gives answers to following questions;

Question 1

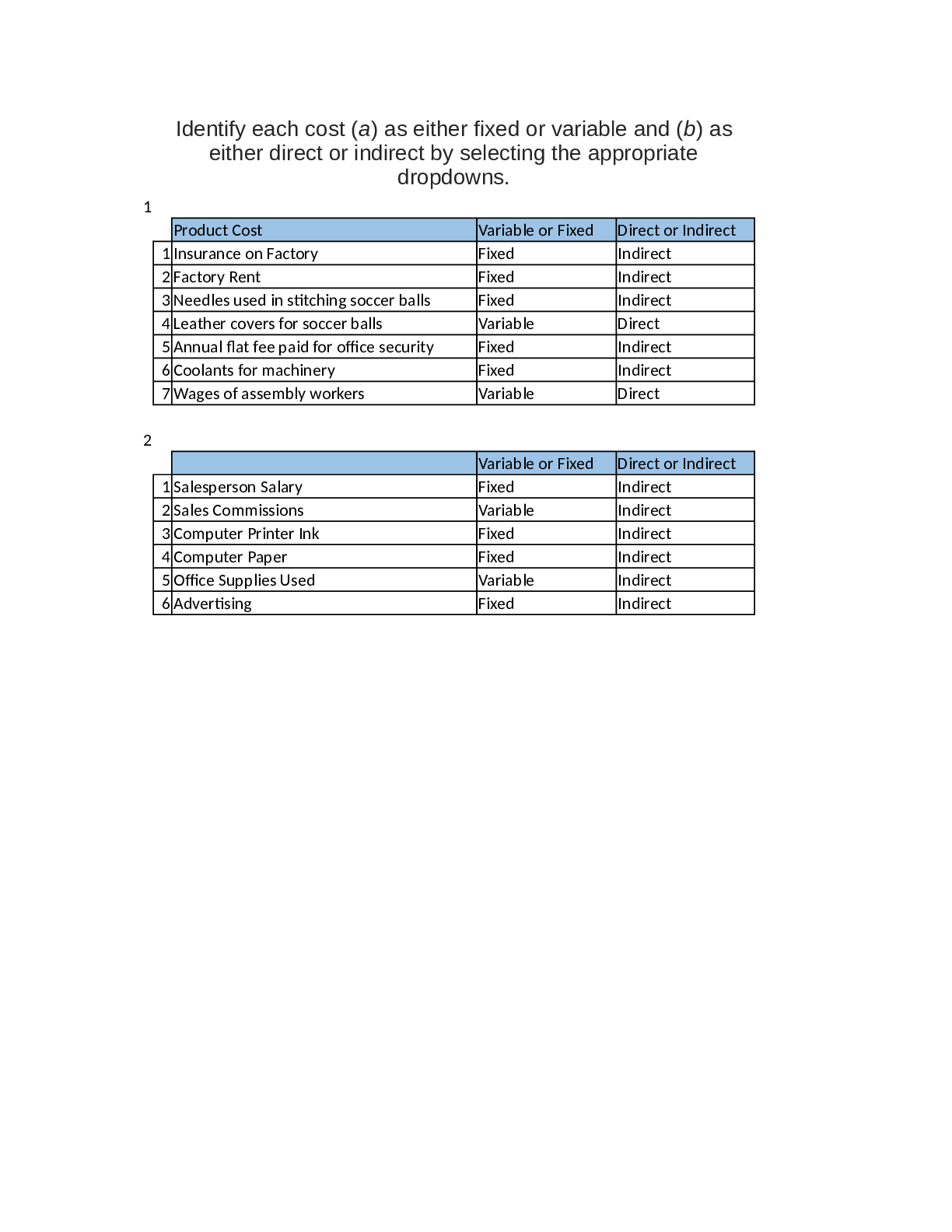

Listed here are product costs for the production of soccer balls.

Identify each cost (a) as either fixed or variable and (b) as either direct or indirect by selecti

...

gives answers to following questions;

Question 1

Listed here are product costs for the production of soccer balls.

Identify each cost (a) as either fixed or variable and (b) as either direct or indirect by selecting the appropriate dropdowns.

Question 2

TechPro offers instructional courses in e-commerce website design. The company holds classes in a building that it owns.

Identify each of TechPro’s costs below as (a) variable or fixed and (b) direct or indirect by selecting the appropriate dropdowns. Assume the cost object is an individual class.

Question 3

Current assets for two different companies at fiscal year-end are listed here. One is a manufacturer, Rayzer Skis Mfg., and the other, Sunrise Foods, is a grocery distribution company.

1. Identify which set of numbers relates to the manufacturer and which to the merchandiser.

2a. & 2b. Prepare the current asset section for each company from this information.

Which of these company is manufacturer

Which of these company is a merchandiser

Question 4

The following data is provided for Garcon Company and Pepper Company.

1. Complete the table to find the cost of goods manufactured for both Garcon Company and Pepper Company for the year ended December 31, 2019.

2. Complete the table to calculate the cost of goods sold for both Garcon Company and Pepper Company for the year ended December 31, 2019.

Question 5

1. Prepare income statements for both Garcon Company and Pepper Company.

2. Prepare the current assets section of the balance sheet for each company.

Question 6

1. Compute the total prime costs for both Garcon Company and Pepper Company.

2. Compute the total conversion costs for both Garcon Company and Pepper Company.

Question 7

Compute cost of goods sold for each of these two companies for the year.

Question 8

The following selected account balances are provided for Delray Mfg.

Prepare its schedule of cost of goods manufactured for the current year ended December 31.

Question 9

Prepare an income statement for Delray Mfg. (a manufacturer).

Question 10

Beck Manufacturing reports the following information in T-account form for 2019.

1. Prepare the schedule of cost of goods manufactured for the year.

2. Compute cost of goods sold for the year.

Question 11

The following calendar year-end information is taken from the December 31, 2019, adjusted trial balance and other records of Leone Company.

1. Prepare the company’s 2019 schedule of cost of goods manufactured.

Question 12

2. Prepare the company’s 2019 income statement that reports separate categories for (a) selling expenses and (b) general and administrative expenses.

Question 13

Shown here are annual financial data taken from two different companies.

1. Prepare the cost of goods sold section of the income statement for the year for each company in Merchandising Business and Manufacturing Business.

[Show More]