

33)

34)

The mean plus or minus one standard deviation defines the percent probability 35)

range of a normal distribution.

A) 95 B) 82 C) 90 D) 50 E) 68

Assume you own a portfolio that is invested 50 percent in large-company stocks and 50 percent in corporate bonds. If you want to increase the potential annual return on this portfolio, you could:

replace the corporate bonds with intermediate-term government bonds.

decrease the investment in stocks and increase the investment in bonds.

reduce the expected volatility of the portfolio.

replace the corporate bonds with Treasury bills.

increase the standard deviation of the portfolio.

36)

Which one of the following statements is correct? 37)

Large-company stocks are historically riskier than small-companystocks.

The standard deviation of the returns on Treasury bills is zero.

The standard deviation is a means of measuring the volatility of returns on an investment.

A risky asset will always have a higher annual rate of return than a riskless asset.

There is an indirect relationship between risk and return.

The wider the distribution of an investment's returns over time, the the expected average rate of return and the the expected volatility of those returns.

higher; higher

lower; lower

lower; higher

higher; lower

The distribution of returns does not affect the expected average rate of return.

Which one of the following should be used as the mean return when you are defining the normal distribution of an investment's annual rates of return?

geometric average return for the period divided by N - 1

arithmetic average return for the period divided by N - 1

geometric average return for the period

total return for the period divided by N - 1

arithmetic average return for the period

38)

39)

The geometric mean return on large-company stocks for the 1926-2015 period: 40)

is less than the arithmetic mean return.

is approximately equal to the arithmetic mean return plus one-half of the standard deviation.

exceeds the arithmetic mean return.

is approximately equal to the arithmetic mean return plus one-half of the variance.

is approximately equal to the arithmetic mean return minus one-half of the standard deviation.

You have owned a stock for seven years. The geometric average return on this investment for those seven years is positive even though the annual rates of return have varied significantly. Given this, you know the arithmetic average return for the period is:

greater than the geometric average return.

less than the geometric return and could be negative, zero, or positive.

positive but less than the geometric average return.

equal to the geometric average return.

either equal to or greater than the geometric average return.

41)

The geometric return on an investment is approximately equal to the arithmetic return: 42)

minus half the standard deviation.

divided by two.

plus half the standard deviation.

plus half the variance.

minus half the variance.

Blume's formula is used to: 43)

compute the historical mean returnover a multi-year period of time.

predict future rates of return.

measure past performance in a consistent manner.

convert an arithmetic average return into a geometric average return.

convert a geometric average return into an arithmetic average return.

One year ago, you purchased 200 shares of Southern Foods common stock for $39.50 a share.

Today, you sold your shares for $35.40 a share. During this past year, the stock paid

$1.25 in dividends per share. What is your dividend yield on this investment?

3.375 percent

3.533 percent

3.610 percent

3.442 percent

3.165 percent

You purchased a stock for $25.50 a share, received a dividend of $0.70 per share, and sold the stock after one year for $28.55 a share. What was your dividend yield on this investment?

2.30 percent

2.67 percent

2.38 percent

2.75 percent

2.45 percent

One year ago, you purchased 500 shares of stock at a cost of $10,500. The stock paid an annual dividend of $1.10 per share. Today, you sold those shares for $23.90 each. What is the capital gains yield on this investment?

12.49 percent

10.52 percent

13.81 percent

9.96 percent

14.75 percent

Today, you sold 800 shares of DeSoto Inc., for $57.60 a share. You bought the shares one year ago at a price of $61.20 a share. Over the year, you received a total of $500 in dividends. What is your capital gains yield on this investment?

7.34 percent

-4.86 percent

6.25 percent

-6.03 percent

-5.88 percent

44)

45)

46)

47)

One year ago, you purchased 300 shares of Southern Cotton at $32.60 a share. During

the past year, you received a total of $280 in dividends. Today, you sold your shares for

$35.80 a share. What is your total return on this investment?

8.79 percent

11.64 percent

12.68 percent

9.64 percent

10.16 percent

You purchased a stock for $50.00 a share and resold it one year later. Your total return for the year was 11.5 percent and the dividend yield was 2.8 percent. At what price did you resell the stock?

A) $51.93 B) $54.35 C) $50.62 D) $42.78 E) $52.08

A stock sold for $25 at the beginning of the year. The end of year stock price was

$25.70. What is the amount of the annual dividend if the total return for the year was 7.7 percent?

