Question 1

2019 2018 2017 2016 2015

Sales 675105 438380 363801 246645 182700

Cost of goods sold 346904 225324 188589 126889 93177

Accounts receivable 32743 25514 24920 14429 12497

Compute trend percents for the abov

...

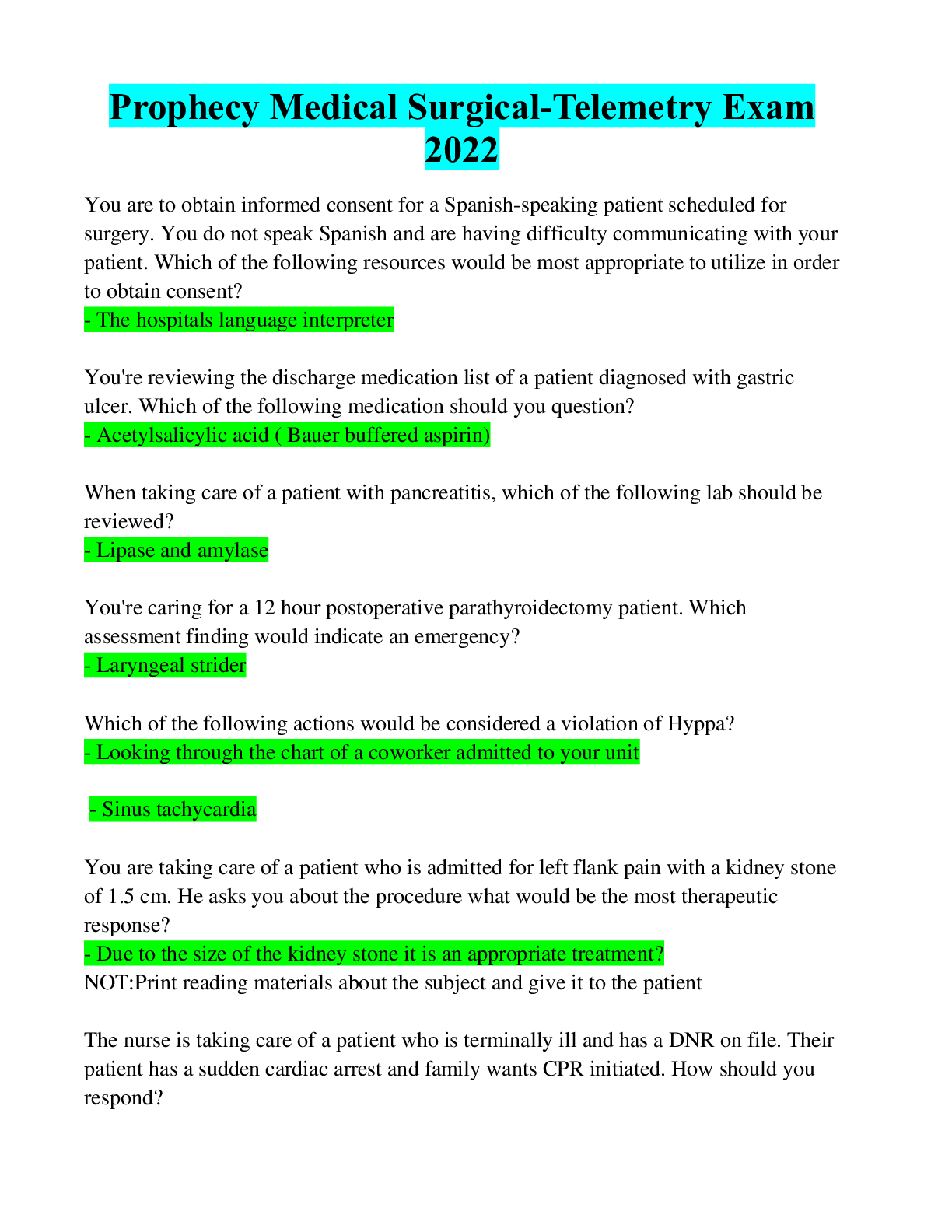

