WGU C211 Complete Solutions

$ 9.5

Test Bank for Applied Pathophysiology A Conceptual Approach 4th Edition By Judi Nath-Carie Braun

$ 18

Answer Key for AP English Literature and Composition Practice Exam, Section I (Complete)

$ 11

HESI Leadership Exit Exam Version 2 – Just Released with All Correct and Verified Answers (2025 Update)

$ 10.5

ATI PN Comprehensive Online Practice 2022/2023 A

$ 45.5

Principles of Microeconomics, A Streamlined Approach, 4th Edition By Robert H. Frank, Ben Bernanke, Kate Antonovics, Ori Heffetz (eBook PDF)

$ 25

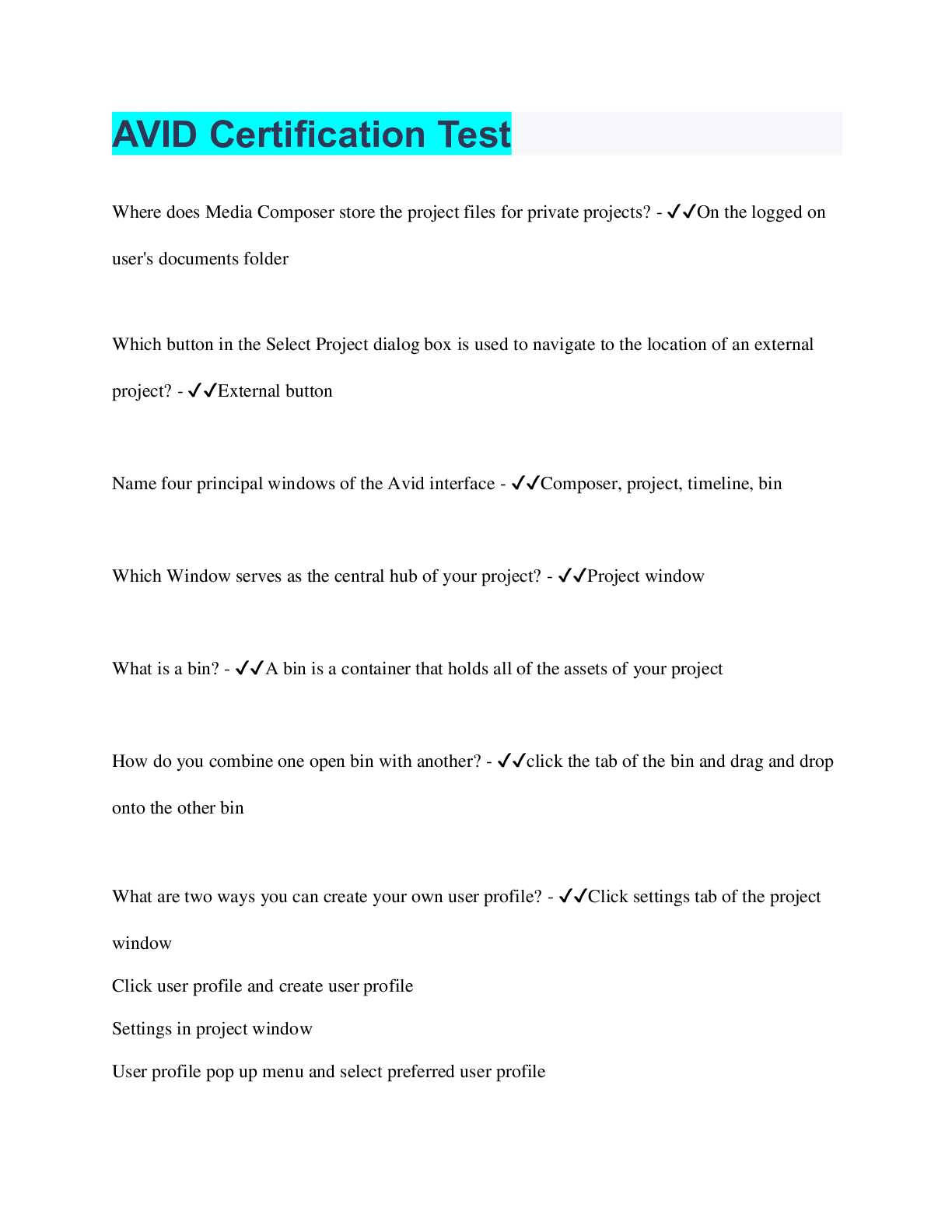

AVID Certification Test

$ 10

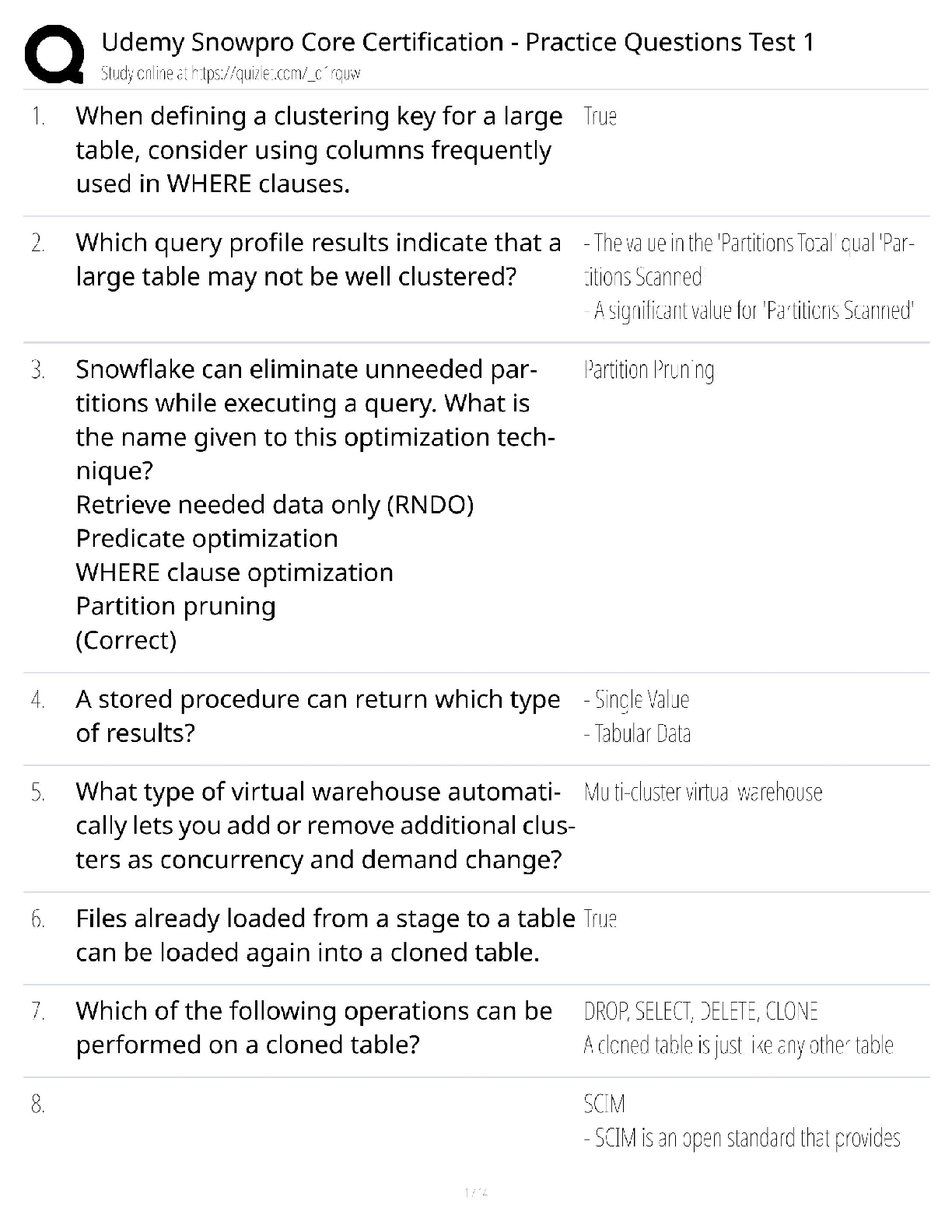

SnowPro Core Certification - Practice Test 1 (2025) / Udemy-Style Questions / Warehouse Optimization & Security / Score 90%+

