Finance > QUESTIONS & ANSWERS > Louisiana State University - FIN 4820Chapter 18 Problems THE ANALYSIS AND VALUATION OF BONDS ( 10 (All)

Louisiana State University - FIN 4820Chapter 18 Problems THE ANALYSIS AND VALUATION OF BONDS ( 100% CORRECT AND COMPLETE ANSWERS AND SOLUTIONS )

Document Content and Description Below

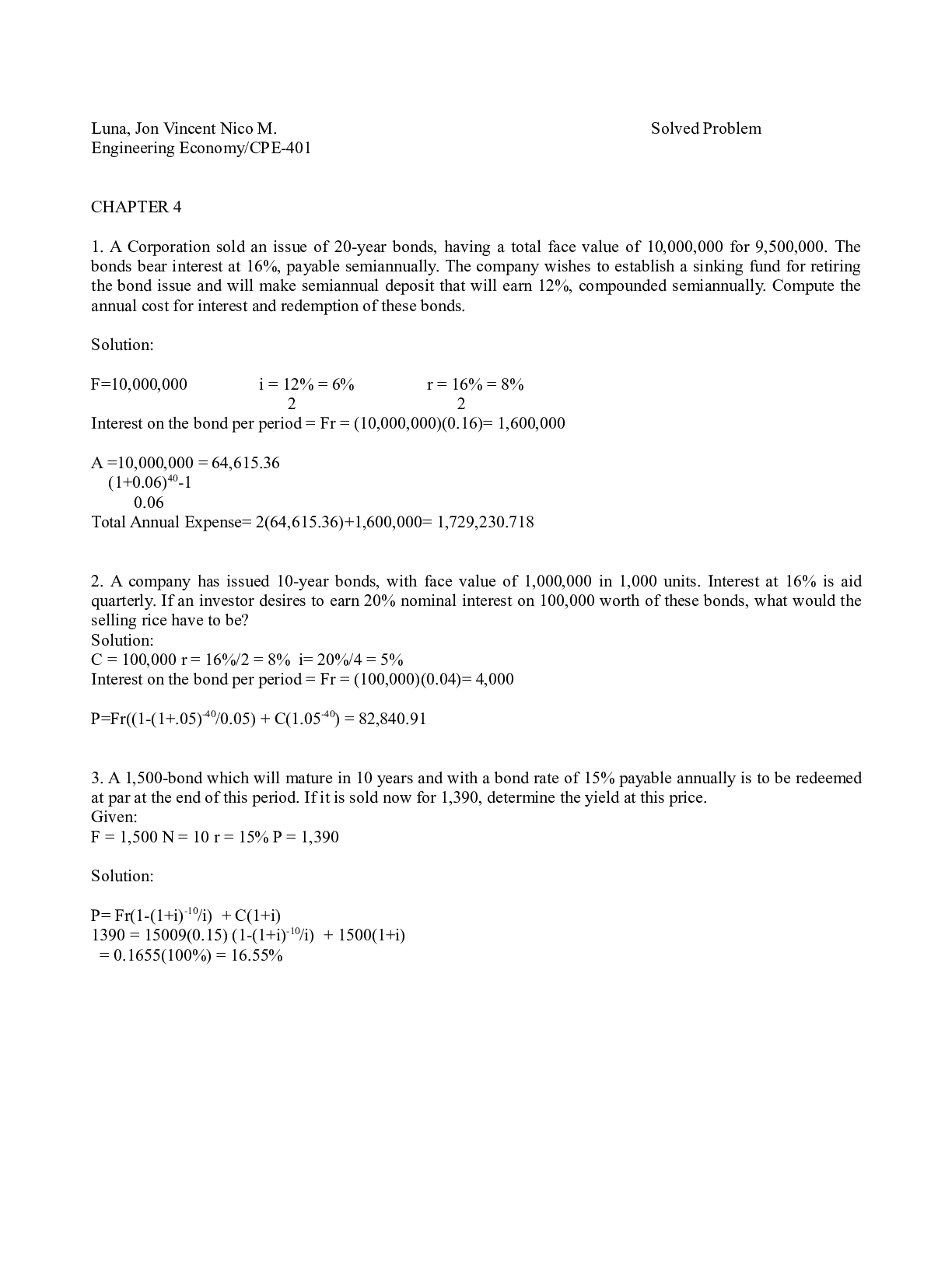

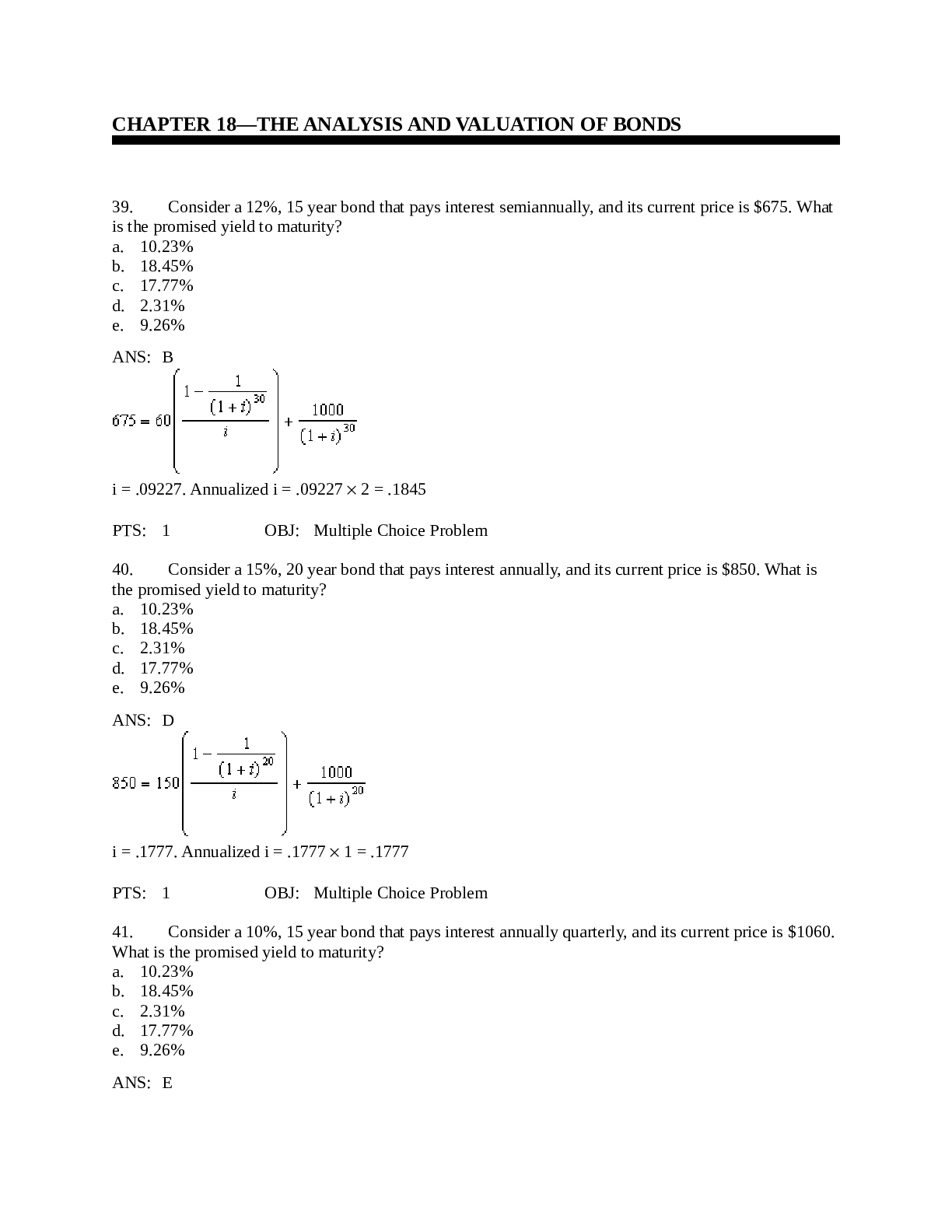

CHAPTER 18—THE ANALYSIS AND VALUATION OF BONDS 39. Consider a 12%, 15 year bond that pays interest semiannually, and its current price is $675. What is the promised yield to maturity? a. 10.23% ... b. 18.45% c. 17.77% d. 2.31% e. 9.26% ANS: B i = .09227. Annualized i = .09227 2 = .1845 PTS: 1 OBJ: Multiple Choice Problem 40. Consider a 15%, 20 year bond that pays interest annually, and its current price is $850. What is the promised yield to maturity? a. 10.23% b. 18.45% c. 2.31% d. 17.77% e. 9.26% ANS: D i = .1777. Annualized i = .1777 1 = .1777 PTS: 1 OBJ: Multiple Choice Problem 41. Consider a 10%, 15 year bond that pays interest annually quarterly, and its current price is $1060. What is the promised yield to maturity? a. 10.23% b. 18.45% c. 2.31% d. 17.77% e. 9.26% ANS: Ei = .02314. Annualized i = .02134 4 = .0926 PTS: 1 OBJ: Multiple Choice Problem 42. Consider