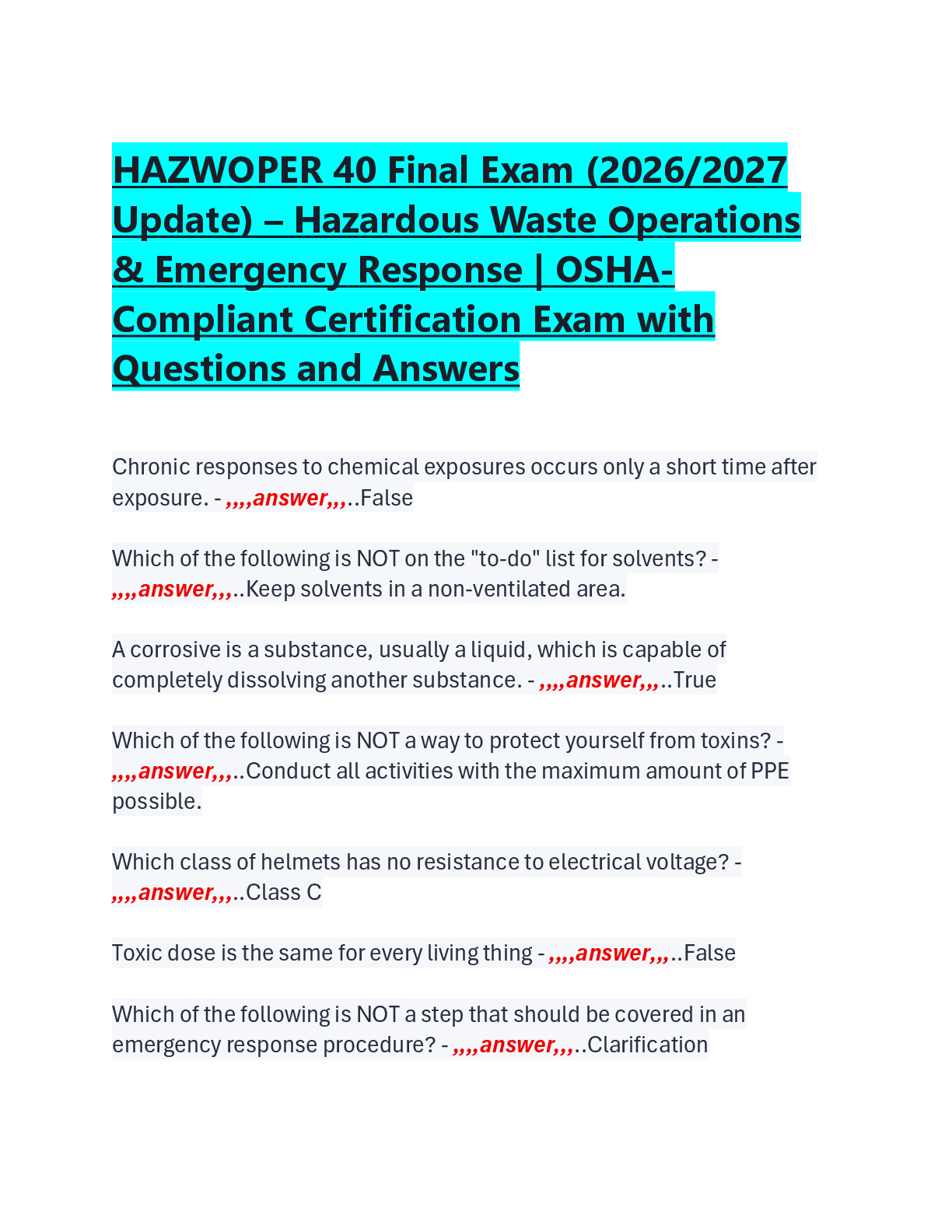

Financial Accounting > EXAMs > 2021-ACC 350 - Managerial Accounting -Practice Quiz 6 (All)

