Technical Interview Guide

Preparation for Finance Interviews

Second Edition

Copyright 2009 by WallStreetOasis.com. All rights reserved.

All information in this guide is subject to change without notice. WallStreetOas

...

Technical Interview Guide

Preparation for Finance Interviews

Second Edition

Copyright 2009 by WallStreetOasis.com. All rights reserved.

All information in this guide is subject to change without notice. WallStreetOasis.com makes no

claims as to the accuracy and reliability of this guide and the information contained within. No part of

this guide may be reproduced or transmitted in any form or by any means, electronic or mechanical,

for any purpose, without the express written permission of WallStreetOasis.com

Buyer: Gena Jiang (

[email protected])

Transaction ID: 83G76986JA281445GPage 2

Contents

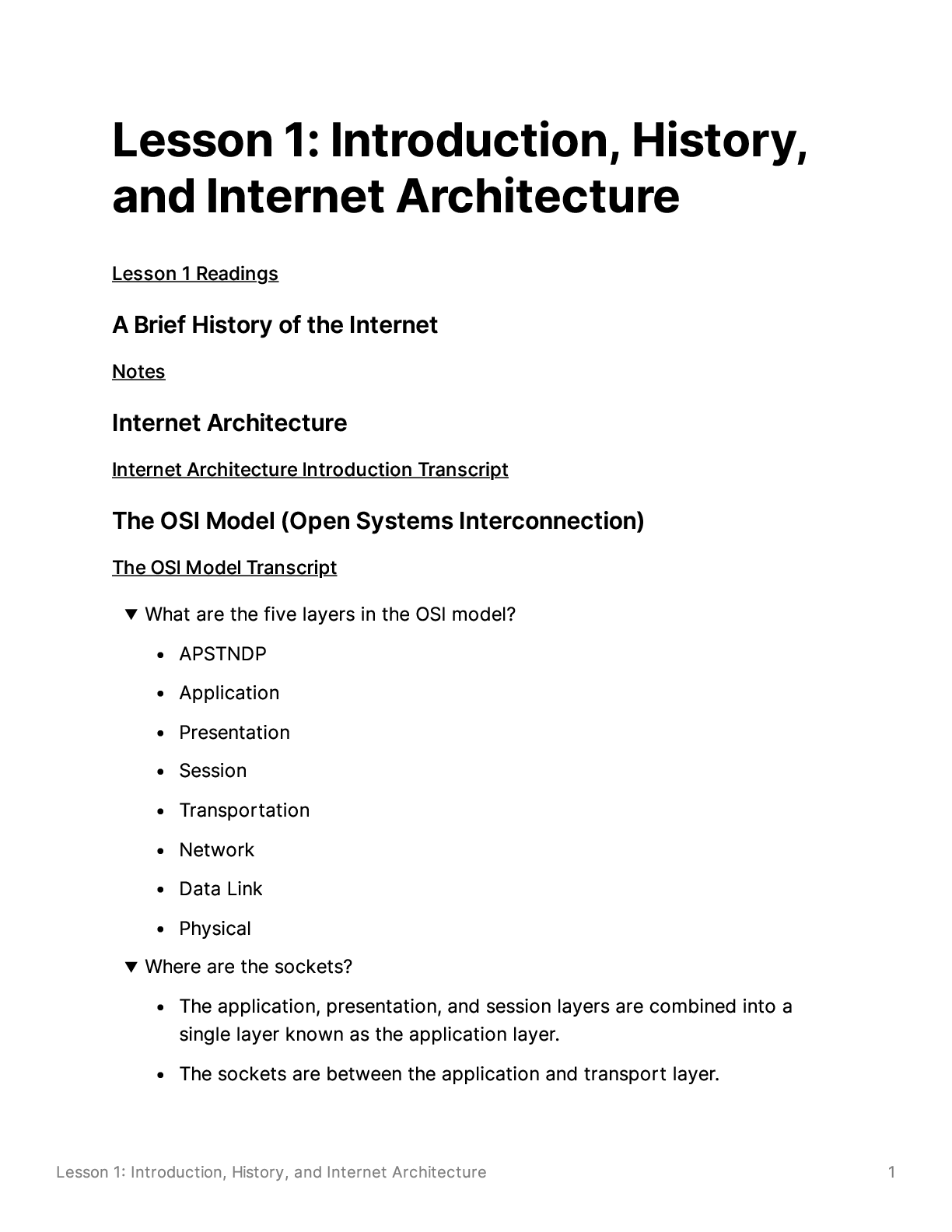

Technical Questions: Introduction ..................................................................................................................................................... 3

