[FAP Final Assessment]

Instructions: You must enter your answers to each assessment question in the sections noted

below, and must not change any information contained within the first set of black brackets [] for

eac

...

[FAP Final Assessment]

Instructions: You must enter your answers to each assessment question in the sections noted

below, and must not change any information contained within the first set of black brackets [] for

each Task.

[ Task 1 ]

ksat

Memorandum

To: Project Lead

From; FAP Candidate

Re: Risk Management Policies Supporting the CDEF

This memorandum is intended to provide the CDEF management team with a list of risks that the

fund faces along with recommended risk mitigation strategies for the most important of those risks.

The following risk categorization and definition tool (RCD) identifies multiple risk relevant to the

management of the education fund in the four major categories of risks: Financial, Strategic, Insurance,

and Operational.

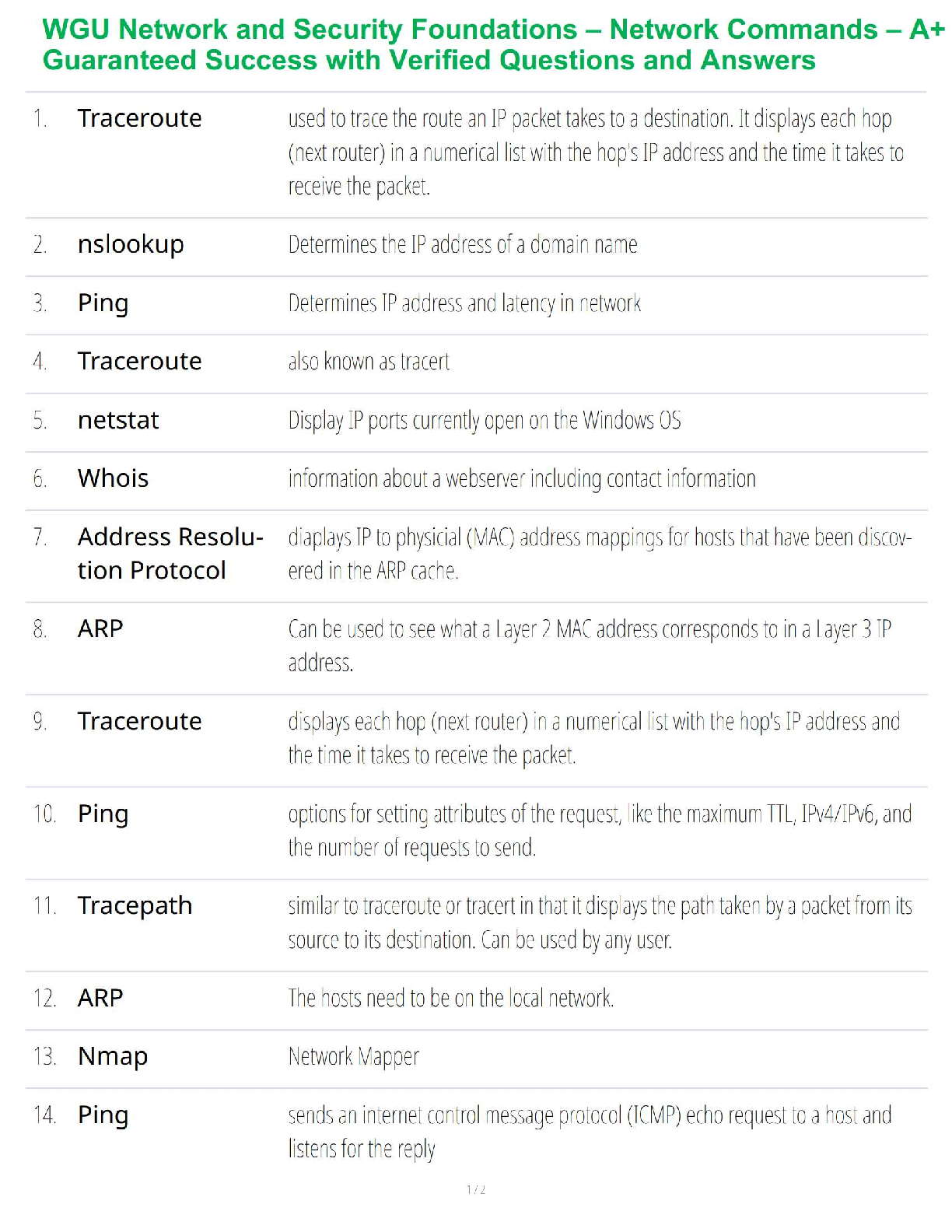

Risk Category Risk Definition Likelihoo

d

Severity

Financial Market Return The risk that market returns differ from

expectations, resulting in insufficiency or

excessive surplus in fund balance

Medium High

Inflation Rate of

Tuition

The risk that inflation rate differs from

expectation, resulting in liabilities (future

tuition payments) being higher or lower

than expected

Medium High

Unemployment The risk that unemployment rates

increase or decrease due to economic

downturn or other reasons, resulting in

fund contributions being higher or lower

than expected

Medium Low

Credit Default When investing in bonds, there is a risk

that some bond issuers default on their

obligations to the fund

Low Medium

Interest Rate Fluctuation in interest rates impacts the

price and value of treasury bills

Medium Low

Strategic Regulatory/Politica

l

Risk that future legislation does not

support the CDEF’s goals, such as a

legislated reduction in tax payments or a

re-appropriation of funds (unlikely given

that the fund was set up separate from

other government funds)

Low Medium

Reputational

Damage

Risk that stakeholders form an

unfavorable view of the fund for any

Low Low

FA – page 1reason, including political atmosphere or

errors

Capital Availability Risk that the investment portfolio is not

sufficiently liquid to cover financial

obligations on any given business day

Low High

Social/Cultural

Trends

Risk that citizens of Cascadia favor

college educations less in the future,

opting for apprenticeships or other ways

to enter to workforce sooner

Low Medium

Insurance Beneficiary

Behavior

Risk that the number of beneficiaries

differs from expectation due to

implementation of CDEF. i.e. attrition

