Accounting > STUDY GUIDE > Arkansas State University ACCT 4113 ROCK the Ages LLC.. (All)

Arkansas State University ACCT 4113 ROCK the Ages LLC..

Document Content and Description Below

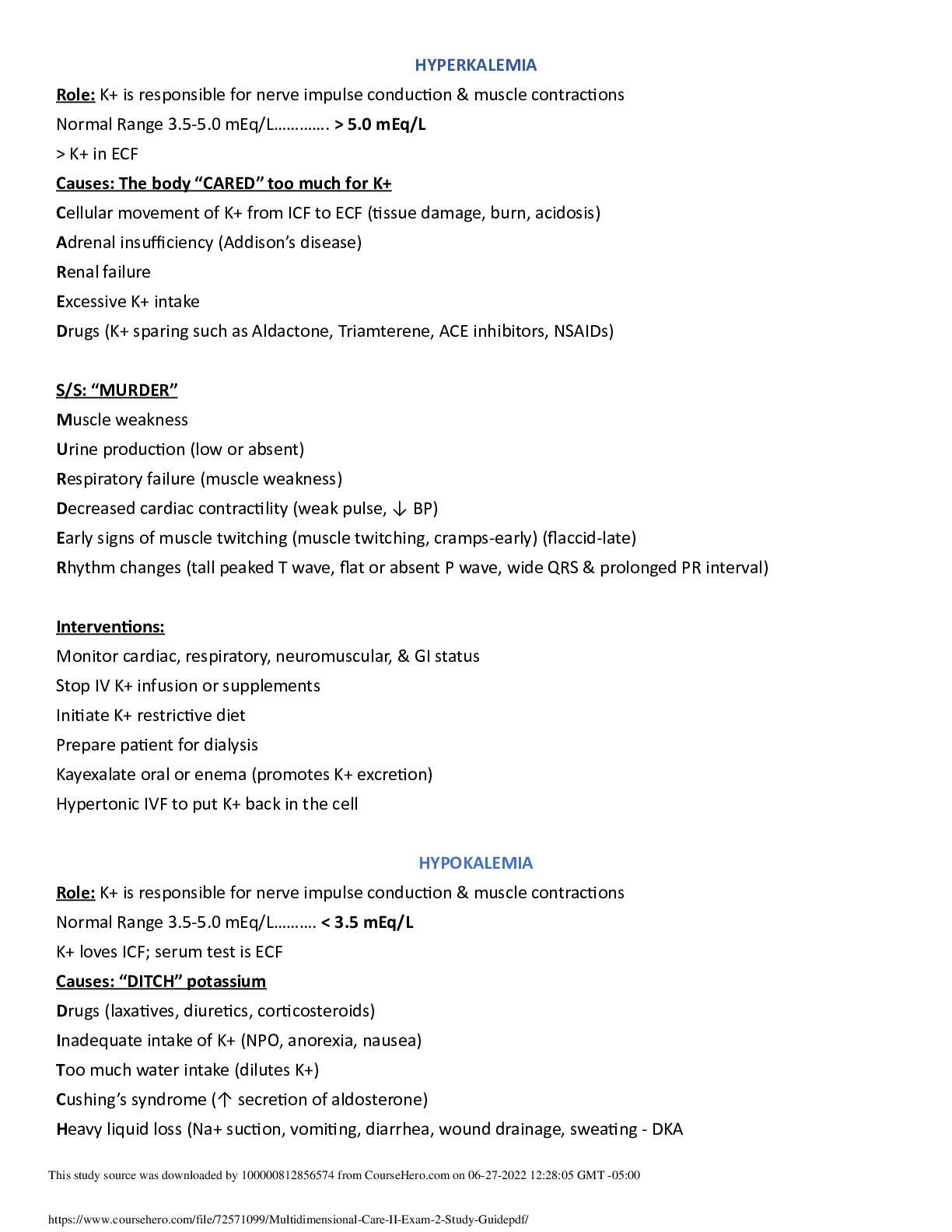

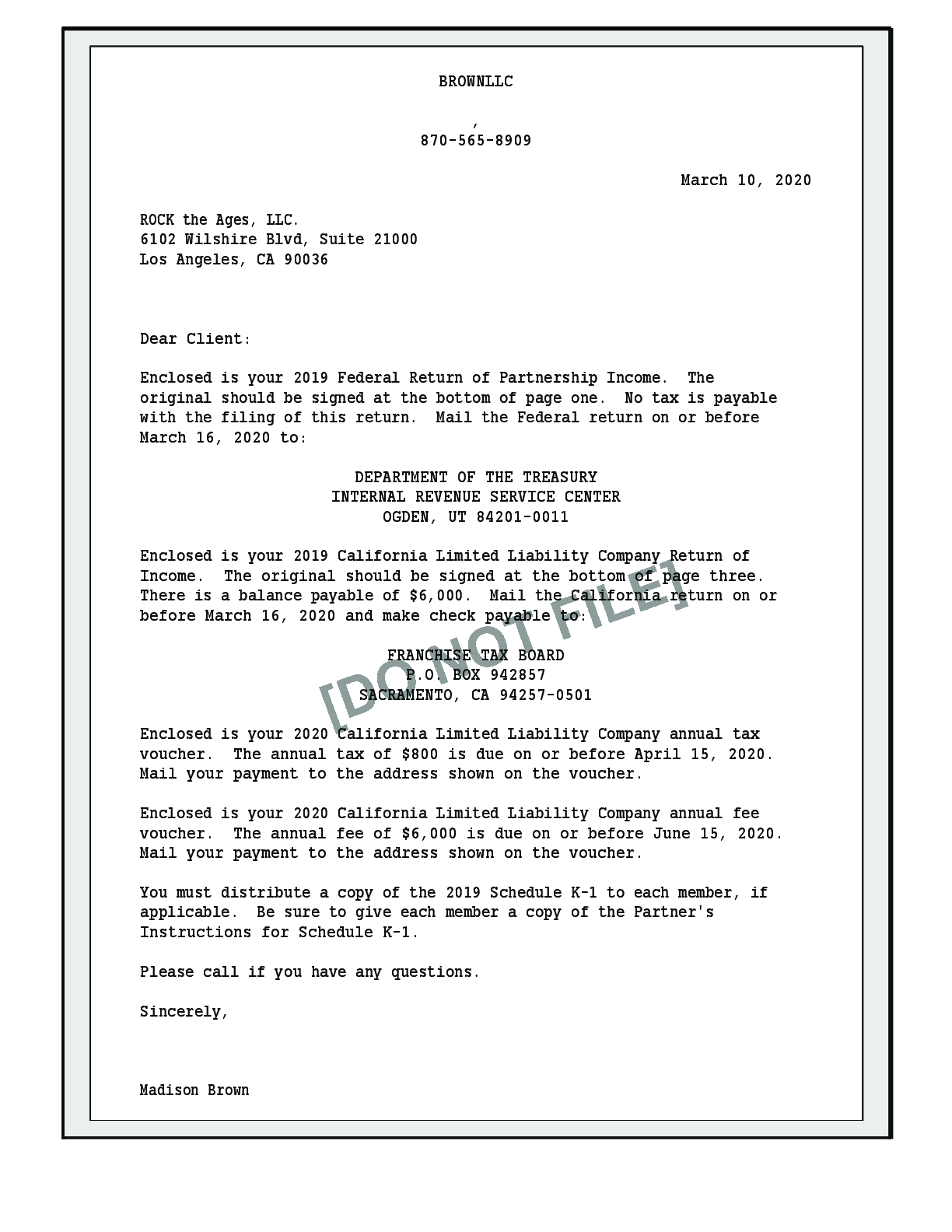

BROWNLLC , 870-565-8909 March 10, 2020 ROCK the Ages, LLC. 6102 Wilshire Blvd, Suite 21000 Los Angeles, CA 90036 Dear Client: Enclosed is your 2019 Federal Return of Partnership Income. The o... riginal should be signed at the bottom of page one. No tax is payable with the filing of this return. Mail the Federal return on or before March 16, 2020 to: DEPARTMENT OF THE TREASURY INTERNAL REVENUE SERVICE CENTER OGDEN, UT 84201-0011 Enclosed is your 2019 California Limited Liability Company Return of Income. The original should be signed at the bottom of page three. There is a balance payable of $6,000. Mail the California return on or before March 16, 2020 and make check payable to: FRANCHISE TAX BOARD P.O. BOX 942857 SACRAMENTO, CA 94257-0501 Enclosed is your 2020 California Limited Liability Company annual tax voucher. The annual tax of $800 is due on or before April 15, 2020. Mail your payment to the address shown on the voucher. Enclosed is your 2020 California Limited Liability Company annual fee voucher. The annual fee of $6,000 is due on or before June 15, 2020. Mail your payment to the address shown on the voucher. You must distribute a copy of the 2019 Schedule K-1 to each member, if applicable. Be sure to give each member a copy of the Partner's Instructions for Schedule K-1. Please call if you have any questions. Sincerely, Madison BrownTRADE OR BUSINESS INCOME Gross receipts less returns. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,800,000 Gross profit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,800,000 Total income (loss). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,800,000 TRADE OR BUSINESS DEDUCTIONS Salaries and wages (less emp. credits). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,000,000 Guaranteed payments to partners. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,400,000 Rent. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80,000 Taxes and licenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 92,000 Interest. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,000 Other deductions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,238,800 Total deductions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,820,800 SCHEDULE K - INCOME Ordinary business income (loss). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 979,200 Guaranteed payments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,400,000 Interest income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,600 Net short-term capital gain (loss). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . -20,000 Net long-term capital gain (loss). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24,000 SCHEDULE K - DEDUCTIONS Section 179 deduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20,000 Charitable contributions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28,000 SCHEDULE K - SELF-EMPLOYMENT Net earn. (loss) from self-employment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,379,200 SCHEDULE K - OTHER Tax-exempt interest income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,200 Nondeductible expenses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 100,000 Distributions of cash & marketable sec. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,000,000 Investment income. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,600 SCHEDULE L - BALANCE SHEET Beginning Assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,000,000 Beginning Liabilities and Capital. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,000,000 Ending Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 800,000 Ending Liabilities and Capital. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 800,000 2019 Federal Income Tax Summary Page 1 ROCK the Ages, LLC. 55-5555555ENDING ASSETS Cash. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 380,000 Tax exempt securities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 120,000 Other current assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 300,000 Buildings and other assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 980,000 Less accumulated depreciation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (980,000) Total Assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 800,000 ENDING LIABILITIES & CAPITAL Short term notes payable. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 160,000 Partners' capital accounts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 640,000 Total Liabilities and Capital. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 800,000 2019 Federal Balance Sheet Summary Page 1 ROCK the Ages, LLC. 55-5555555TRADE OR BUSINESS INCOME Gross receipts less returns. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,800,000 Gross Profit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,800,000 Total income (loss). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,800,000 TRADE OR BUSINESS DEDUCTIONS Salaries and wages. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,000,000 Guaranteed payments to partners. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,400,000 Deductible interest expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,000 Other deductions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,410,800 Total deductions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,820,800 INCOME Ordinary income (loss). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . [Show More]

Last updated: 2 years ago

Preview 1 out of 73 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$14.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jul 22, 2021

Number of pages

73

Written in

Additional information

This document has been written for:

Uploaded

Jul 22, 2021

Downloads

0

Views

37