Financial Accounting > TEST BANKS > LATEST VERIFIED CORRECT ANSWER FOR[Test Bank] South-Western Federal Taxation CHAPTER 12: Essentials (All)

LATEST VERIFIED CORRECT ANSWER FOR[Test Bank] South-Western Federal Taxation CHAPTER 12: Essentials of Taxation

Document Content and Description Below

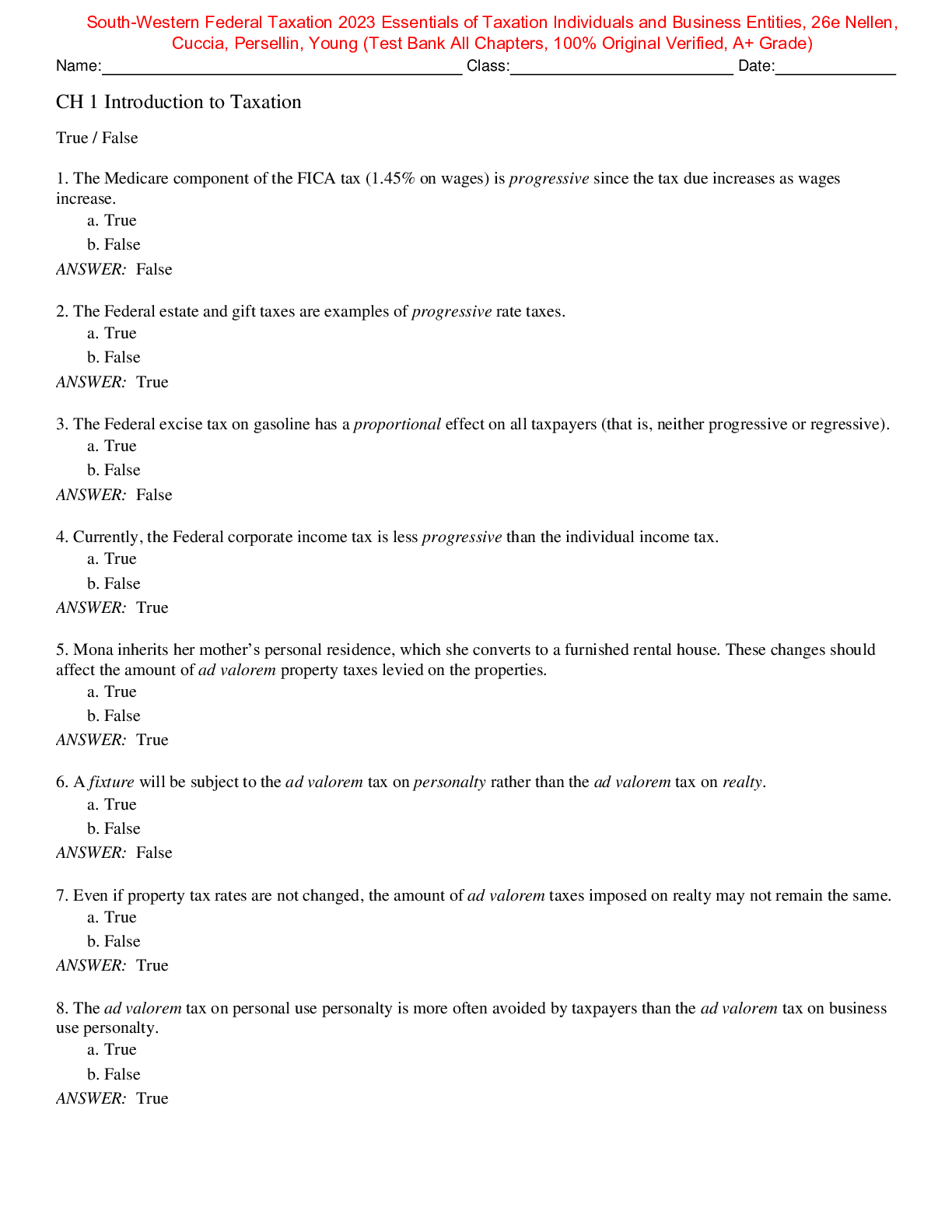

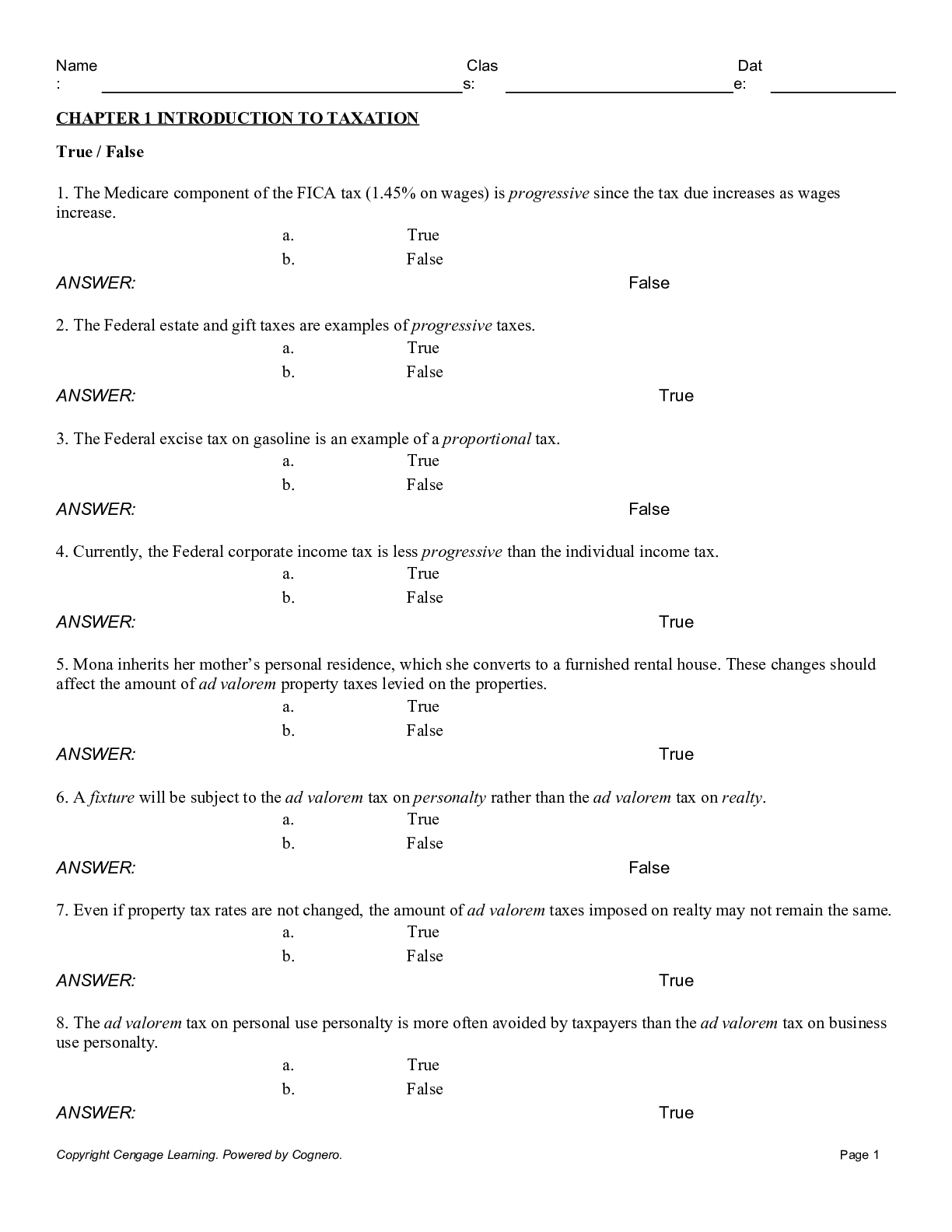

CHAPTER 12: S CORPORATIONS 1. S corporations are treated as partnerships under state property laws. a. True b. False ANSWER: False 2. Liabilities affect the owner’s basis differently in an S co... rporation than they do in a partnership. a. True b. False ANSWER: True 3. An S corporation cannot incur a tax liability at the corporation level. a. True b. False ANSWER: False RATIONALE: There are two potential penalty taxes. 4. Distributions of appreciated property by an S corporation are not taxable to the entity. a. True b. False ANSWER: False 5. Where the S corporation rules are silent, C corporation provisions apply. a. True b. False ANSWER: True 6. A newly formed S corporation does not receive any tax benefit from an NOL incurred in its first tax year. a. True b. False ANSWER: False 7. S corporation status allows shareholders to realize tax benefits from corporate losses immediately (assuming sufficient stock basis). a. True b. False ANSWER: True Chapter 12: S Corporations 8. NOL carryovers from C years can be used in an S corporation year against ordinary income. a. True b. False ANSWER: False 9. Tax-exempt income at the S corporation level flows through as taxable to the shareholder. a. True b. False ANSWER: False 10. An estate may be a shareholder of an S corporation. a. True b. False ANSWER: True 11. Most limited liability partnerships can own stock in an S corporation. a. True b. False ANSWER: False 12. Most IRAs cannot own stock in an S corporation. a. True b. False ANSWER: True 13. An S corporation cannot be a shareholder in another corporation. a. True b. False ANSWER: False [Show More]

Last updated: 2 years ago

Preview 1 out of 40 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$13.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jun 13, 2021

Number of pages

40

Written in

Additional information

This document has been written for:

Uploaded

Jun 13, 2021

Downloads

0

Views

96