Financial Accounting > EXAM > DeVry University, Keller Graduate School of Management - ACCT 551/ACCT 551 Week 1 Quiz Question And (All)

DeVry University, Keller Graduate School of Management - ACCT 551/ACCT 551 Week 1 Quiz Question And Answers_Already Graded A.

Document Content and Description Below

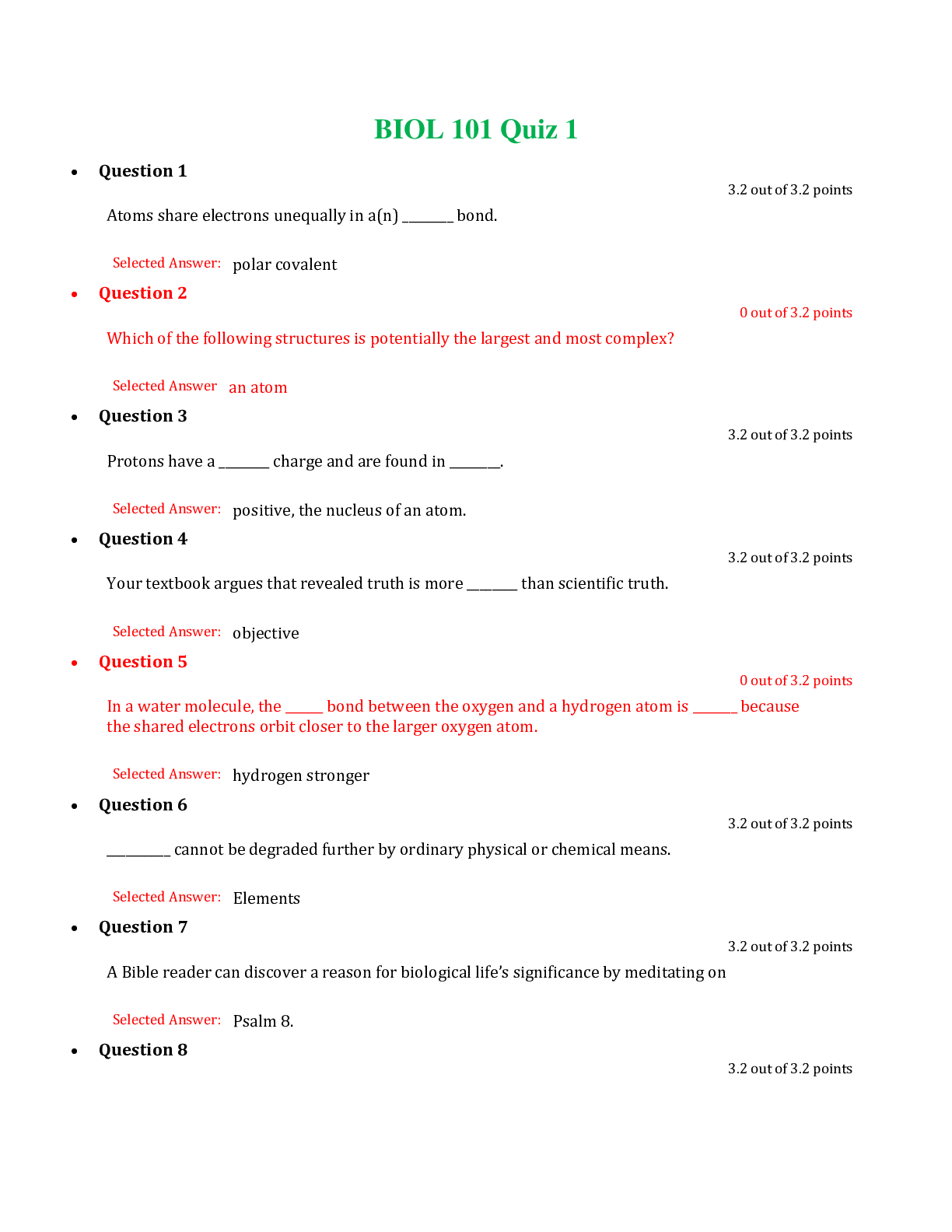

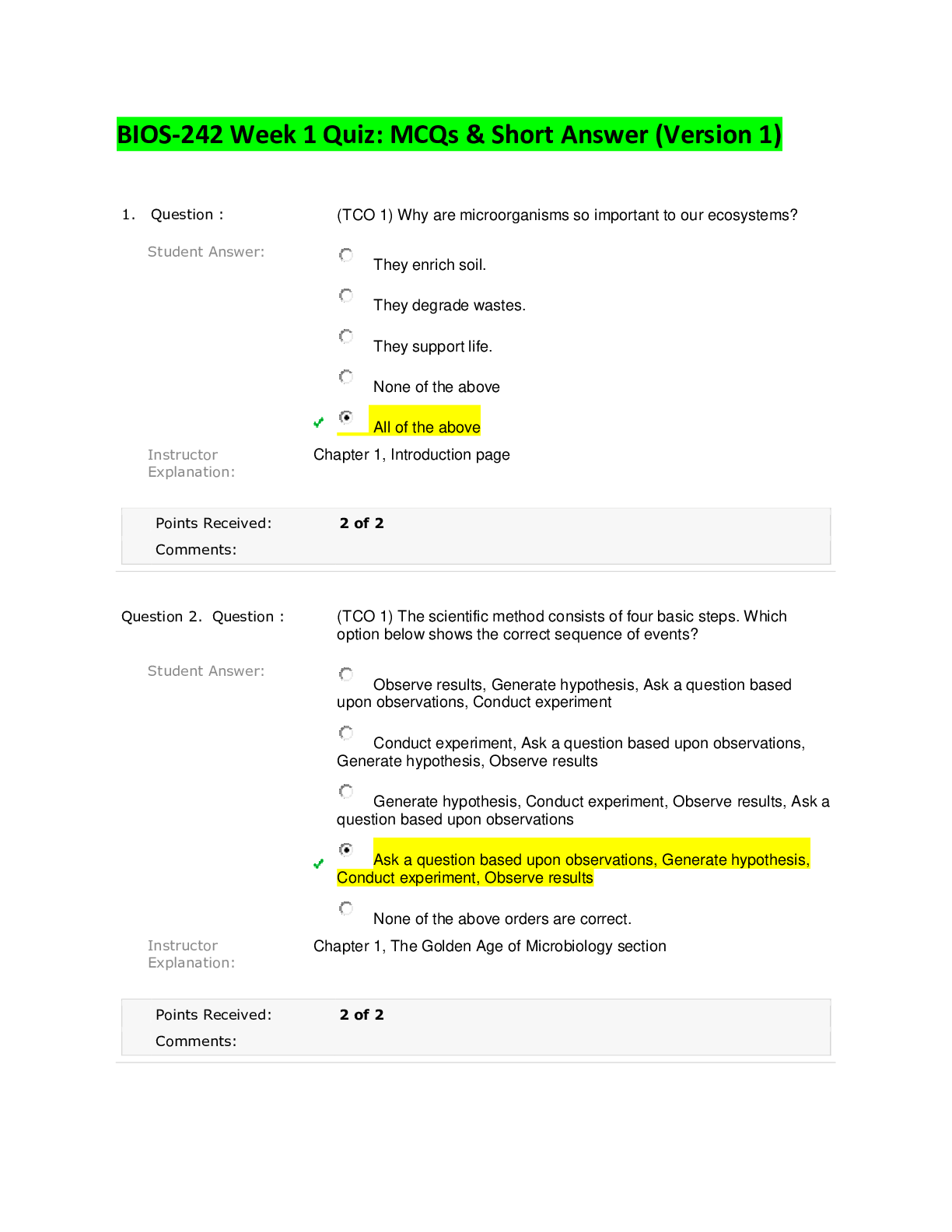

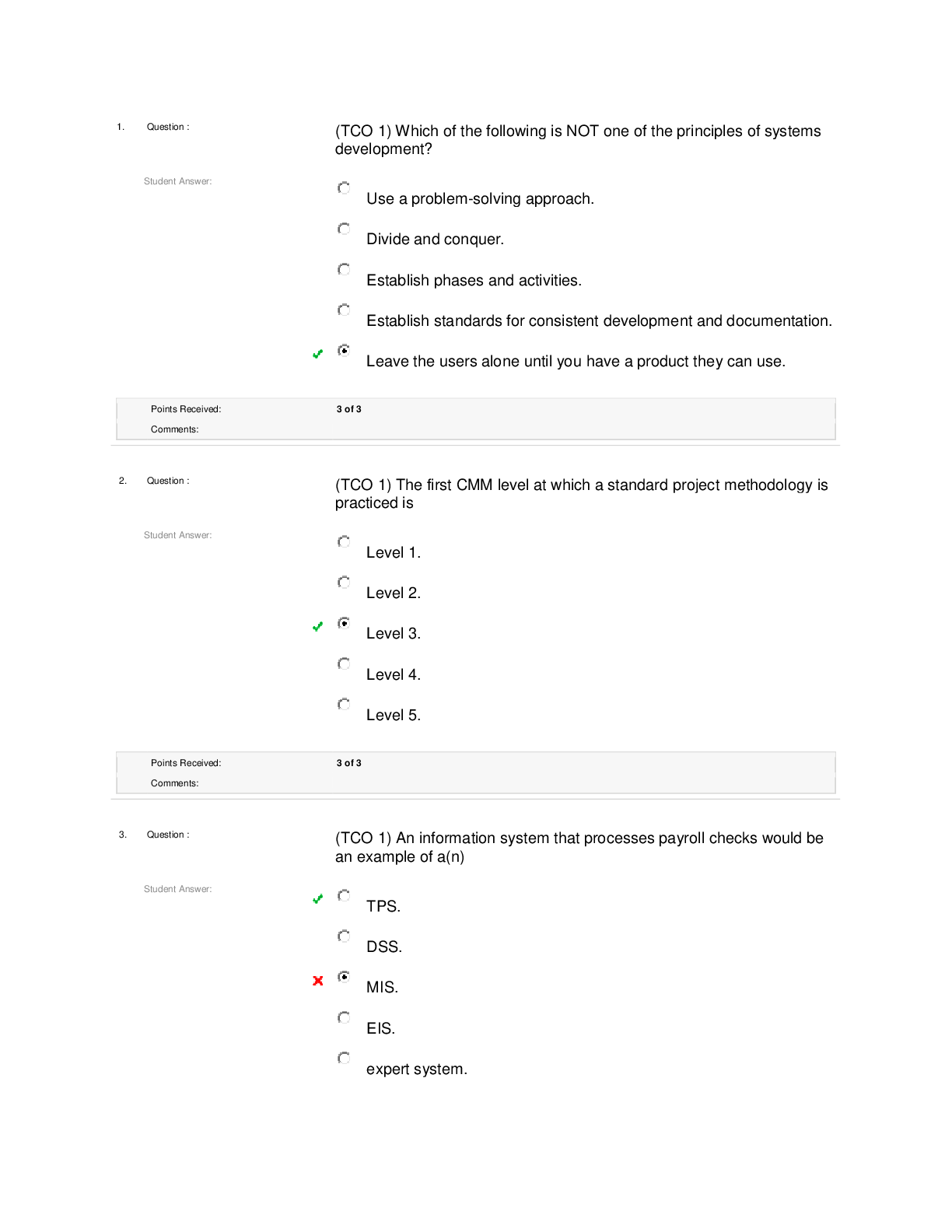

