ACCOUNTING 305exam+3+practice Chapter 10. All Answers Correct

$ 13

FINA 365 Final Exam Review

$ 15

eBook Privacy at Sea Practices, Spaces, and Communication in Maritime History 1st Edition By Natacha Klein Käfer

$ 30

Kansas State University FNDH 620 Exam 3 – 2022 (COMPLETE SOLUTIONS)

$ 10

NR 661 Week 3 All in One

$ 5

FUNDAMENTAL PN HESI SPECIALTY V2

$ 11

NUR 3655 Maternity Nursing Test Bank

$ 30

MATH 221 Week 1 Discussion: Descriptive Statistics (Summer 2020)-Already Graded A

$ 15

Test Bank for Exploring Lifespan Development 4th Edition by Laura E. Berk

$ 13

.png)

Chapter 13 study guide[The Molecular Basis of Inheritance]

$ 9

AQA 2022 PHYSICS A LEVEL MARKSCHEME PAPER 2

$ 9

NUTR 331 Final Exam Prep Study Guide Questions and Answers Athabasca University

$ 13

Final Exam Study Guide NUR 2790: Professional Nursing III( Complete Solution Rated A

$ 18.5

Questions & Answers.png)

HISTORY 104 Sophia US History Milestone 3 (1) Questions & Answers. LATEST 2022-2023

