Financial Accounting > QUESTIONS & ANSWERS > Divine Word College of Legazpi - SBMA BSAPAS 8 Accounting Policies, Estimates and Errors. (All)

Divine Word College of Legazpi - SBMA BSAPAS 8 Accounting Policies, Estimates and Errors.

Document Content and Description Below

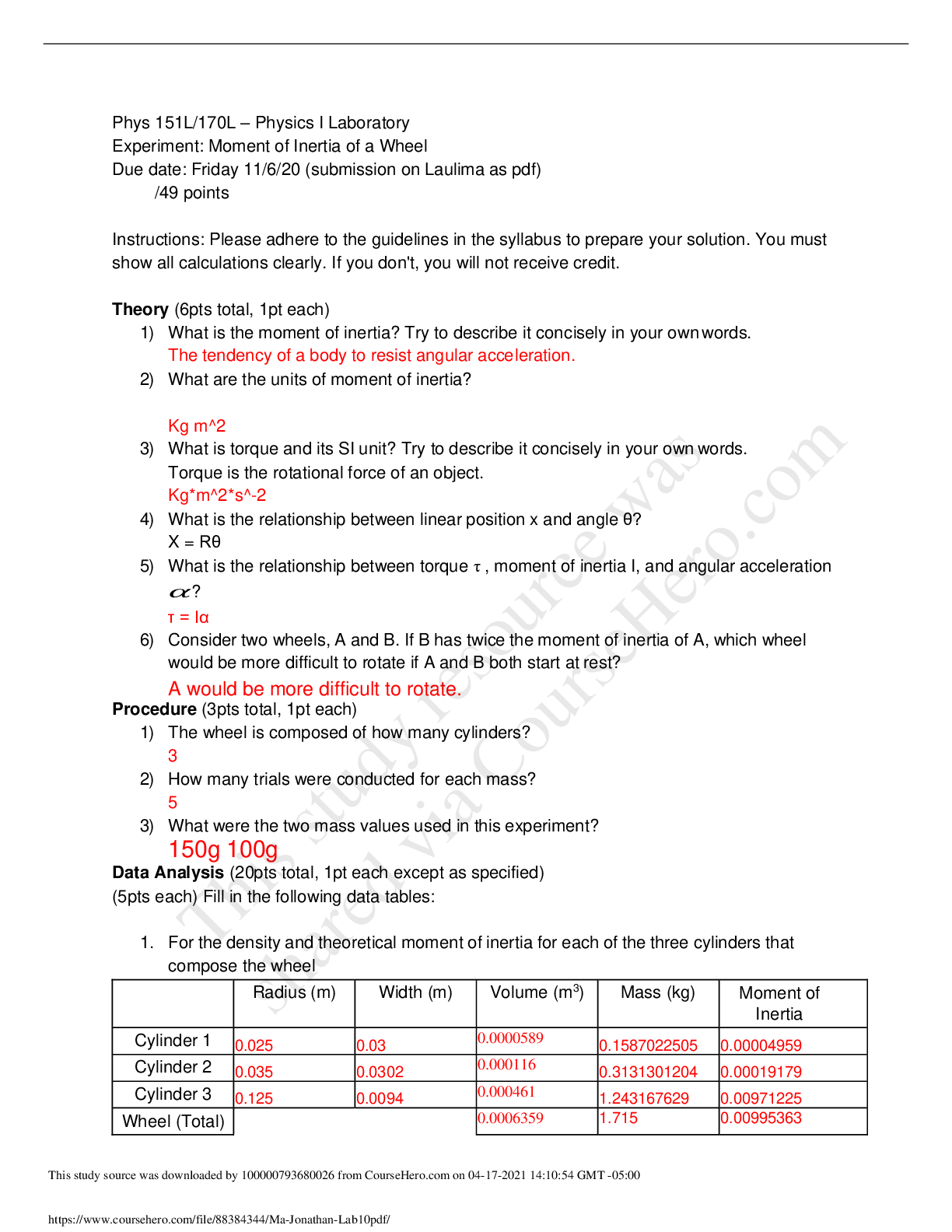

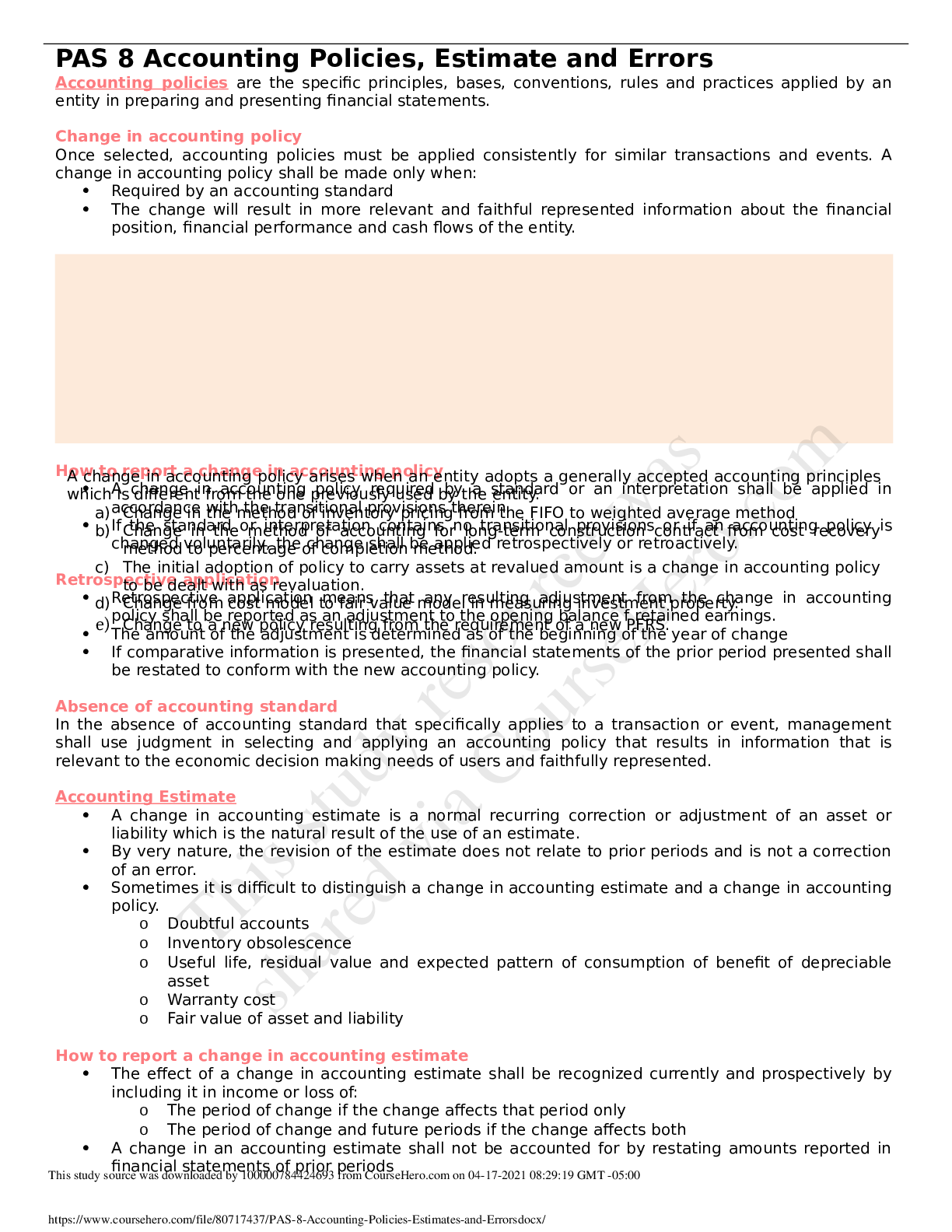

PAS 8 Accounting Policies, Estimate and Errors Accounting policies are the specific principles, bases, conventions, rules and practices applied by an entity in preparing and presenting financial sta... tements. Change in accounting policy Once selected, accounting policies must be applied consistently for similar transactions and events. A change in accounting policy shall be made only when: Required by an accounting standard The change will result in more relevant and faithful represented information about the financial position, financial performance and cash flows of the entity. How to report a change in accounting policy A change in accounting policy required by a standard or an interpretation shall be applied in accordance with the transitional provisions therein. If the standard or interpretation contains no transitional provisions or if an accounting policy is changed voluntarily, the change shall be applied retrospectively or retroactively. Retrospective application Retrospective application means that any resulting adjustment from the change in accounting policy shall be reported as an adjustment to the opening balance f retained earnings. The amount of the adjustment is determined as of the beginning of the year of change If comparative information is presented, the financial statements of the prior period presented shall be restated to conform with the new accounting policy. Absence of accounting standard In the absence of accounting standard that