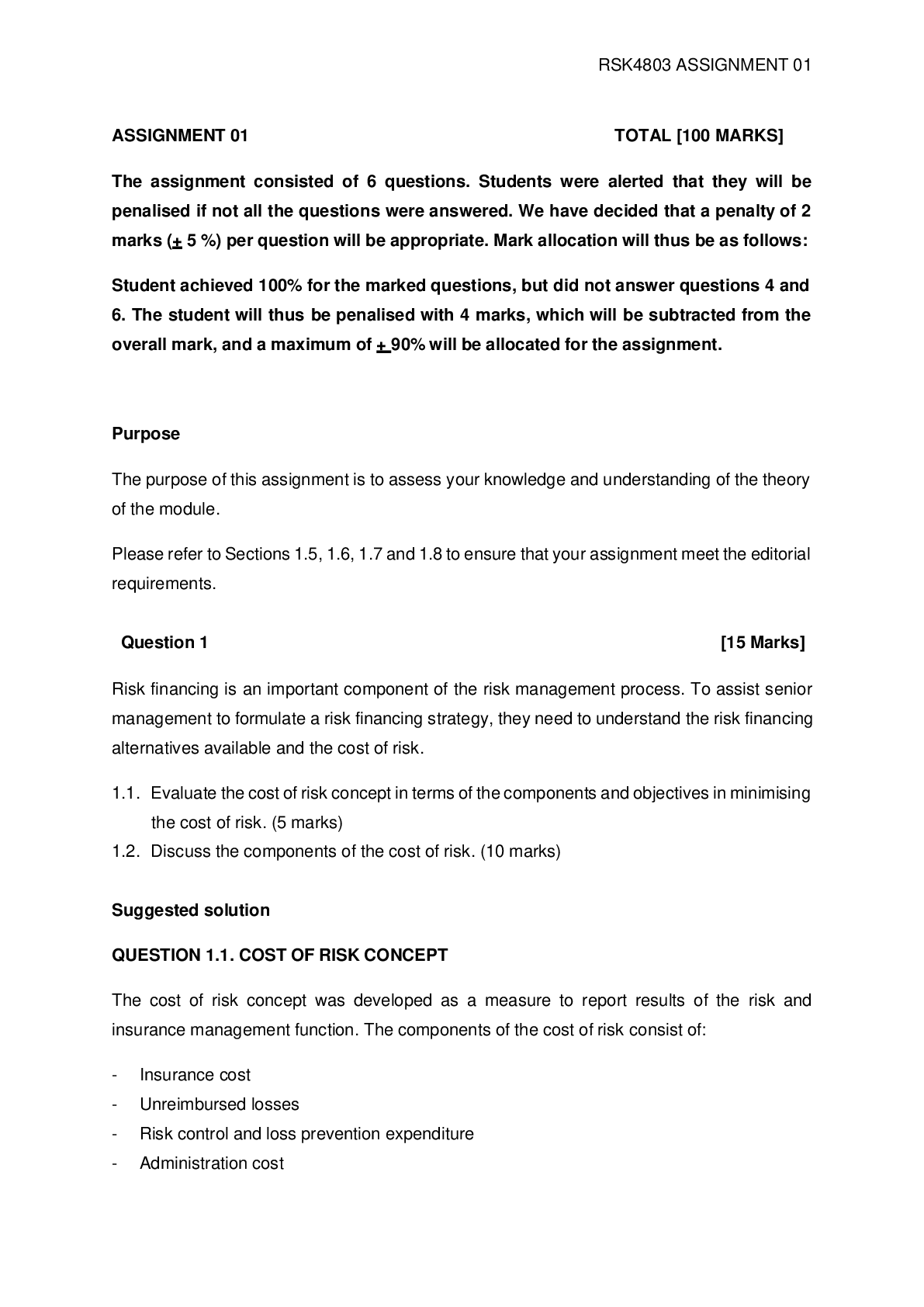

TEST BANK FOR MICROBIOLOGY FUNDAMENTALS: A CLINICAL APPROACH 4TH EDITION BY COWAN .