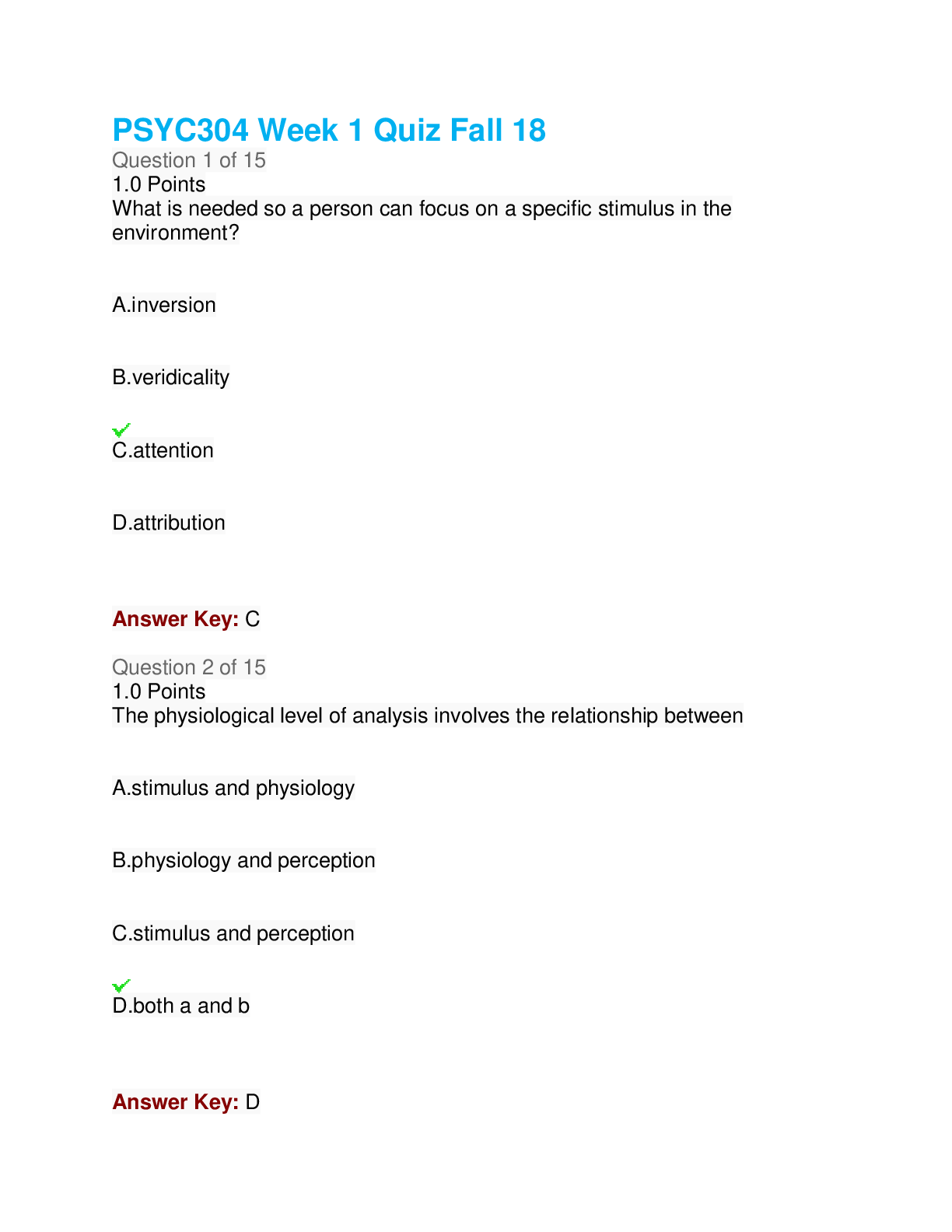

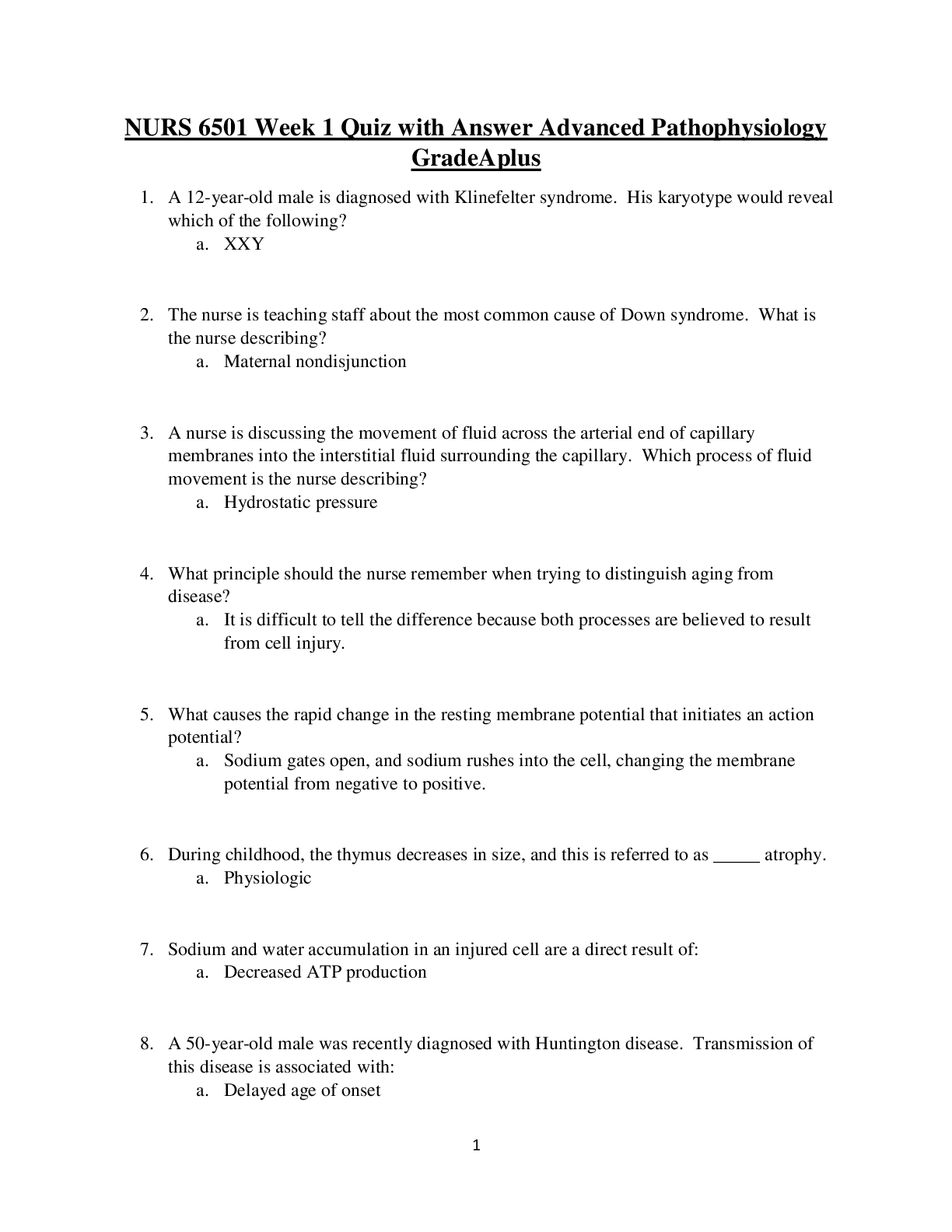

ACCT 551 Week 1 Quiz Question: (TCO C) Which of the following should not be reported in the income statement? Question: (TCO C) Which of the following is often reported as an extraordinary item? Q... uestion: (TCO C) Alonzo Co. acquires three patents from Shaq Corp. for a total of $360,000. The patents were carried on Shaq’s books as follows: Patent AA, $5,000; Patent BB, $2,000; and Patent CC, $3,000. When Alonzo acquired the patents, their fair market values were: Patent AA, $20,000; Patent BB, $240,000; and Patent CC, $60,000. At what amount should Alonzo record Patent BB? Question: (TCO C) Day Company purchased a patent on January 1, 2010 for $360,000. The patent had a remaining useful life of 10 years at that date. In January of 2011, Day successfully defends the patent at a cost of $162,000, extending the life of the patent to 12/31/22. What amount of amortization expense would Kerr record in 2011? Question: (TCO C) Howard Company acquired a patent on a coal extraction technique on January 1, 2010 for $8,000,000. It was expected to have a 20-year life and no residual value. Howard uses the straight-line amortization for all patents……….. patent be carried on the December 31, 2011 balance sheet? [Show More]

Last updated: 2 years ago

Preview 1 out of 2 pages

.png)

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$15.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 14, 2020

Number of pages

2

Written in

Additional information

This document has been written for:

Uploaded

Aug 14, 2020

Downloads

0

Views

118