General Topics of Study ..................................................................................................................................................................... 5

Keeping Current is Key! ................................................................................................................................................................. 5

Financial Report Basics .................................................................................................................................................................. 6

Current Event Related ........................................................................................................................................................................ 7

Accounting, Finance and Valuation .................................................................................................................................................. 10

Basic ............................................................................................................................................................................................ 10

Intermediate ................................................................................................................................................................................. 23

Advanced ..................................................................................................................................................................................... 30

Stocks .............................................................................................................................................................................................. 31

Basic ............................................................................................................................................................................................ 31

Intermediate ................................................................................................................................................................................. 34

Advanced......................................................................................................................................................................................... 39

Bonds and Interest Rates .................................................................................................................................................................. 40

Basic ............................................................................................................................................................................................ 40

Intermediate ................................................................................................................................................................................. 46

Advanced......................................................................................................................................................................................... 51

Currencies........................................................................................................................................................................................ 53

Basic ............................................................................................................................................................................................ 53

Intermediate ................................................................................................................................................................................. 54

Advanced ..................................................................................................................................................................................... 55

Options and Derivatives ................................................................................................................................................................... 56

Basic ............................................................................................................................................................................................ 56

Intermediate ................................................................................................................................................................................. 59

Advanced ..................................................................................................................................................................................... 61

Mergers and Acquisitions ................................................................................................................................................................. 63

Basic ............................................................................................................................................................................................ 63

Intermediate ................................................................................................................................................................................. 65

Advanced ..................................................................................................................................................................................... 67

Other ............................................................................................................................................................................................... 73

Brainteasers ..................................................................................................................................................................................... 75

Income Statement Basics .................................................................................................................................................................. 78

Balance Sheet Basics........................................................................................................................................................................ 79

Cash Flow Basics ............................................................................................................................................................................. 80

Link Between Financial Statements .................................................................................................................................................. 81

Buyer: Gena Jiang (

[email protected])

Transaction ID: 83G76986JA281445GPage 3

Technical Questions: Introduction

Technical questions are part of almost every finance interview. While the level of difficulty of these

questions vary from firm to firm, and will change based on a candidates background, all interviewees will

undoubtedly be quizzed on technical questions in at least one round. This guide is a fairly exhaustive

compilation of the most common technical questions in finance interviews. Obviously, you will not encounter

every question, however, the interview may also contain variations or new questions altogether. The more

detailed and accurate responses you give, the more likely you will impress your interviewer.

