ACCT 301 Quiz 3 Power answer.

Document Content and Description Below

ACCT 301 Quiz 3 Power answer.

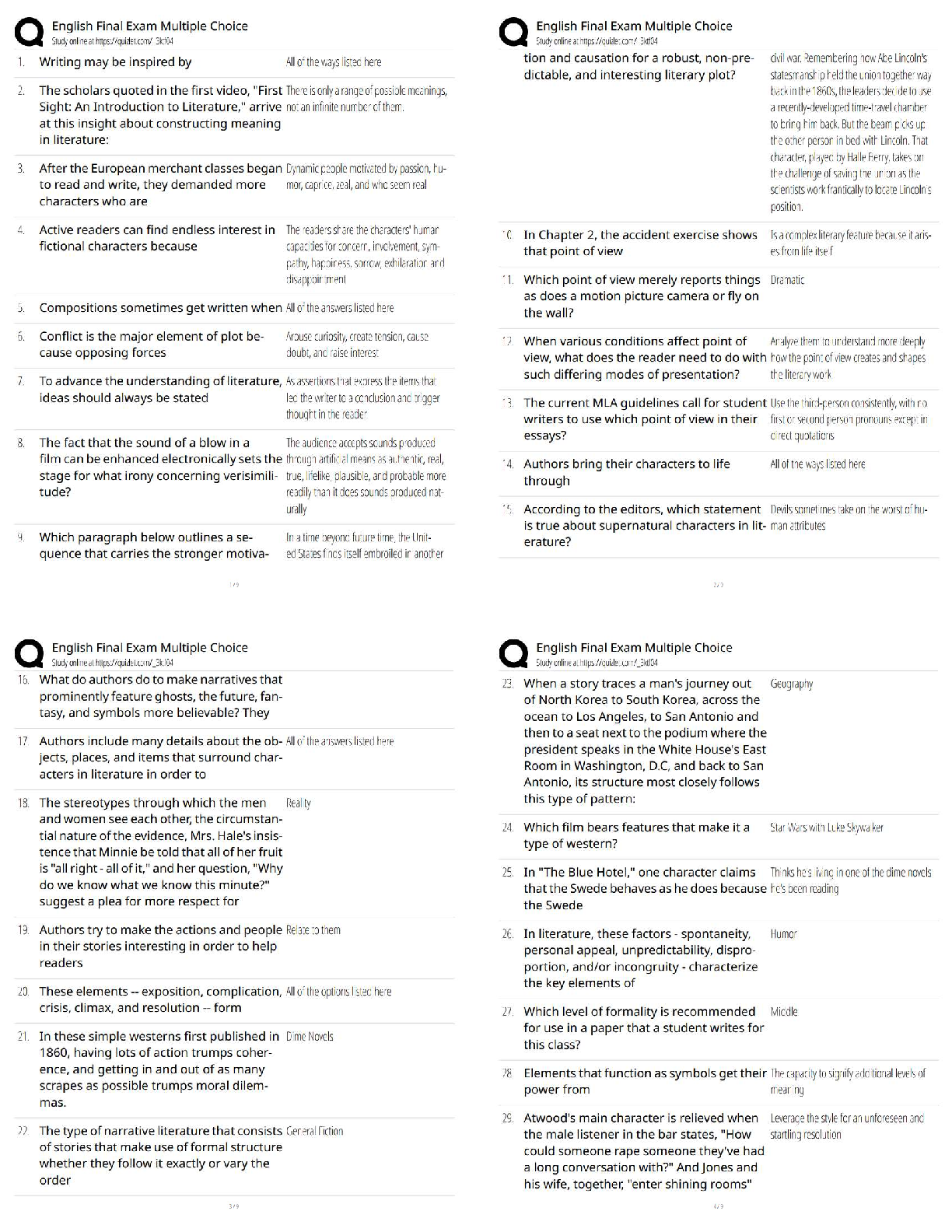

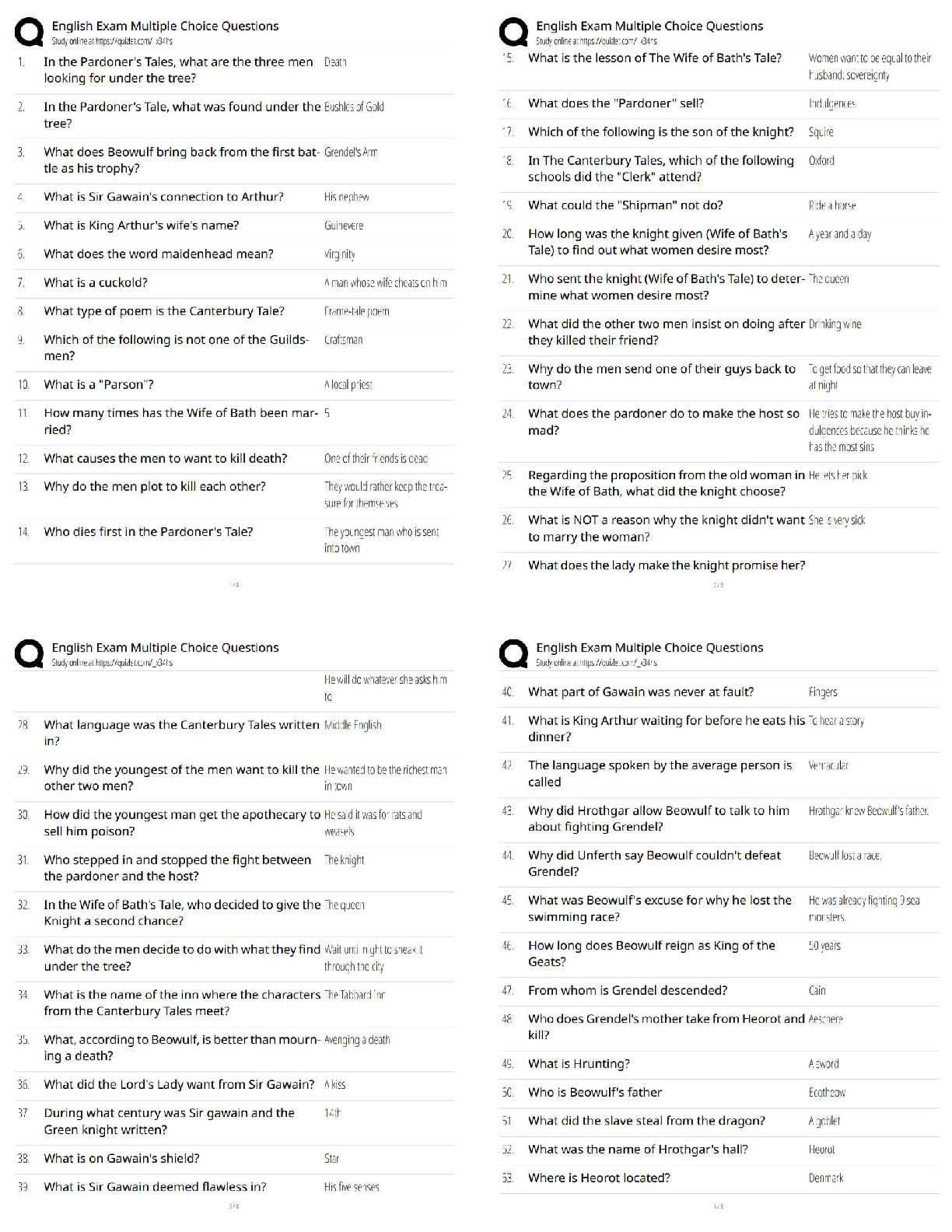

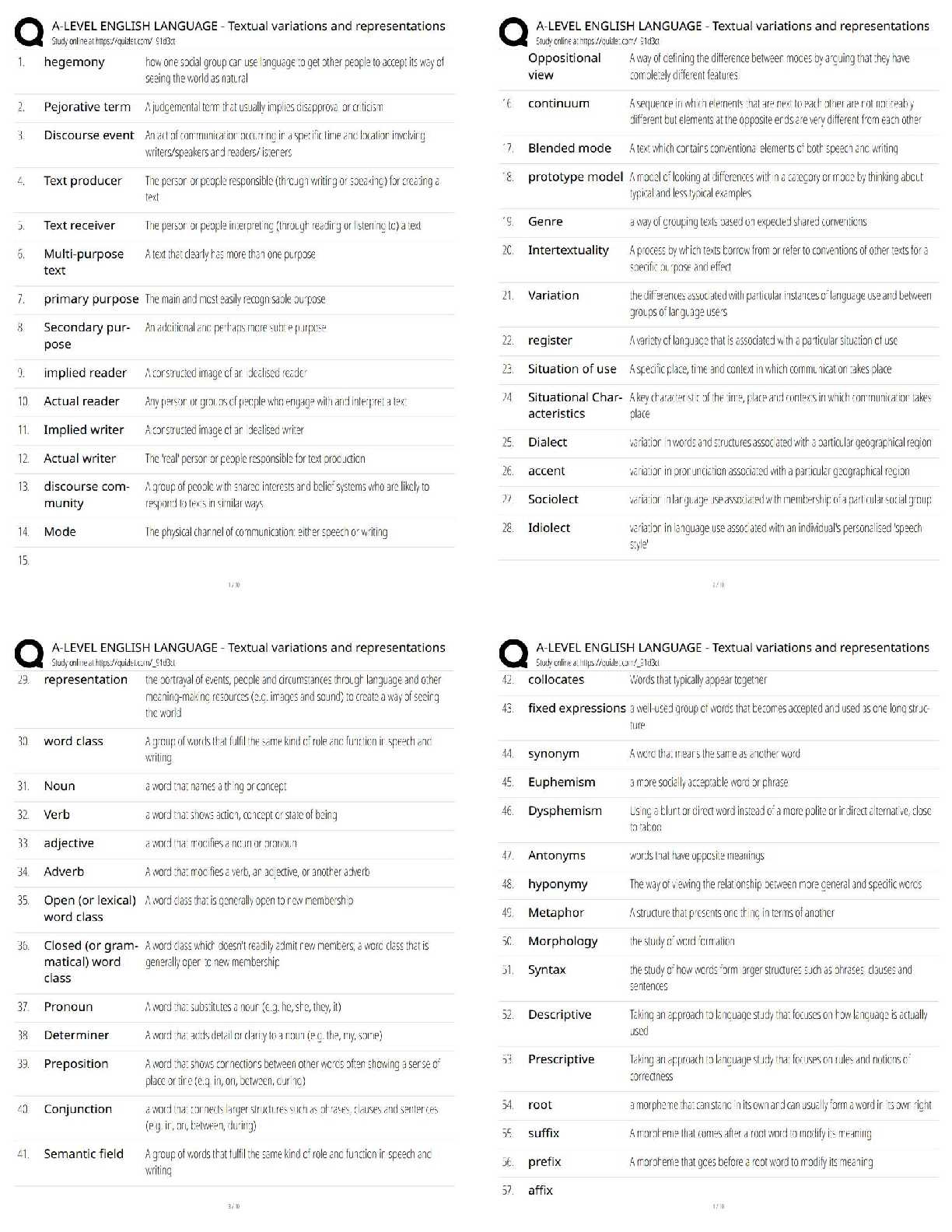