$ 11

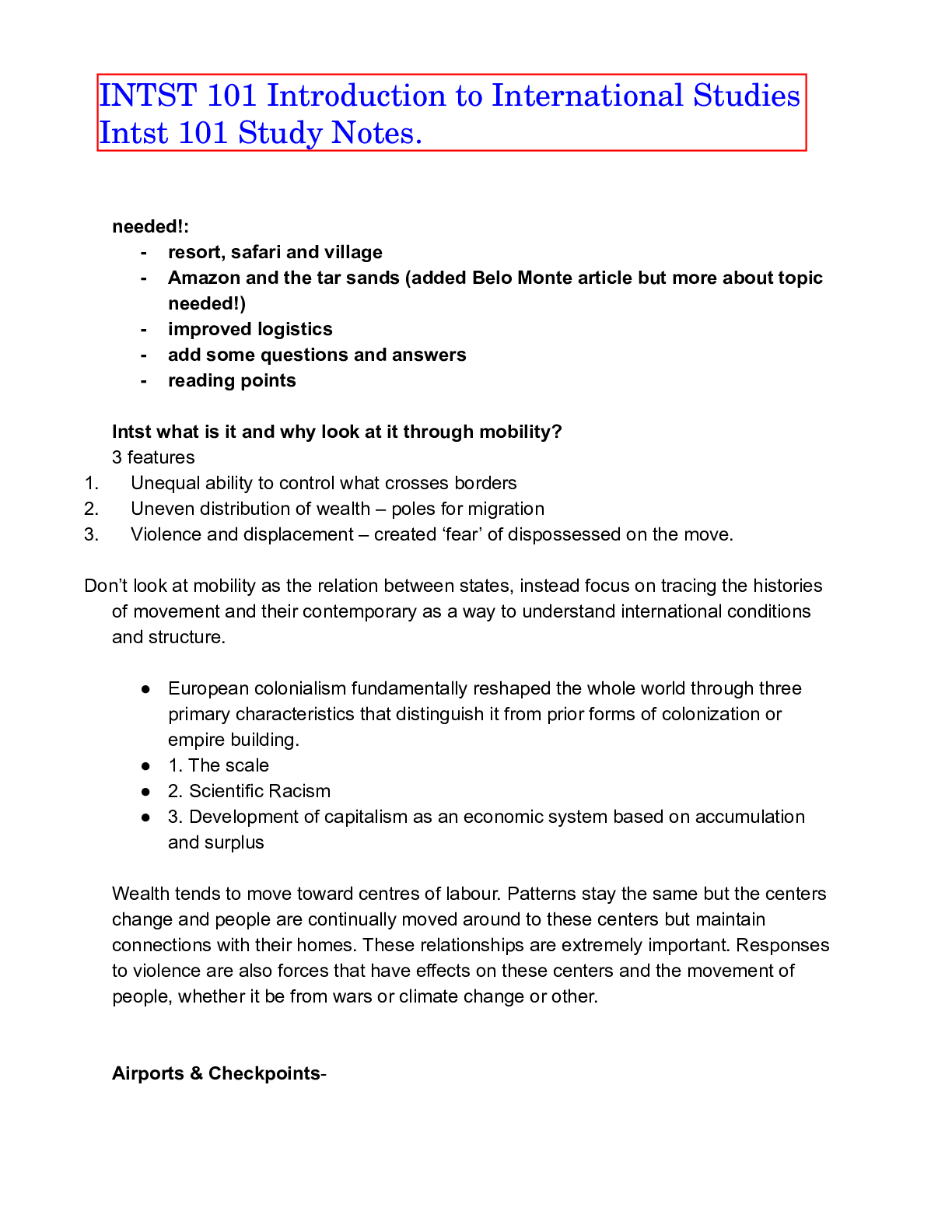

INTST 101 Introduction to International Studies Intst 101 Study Notes. - University of Waterloo.

$ 7.5

.png)

ATI Teas study manual for science-6th edition already passed

$ 10

Lecture Notes for Microeconomics Theory ECON 630

$ 8

eBook Writing Literature Reviews 8th Edition By Melisa C. Galvan, Jose L. Galvan

$ 29

Rashid Ahmed Feedback Log & Score VSIM CASE STUDY 2020

$ 9

Loan Fraud Guide V.3.5 (With Scans)

$ 7

Correct Study Guide, Download to Score A.png)

Southern New Hampshire University - IT 640 Final BA(Latest 2021) Correct Study Guide, Download to Score A

$ 7

NRNP 6675 Week 11 Final Exam 2022 (100% Correct Answers)

