Financial Accounting > EXAM > University Of Phoenix ACC 422. Questions and Answers For an A+ (All)

University Of Phoenix ACC 422. Questions and Answers For an A+

Document Content and Description Below

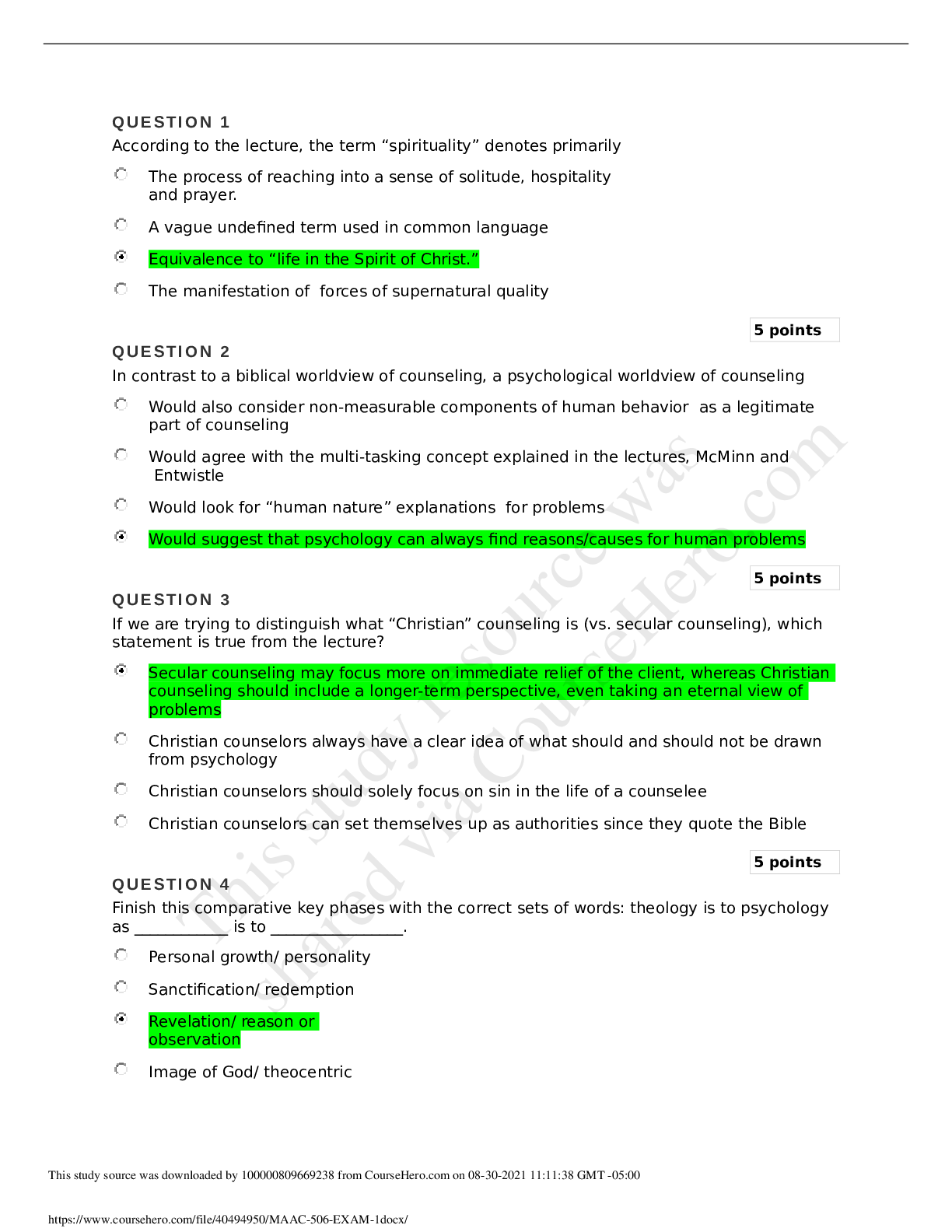

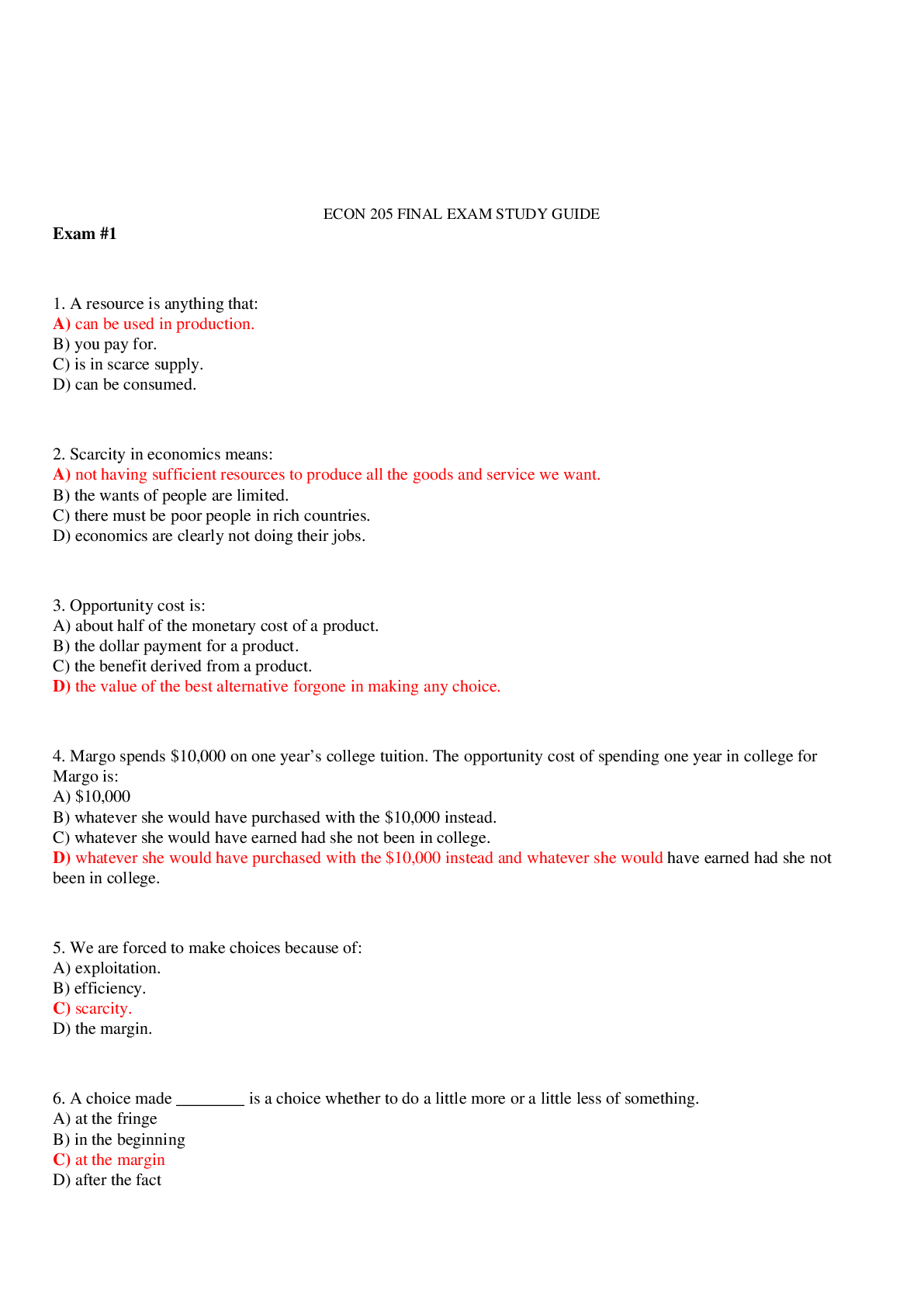

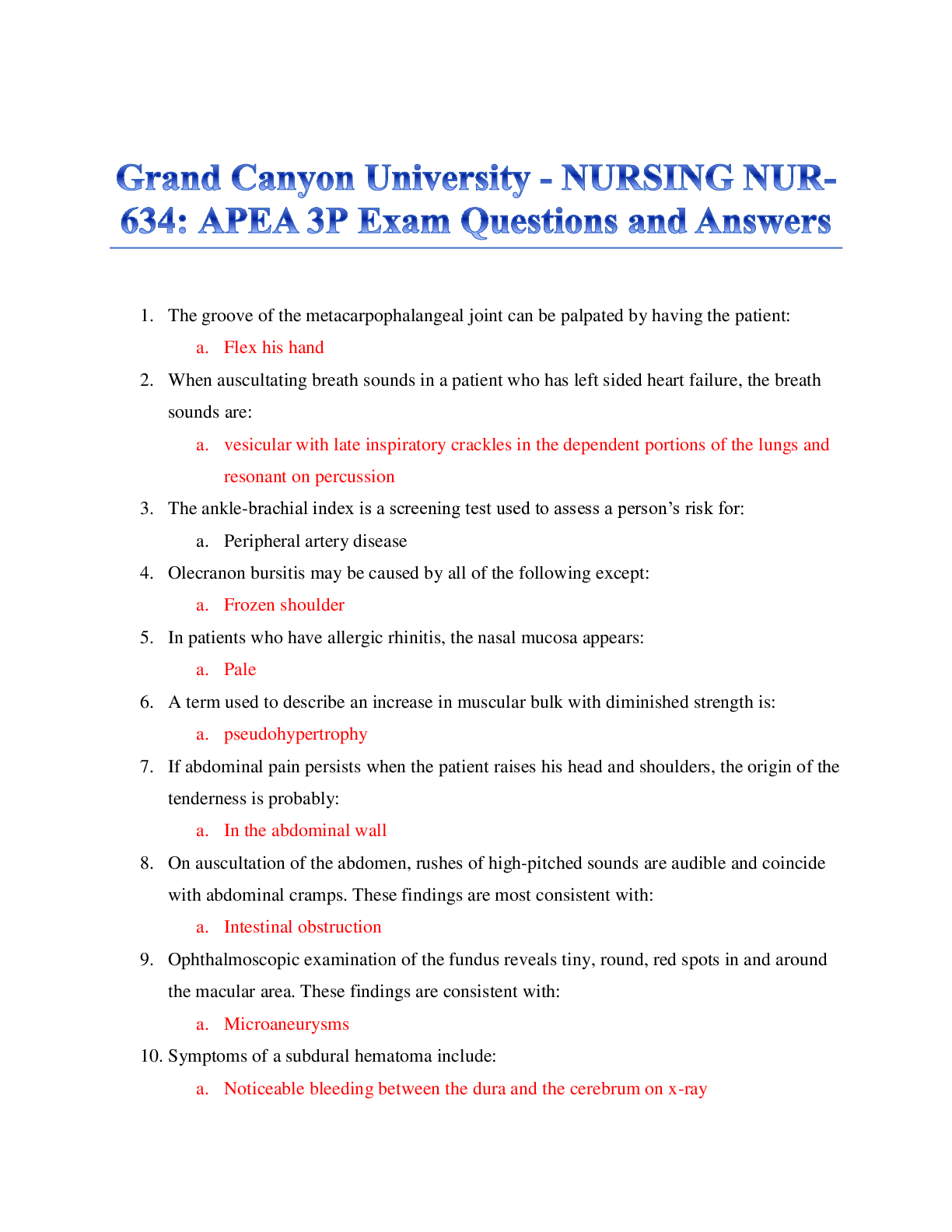

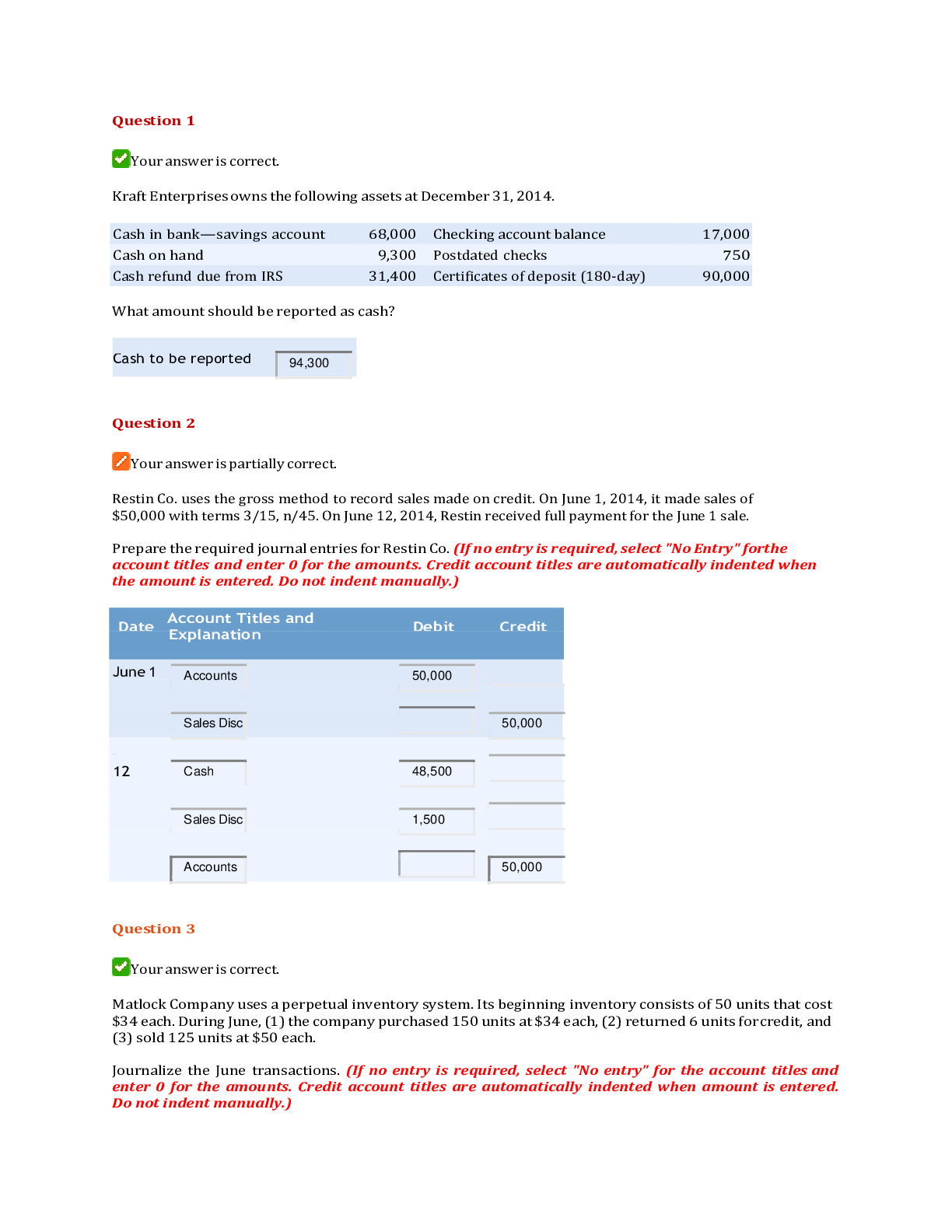

Question 1 Your answer is correct. Kraft Enterprises owns the following assets at December 31, 2014. Cash in bank—savings account 68,000 Checking