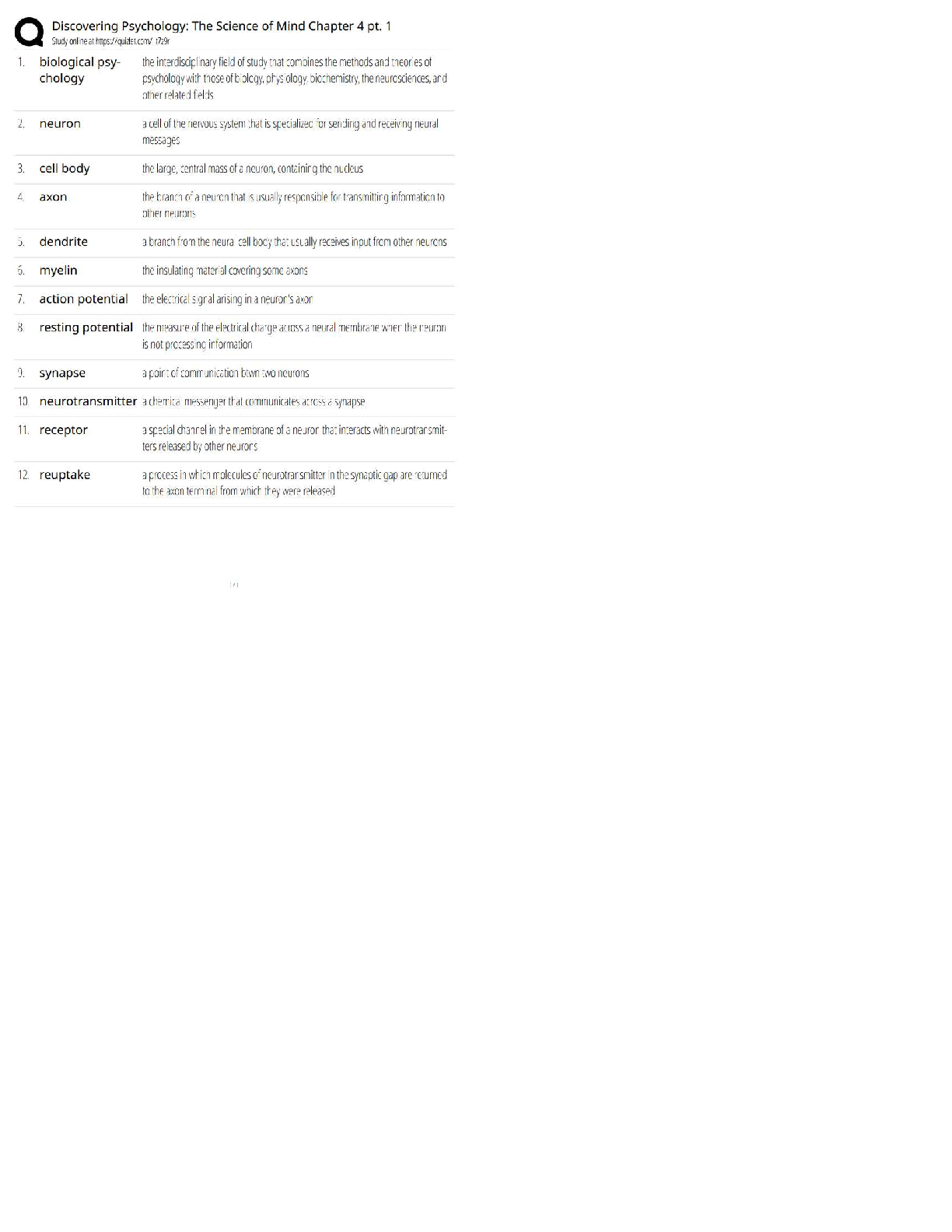

During Burns Company’s first year of operations, credit sales totaled $150,000 and collections on credit sales totaled $110,000. Burns estimates that bad debt losses w

...

ill be 1.0% of credit sales. By year-end, Burns had written off $350 of specific accounts as uncollectible. Required: 1. Prepare all appropriate journal entries relative to uncollectible accounts and bad debt expense. 2. Show the year-end balance sheet presentation for accounts receivable.

Oswego Clay Pipe Company sold $46,000 of pipe to Southeast Water District #45 on April 12 of the current year with terms 1/15, n/60. Oswego uses the gross method of accounting for sales discounts. What entry would Oswego make on April 12?