specifically applies to a transaction or event, management shall use judgment in selecting and applying an accounting policy that results in information that is relevant to the economic decision making needs of users and faithfully represented. Accounting Estimate A change in accounting estimate is a normal recurring correction or adjustment of an asset or liability which is the natural result of the use of an estimate. By very nature, the revision of the estimate does not relate to prior periods and is not a correction of an error. Sometimes it is difficult to distinguish a change in accounting estimate and a change in accounting policy. o Doubtful accounts o Inventory obsolescence o Useful life, residual value and expected pattern of consumption of benefit of depreciable asset o Warranty cost o Fair value of asset and liability How to report a change in accounting estimate The effect of a change in accounting estimate shall be recognized currently and prospectively by including it in income or loss of: o The period of change if the change affects that period only o The period of change and future periods if the change affects both A change in an accounting estimate shall not be accounted for by restating amounts reported in financial statements of prior periods A change in accounting policy arises when an entity adopts a generally accepted accounting principles which is different from the one previously used by the entity. a) Change in the method of inventory pricing from the FIFO to weighted average method b) Change in the method of accounting for long-term construction contract from cost recovery method to percentage of completion method. c) The initial adoption of policy to carry assets at revalued amount is a change in accounting policy to be dealt with as revaluation. d) Change from cost model to fair value