A) $1.81 B) $1.38 C) $2.31 D) $1.60 E) $1.23

Todd purchased 600 shares of stock at a price of $68.20 a share and received a dividend of $1.42 per share. After six months, he resold the stock for $71.30 a share. What was his total dollar return?

A) $3,211 B) $2,712 C) $1,008 D) $3,400 E) $1,860

Christine owns a stock that dropped in price from $43.80 to 39.49 over the past year. The dividend yield on that stock is 1.8 percent. What is her total return on this investment for the year?

-9.91 percent

-10.49 percent

-8.04 percent

-11.31 percent

-9.59 percent

You have been researching a company and have estimated that the firm's stock will sell for $44 a share one year from now. You also estimate the stock will have a dividend yield of 2.18 percent. How much are you willing to pay per share today to purchase this stock if you desire a total return of 15 percent on your investment?

A) $38.00 B) $39.00 C) $40.20 D) $37.55 E) $38.24

Shane purchased a stock this morning at a cost of $13 a share. He expects to receive an annual dividend of $0.27 a share next year. What will the price of the stock have to be one year from today if Shane is to earn a 8 percent rate of return on this investment?

A) $13.77 B) $12.88 C) $12.60 D) $12.38 E) $14.28

48)

49)

50)

51)

52)

53)

54)

Ellen just sold a stock and realized a 5.8 percent return for a 5-month holding period. What was her annualized rate of return?

27.20 percent

21.29 percent

19.78 percent

11.98 percent

14.49 percent

You purchased a stock eight months ago for $36 a share. Today, you sold that stock for

$41.50 a share. The stock pays no dividends. What was your annualized rate of return?

26.03 percent

27.67 percent

23.32 percent

25.70 percent

24.77 percent

Eight months ago, you purchased 300 shares of a non-dividend paying stock for $27 a share. Today, you sold those shares for $31.59 a share. What was your annualized rate of return on this investment?

21.45 percent

17.00 percent

25.50 percent

26.55 percent

28.00 percent

Jack owned a stock for five months and earned an annualized rate of return of 6 percent. What was the holding period return?

2.72 percent

2.42 percent

2.37 percent

2.46 percent

2.64 percent

Scott purchased 200 shares of Frozen Foods stock for $48 a share. Four months later, he received a dividend of $0.22 a share and also sold the shares for $42 each. What was his annualized rate of return on this investment?

-40.14 percent

-44.69 percent

-28.07 percent

-31.95 percent

-33.00 percent

55)

56)

57)

58)

59)

A stock has an average historical risk premium of 5.6 percent. The expected risk-free rate for next year is 2.4 percent. What is the expected rate of return on this stock for next year?

6.50 percent

8.00 percent

7.53 percent

9.34 percent

11.70 percent

Last year, ABC stock returned 11.43 percent, the risk-free rate was 3.0 percent, and the inflation rate was 2.5 percent. What was the risk premium on ABC stock?

8.43 percent

8.60 percent

8.97 percent

8.20 percent

8.88 percent

Over the past four years, Jellystone Quarry stock produced returns of 12.5, 15.1, 8.7, and

2.6 percent, respectively. For the same time period, the risk-free rate 4.7, 5.3, 3.9, and

percent, respectively. What is the arithmetic average risk premium on this stock during these four years?

5.25 percent

5.13 percent

5.40 percent

5.97 percent

5.83 percent

Over the past five years, Teen Clothing stock produced returns of 18.7, 5.8, 7.9, 10.8, and 11.6 percent, respectively. For the same five years, the risk-free rate 5.2, 3.4, 2.8, 3.4, and 3.9 percent, respectively. What is the arithmetic average risk premium on Teen Clothing stock for this time period?

7.01 percent

7.22 percent

6.89 percent

7.34 percent

7.57 percent

60)

61)

62)

63)

Over the past ten years, large-company stocks have returned an average of 9.8 percent annually, long-term corporate bonds have earned 4.6 percent, and U.S. Treasury bills have returned 3.0 percent. How much additional risk premium would you have earned if you had invested in large-company stocks rather than long-term corporate bonds over those ten years?

8.1 percent

5.8 percent

3.7 percent

1.7 percent

5.2 percent

An asset had annual returns of 12, 18, 6, -9, and 5 percent, respectively, for the last five years. What is the variance of these returns?

