Dennis Hermanzo - Talking Mental Stevens Magic

$ 20

PROJ586 Risk Event Case Study / DeVry University, Chicago - PROJ 586 week 5 presentation

$ 11

Summary Texas Commission on Law Enforcement > TCOLE Final review complete TCOLE Test: Answered Correctly.

$ 9

Solutions Manual with Test Bank Hospitality Management Accounting 9th Edition By Martin Jagels

$ 30

IGCSE Accounting Questions and Correct Answers

$ 11

Sepsis/Septic Shock UNFOLDING Reasoning Case Study

$ 10

review NEW 2022 PRACTICE SOLUTION.png)

EKG for Medical Assisting (CCMA, RMA) review NEW 2022 PRACTICE SOLUTION

$ 13.5

023 AQA GCSE GERMAN 8668/RH Paper 3 Reading Higher Tier Question Paper & Mark scheme (Merged) June 2023 [VERIFIED] GCSE GERMAN Higher Tier Paper 3 Reading

$ 7

IB ESS Revision Exam Prep Question section and answers, 100% Accurate, graded A+

$ 8

NURS 3632 HESI A2 V2 grammar Study Guide for 2022/2023 COMPLETED A

$ 7

Kaplan Secure Predictor Exam Questions and Correct Answers (Verified Answers) with Rationales 2025

$ 16

PMP Project Management Fundamentals with all Correct & 100% Verified Answers |Latest Update |Already Graded A+

$ 10.5

STAT 200 Week 4 Homework Problems (summer 2022) complete solutions.

$ 8

V1.png)

AQA GCSE 8462 Chemistry Chemical analysis and using resources (Higher) Answers and Commentaries. 2021 Assessment resources.

