Financial Accounting > QUESTIONS & ANSWERS > ACCT 212 Week 3 Homework Questions and Detailed Answers Download to Score A+ (All)

ACCT 212 Week 3 Homework Questions and Detailed Answers Download to Score A+

Document Content and Description Below

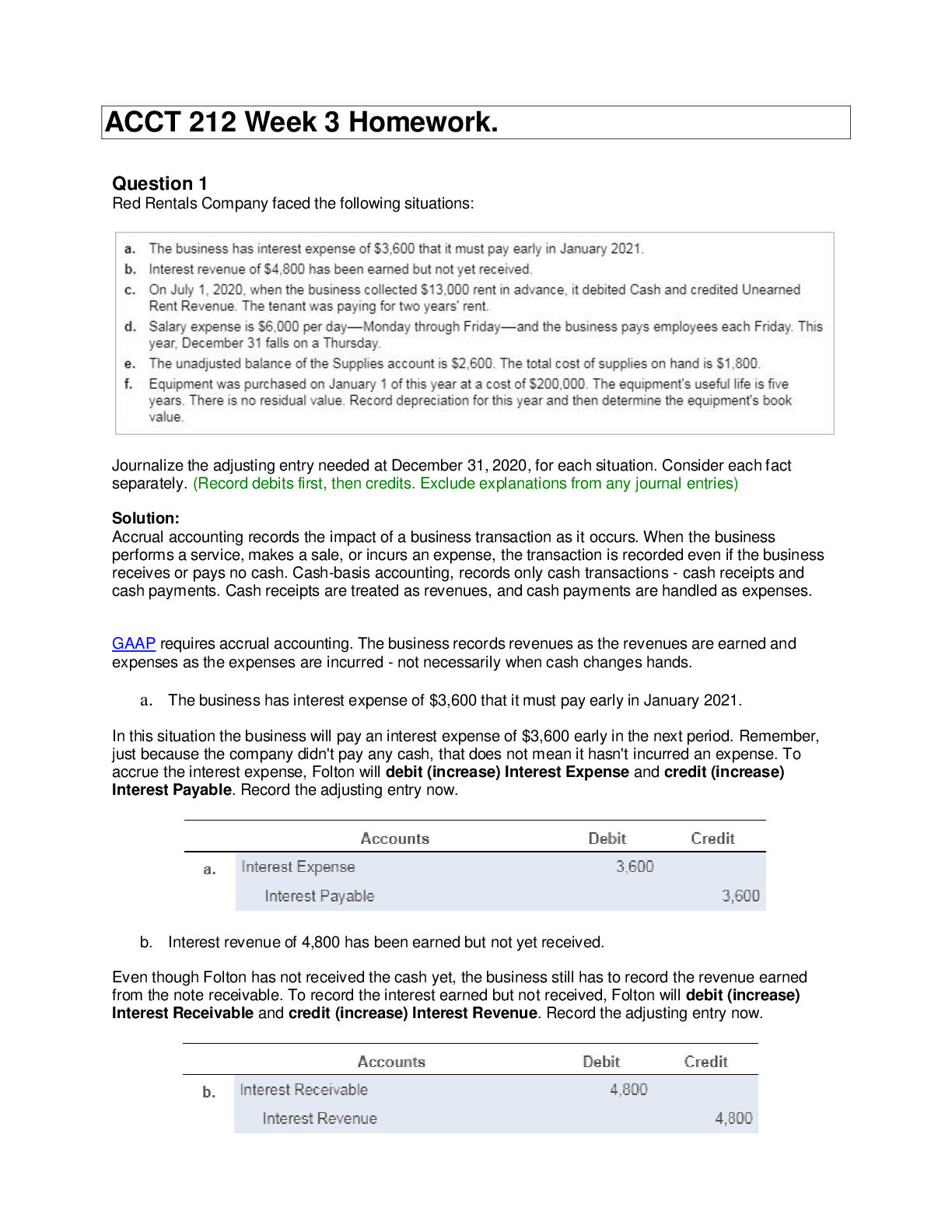

Question 1 Red Rentals Company faced the following situations: Journalize the adjusting entry needed at December 31, 2020, for each situation. Consider each fact separately. (Record debits first, t... hen credits. Exclude explanations from any journal entries) Solution: Accrual accounting records the impact of a business transaction as it occurs. When the business performs a service, makes a sale, or incurs an expense, the transaction is recorded even if the business receives or pays no cash. Cash-basis accounting, records only cash transactions - cash receipts and cash payments. Cash receipts are treated as revenues, and cash payments are handled as expenses. GAAP requires accrual accounting. The business records revenues as the revenues are earned and expenses as the expenses are incurred - not necessarily when cash changes hands. a. The business has interest expense of $3,600 that it must pay early in January 2021. In this situation the business will pay an interest expense of $3,600 early in the next period. Remember, just because the company didn't pay any cash, that does not mean it hasn't incurred an expense. To accrue the interest expense, Folton will debit (increase) Interest Expense and credit (increase) Interest Payable. Record the adjusting entry now. b. Interest revenue of 4,800 has been earned but not yet received. Even though Folton has not received the cash yet, the business still has to record the revenue earned from the note receivable. To record the interest earned but not received, Folton will debit (increase) Interest Receivable and credit (increase) Interest Revenue. Record the adjusting entry now. c. On July 1, 2020, when the business collected 13,000 rent in advance, it debited Cash and credited Unearned Rent Revenue. The tenant was paying for two years' rent. Here we are told that when the business collected 13,000 rent in advance six months ago, the amount was debited to Cash and credited to Unearned Rent Revenue. The tenant was paying for two years' rent. Unearned revenue is a liability account. The company has received cash and now "owes" the service of providing a rental space to the tenant. The company will earn the revenue over the time the customer occupies the space. At the end of the year, we need to record the portion of the revenue that has been earned for the year. Using the table below, calculate the amount of revenue to be recognized. Using the amount calculated above, record adjusting entry c. Remember, Folton will need to reduce the Unearned Rent Revenue liability account and record rent revenue for the amount earned. d. Salary expense is $6,000 per Day Monday through Friday and the business pays employees each Friday. This year, December 31 falls on a Thursday. Here we have an accrual. The employees have worked for four days, but have not yet been paid. The company needs to accrue for the salary expense that has been incurred. Remember, just because the company didn't pay any cash, that does not mean it hasn't incurred an expense. Using the table below, determine the amount of expense to be recorded. Using the amount calculated above, record adjusting entry d. To record the accrual of salary expense, Folton will debit (increase) Salary Expense and credit (increase) Salary Payable. e. The unadjusted balance of the Supplies account is 2,600. The total cost of supplies on hand is $1800. Supplies are used by a business to assist in the earnings process. When supplies are purchased they are debited to the Suppliesaccount, which is an asset. At the end of the period, a count is performed to determine the value of supplies on hand. The difference between the balance of the supplies account and the supplies on hand amount is the amount of the supplies used during the period, or the supplies expense. The Supplies account is reduced and an expense is recorded for the supplies used during the accounting period. Using the table below, calculate the amount of supplies expense to be recorded. Using the amount calculated above, record adjusting entry e. Equipment was purchased on January 1 of this year at a cost of 200,000. The equipment's useful life is five years. There is no residual value. Record depreciation for this year and then determine the equipment's book