2021-ACC 350 - Managerial Accounting -Practice Quiz 6

Document Content and Description Below

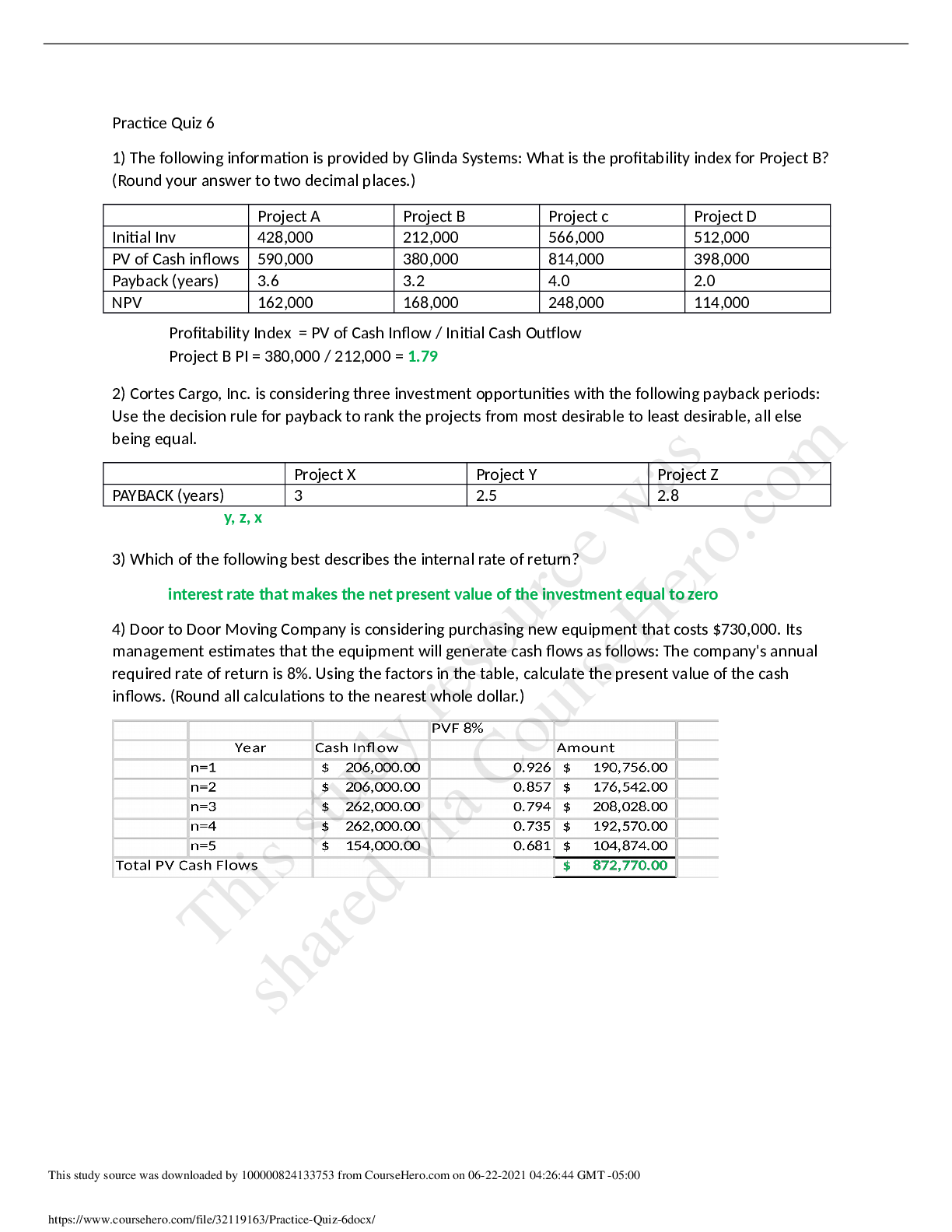

The following information is provided by Glinda Systems: What is the profitability index for Project B? (Round your answer to two decimal places.) 2) Cortes Cargo, Inc. is considering three investment ... opportunities with the following payback periods: Use the decision rule for payback to rank the projects from most desirable to least desirable, all else being equal) Which of the following best describes the internal rate of returnDoor to Door Moving Company is considering purchasing new equipment that costs $730,000. Its management estimates that the equipment will generate cash flows as follows: The company's annual required rate of return is 8%. Using the factors in the table, calculate the present value of the cash inflows. (Round all calculations to the nearest whole dollar.)) Newman Automobiles Manufacturing is considering two alternative investment proposals with the following data: Calculate the payback period for Proposal X) Lobel Machines Company is evaluating an investment of $1,550,000 which will yield net cash inflows of $220,672 per year for 10 years with no residual value. What is the internal rate of return? Present value of ordinary annuity of $1: “Table) The following information is provided by Glinda Systems: What is the profitability index for Project B? (Round your answer to two decimal places.) 2) Cortes Cargo, Inc. is considering three investment opportunities with the following payback periods: Use the decision rule for payback to rank the projects from most desirable to least desirable, all else being equal) Which of the following best describes the internal rate of returnDoor to Door Moving Company is considering purchasing new equipment that costs $730,000. Its management estimates that the equipment will generate cash flows as follows: The company's annual required rate of return is 8%. Using the factors in the table, calculate the present value of the cash inflows. (Round all calculations to the nearest whole dollar.)) Newman Automobiles Manufacturing is considering two alternative investment proposals with the following data: Calculate the payback period for Proposal X) Lobel Machines Company is evaluating an investment of $1,550,000 which will yield net cash inflows of $220,672 per year for 10 years with no residual value. What is the internal rate of return? Present value of ordinary annuity of $1 [Show More]

Last updated: 3 years ago

Preview 1 out of 4 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jun 23, 2021

Number of pages

4

Written in

All

Additional information

This document has been written for:

Uploaded

Jun 23, 2021

Downloads

0

Views

120