SUBJECT CM2 CORE READING

Contents

Accreditation

Introduction

References

Unit 1 Theories of financial market behaviour

Unit 2 Measures of investment risk

Unit 3 Introduction to stochastic investment returns

Unit 4

...

SUBJECT CM2 CORE READING

Contents

Accreditation

Introduction

References

Unit 1 Theories of financial market behaviour

Unit 2 Measures of investment risk

Unit 3 Introduction to stochastic investment returns

Unit 4 Asset valuations

Unit 5 Liability valuations

Unit 6 Option theorySUBJECT CM2 CORE READING

Accreditation

The Institute and Faculty of Actuaries would like to thank the numerous people who have helped in

the development of the material contained in this Core Reading.

Introduction

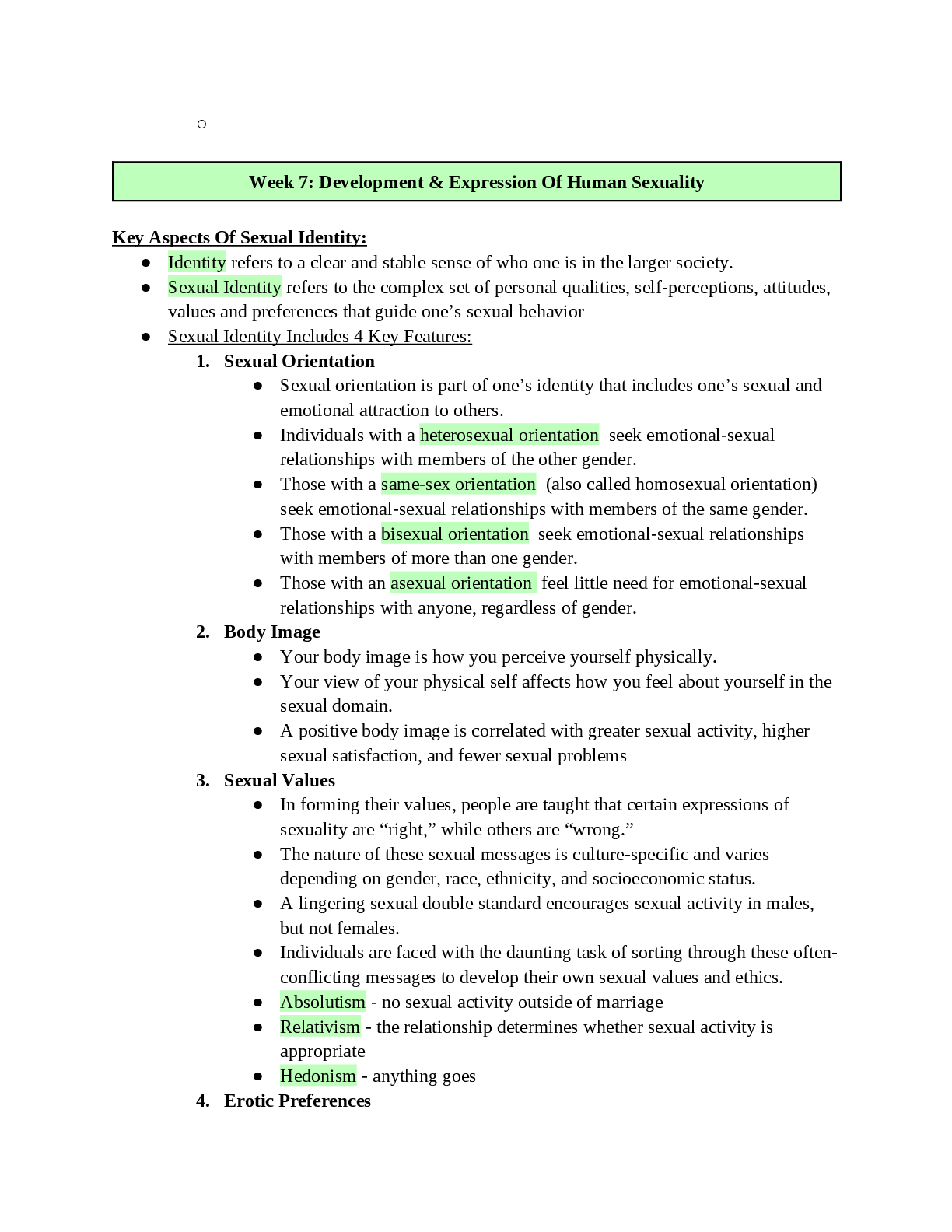

The Core Reading manual has been produced by the Institute and Faculty of Actuaries. The purpose

of the Core Reading is to ensure that tutors, students and examiners understand the requirements of

the syllabus for the qualification examinations for Fellowship of the Institute and Faculty of

Actuaries.

The examinations require students to demonstrate their understanding of the concepts given in the

syllabus and described in the Core Reading; this will be based on the legislation, professional

guidance etc. which are in force when the Core Reading is published, i.e. on 31 May in the year

preceding the examinations. Examiners will have this Core Reading manual when setting the papers.

In preparing for examinations students are advised to work through past examination questions and

may find additional tuition helpful. The manual will be updated each year to reflect changes in the

syllabus and current practice, and in the interest of clarity.CM2 References

CS1 Actuarial Statistics 1

CS2 Risk Modelling and Survival Analysis

SP5 Investment and Finance Principles

SP7 General Insurance: Reserving and Capital Modelling Principles

Formulae and Tables for Examinations

Johnson, T. (2017). Ethics in Quantitative Finance: A Pragmatic financial market theory.

Palgrave Macmillan.

Davies, M. (2006). Louis Bachelier’s Theory of Speculation: The Origins of Modern Finance.

Princeton University Press.Subject CM2 Theories of Financial Market Behaviour 2020

© Institute and Faculty of Actuaries Unit 1, Page 1

UNIT 1 — THEORIES OF FINANCIAL MARKET

BEHAVIOUR

Syllabus objectives

Rational expectations theory

1.1.1 Discuss the three forms of the Efficient Markets Hypothesis and their

consequences for investment management.

1.1.2 Describe briefly the evidence for or against each form of the Efficient

Markets Hypothesis.

1 Rational Expectations Theory

1.1 The three forms of the Efficient Markets Hypothesis

From the 1930s until the early 1960s, there was a widespread folklore about how to make

money on the stock market. The dominant theory, going back to Adam Smith in the

1700s, was that markets are essentially fickle, and that prices tend to oscillate around some

true or fundamental value. Starting with the seminal work by Benjamin Graham,

traditional investment analysis involved detailed scrutiny of company accounts, t

[Show More]