$ 9

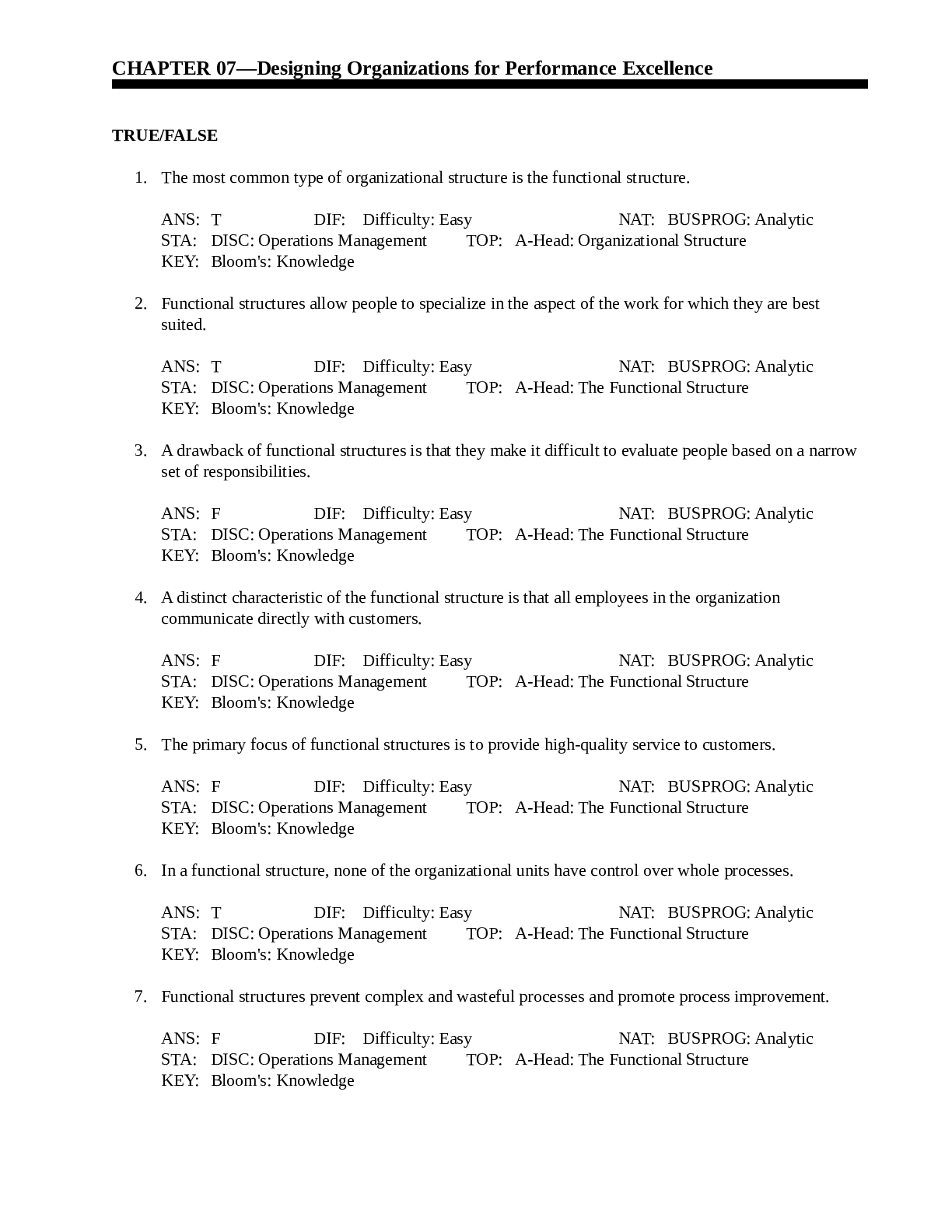

QUAL 556 Human Aspects Continuous Improvement - Eastern Michigan University. CHAPTER 07—Designing Organizations for Performance Excellence

$ 5.5

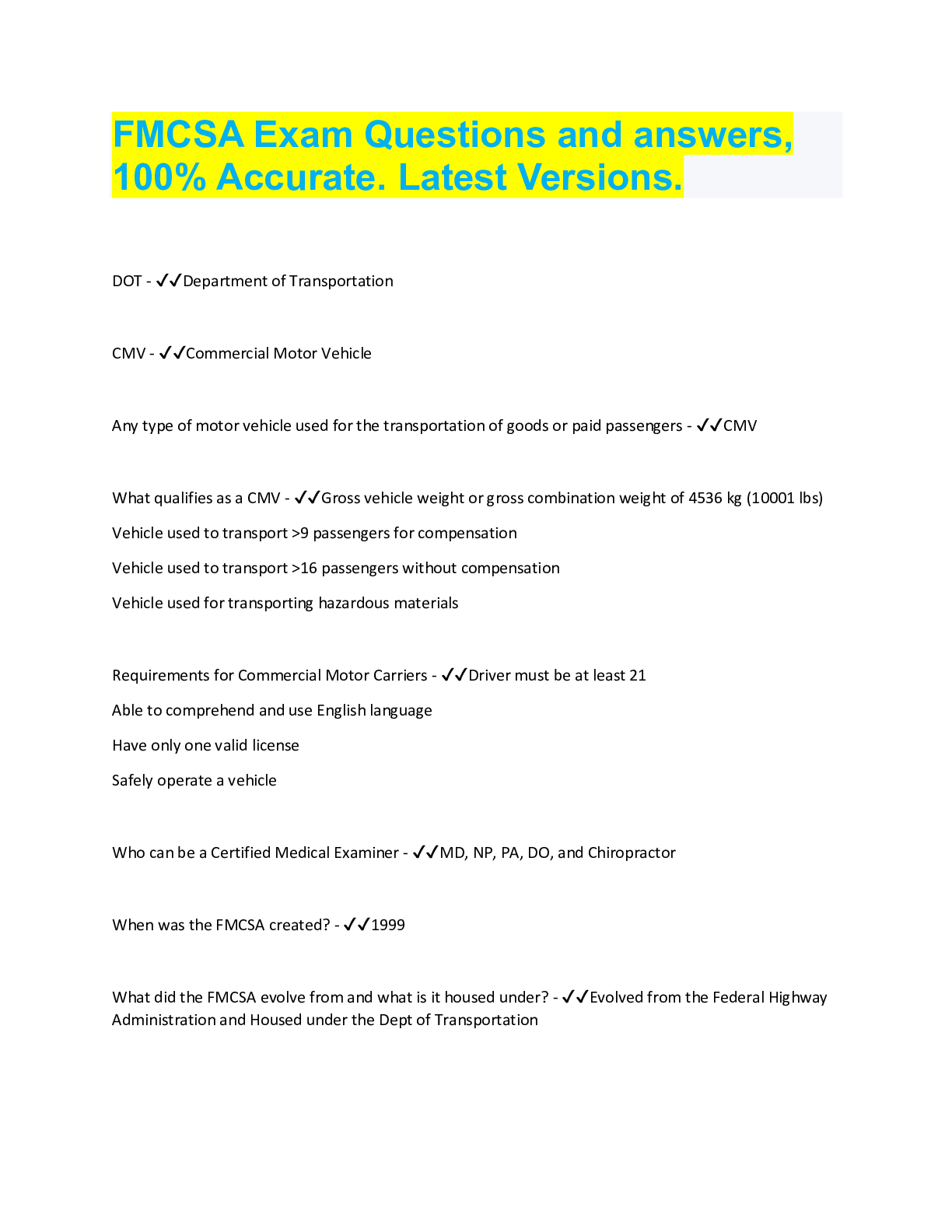

FMCSA Exam Questions and answers, 100% Accurate. Latest Versions.

