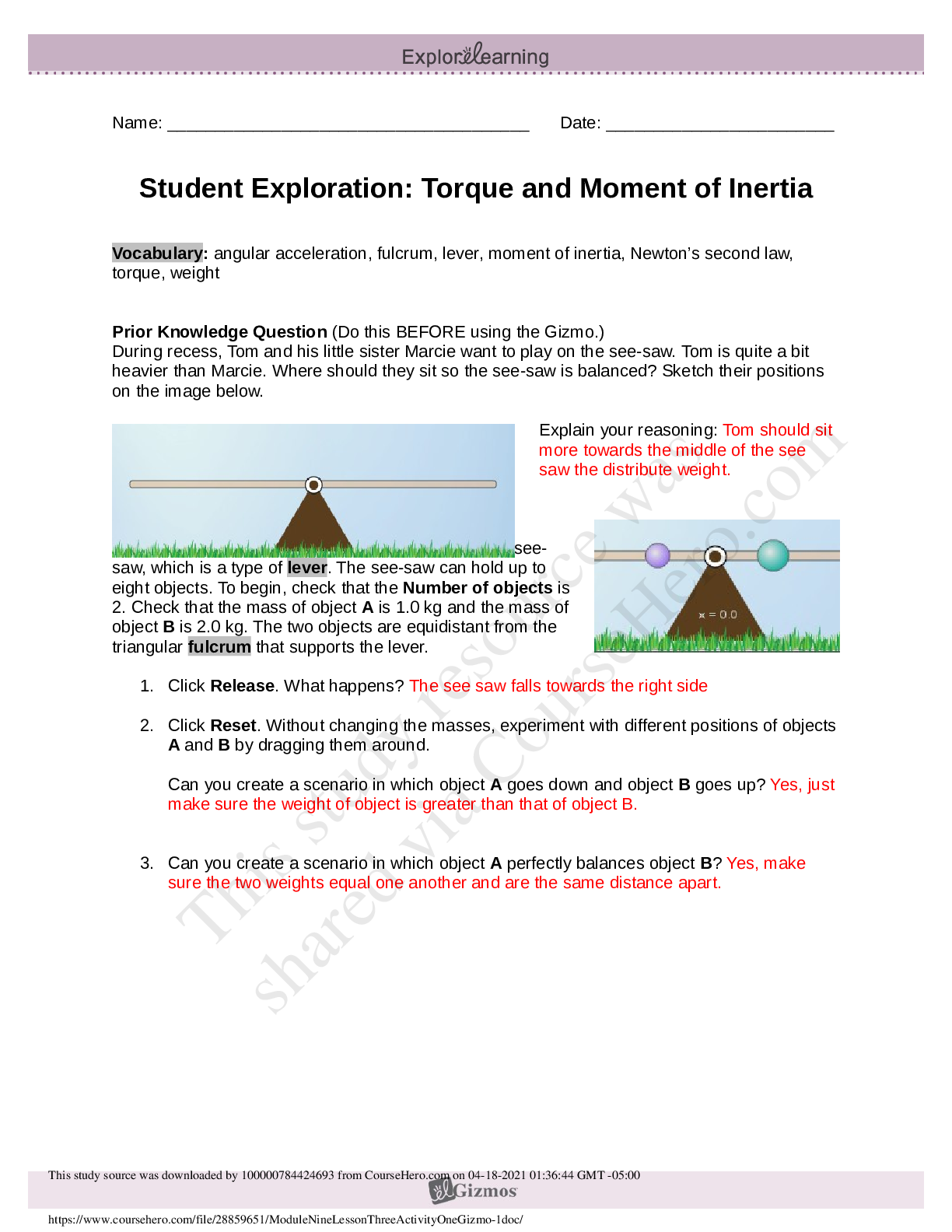

CHAPTER 22

ACCOUNTING CHANGES AND ERROR ANALYSIS

TrUE-FALSE—Conceptual

1. A change in accounting principle is a change that occurs as the result of new information or additional

experience. False

2. Errors in financ

...