$ 15

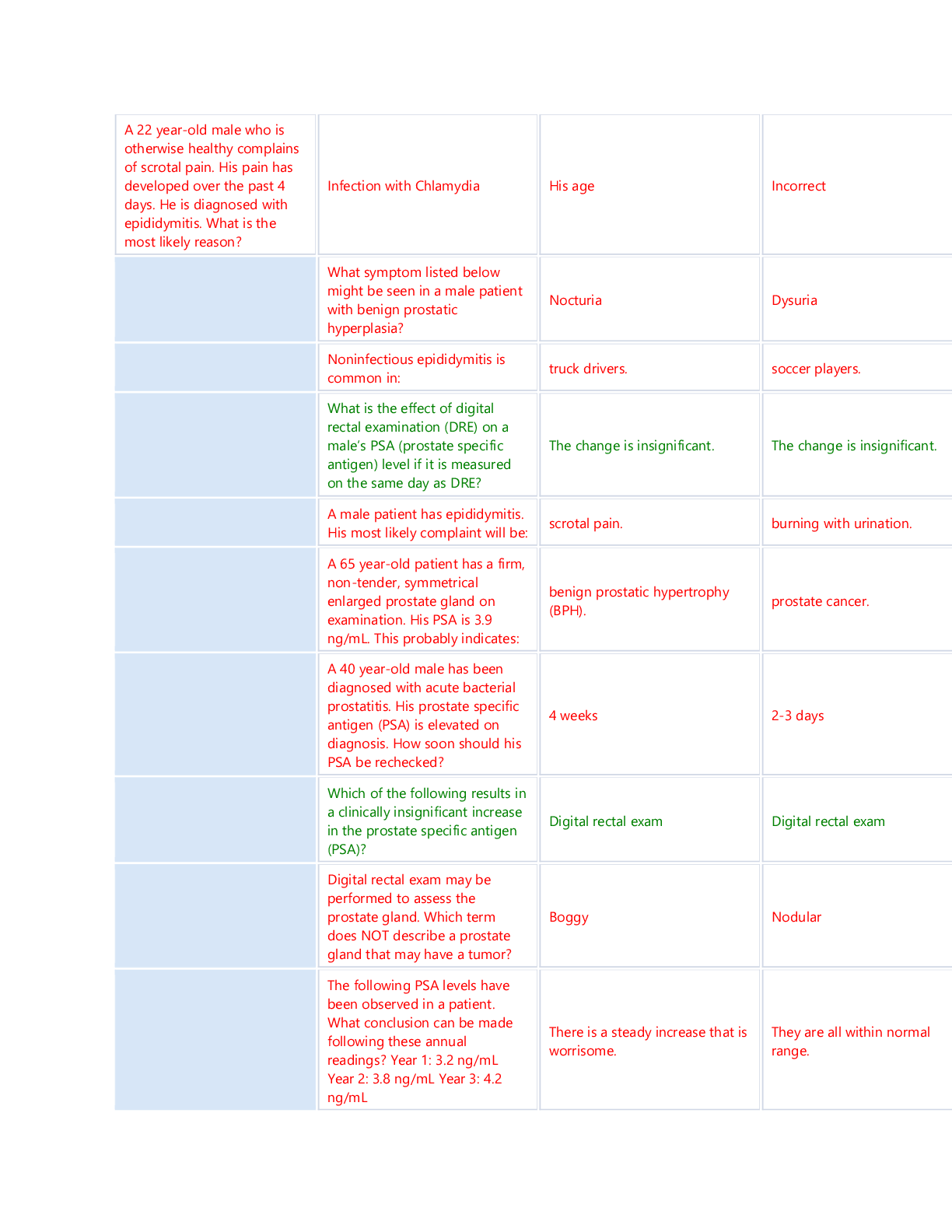

NSG 6545 mens answers

$ 7

AA RN Comprehensive Predictor | 180 Q&A - 100% Correct

$ 11

NR511-Final Exam Study Guide-Entire week 1-5 Q $ A.