A) 0.01065 B) 0.00810 C) 0.04052 D) 0.01013 E) 0.02038

Over the past five years, Southwest Railway stock had annual returns of 10, 14, -6, 7.5, and 16 percent, respectively. What is the variance of these returns?

A) 0.00770 B) 0.00548 C) 0.02740 D) 0.00685 E) 0.01370

An asset had returns of 7.7, 5.4, 3.6, -4.2, and -1.3 percent, respectively, over the past five years. What is the variance of these returns?

A) 0.00240 B) 0.00216 C) 0.00173 D) 0.00259 E) 0.00184

An asset had annual returns of 13, 10, -14, 3, and 36 percent, respectively, for the past five years. What is the standard deviation of these returns?

8.96 percent

18.09 percent

16.05 percent

20.03 percent

17.92 percent

Over the past four years, a stock produced returns of 13, 6, -5, and 18 percent, respectively. What is the standard deviation of these returns?

8.63 percent

10.15 percent

9.93 percent

9.97 percent

10.11 percent

64)

65)

66)

67)

68)

69)

Downtown Industries common stock had returns of 7.2, 11.5, 10.5, and 7.5 percent, respectively, over the past four years. What is the standard deviation of these returns?

2.38 percent

2.59 percent

2.15 percent

2.82 percent

2.41 percent

An asset has an average annual historical return of 11.6 percent and a standard deviation of 17.8 percent. What range of returns would you expect to see 95 percent of the time?

-5.4 to + 41.0 percent

-41.8 to + 65.0 percent

-6.2 to + 29.4 percent

-24.0 to + 47.2 percent

-34.4 to + 53.6 percent

A stock has an average historical return of 11.3 percent and a standard deviation of 20.2 percent. Which range of returns would you expect to see approximately two-thirds of the time?

-3.9 to + 32.5 percent

-23.8 to + 53.0 percent

C) +4.6 to + 33.8 percent

D) -8.9 to + 31.5 percent

E) +5.8 to + 31.6 percent

An asset has an average historical rate of return of 13 percent and a variance of 0.0106. What range of returns would you expect to see approximately two-thirds of the time?

-2.28 to + 24.48 percent

B) +13.1 to + 13.3 percent

C) -9.58 to + 38.8 percent

D) +2.70 to + 23.30 percent

E) -6.52 to + 32.92 percent

Jeremy owns a stock that has historically returned 7.5 percent annually with a standard deviation of 10.2 percent. There is only a 0.5 percent chance that the stock will produce a return greater than percent in any one year.

A) 32.2 B) 54.8 C) 22.9 D) 38.1 E) 20.9

Jefferson Mills stock produced returns of 14.8, 22.6, 5.9, and 9.7 percent, respectively, over the past four years. During those same years, U.S. Treasury bills returned 3.8, 4.6, 4.8, and 4.0 percent, respectively, for the same time period. What is the variance of the risk premiums on Jefferson Mills stock for these four years?

A) 0.00478 B) 0.00528 C) 0.00298 D) 0.00396 E) 0.00196

70)

71)

72)

73)

74)

75)

Over the past four years, the common stock of Jess Electronics Co. produced annual returns of 7.2, 5.8, 11.2, and 13.6 percent, respectively. Treasury bills produced returns of 3.4, 3.3, 4.1, and 4.0 percent, respectively over the same period. What is the standard deviation of the risk premium on Jess Electronics Co. stock for this time period?

2.86 percent

3.22 percent

4.46 percent

4.61 percent

2.23 percent

Big Town Markets common stock returned 13.8, 14.2, 9.7, 5.3, and 12.2 percent, respectively, over the past five years. What is the arithmetic average return?

11.04 percent

12.20 percent

10.99 percent

13.80 percent

11.56 percent

Over the past four years, Hi-Tech Development stock returned 35.2, 38.8, 18.4, and

-32.2 percent annually. What is the arithmetic average return?

17.67 percent

32.25 percent

20.53 percent

15.05 percent

24.20 percent

You own a stock that has produced an arithmetic average return of 8.6 percent over the past five years. The annual returns for the first four years were 16, 11, -19, and 3 percent, respectively. What was the rate of return on the stock in year five?

-5.00 percent

32.00 percent

2.75 percent

6.25 percent

28.00 percent

An asset had annual returns of 17, -35, -18, 24, and 6 percent, respectively, over the past five years. What is the arithmetic average return?

