AASB16 Lease

Woolworths Case Study

Mohammed Gamal Kenawy

44822219

Tas Husain

Thursday 6pmExecutive summary

This paper intends to clarify the current lease arrangements of Woolworths including the impact

of the new

...

AASB16 Lease

Woolworths Case Study

Mohammed Gamal Kenawy

44822219

Tas Husain

Thursday 6pmExecutive summary

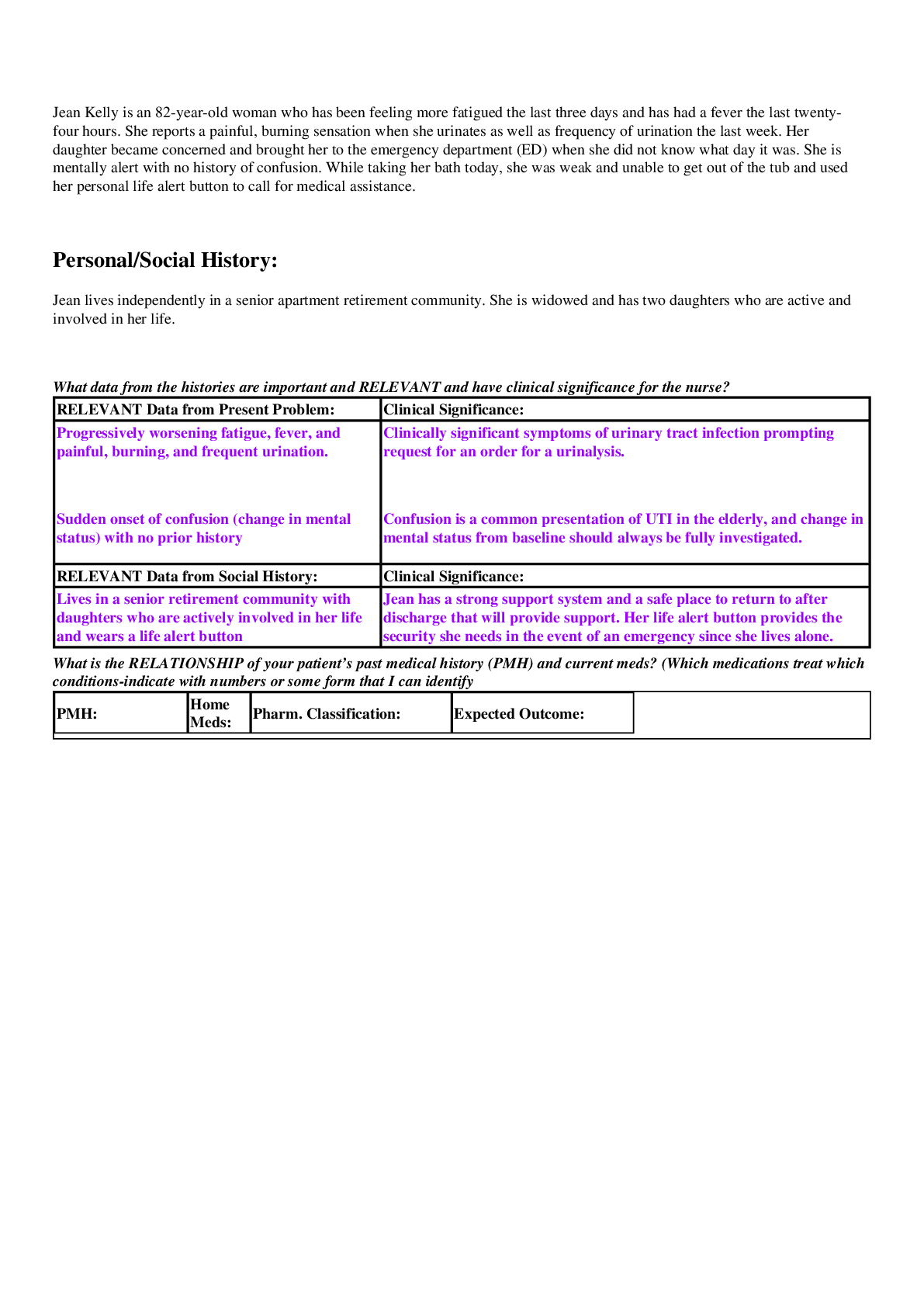

This paper intends to clarify the current lease arrangements of Woolworths including the impact

of the newly introduced accounting standard, AASB 16, on the financial statements. Woolworths

has different lease arrangements in terms of finance or operation lease, approximately 6000

leases, of which 3000 are store leases. According to AASB 17, leases have to be identified to be

either a finance or operation lease.