$ 7.5

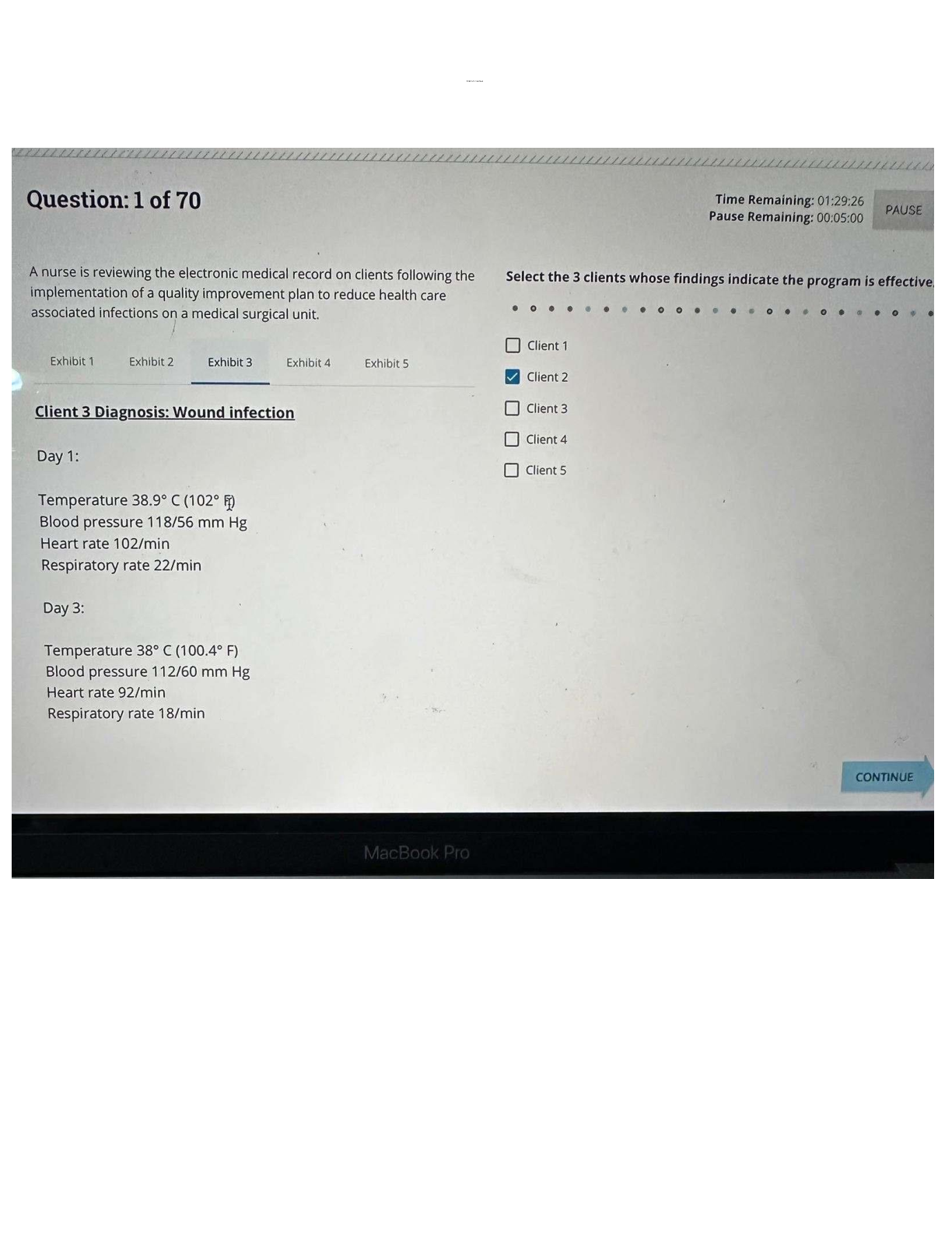

ATI RN Leadership 2023

$ 18

Clinical Chem Practice Questions COMPLETE SOLUTIONS

$ 8

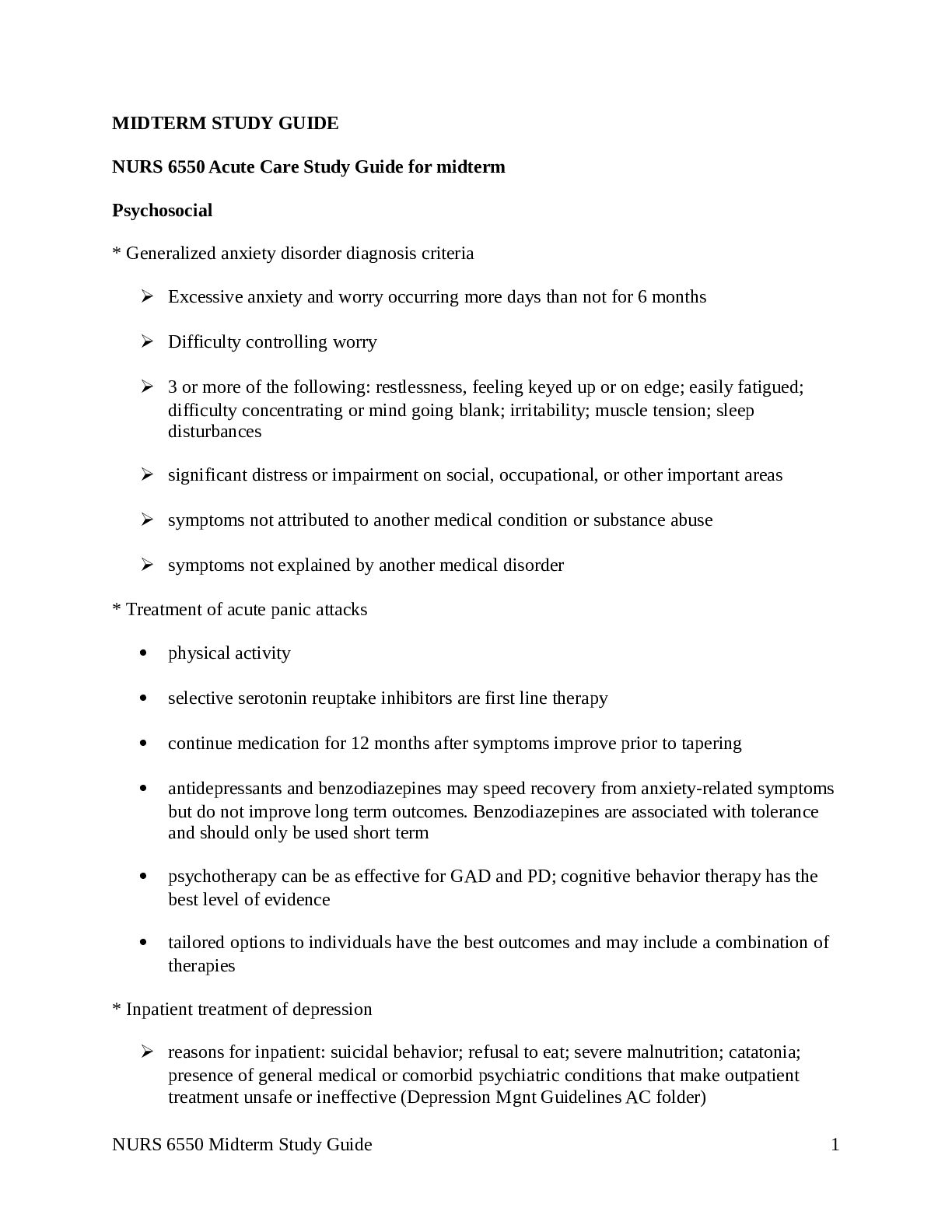

MIDTERM STUDY GUIDE NURS 6550 Acute Care Study Guide for midterm (A GUARANTEED)