-1.2 percent

1.2 percent

0.8 percent

2.3 percent

1.6 percent

76)

77)

78)

79)

80)

Celsius stock had year end prices of $42, $37, $44, and $46 over the past four years, respectively. What is the arithmetic average rate of return?

10.63 percent

3.85 percent

11.79 percent

4.28 percent

3.17 percent

Blackstone Mines stock returned 10.5, 17.2, -9.0, and 14.5 percent over the past four years, respectively. What is the geometric average return?

6.36 percent

7.78 percent

5.84 percent

9.94 percent

10.33 percent

You invested $5,000 eight years ago. The arithmetic average return on your investment is 10.6 percent and the geometric average return is 10.23 percent. What is the value of your portfolio today?

A) $10,947 B) $9,092 C) $11,195 D) $10,623 E) $10,899

Joanne invested $15,000 six years ago. Her arithmetic average return on this investment is 8.72 percent, and her geometric average return is 8.50 percent. What is Joanne's portfolio worth today?

A) $24,472 B) $26,409 C) $26,766 D) $23,989 E) $26,514

A stock produced annual returns of 8.3, -21, 12, 42, and 9 percent over the past five years, respectively. What is the geometric average return?

5.78 percent

6.34 percent

7.21 percent

6.03 percent

8.20 percent

Over the past five years, an investment produced annual returns of 16.5, 21, -18, 4, and 17 percent, respectively. What is the geometric average return?

16.00 percent

6.42 percent

15.60 percent

7.06 percent

8.00 percent

81)

82)

83)

84)

85)

86)

A portfolio had an original value of $7,400 seven years ago. The current value of the portfolio is $11,898. What is the average geometric return on this portfolio?

7.47 percent

7.02 percent

7.59 percent

7.88 percent

7.67 percent

An initial investment of $41,800 fifty years ago is worth $1,533,913 today. What is the geometric average return on this investment?

9.23 percent

7.47 percent

10.47 percent

11.08 percent

8.02 percent

A stock had year end prices of $24, $27, $32, and $26 over the past four years, respectively. What is the geometric average return?

2.18 percent

2.02 percent

2.81 percent

2.70 percent

2.55 percent

The geometric return on a stock over the past 10 years was 7.9 percent. The arithmetic return over the same period was 8.8 percent. What is the best estimate of the average return on this stock over the next 5 years?

9.08 percent

8.40 percent

9.47 percent

9.13 percent

9.05 percent

The geometric return on an asset over the past 12 years has been 14.50 percent. The arithmetic return over the same period was 14.96 percent. What is the best estimate of the average return on this asset over the next 5 years?

14.86 percent

14.47 percent

14.88 percent

14.79 percent

14.67 percent

87)

88)

89)

90)

A stock has an average arithmetic return of 10.55 percent and an average geometric return of 10.41 percent based on the annual returns for the last 15 years. What is projected average annual return on this stock for the next 10 years?

10.38 percent

10.17 percent

10.79 percent

10.21 percent

10.46 percent

Leeanne owns a stock that has an average geometric return of 12.30 percent and an average arithmetic return of 12.55 percent over the past six years. What average annual rate of return should Leeanne expect to earn over the next four years?

12.44 percent

12.51 percent

12.38 percent

12.47 percent

12.40 percent

Tom decides to begin investing some portion of his annual bonus, beginning this year with $6,000. In the first year he earns an 8 percent return and adds $3,000 to his

investment. In the second his portfolio loses 4 percent but, sticking to his plan, he adds

$1,000 to his portfolio. In this year his portfolio returns 2 percent. What is Tom's dollar-weighted average return on his investments?

1.20 percent

2.58 percent

0.34 percent

1.54 percent

2.23 percent

Bill has been adding funds to his investment account each year for the past 3 years. He started with an initial investment of $1,000. After earning a 10 percent return the first year, he added $3,000 to his portfolio. In this year his investments lost 5 percent. Undeterred, Bill added $2,000 the next year and earned a 2 percent return. Last year, discouraged by the recent results, he only added $500 to his portfolio, but in this final year his investments earned 8 percent. What was Bill's dollar-weighted average return for his investments?

3.5 percent

2.5 percent

2.0 percent

1.5 percent

3.0 percent

John began his investing program with a $5,500 initial investment. The table below recaps his returns each year as well as the amounts he added to his investment account. What is his dollar-weighted average return?