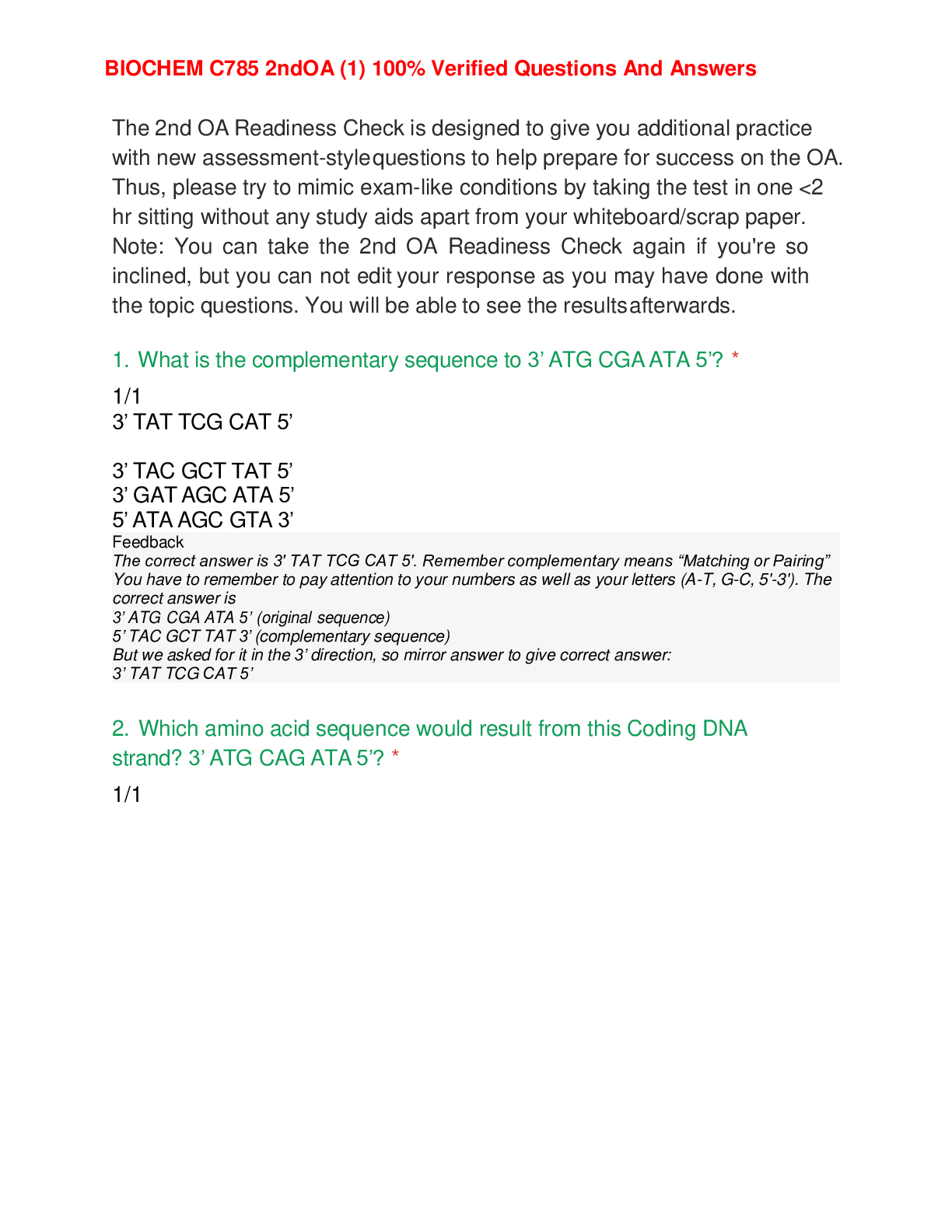

Question 1

2019 2018 2017 2016 2015

Sales 675105 438380 363801 246645 182700

Cost of goods sold 346904 225324 188589 126889 93177

Accounts receivable 32743 25514 24920 14429 12497

Compute trend percents for the above accounts, using 2015 as the base year.

