Finance > EXAM > University of Illinois, Chicago - FIN 494 Final Exam prepared. All questioned Answered. (All)

University of Illinois, Chicago - FIN 494 Final Exam prepared. All questioned Answered.

Document Content and Description Below

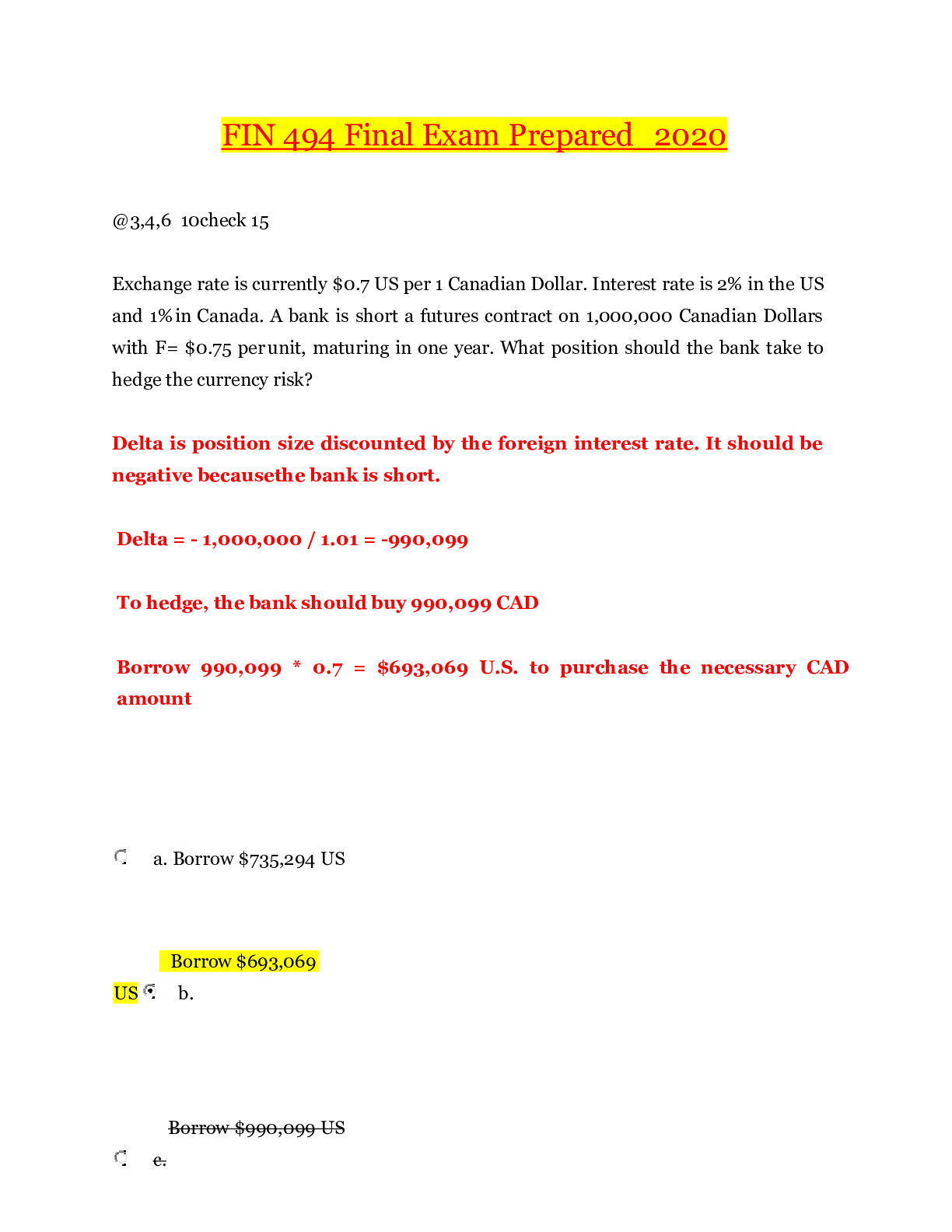

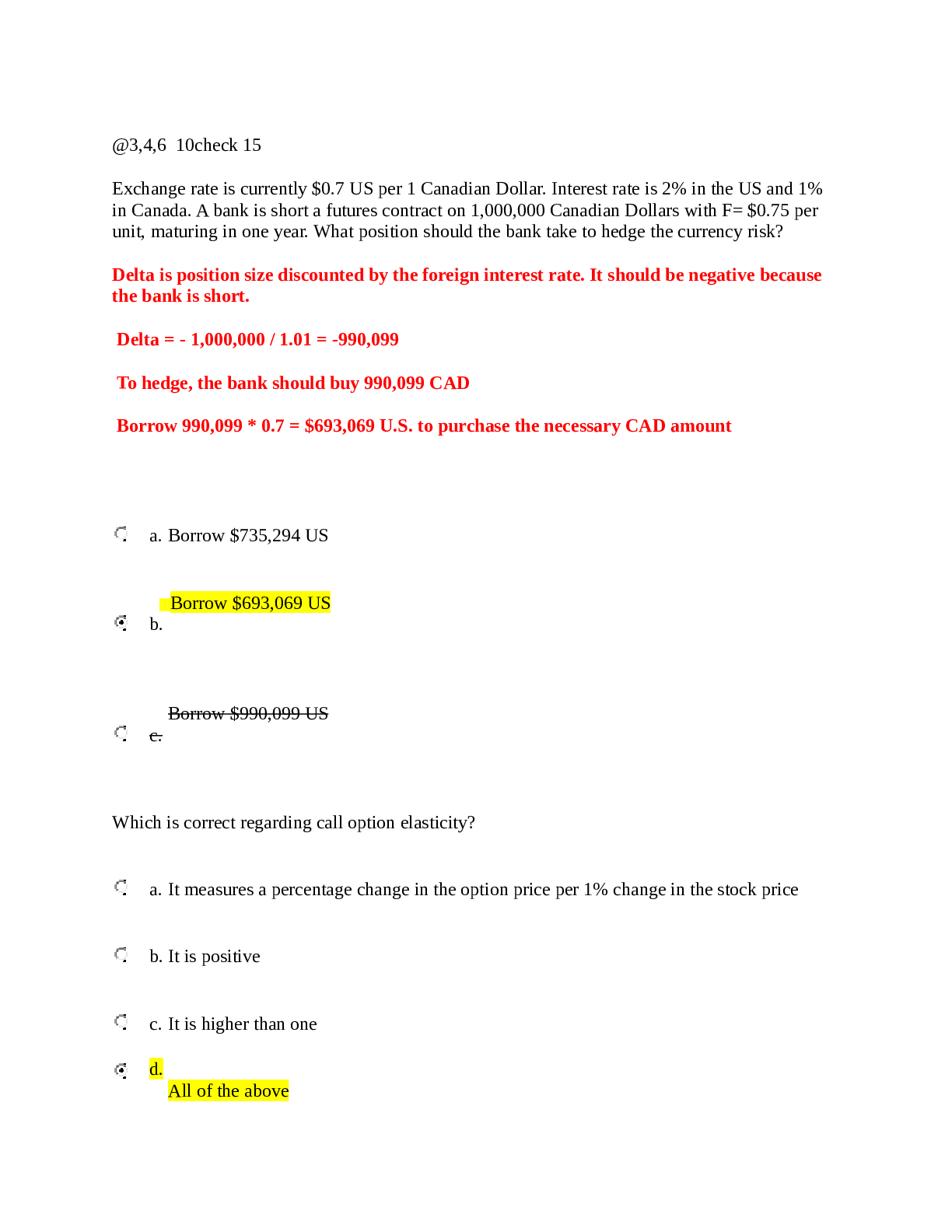

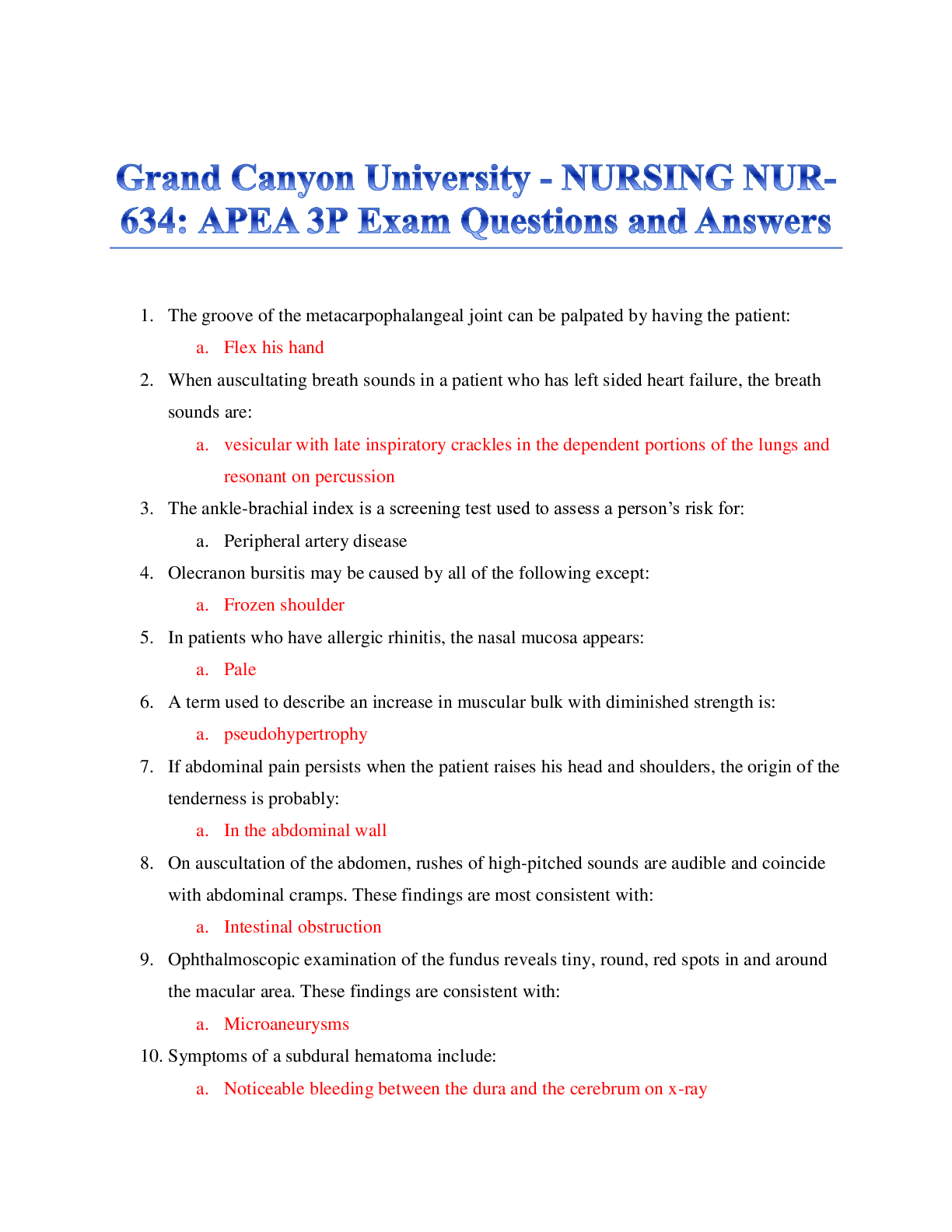

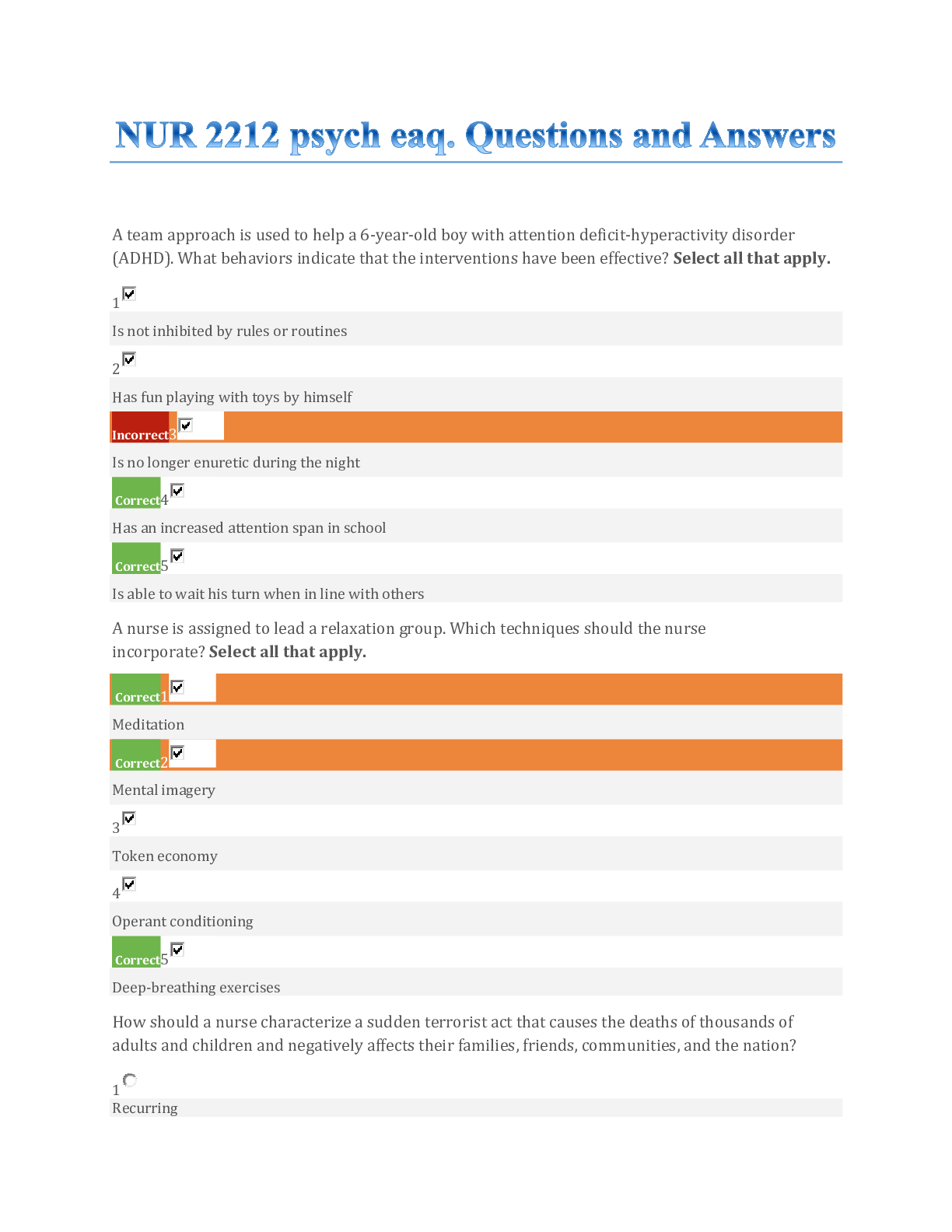

Exchange rate is currently $0.7 US per 1 Canadian Dollar. Interest rate is 2% in the US and 1% in Canada. A bank is short a futures contract on 1,000,000 Canadian Dollars with F= $0.75 per unit, mat... uring in one year. What position should the bank take to hedge the currency risk? a. Borrow $735,294 US b. Borrow $693,069 US c. Borrow $990,099 US Which is correct regarding call option elasticity? a. It measures a percentage change in the option price per 1% change in the stock price b. It is positive c. It is higher than one d. All of the above Delta of a contract is +1 and gamma is 0. Which type of contract is this? a. A futures contract b. A put option c. A call option Exchange rate is currently $0.7 US per 1 Canadian dollar. Interest rate is 2% in the US and 1% in Canada. A company has entered a futures contract to buy 1,000,000 Canadian dollars for $710,000 U.S. in one year. Which of the following statements is correct? a. The company has contracted to buy Canadian dollars at the expected future exchange rate b. The company has contracted to buy Canadian dollars above the expected future exchange rate c. The company has contracted to buy Canadian dollars below the expected future exchange rate Delta of a call option is 0.85. Stock price is currently $50. How much money do you need to borrow