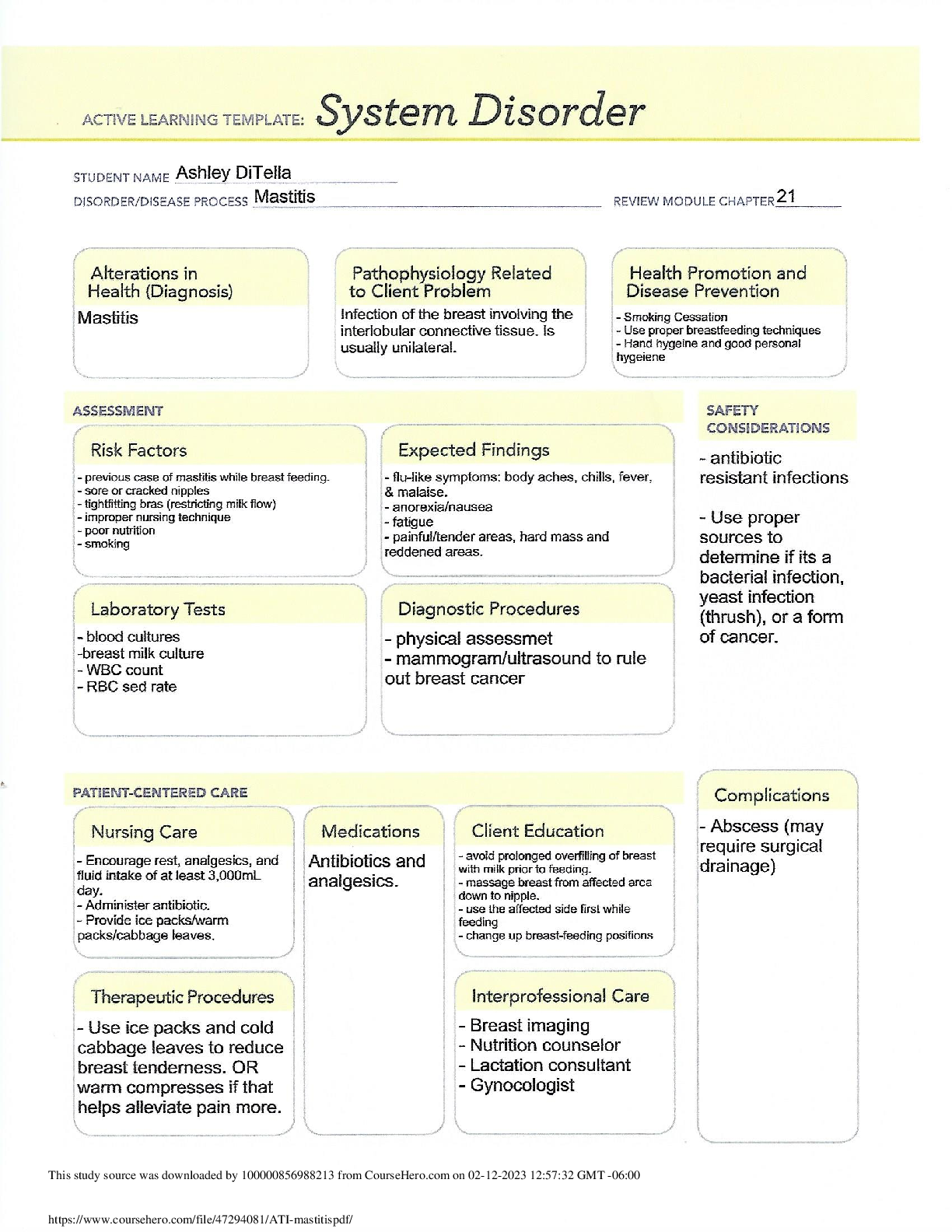

The following information is taken from the 2015 annual report to shareholders of Hughe-Pockets (HP) Co.

What is the balance in HP’s allowance for doubtful accounts at the end of the fiscal years 2015 and 2014, respectively? (Enter your answers in millions (i.e., 10,000,000 should be entered as 10).)

Frankenstein Enterprises received two notes from customers for sales that Frankenstein made in 2021. The notes included:

Frankenstein had accrued a total of $16,400 interest receivable from these notes in its 12/31/2021 balance sheet. The annual interest rate on Note A is closest to:

Important elements of an internal control system for cash disbursements include each of the following except:

Calistoga Produce estimates bad debt expense at 0.30% of credit sales. The company reported accounts receivable and allowance for uncollectible accounts of $477,000 and $1,650, respectively, at December 31, 2020. During 2021, Calistoga’s credit sales and collections were $315,000 and $310,000, respectively, and $1,810 in accounts receivable were written off. Calistoga’s accounts receivable at December 31, 2021, are:

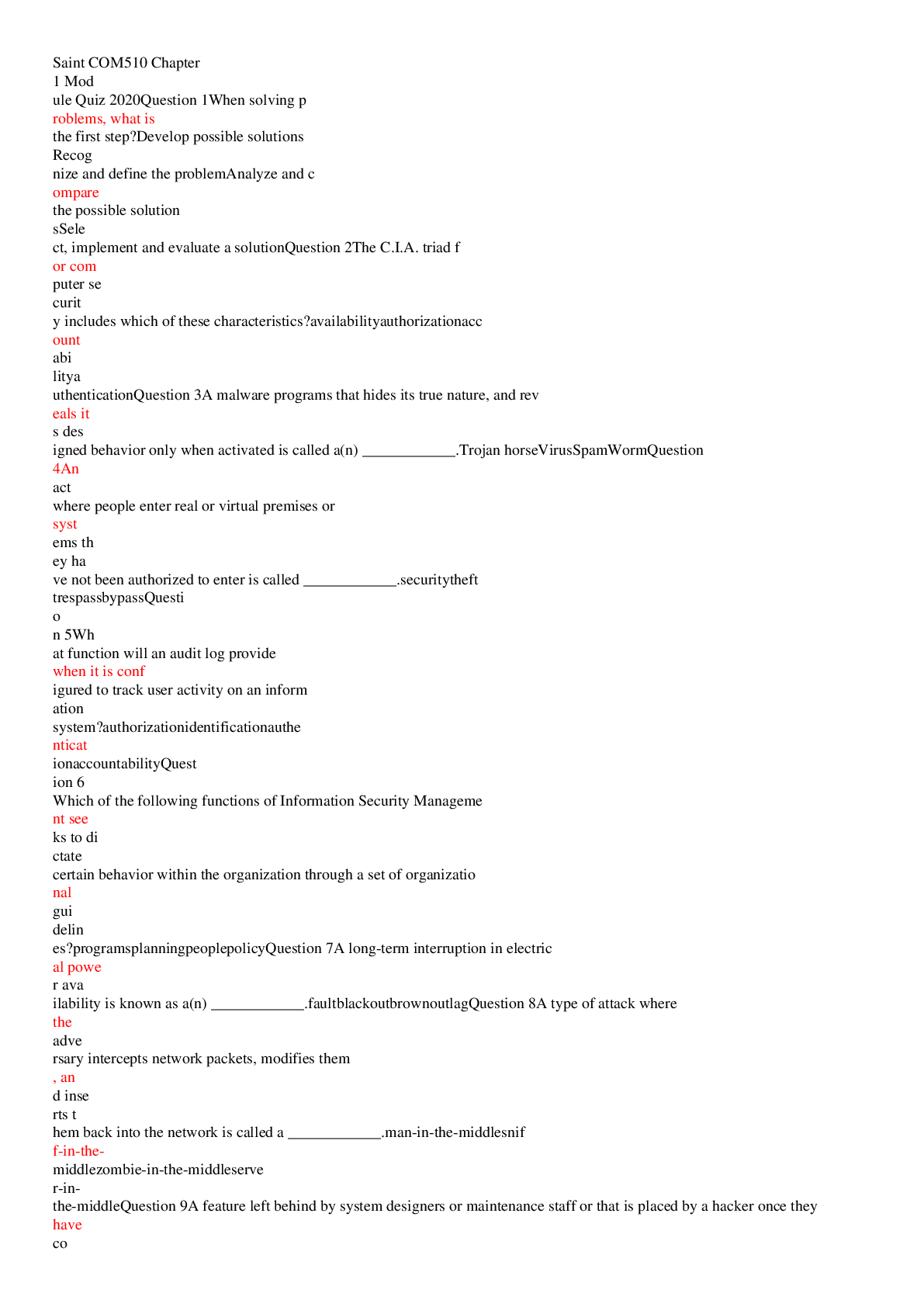

A summary of Klugman Company’s December 31, 2021, accounts receivable aging schedule is presented below along with the estimated percent uncollectible for each age group:

Prepare all journal entries for 2021 with respect to bad debts and the allowance for uncollectible accounts. (If no entry is required for a transaction/event, select “No journal entry required” in the first account field.)

Slinky Company purchased merchandise on June 10, 2021, at a price of $32,000, subject to credit terms of 3/10, n/30. Slinky uses the net method for recording purchases and uses a perpetual inventory system.

Slinky Company purchased merchandise on June 10, 2021, at a price of $20,000, subject to credit terms of 2/10, n/30. Slinky uses the net method for recording purchases and uses a perpetual inventory system.

1. Prepare the journal entry to record the purchase. 2. & 3. Prepare the journal entries to record the appropriate payment if the entire invoice is paid on June 18, 2021 and July 8, 2021.

Hazelton Corporation uses a periodic inventory system and the LIFO method to value its inventory. The company began 2021 with $93,300 in inventory of its only product. The beginning inventory consisted of the following layers:

During 2021, 7,100 units were purchased at $9 per unit and during 2022, 9,200 units were purchased at $10 per unit. Sales, in units, were 9,200 and 16,400 during 2021 and 2022, respectively.

[Show More]

Last updated: 3 years ago

Preview 1 out of 61 pages