$ 10

CLU EXAM REVIEW INCLUSIVE OF 200 QUESTIONS AND CORRECT ANSWERS COMPLETE GUIDE

$ 13.5

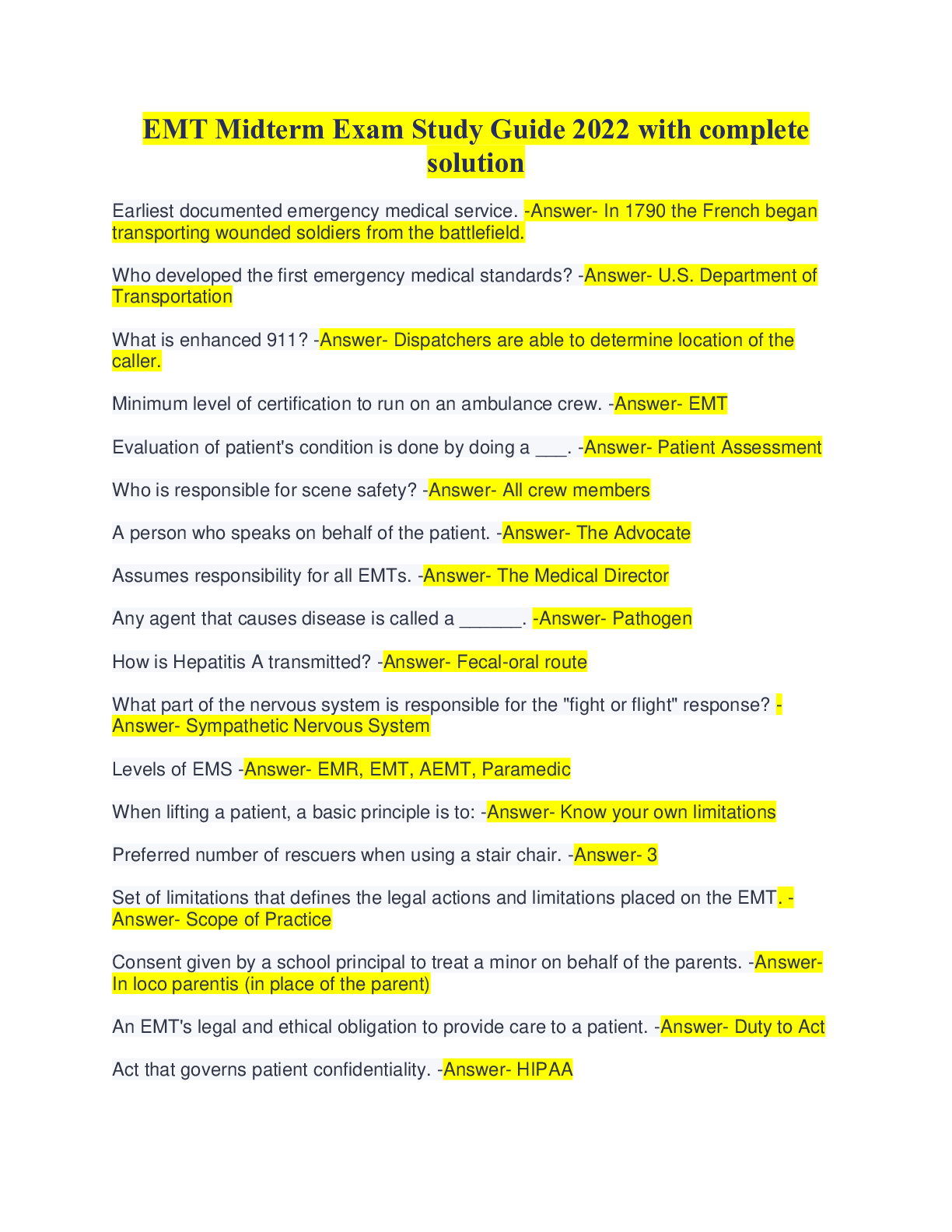

EMT Midterm Exam Study Guide 2022 with complete solution

$ 9

ATI Predictor Comprehensive Assessment 2022 A

$ 8

NSG 5002 Week 4 Knowledge Check with Answers | VERIFIED SOLUTION

$ 10

NR 565 - Week 7 & 8 Final Exam Study Outline

$ 9

NR-708 Week 8 Discussion: Professional Organizations

$ 9

TEST BANK FOR INTRODUCTORY TO MENTAL HEALTH NURSING 4TH EDITION WOMBLE KINCHELOE

$ 23

Rasmussen College - HIM 2410 MODULE 5 QUIZ...