CHAPTER 22

ACCOUNTING CHANGES AND ERROR ANALYSIS

TrUE-FALSE—Conceptual

1. A change in accounting principle is a change that occurs as the result of new information or additional

experience. False

2. Errors in financial statements result from mathematical mistakes or oversight or misuse of facts that

existed when preparing the financial statements. True

3. Adoption of a new principle in recognition of events that have occurred for the first time or that were

previously immaterial is treated as an accounting change. False

4. Retrospective application refers to the application of a different accounting principle to recast previously

issued financial statements—as if the new principle had always been used. True

5. When a company changes an accounting principle, it should report the change by reporting the

cumulative effect of the change in the current year’s income statement. False

6. One of the disclosure requirements for a change in accounting principle is to show the cumulative effect

of the change on retained earnings as of the beginning of the earliest period presented. True

7. An indirect effect of an accounting change is any change to current or future cash flows of a company

that result from making a change in accounting principle that is applied retrospectively. True

8. Retrospective application is considered impracticable if a company cannot determine the prior period

effects using every reasonable effort to do so. True

9. Companies report changes in accounting estimates retrospectively. False

10. When it is impossible to determine whether a change in principle or change in estimate has occurred,

the change is considered a change in estimate. True

11. Companies account for a change in depreciation methods as a change in accounting principle. False

12. When companies make changes that result in different reporting entities, the change is reported

prospectively. False

13. Changing the cost or equity method of accounting for investments is an example of a change in

reporting entity. True

14. Accounting errors include changes in estimates that occur because a company acquires more

experience, or as it obtains additional information. False

15. Companies record corrections of errors from prior periods as an adjustment to the beginning balance of

retained earnings in the current period. True

16. If an FASB standard creates a new principle, expresses preference for, or rejects a specific accounting

principle, the change is considered clearly acceptable. True

17. Balance sheet errors affect only the presentation of an asset or liability account. False

18. Counterbalancing errors are those that will be offset and that take longer than two periods to correct

themselves. False

19. For counterbalancing errors, restatement of comparative financial statements is necessary even if a

correcting entry is not required. True

20. Companies must make correcting entries for non-counter-balancing errors, even if they have closed the

prior year’s books. True

21. Accounting changes are often made and the monetary impact is reflected in the financial statements of

a company even though, in theory, this may be a violation of the accounting concept of

a. materiality.

b. consistency.

c. conservatism.

d. objectivity.

22. Which of the following is not treated as a change in accounting principle?

a. A change from LIFO to FIFO for inventory valuation

b. A change to a different method of depreciation for plant assets

c. A change from full-cost to successful efforts in the extractive industry

d. A change from completed-contract to percentage-of-completion

23. Which of the following is not a retrospective-type accounting change?

a. Completed-contract method to the percentage-of-completion method for long-term contracts

b. LIFO method to the FIFO method for inventory valuation

c. Sum-of-the-years'-digits method to the straight-line method

d. "Full cost" method to another method in the extractive industry

24. Which of the following is accounted for as a change in accounting principle?

a. A change in the estimated useful life of plant assets.

b. A change from the cash basis of accounting to the accrual basis of accounting.

c. A change from expensing immaterial expenditures to deferring and amortizing them as they

become material.

d. A change in inventory valuation from average cost to FIFO.

25. A company changes from straight-line to an accelerated method of calculating depreciation, which will

be similar to the method used for tax purposes. The entry to record this change should include a

a. credit to Accumulated Depreciation.

b. debit to Retained Earnings in the amount of the difference on prior years.

c. debit to Deferred Tax Asset.

d. credit to Deferred Tax Liability.

26. Which of the following disclosures is required for a change from sum-of-the-years-digits to straight-line?

a. The cumulative effect on prior years, net of tax, in the current retained earnings statement

b. Restatement of prior years’ income statements

c. Recomputation of current and future years’ depreciation

d. All of these are required.

27.A company changes from percentage-of-completion to completed-contract, which is the method used for tax

purposes. The entry to record this change should include a

a. debit to Construction in Process.

b. debit to Loss on Long-term Contracts in the amount of the difference on prior years, net of tax.

c. debit to Retained Earnings in the amount of the difference on prior years, net of tax.

[Show More]

.png)

.png)