$ 20

NSG 5003 Patho Module 14 notes

$ 13

NURSING ENTRANCE EXAM STUDY GUIDE

$ 18

Ati rn comprehensive predictor retake questi ons and answers GRADED A REAL EXAM U PDATED 2023 APRIL

$ 40.5

A Level Further Mathematics A Y545/01 Additional Pure Mathematics June 2023 QP

$ 4

RN ATI COMPREHENSIVE PREDICTOR QUESTION TEST BANK FINAL EXAM 2024 -2025 UPDATED EXAM LATEST VERSION GUARANTEED SUCCESS ALREADY GRADED A+ ALL 2023\2024 ACTUAL VERSION COMBINED AND REVIEWED

$ 24.5

.png)

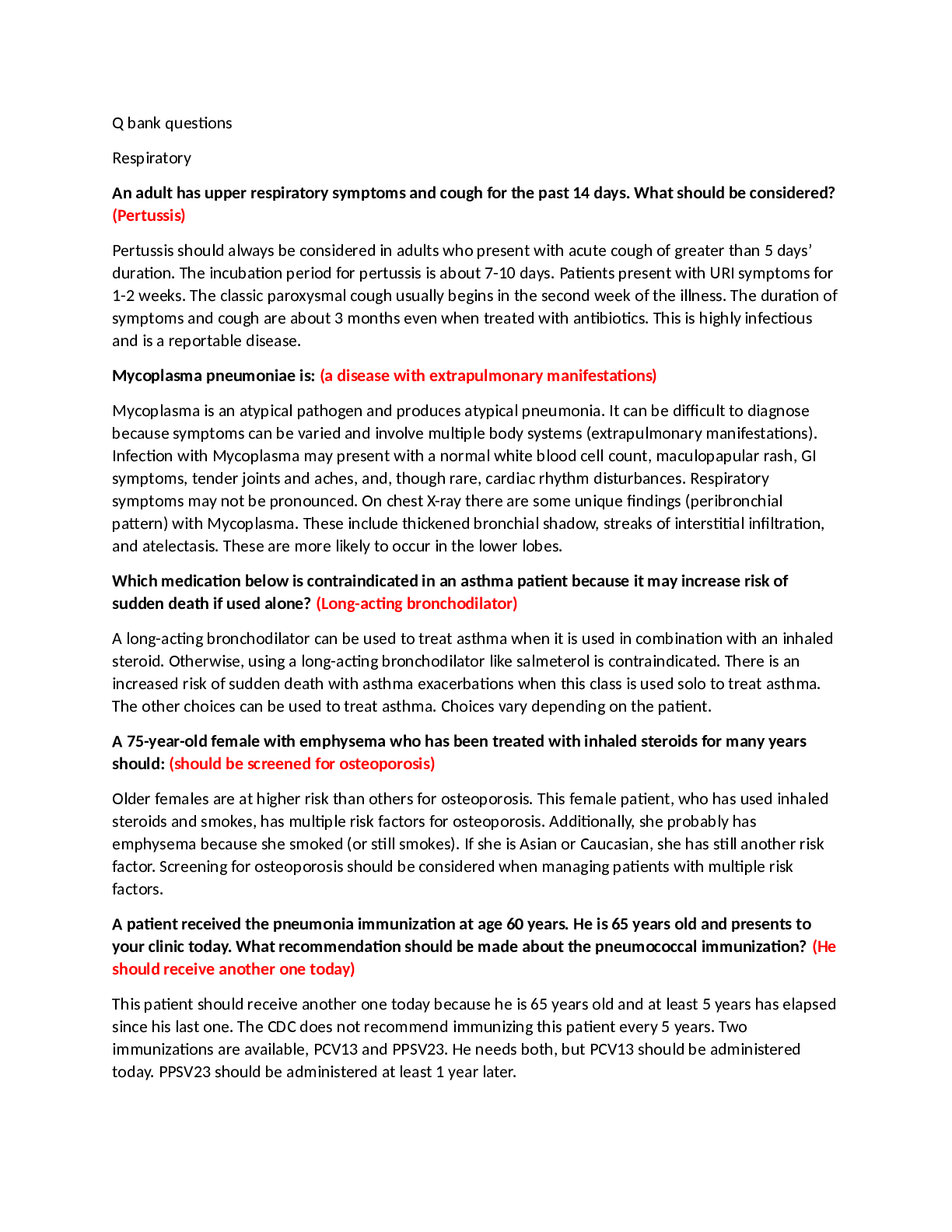

ATI TEAS 7 Math Practice Test With Complete Solutions

$ 14

Pearson Edexcel Level 3 GCE January 2022 | Question Paper | French Advanced PAPER 2: Written response to works and translation 9FR0/02