a zero coupon bond that has a current price of $436.19 and matures in 10 years. What is its yield to maturity? a. 0.86% b. 8.65% c. 8.00% d. 58.80% e. 6.564% ANS: B Price = Par/(1 + YTM)n YTM = (Price/Par)1/n 1 YTM = (1000/436.19)1/10 1 = 8.65% PTS: 1 OBJ: Multiple Choice Problem 43. What is the current price of a zero coupon bond with a 6% yield to maturity that matures in 15 years? a. $4.17 b. $41.27 c. $417.27 d. $4,172.00 e. None of the above ANS: C Price = Par/(1 + YTM)n = 1000/(1.06)15 = $417.27 PTS: 1 OBJ: Multiple Choice Problem 44. What is the current price of a zero coupon bond with a 7% yield to maturity that matures in 20 years? a. $1,000 b. $2,582 c. $25.82 d. $258.42 e. $100.00 ANS: D Price = Par/(1 + YTM)n = 1000/(1.07)20 = $258.42 PTS: 1 OBJ: Multiple Choice Problem 45. Consider a bond with a 9% coupon and a current yield of 8 1/2%. What is this bond's price? [Show More]

Last updated: 2 years ago

Preview 1 out of 16 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$7.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 06, 2021

Number of pages

16

Written in

Additional information

This document has been written for:

Uploaded

Apr 06, 2021

Downloads

0

Views

68

.png)

Philosophy The Ancient Greeks The Pre-Socratic Philosophers.png)

.png)