$ 14

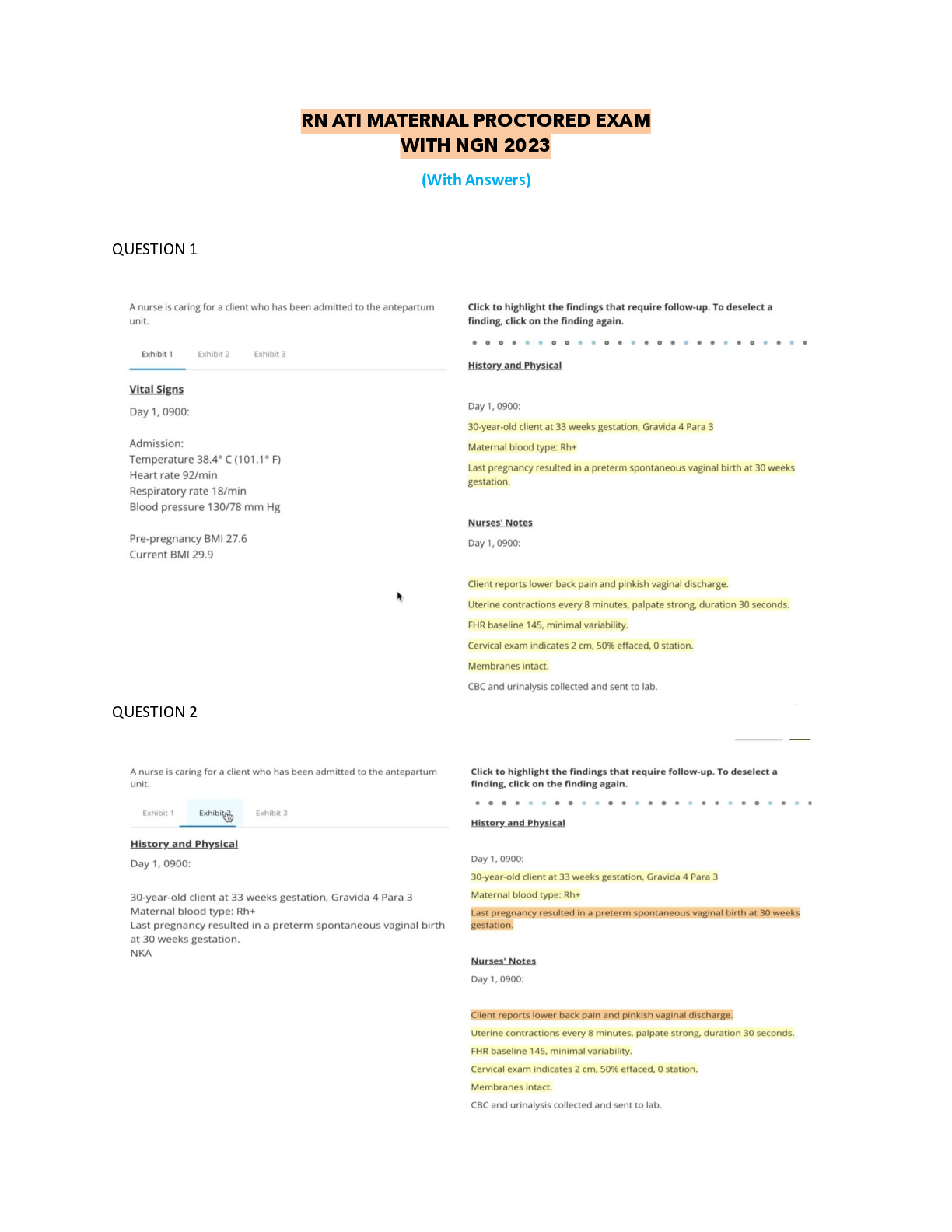

RN ATI MATERNAL PROCTORED EXAM WITH NGN 2023

$ 29.5

.png)

[Solved] You have 2 employment candidates for a marketing position. Both have similar educational

$ 14

AQA A-level GEOGRAPHY PAPER 1 PHYSICAL GEOGRAPHY Mark scheme Additional specimen

$ 11

eBook [PDF] New Ways of Solidarity with Korean Comfort Women Comfort Women and What Remains 1st Edition By Ñusta Carranza Ko

$ 29

eBook Durée as Einstein-in-the-Heart (Routledge Studies in Twentieth-Century Literature) 1st Edition By Candice Lee Kent