to hedge a short position in 200 call contracts (each contract is for 100 shares of stock), provided that you finance the hedge entirely with borrowed funds? a. 1,000,000 b. 850,000 c. 500,000 d. 950,000 Discount factor is 0.985. Stock XYZ is selling for $40 a share. A European option on this stock with a strike price of $38 is trading at $0.50 per share. If it is known that this option is priced A call b. A put The _______ is a higher bound of the price of an American call option. a. Strike price b. Present value of strike price c. Stock price d. Intrinsic value= lower bound You sell a two-year interest rate swap with annual payments and notional principal of $100 million. At the time you enter the contact, one-year spot rate is 3% and the two-year spot rate is 5.5%. Forward rate for the second year is 8.1%. Find the way to calculate the present value of the floating-rate payments b. $3/1.03 + $5.5/(1.081) c. $3/1.03 + $8.1/(1.081)2 d. $3/1.03 + $5.5/(1.055) Which of the following strategies protects the consumer of a commodity from a possible price increase?. a. Short put b. Long put c. Short call d. Long call Which of the Greeks measures the sensitivity of option price to the interest rate? a. vega b. theta c. gamma d. rho For a call option, which of the following statements is INCORRECT? a. Gamma is positive b. Pho is positive c. Implied volatility is negative d. Delta is positive Which of the following is NOT one of the assumptions of the Black-Scholes model? a. There are no jumps in the stock price b. There are no transaction costs c. Time is continuous d. Volatility of the stock is normally distributed Volatility smile is a relationship between: a. Option's delta and the underlying stock