model in measuring investment property. e) Change to a new policy resulting from the requirement of a new PFRS. This study source was downloaded by 100000784424693 from CourseHero.com on 04-17-2021 08:29:19 GMT -05:00 https://www.coursehero.com/file/80717437/PAS-8-Accounting-Policies-Estimates-and-Errorsdocx/ This study resource was shared via CourseHero.com Changes in accounting estimates are to be handled currently and prospectively, if necessary. Prospective recognition of the effect of a change in accounting estimate means that the change in accounting estimate means that the change is applied to transactions, other events and conditions from the date of change in estimate. Prior period errors Prior period errors are omissions and misstatements in the financial statements for one and more periods arising from a failure to use or misuse of reliable information. How to treat prior period errors Prior period errors shall be corrected retrospectively by adjusting the opening balances of retained earnings and affected assets and liabilities. Problem 1 During 2019, Orca Company decided to change from the FIFO method of inventory valuation to the weighted average method. FIFO Weighted average January 1 7,100,000 7,700,000 December 31 7,900,000 8,300,000 In the statement of retained earnings for 2019, what amount should be reported as the pretax cumulative effect of this accounting change? FIFO inventory – January 1 7,100,000 Weighted average inventory – January 1 7,700,000 Cumulative effect [Show More]

Last updated: 2 years ago

Preview 1 out of 7 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$7.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 17, 2021

Number of pages

7

Written in

Additional information

This document has been written for:

Uploaded

Apr 17, 2021

Downloads

0

Views

72

.png)