The new AASB 16 will take place on 31 January 2019, that will impact the financial

statements/ratios of Woolworths. On the top of that, it will force some changes in lease

accounting. AASB 16 will not show what type of lease the company is using in terms finance or

operation lease likewise AASB17 which failed to provide a faithful image of the company leases,

on the other hand, requires all the leases of the company to account ‘on balance sheet’ by

recognising the right of use assets and lease liability (Sivanantham, 2016, p.1). Also, recognising

depreciation of lease assets as well as interest on lease liability on the income statement while

short term leases are exempted from any requirements.

AASB 16 will aid in improving the financial reporting through providing more transparency for

companies with material off balance sheet leases and improve comparability of financial

information. However, since companies are not implementing AASB 16 they will be subject to

implementation costs and an ongoing cost.

1.Introduction

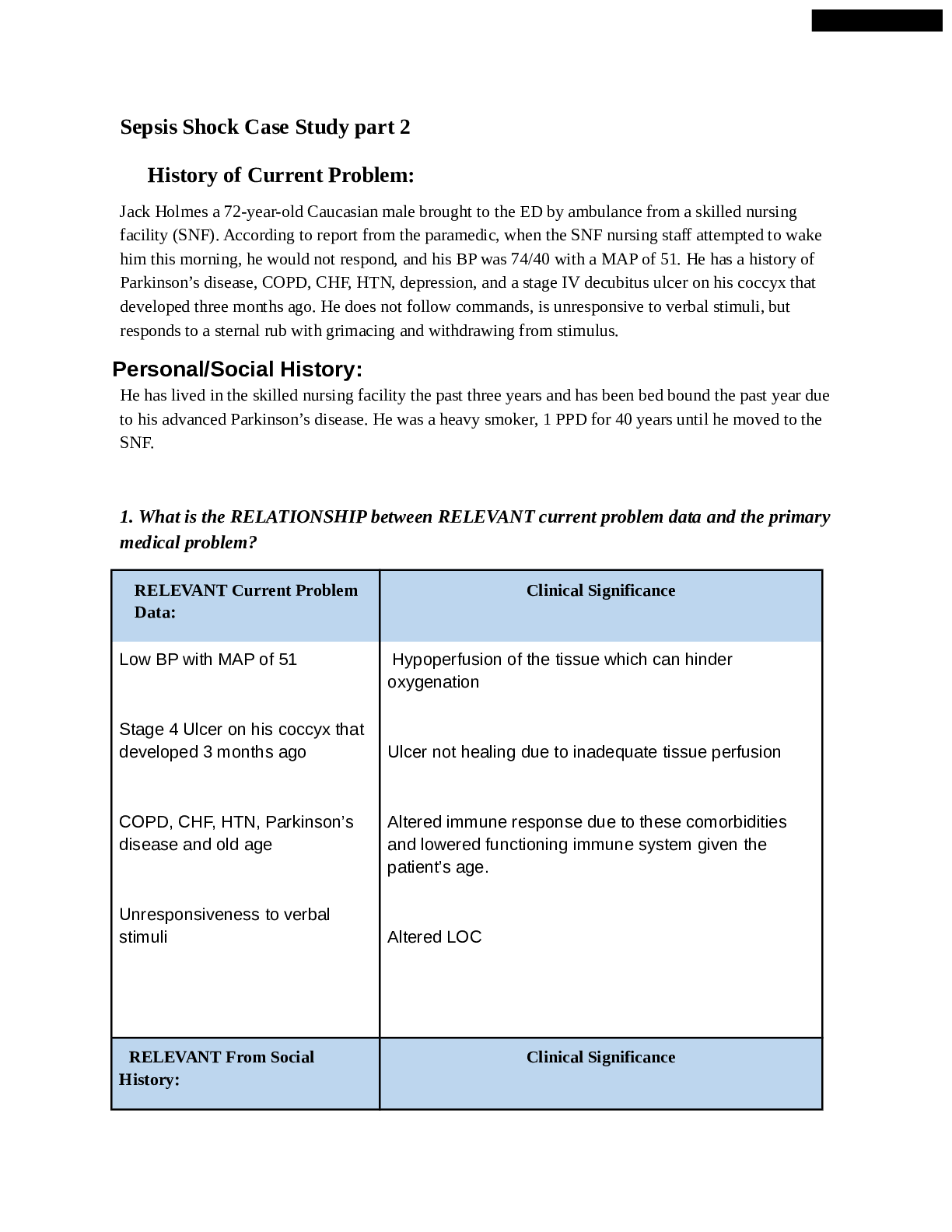

The Australian standards board has developed and issued a new standard AASB 16 that all

companies have to comply with starting on 31 January 2019. This paper will discuss the different

types of lease arrangements Woolworths uses along with a summary of the new AASB 16 leases

compared to AASB 117. Moreover, an analysis of the new lease standard will be taken into

account to show the impact of AASB 16 on the company’s financial position and performance.Actions and recommendations will also be given to show how Woolworths will apply the new

standard.

2.Body

2.1 Woolworths lease arrangements.

Woolworths use a combination of finance and operating lease. Finance lease is a lease that

transfer substantially all the risks and rewards incidental to ownership of an asset irrespective of

whether title for the asses is eventually transferred (Leo, Knapp, McGowan, Sweeting, Company

Accounting, p. 456). Woolworths Current, unsecured finance leases accounted for $400,000

which has decreased from last year by $1,300,000. While noncurrent unsecured finance leases

$2,900,000 the same as last year. On the other hand, operation lease is a lease other than a

finance lease (Leo, Knapp, McGowan, Sweeting, Company Accounting, p. 456), which is

recognised as an expense based on a straight line method over the lease period, accounted for

$25,277,200. Operating lease obligations for onerous lease is recognised in the consolidated

report of financial position also disclosed in the operating lease commitment.

Furthermore, the commitments which are charged on the retails premises leased by the group are

calculated as a turnover percentage of the store occupying the premises.