price b. Past volatility of the underlying stock and the option's time to expiration c. Implied volatility of the option and the option's delta d. Implied volatility of the option and the option's strike price Consider the following data on a European call option, recorded at two different points in time on the same day (10:00 am and 10:15 am). Suppose you hold a short position in the option and delta-hedge it by a long position in the underlying stock. Which of the following statements is correct? 10:00 am 10:15 am S 27.8 30.2 X 25 25 R 0.02 0.02 T 0.5 0.5 Sigma 0.17 0.17 a. Black-Scholes price of the option is higher at 10:15 am b. Delta of the option is higher at 10:15 am c. You need to buy additional shares of stock at 10:15 am to keep the portfolio delta-neutral d. All of the above You decide to design a bullish spread with two call options: buy the call struck at X1 = 500 trading at C1 = $50, write the call struck at X2 = 560 trading at C2 = $5. What will be the profit from your strategy on the expiration day if the underlying stock trades at $580? a. 0 b. 15 c. 45 d. 60 One year ago, you bought a two-year swap to exchange LIBOR for 2.74% fixed-rate payments on a $100 million notional principal. Back then, LIBOR rates were as follows: One-year spot rate was 2% per year. Second-year forward rate was 3.5%. Now it is one year since you bought the swap, the first payment has already been made and only one more payment remains. Secondyear rate turned out to be 2.5%. Which of the following statements is correct? a. You are the receiver of the fixed-rate payment b. The floating-rate payment is lower in the second year than it was in the first year c. You face counterparty default risk now d. None of