account balance 17,000 Cash on hand 9,300 ... Postdated checks 750 Cash refund due from IRS 31,400 Certificates of deposit (180-day) 90,000 What amount should be reported as cash? $ Question 2 Your answer is partially correct. Restin Co. uses the gross method to record sales made on credit. On June 1, 2014, it made sales of $50,000 with terms 3/15, n/45. On June 12, 2014, Restin received full payment for the June 1 sale. Prepare the required journal entries for Restin Co. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) June Question 3 Your answer is correct. Matlock Company uses a perpetual inventory system. Its beginning inventory consists of 50 units that cost $34 each. During June, (1) the company purchased 150 units at $34 each, (2) returned 6 units for credit, and (3) sold 125 units at $50 each. Journalize the June transactions. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) No Account Titles and . Explanation Debit Credit (1) Inventory 5,100 Accounts P 5,100 (2) Accounts P 204 Inventory 204 (3) Accounts R 6,250 Sales Reve 6,250 (To record sales) Cost of Go 4,250 Inventory 4,250 Show Solution Show Answer Link to Text Ending inventory 4,740 $ Cost of goods sold 7,110 [Show More]

Last updated: 3 years ago

Preview 1 out of 20 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$8.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 22, 2021

Number of pages

20

Written in

All

Additional information

This document has been written for:

Uploaded

Apr 22, 2021

Downloads

0

Views

130

nr451 rn Capstone Course.png)