Choose Numerator: Choose Denominator:

Analysis period net sales Base year net sales Sales

2019 675105 182700 370%

2018 438380 182700 240%

2017 363801 182700 199%

2016 246645 182700 135%

Choose Numerator: Choose Denominator:

Analysis period cost of goods soldBase year cost of goods sold Cost of goods sold

2019 346904 93177 372%

2018 225324 93177 242%

2017 188589 93177 202%

2016 126889 93177 136%

Choose Numerator: Choose Denominator:

Analysis period accounts receivable Base year accounts receivableAccounts receivable

2019 32743 12497 262%

2018 25514 12497 204%

2017 24920 12497 199%

2016 14429 12497 115%

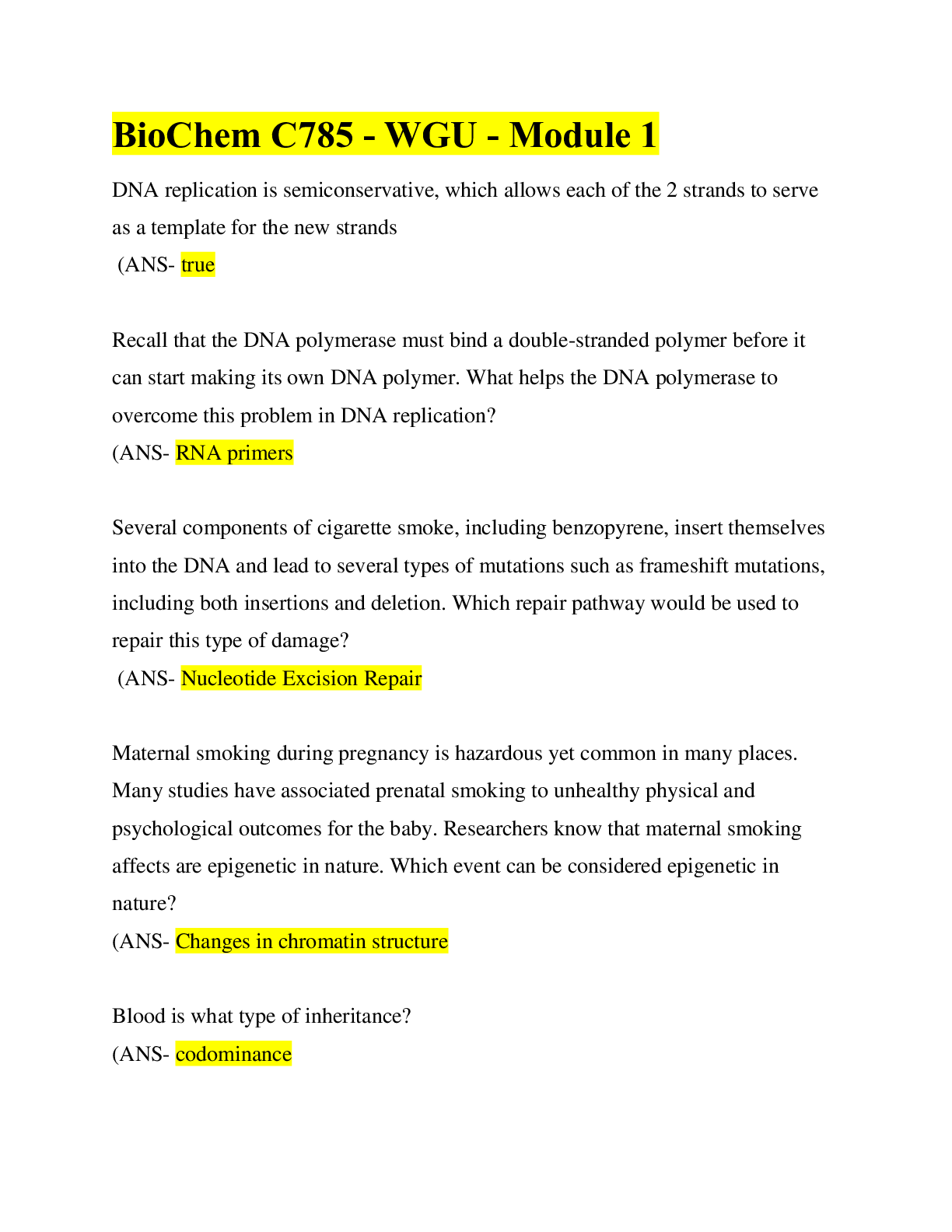

Question 2

Express the following comparative income statements in common-size percents.