$ 7

BSC CHEM102_AQA A Level Chemistry_paper_2_Mark Scheme

$ 4.5

WOMS 240 FINAL EXAM

$ 10

NURS 6551 – Week 6 Quiz

$ 9.5

Aetna Individual MA/MAPD/DSNP Quiz with Certified Solutions

$ 7.5

CHEM101 Topic 9: Properties of Gases[GRADED A+]

$ 9

eBook Reframing Organizations Artistry, Choice, and Leadership 7th Edition By Lee G. Bolman , Terrence E. Deal

$ 30

NURS 6640 FINAL EXAM 7 – QUESTION AND ANSWERS

$ 20

ATI RN Pharmacology Proctored 2019

$ 18.5

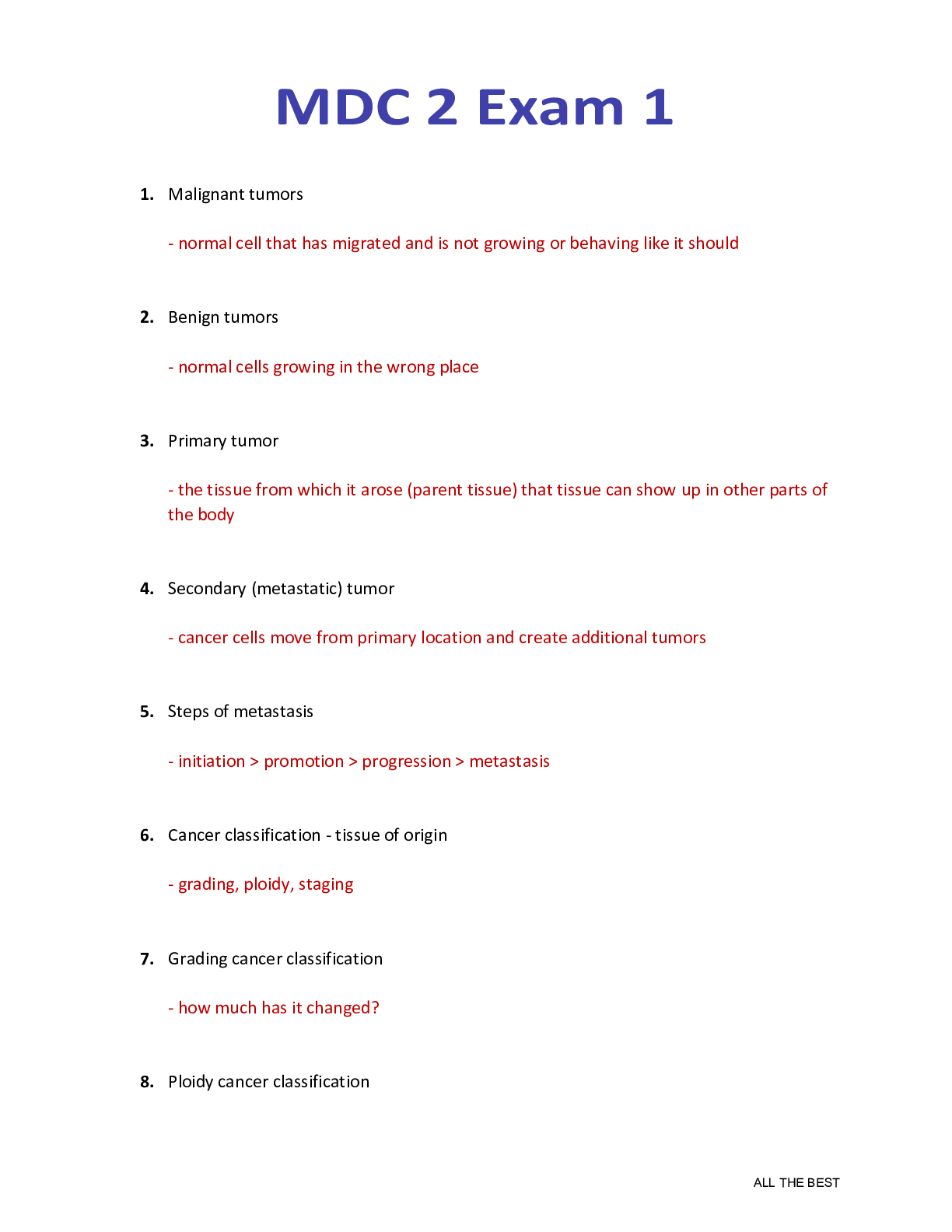

NURS_2392_MDC_2_EXAM_1_VERSION_4_CORRECTLY ANSWERED

$ 11

EC 3300 (Principles of Microeconomics) Midterm Exam Q & S 2024

$ 14

[eBook] [PDF] Succeeding With Adult ADHD 2nd Edition By Abigail L. Levrini

$ 25

Horizon CharterBIO 1Strategic Leadership_HU_MBA_706_SL (1)

$ 7

Mission College - BUSINESS 125Chapter 3.