Woolworth is using AASB 17 lease standard to prepare the accounting for lease with no

intentions to change AASB 17 model, since the new standard provide additional complexity,

huge cost and administrative responsibilities on the management without benefit.

2.2 Comparing AASB 17 to AASB 16.

The old AASB 17 standard require the type of lease has to be identified whether it’s a financial

or operation lease, resulting in misguiding the user when making an assessment on the company

and failed to meet the user requirements by not providing a faithful representation of the lease

transaction. since the appreciation of the lease assets and liabilities on the balance sheet is not

shown due to the off balance sheet leases (AASB 17), which let the accountants able to hide andmanipulate the representation of the financial information to enhance the company financial

position and attract the user to invest in the company.

On the other hand, the new AASB 16 standard will provide new changes that will render a fair

representation of the company financial position by applying on balances sheet leases which are,

Recognising leases assets and lease liabilities on the balance sheet measured initially using the

present value of unavoidable lease future payments, lease depreciation and interest should show

up on the company income statement over the lease term, Separating the amount of cash paid

into a principal based on the financing activities in the cash flow statements, therefore, AASB 16

is expected to make some changes on the balance sheet, income statement and cash flow

statement.

The lessees have to disclose according to AASB16. When preparing the financial statements

lessees will have to apply their own judgement in distinguishing between what information to

disclose that will meet requirements and goals of the user of the financial statements, users will

start to make an assessment on the effects of the lease on the financial statements.

2.3Impact on Woolworths financial statements.

2.3.1 Balance sheet changes.

Woolworths financial statements will witness changes due to the implementation of the new

standard, (AASB 16), which requires Woolworths to prepare the financial report on the balance

sheet for lease assets and lease liabilities which is predicted to increase lease assets and

liabilities, since Recognising of the assets that were not recognised before will lead to increase in

lease assets, as well as for lease liabilities accordingly.

2.3.2 Income statement changes

AASB 16 will have an impact on Woolworths income statement:

a- Recognition of expenses that belongs to lease for an individual lease and a portfolio.

b- Presentation of the lease related expense

c- Other effects.

Since Woolworths has off balance sheet lease AASB 16 expected to increase the profit before

[Show More]

.png)