$ % $ %

Sales 790000 100% 640000 100%

Cost of goods sold 570800 72.3% 280000 43.8%

Gross profit 219200 27.7% 360000 56.3%

Operating expenses 128000 16.2% 270800 42.3%

Net income 91200 11.5% 89200 13.9%

Using the common-size percentages, which item is most responsible for the decline in net income?

Cost of goods sold

Current Year Prior Year

For Years Ended December 31

Trend Percent for Net Sales:

Trend Percent for Cost of Goods Sold:

Trend Percent for Accounts Receivables:

GOMEZ CORPORATION

Comparative Income Statements

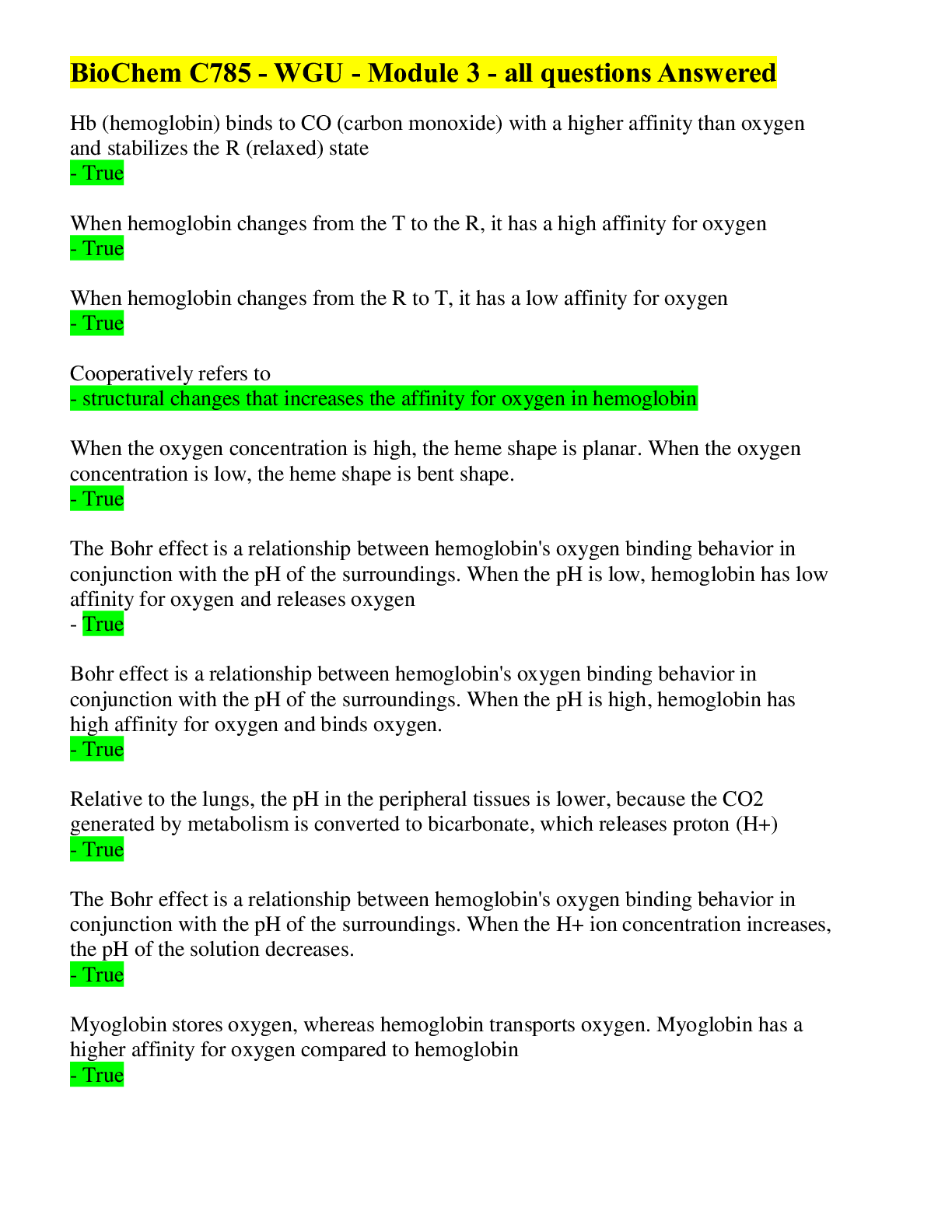

Question 3

Common-size and trend percents for Rustynail Company's sales, cost of goods sold, and expenses follow.