value. Here we are told that an asset with a useful life that extends beyond one year was acquired. Depreciation is the systematic and rational allocation of the cost of a capital asset (greater than one year) over the expected useful life of that asset. Using the table below, calculate the amount of depreciation expense to be recorded. Using the amount calculated above, record adjusting entry f. Remember that the Accumulated Depreciation Equipment account (not Equipment) is credited to preserve the original cost of the asset in the Equipment account. Determine the equipment's book value. We will take the original equipment cost of $200,000, and subtract the amount of accumulated depreciation from adjusting entry f. Remember that the equipment has been depreciated for 1 year. Question 2 The adjusted trial balance of Holiday Hams, Inc., is as follows. Prepare Holiday Hams, Inc.'s single-step income statement and statement of retained earnings for the year ended December 31, 2018, and its balance sheet on that date. Start by preparing the single step income statement. The income statement lists all the revenues together under a heading such as Revenues. The expenses are listed together in a single category titled Expenses, or Expenses and Losses. Begin by selecting the labels for the income statement. Prepare the Holiday Hams, Inc. statement of retained earnings for the year ended December 31, 2018. The statement of retained earnings calculates the change in retained earnings from the beginning of the period to the end of theperiod, by displaying the increases and decreases to retained earnings during the period. Begin by selecting the labels for the statement of retained earnings. Prepare the Holiday Hams, Inc. balance sheet at December 31, 2018. Begin the preparation of the balance sheet by selecting the statement accounts and labels. Remember that the balance sheet presents the assets, liabilities and equity accounts of a business. Assets are generally presented in order of liquidity, which is the order they appear on the adjusted trial balance. Select the labels for the assets section now followed by the liabilities andshareholders's equity labels in the next step. (Do not classify the balance sheet into current and long-term sections.) Remember… Assets = Liabilities + Stakeholders Equity Question 3 Consider the following selected accounts from the records of East Shore Enterprises at December 31, 2018: Closing the books means to prepare the accounts for the next period's transactions. The closing entries set the revenue, expense, and dividends balances back to zero at the end of the period in order to measure each period's net income. Because revenues and expenses relate to a limited period, they are called temporary accounts. The Dividends account is also temporary. The closing process applies only to temporary accounts. Closing entries transfer the revenue, expense, and dividends balances to Retained Earnings. The first step of the process is to close out the revenue and expense accounts to the retained earnings account. Finally, close out the dividend account to the retained earnings account. We will record the entries one step at a time. Begin by recording the entry to close out the revenue accounts. Select the accounts to transfer the revenue balances to the Retained Earnings account. In order to transfer the revenue balances to Retained Earnings, you need to decrease each account by its entire balance. Using the rules of debit and credit, determine whether the balance transfer would be done with a debit or a credit. Then enter the amounts necessary to reduce the revenue accounts to a zero balance. The amount posted to the retained earnings account will be the sum of the revenue accounts. (Record debits first, then credits. Exclude explanations from any journal entries.) Next close out the expense accounts. In order to transfer the balances to retained earnings, you will need to decrease each expense account by its entire balance. Using the rules of debit and credit determine whether the balance transfer would be done with a debit or a credit. The amount posted to the retained earnings account will be the sum of all the expense account balances. [Show More]

Last updated: 2 years ago

Preview 1 out of 12 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$9.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Aug 02, 2021

Number of pages

12

Written in

Additional information

This document has been written for:

Uploaded

Aug 02, 2021

Downloads

0

Views

112

.png)