$ 29

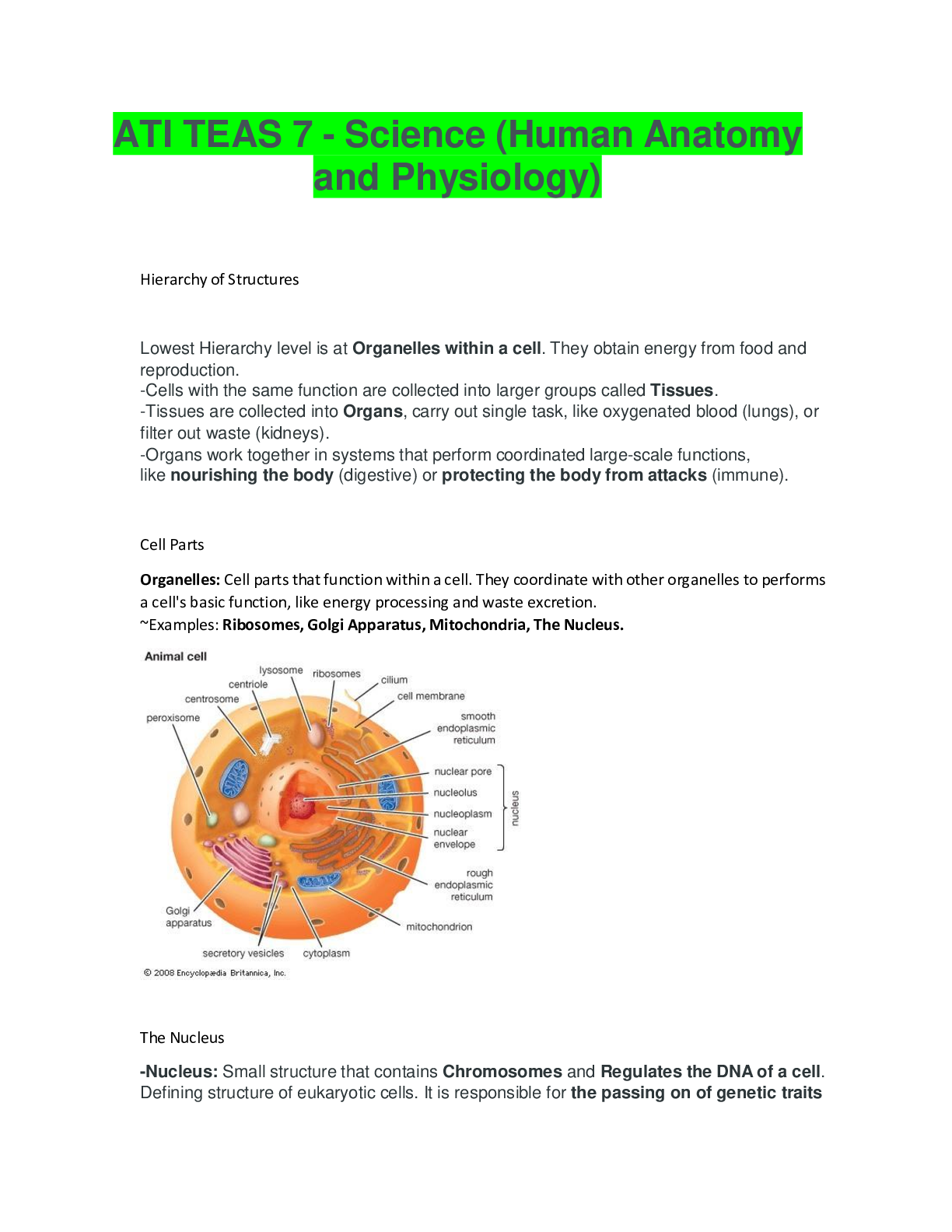

ATI TEAS 6 - Science (Human Anatomy and Physiology) Complete Final Exam Review

$ 15

CHEM212 BIOCHEMISTRY LAB MODULE 6 PIG HEART COMPREHENSIVE FINAL ASSESSMENT REVIEW Q & A 2024

$ 13

BIOS-255 Week 3 Assignment: Cardiovascular System: Blood Vessels | part B | GRADED A

$ 13.5

Review Test Submission: Exam 1,100% CORRECT

.png)

.png)