$ 4

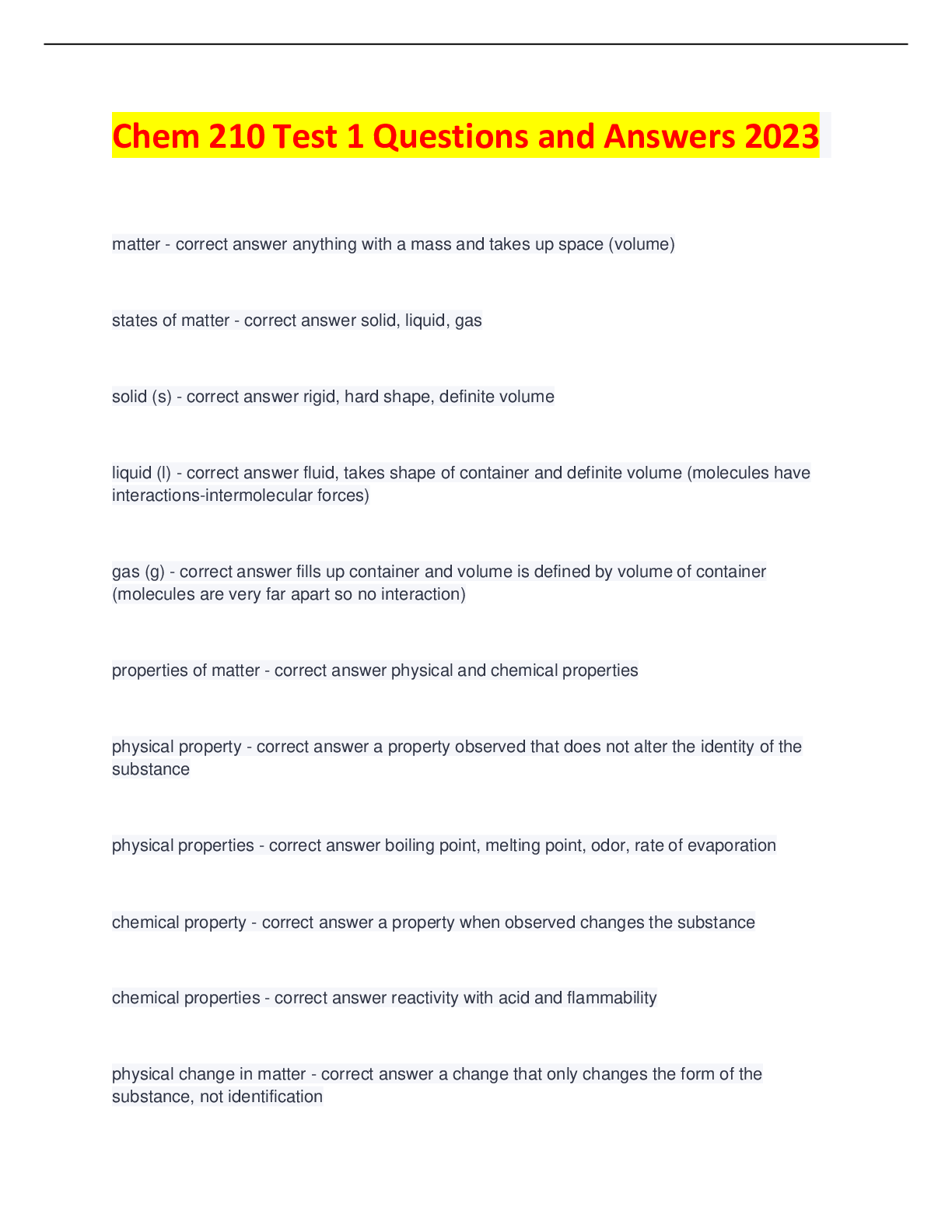

Chem 210 Test 1 Questions and Answers 2023

$ 7

Lecture: Managing Project Teams. People In Projects

$ 7.5

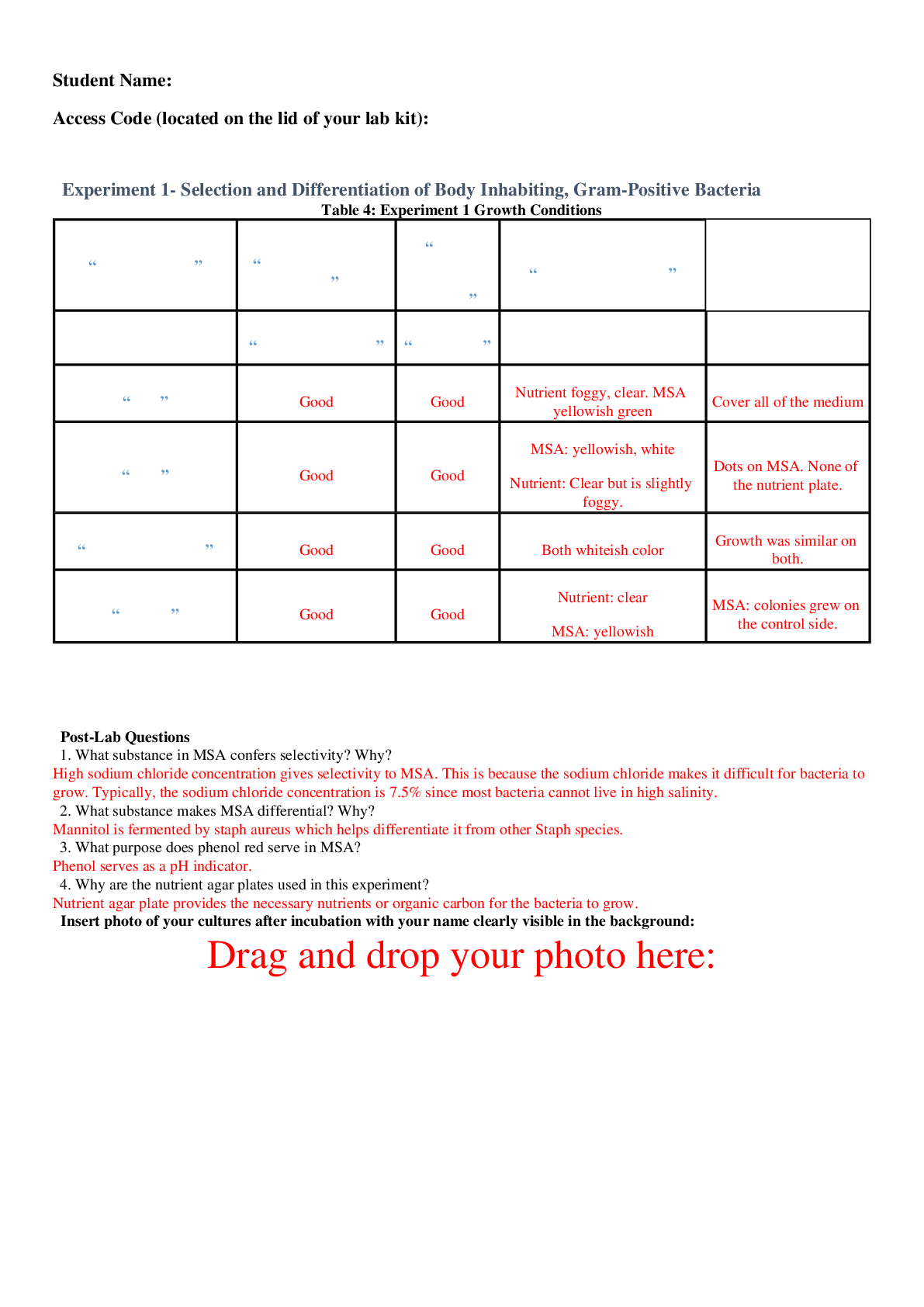

BIOLOGY LAB EXPERIMENT : Experiment 1- Selection and Differentiation of Body Inhabiting, Gram-Positive Bacteria

$ 10

How Plagiarism can Impact A Communication Manager Career

$ 2.5

CLG 0010 DOD GOV. COM. PUR. CARD OVERVIEW EXAM QUIZ & Answers.

$ 7

SSL AND TLS THEORY AND PRACTICE, INFORMATION SECURITY AND PRIVACY SERIES 4TH EDITION BY ROFL OPPLINGER

$ 21

eBook The Politicization of Police Stops in Europe 1st Edition By Jacques de Maillard, Kristof Verfaillie, Mike Rowe

$ 30

NUR 514 Topic 3 - Discussion Question 1

$ 5

(7037) AQA A-Level Geography Component 2 Human Geography Exam Guide Qns & Ans Updated Version 2024