Current Yr 1 Yr Ago 2 Yrs Ago Current Yr 1 Yr Ago 2 Yrs Ago

Sales 100 100 100 104.2 103 100

Cost of goods sold 63.6 61.4 57.8 114.7 109.4 100

Operating expenses 14.3 13.8 14.1 105.7 100.8 100

Determine the net income for the following years.

Current Yr 1 Yr Ago 2 Yrs Ago

Sales 104200 103000 100000

Cost of goods sold 66297 63233 57800

Operating expenses 14904 14213 14100

Net income 23000 25554 28100

Did the net income increase, decrease, or remain unchanged in this three-year period?

Net income decreased

Question 4

Simon Company's year-end balance sheets follow.

At December 31 Current Yr 1 Yr Ago 2 Yrs Ago

Assets

Cash $ 31,097 $ 35,996 $ 35,323

Accounts receivable, net 90,128 60,523 47,573

Merchandise inventory 111,118 83,241 51,177

Prepaid expenses 9,528 9,356 3,925

Plant assets, net 269,840 252,014 222,402

Total assets $ 511,711 $ 441,130 $ 360,400

Liabilities and Equity

Accounts payable $ 127,416 $ 74,551 $ 47,097

Long-term notes payable secured by

mortgages on plant assets 93,316 102,474 81,241

Common stock, $10 par value 163,500 163,500 163,500

Retained earnings 127,479 100,605 68,562

Total liabilities and equity $ 511,711 $ 441,130 $ 360,400

1. Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.)

Current Year 1 Year Ago 2 Years Ago

Assets

Cash 6.1% 8.2% 9.8%

Accounts receivable, net 17.6% 13.7% 13.2%

Merchandise inventory 21.7% 18.9% 14.2%

Prepaid expenses 1.9% 2.1% 1.1%

Plant assets, net 52.7% 57.1% 61.7%

Total assets 100.0% 100.0% 100.0%

Common-Size Comparative Balance Sheets

Common-Size Percents Trend Percents

SIMON COMPANY

December 31

Liabilities and Equity

Accounts payable 24.9% 16.9% 13.1%

Long-term notes payable secured by mortgages on plant assets 18.2% 23.2% 22.5%

Common stock, $10 par 32.0% 37.1% 45.4%

Retained earnings 24.9% 22.8% 19.0%

Total liabilities and equity 100.0% 100.0% 100.0%

2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable?

Change in accounts receivable unfavorable development

3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable?