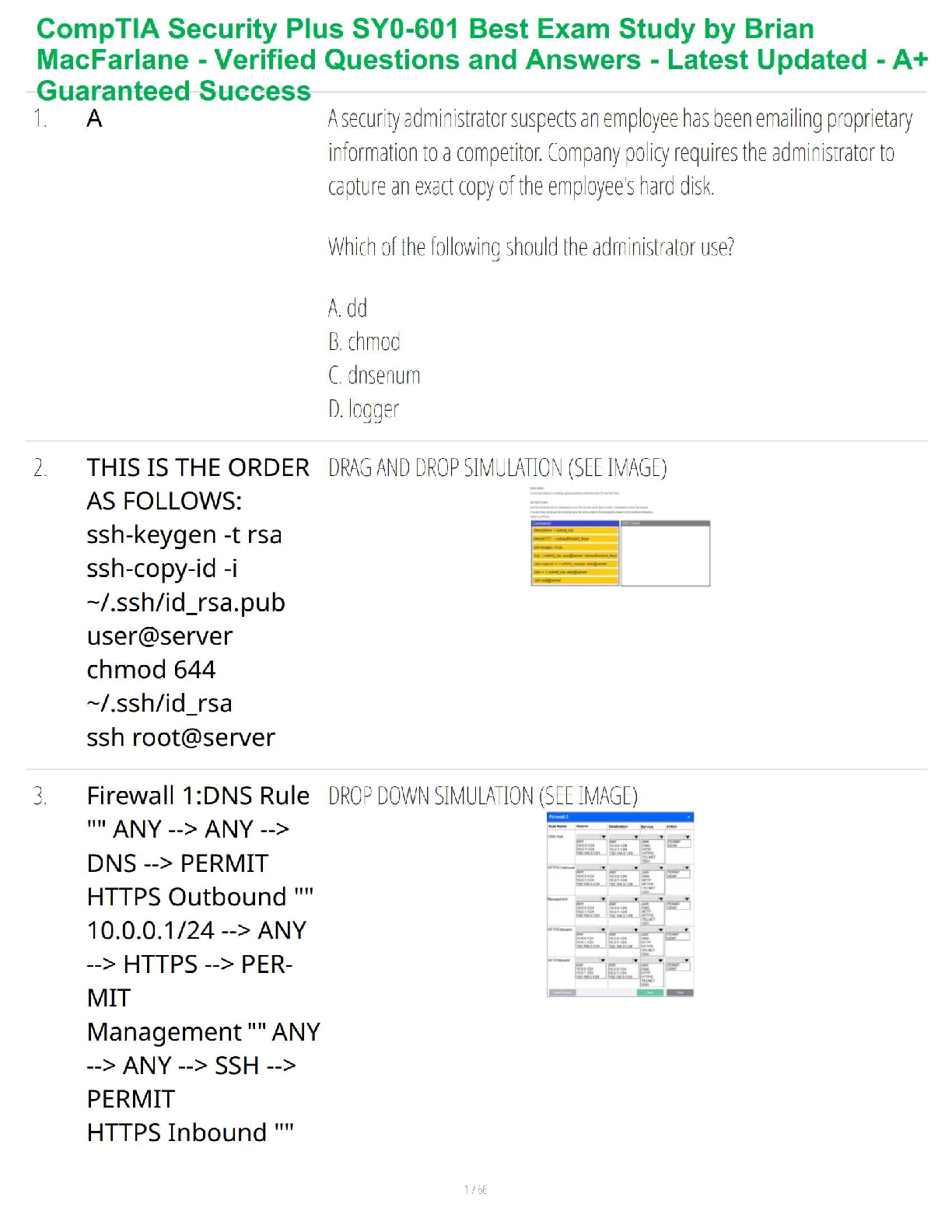

The questions in this guide are broken down into the following categories: Current Events, Accounting /

Finance / Valuation, Stocks, Bonds / Interest Rates, Currencies, Options / Derivatives, and Mergers &

Acquisitions. These categories are then divided into basic, intermediate and advanced concepts. The questions

you are most likely to be asked are in bold. Obviously, you should focus your studies on the relevant industry

you are trying to enter. If you are preparing for a Sales and Trading interview, you should focus on stocks,

bonds/interest rates, currencies, and options/derivatives. For Investment Banking positions you should have a

general background in all of those categories, but you are more likely to encounter questions from the

Accounting/Finance/Valuation and the Mergers and Acquisitions section.

The final category is the brainteasers section. Getting brainteasers can definitely rattle you in an

interview. In some cases, an interviewer will give a brain teaser to see how you react under pressure. What is

more important than actually getting the answer to the teaser correct is the way you think through the problems

-- they want to observe your analytical ability. See the examples for more information.

You will soon find out that interviews are a game. Your interviewer will likely push you to see how far

you can go until you don’t know an answer -- and that’s a good thing. You can have a 4.0 with a double major

in finance and econ from Wharton, but you still know little compared to the person on the other side of the

table. Remember when studying these questions, you cannot prepare for everything that interviewers may ask.

They will always be coming up with new questions and new twists on older concepts so it is important that you

try and understand the concepts behind the answers, rather than just memorizing them. If you come to a

question you do not understand, try to do some research and develop a deeper understanding. The explanations

in this guide are intentionally kept brief.

Your answers to most of these questions should not take more than 30 seconds to a minute. Answer the

question and move on. Do not try and guess your way through technical questions. If you do not know the

answer, do not waste your interviewer’s time and just say that you don’t know -- but also do not apologize. Ask

them if they can explain it to you. Be confident in what you know and don’t know. What is most important is

that you prove you have the ability to learn on the job. If you get into questions from the advanced section of

this guide, chances are that your interviewer is trying to push you to see how you respond to pressure. The key

is to remain calm, cool and collected.

Finally, in most cases you cannot eliminate yourself from contention by failing to answer a technical

question. However, you can definitely hurt your chances by answering a fit or behavioral question in an

Buyer: Gena Jiang (

[email protected])

Transaction ID: 83G76986JA281445GPage 4

undesirable manner. Most of the time truly connecting with your interviewer on a personal level and showing

you have the drive, passion and ability to learn in this crazy business can outweigh a misstep on a technical

question (just don't stumble too much!)

Note: The first few bullets of each question include any pertinent definitions and information

about the question. The bullet in italics is a sample response and common follow-up questions are also

included in subsequent bullets.

.png)

.png)