Time Investment Return

0 $ 5,500 8.5 %

1 $ 2,000 - 5.0 %

2 $ 2,600 4.5 %

3 $ 3,000 9.0 %

4 $ 900 - 2.5 %

2.6 percent

1.5 percent

2.0 percent

2.2 percent

1.8 percent

Jim began his investing program with a $4,000 initial investment. The table below recaps his returns each year as well as the amounts he added to his investment account. What is his dollar-weighted average return?

TIME INVESTMENT RETURN

0 $ 4,000 10 %

1 $ 2,800 -5 %

2 $ 900 2 %

3 $ 1,600 8 %

4 $ 2,100 -3 %

5 $ 2,400 6 %

1.6 percent

2.2 percent

3.6 percent

3.2 percent

2.6 percent

One year ago, you purchased 300 shares of stock at a cost of $6,000. The stock paid an annual dividend of $1.10 per share. Today, you sold those shares for $22.50 each. What is the capital gains yield on this investment?

13.81 percent

12.50 percent

10.52 percent

9.96 percent

14.75 percent

Eileen just sold a stock and realized a 6.25 percent return for a 7-month holding period. What was her annualized rate of return?

17.20 percent

15.29 percent

9.98 percent

10.95 percent

12.78 percent

Downtown Industries common stock had returns of 5.2, 10.3, 9.3, and 9.5 percent, respectively, over the past four years. What is the standard deviation of these returns?

2.38 percent

2.41 percent

2.82 percent

2.59 percent

2.29 percent

You own a stock that has produced an arithmetic average return of 5.6 percent over the past five years. The annual returns for the first four years were 15, 10, -18, and 8 percent, respectively. What was the rate of return on the stock in year five?

6.25 percent

2.75 percent

32.00 percent

-5.00 percent

13.00 percent

A stock produced annual returns of 8.5, -18, 15, 17, and 12 percent over the past five years, respectively. What is the geometric average return?

7.21 percent

6.04 percent

8.20 percent

5.78 percent

6.34 percent

Louis owns a stock that has an average geometric return of 10.50 percent and an average arithmetic return of 11.00 percent over the past six years. What average annual rate of return should Louis expect to earn over the next four years?

10.81 percent

10.64 percent

10.40 percent

10.38 percent

10.70 percent

John began his investing program with a $5,500 initial investment. The table below recaps his returns each year as well as the amounts he added to his investment account. What is his dollar-weighted average return?

Time Investment Return

0 $ 6,500 7.5 %

1 $ 2,500 - 4.0 %

2 $ 3,100 5.0 %

3 $ 3,000 8.0 %

4 $ 800 - 1.5 %

1.5 percent

2.8 percent

1.8 percent

2.0 percent

2.2 percent

Exam

Name

MULTIPLE CHOICE. Choose the one alternative that best completes the statement or answers the question.

Market timing is the: 1)

placing of an order within the last half-hourof trading for a day.

placing of trades within the last half-hour prior to the commencement of daily trading.

period of time between the placement of a short sale and the covering of that sale.

buying and selling of securities in anticipation of the overall direction of the market.

staggering of either buy or sell orders to mask the total size of a large transaction.

Asset allocationis the: 2)

distribution of investment funds among various broad asset classes.

selection of specific securities within a particular class or industry.

division of a purchase price between a cash payment and a margin loan.

dividing of assets into those that are hypothecated and those that are not.

division of a portfolio into short and long positions.

Jack is researching chemical companies in an effort to determine which company's stock he should purchase. This process is known as:

security selection.

purchase shorting.

marketing research.

asset allocation.

market timing.

A Roth IRA: 4)

funds are taxed at the time you begin withdrawals.

is a form of "tax-deferred" account.

invests after-tax dollars.

are well-suited to investors nearing retirement.

is the type of account offered by most employers.

A brokerage account in which purchases can be made using credit is referred to as which type of account?

funds available

cash

call

margin

clearing

Kay just purchased $5,000 worth of stock. She paid $3,000 in cash and borrowed

$2,000. In this example, the term margin refers to:

the percentage of the purchase that was paid incash.

any future increase in the value of the stock.

the percentage of the purchase paid with borrowedfunds.

any future decrease in the value of the stock.

the total amount of the purchase.

Which one of the following best describes the term "initial margin"? 7)

Amount of cash that must be paid when a broker issues a margin call

Total loan amount offered to a customer by a brokerage firm to cover future purchases

Amount of money that must be deposited to open a margin account with a broker

Amount of money borrowed when a security is purchased

Amount of cash that must be paid to purchase a security on margin

The minimum equity that must be maintained at all times in a margin account is called the:

call requirement.

maintenance margin.

initial equity position.

margin call.

initial margin.