the above A U.S. company has international operations, with revenue of 1,000,000 Euro expected in one year. To hedge this revenue with a futures contract, the company should a. Short Euro futures b. Buy Euro futures A portfolio has a delta of 0 and a gamma of -4000. This means: a. If the stock price increases by 1%, the delta of the portfolio will drop by 4,000 units b. If the stock price increases by $1, the delta of the portfolio will drop by 4,000 units c. If the stock price increases by 1%, the value of the portfolio will drop by $4,000 d. If the stock price increases by $1, the value of the portfolio will drop by $4,000 When hedging a portfolio to make it delta-neutral, gamma-neutral, and vega-neutral, one needs to trade a. underlying stock and two more options b. underlying stock and one more option c. underlying stock Given the following data: Treasury Bill Maturity DTM Bid Asked Mar 90 1.20 1.15 If you invest $10,000 today at the risk-free rate, how much will you receive in 90 days? Please round to the nearest integer. a. 10,000 b. 10,029 c. 10,039 Consider the following data on a European call option. Calculate the delta using the BlackScholes model. S 27.8 X 25 r 0.02 T 0.5 Sigma 0.17 a. 0.64 b. 0.85 c. 1.03 d. 0.75 If convenience yield exceeds the carrying cost of a commodity, then the futures price is below the spot price. This situation is known as a. Backwardation b. Convergence property c. Spot-futures parity d. Contango Which is correct regarding a European put option? a. It cannot be worth more than its intrinsic value b. It cannot be exercised until expiration day c. It is a contract to buy the underlying stock at the strike price A futures contract on S&P 500 with maturity 1 