Change in merchandise inventory unfavorable development

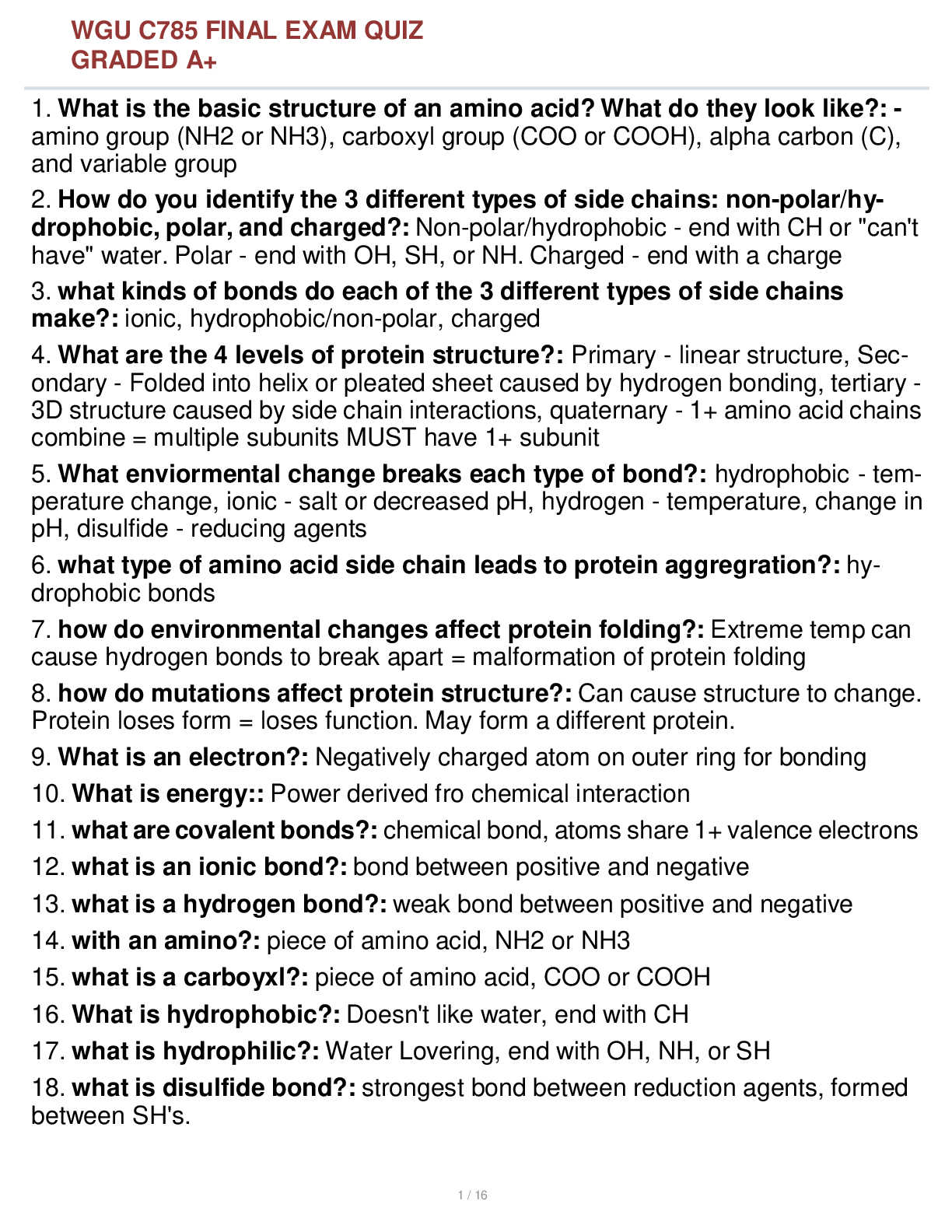

Question 5

Simon Company’s year-end balance sheets follow.

At December 31 Current Yr 1 Yr Ago 2 Yrs Ago

Assets

Cash $ 31,164 $ 36,428 $ 38,333

Accounts receivable, net 89,600 62,600 50,900

Merchandise inventory 110,000 84,000 59,000

Prepaid expenses 10,036 9,562 4,259

Plant assets, net 298,180 272,048 242,608

Total assets $ 538,980 $ 464,638 $ 395,100

Liabilities and Equity

Accounts payable $ 131,522 $ 76,953 $ 51,110

Long-term notes payable secured by mortgages on plant assets 99,302 104,729 85,571

Common stock, $10 par value 162,500 162,500 162,500

Retained earnings 145,656 120,456 95,919

Total liabilities and equity $ 538,980 $ 464,638 $ 395,100

The company’s income statements for the Current Year and 1 Year Ago, follow. Assume that all sales are on credit:

For Year Ended December 31

Sales $ 700,674 $ 552,919

Cost of goods sold $ 427,411 $ 359,397

Other operating expenses 217,209 139,889

Interest expense 11,911 12,717

Income taxes 9,109 8,294

Total costs and expenses 665,640 520,297

Net income $ 35,034 $ 32,622

Earnings per share $ 2.16 $ 2.01

(1-a) Compute days' sales uncollected.

[Show More]

.png)

.png)

.png)