$ 10

.png)

American Military University GEOG 100 QUIZ 1 Week 1

$ 7

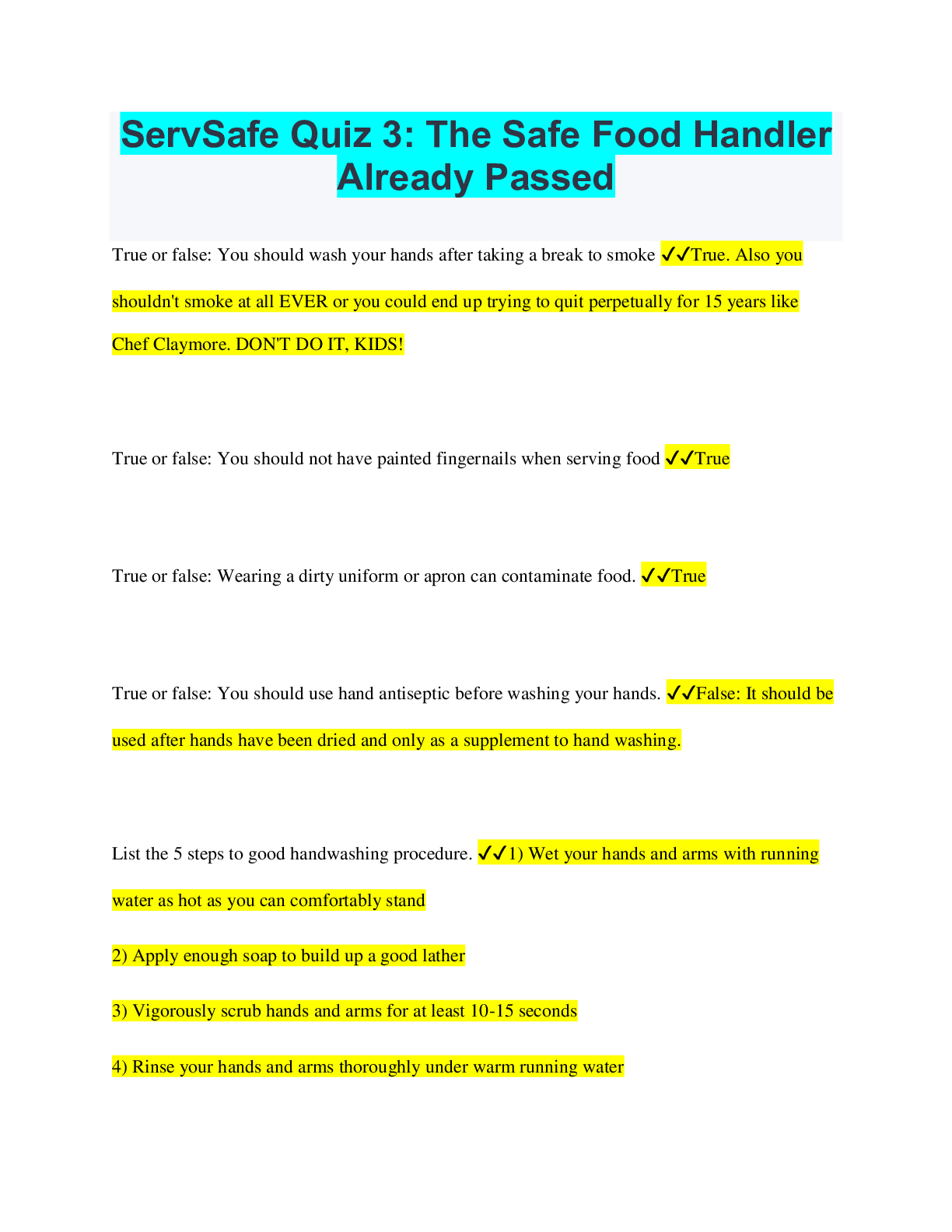

ServSafe Quiz 3: The Safe Food Handler Already Passed