When your equity position in a security is less than the required amount, your brokerage firm will issue a:

limit order.

leverage call.

margin call.

margin certificate.

cash certificate.

Sam purchased 500 shares of Microsoft stock which he has pledged to his broker as collateral for the loan in his margin account. This process of pledging securities is called:

leveraging.

hypothecation.

margin calling.

street securitization.

maintaining the margin.

Staci owns 1,000 shares of stock in a margin account. Those shares are most likely held in:

transit.

her registered name.

street name.

a discretionary account.

a wrap account.

This morning, Josh sold 800 shares of stock that he did not own. This sale is referred to as a:

wrap trade.

hypothecated sale.

margin sale.

long position.

short sale.

The amount of common stock held in short positions is referred to as the short: 13)

margin. B) sale. C) interest. D) proceeds. E) shares.

A company that owns income-producing real estate such as an apartment complex or a retail shopping center is called a(n):

EAR. B) SPIC. C) SIPC. D) REIT. E) REEF.

An investor who has a resource constraint: 15)

has insufficient funds to purchase a security.

will only invest in socially acceptable securities.

has a relatively high marginal tax rate.

has only one source of income.

pays no income taxes.

To be considered liquid, a security must: 16)

be held for less than one year.

pay dividends.

be able to be sold on short notice.

be able to be sold quickly with little, if any, price concession.

be held in a cash account.

Walter is trying to decide whether he wants to purchase shares in General Motors, Ford, or Honda, all of which are auto manufacturers. Walter is making a(n) decision.

active strategy

risk aversion

tax-advantaged

asset allocation

security selection

Brooke has decided to invest 55 percent of her money in large company stocks, 40 percent in small company stocks, and 5 percent in cash. This is a(n) decision.

tax-advantaged

asset allocation

active strategy

market timing

security selection

Kay plans to retire in two years and wishes to liquidate her account at that time. Kay has a constraint.

liquidity

tax

special circumstances

resource

horizon

The SIPC:

guarantees cash balances held in brokerage accounts up to $500,000.

protects investors from missing assets when a brokerage firmcloses.

protects private brokerage firms from bankruptcy.

guarantees investors against any loss related to an investment account held at a brokerage firm.

is an agency of the federal government.

The determination of which individual stocks to purchase within a particular asset class is referred to as:

market timing.

security analysis.

asset allocation.

market selection.

security selection.

An investor who follows a fully active strategy will: 22)

maintain a relatively constant mix of asset classes while continually buying and selling individual securities.

concentrate solely on asset allocation to maximize potentialreturns.

move money between asset classes as well as try to select the best performers in each class.

focus on picking individual stocks only.

move money between asset classes but will not be concerned about which individual securities are owned.

Which one of the following decisions falls under the category of asset allocation? 23)

Adopting a passive investment strategy

Deciding to actively analyse individual securities

Purchasing Ford stock rather than General Motors stock

Determining that thirty percent of a portfolio should be invested in bonds

Deciding to use an online broker

Tom recently inherited a large sum of money that he wants to invest in the stock market. Since he has no investment experience, he has decided that he would like to work with a professional who can explain the market to him and also manage his funds for him. Ted most likely needs the services offered by a(n):

full-service broker.

deep-discount broker.

online broker.

discount broker.

cyber broker.

Which one of the following statements is correct? 25)

Most brokerage agreements require disputes be settled in a court oflaw.

Churning is the preferred method of providing deep-discount brokerage services.

Full service brokers frequently provide financial planning services to clients.

Discount brokers only provide order execution services.

Arbitration is a formal legal process for settling disputes related to brokerage accounts.

Martin has an investment account with William, who is a broker with City Brokerage. Martin believes that William has mishandled his account by churning it. If he files a complaint against William seeking compensation, the case will most likely be decided by:

a civil suit judge.

the office manager of City Brokerage.

the SEC Hearing Board.

a jury.

an arbitration panel.

You currently have $5,000 in cash in your brokerage account. You decide to spend

$8,000 to purchase shares of stock and borrow $3,000 from your broker to do so. Which type of brokerage account do you have?

Asset allocation

Short

Cash

Wrap

Margin

[Show More]

HESI VI EXIT EXAM.png)