month has settled at 2,510 today. The underlying index value is $2,500 now and is going to pay a $5 dividend in 1 month. The discount factor is 0.995. Calculate your arbitrage profit in 1 month from the strategy in the table below (per unit of the index). a. 1.58 b. 2.44 c. 3.96 d. 2.75 The bond that gets to be delivered to the CDS seller in in the event of default is referred to as: a. Reference entity b. Defaulted bond c. Cheapest-to-deliver bond S&P 500 Index is at 2780. A European June 21, 2020 SPX call option struck at 2500 is trading at $316.94. An identical European put option is trading at $5.15. A T-bill with 200 days to maturity is quoted at a yield of 2.46. According to put-call parity, which of the following strategies will earn you arbitrage profits? a. Buy the call and exercise immediately b. Buy the put and exercise immediately c. Write the put, buy the call, short S&P 500, invest at the risk-free rate d. Write the call, buy the put, buy S&P 500, borrow at the risk-free rate You bought a European call option with strike price $30 and one year to expiration. Option premium was $12. Ignore the interest rate. Six months later, you still have an open long position in the call. The underlying stock is trading at $42. Which statement is correct? a. Your profit to date is zero, you just broke even b. Your profit to date is positive c. Your profit to date is negative. [Show More]

Last updated: 2 years ago

Preview 1 out of 16 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$12.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 16, 2021

Number of pages

16

Written in

Additional information

This document has been written for:

Uploaded

Apr 16, 2021

Downloads

0

Views

69

.png)