rates do not fully capture the new

incentive to get a college education

High Medium

Contributor

Behavior

Risk that employed population size

assumption does not reflect behavior

change due to new tax (e.g. emigration)

Low High

Operational Litigation Risk that litigation costs (e.g. lawsuits

over program eligibility or fund

mismanagement) affect fund management

expenses

Low Medium

Reporting Risk Risk that material errors in investment

statements increase internal cost due to

re-work and external cost due to fines or

settlements

Low Low

Loss of Key

Personnel

Risk that key personnel leave the fund,

resulting in an interruption to operations

Low Low

Among the risks in the RCD, key risks are defined as any risk for which the likelihood OR

severity is high, or any risks in which both likelihood AND severity are medium. The risks that meet these

criteria are Market Return, Inflation Rate, Capital Availability, and Beneficiary Behavior.

Market return is considered a key risk due to the volatility of equity markets and the impact of

returns deviating from expectation on CDEF’s assets. This risk includes both sets of key stakeholders:

contributors and beneficiaries. Lower market returns could result in underfunded tuition liabilities, while

higher market returns could result in taxpayers contributing more than necessary to maintain the fund. I

recommend a diverse investment portfolio consisting assets with uncorrelated or inversely correlated

rates of return to reduce this volatility. No more than 50% of the portfolio should be placed in a single

asset class. This strategy would reduce the impact of large positive or negative moves in a single asset

class.

Inflation is considered a key risk to the liability cash flows, specifically as it applies to the tuition

rate. When compounded across the entire 33-year projection period, a small change in annual tuition

inflation can result in a large surplus or deficit for the fund. Tuition inflation impact can be partially

hedged by holding assets whose value typically rise with inflation. Examples of such assets include

commodities, real estate, and gold.

Capital Availability ties to one of CDEF’s main objectives, which is to “Ensure the CDEF meets

its financial obligations on any given business day.” Failure to do so would result in reputational

damage, possible fines, and potential for adverse financial results from selling assets before maturity. To

mitigate this risk, I recommend that the CDEF maintain a minimum of 40% of investments in stable,

liquid asset classes, such as treasury bills. Preliminary modeling indicates that tuition payments could be

over 25% of accumulated fund balance in the early years of the fund assuming 0% return on the

[Show More]

.png)