$ 5

MED_SURG 245 NCLEX STUDY GUIDE REVISED GRADE A

$ 10.5

IVY SOFTWARE BUSINESS MATH AND STATISTICS EXAM 2024 NEWEST COMPLETE 200 QUESTIONS AND CORRECT DETAILED ANSWERS (VERIFIED ANSWERS) ALREADY GRADED A+ BRAND NEW!!

$ 17.5

.png)

Pearson Edexcel Level 3 GCE 9FR0/02 2022 French Advanced PAPER 2: Written response to works and translation

$ 8

MATH-533 Week 2 Course Project, Part A – Exploratory Data Analysis- Graded An A+

$ 13

GCSE (9–1) Mathematics J560/02: Paper 2 (Foundation tier) General Certificate of Secondary Education Mark Scheme for November 2021

$ 5

[eBook] [PDF] Interpersonal Communication 4th Edition By Kory Floyd

$ 30

MATH 225N Week 1 Assignment, Variables and Measures of Data

$ 22.5

COMM 160 UNIT 4 Graded Assignment

$ 15

QA BA3020QA UMD Assignment

$ 6

AQA 2022// GCSE MATHEMATICS Higher Tier Paper 3 Calculator

$ 7

Pearson Edexcel International GCSE In Physics (4PH1) Paper 1P and Science (Double Award) (4SD0) Paper 1P Mark Scheme (Results) January 2022

$ 7

Psychological Testing: Principles, Applications, and Issues, 8th Edition, Kaplan & Dennis. All Chapters 1-21 | TEST BANK

$ 19

Grand Canyon University - COM -312COM-312 Negotiation.

$ 7

SOAP Note Format – CHEST PAIN STUDY GUIDE

$ 8

Pearson Edexcel International GCSE Mathematics A (4MA1) Paper 1HR Mark Scheme (Results) January 2021

$ 6

HESI Mathematics.

$ 9

.png)

Pearson Edexcel Level 3 GCE French Advanced PAPER 1: Listening, Reading and Translation 9FR0/01

$ 8

PSY480_week4_paper

$ 7.5

TEST BANK for Psychology and Work: Perspectives on Industrial and Organizational Psychology 1st Edition by Ruxillo, Bauer and Erdogan | All Chapters 1-14.

$ 29

GCSE (9–1) Mathematics J560/03: Paper 3 (Foundation tier) General Certificate of Secondary Education Mark Scheme for November 2021

$ 5

eBook Ongoing Crisis Communication 6th Edition By Timothy Coombs

$ 29

Single-Payer Insurance System

$ 4

CLOUD COMPUTING And Business Intelligence and Analysis

$ 25

RN Basic Math Assessment A 2025/2026 | Verified Questions and 100% Correct Answers

$ 35.5

GCSE (9–1) Mathematics J560/06: Paper 6 (Higher tier) General Certificate of Secondary Education Mark Scheme for November 2020

$ 5

NUR 2311 Medical Surgical (Adult Health) Exit Hesi 2020 – Southeastern College. | NUR2311 Medical Surgical (Adult Health) Exit Hesi 2020

$ 14.5

Single-Payer Insurance System

$ 4

Clayton State University - SCI 1901FWho Killed Barry

$ 11

.png)

RVE Study Guide Questions and Answers Latest Updated 2022 Rated A+

$ 8

Liberty University - ENGLISH ASSESSMENT LATEST 2020 ALREADY GRADED A+

$ 13

BSBHRM513 Manage Workforce Planning Project

$ 7

2020/2021 LATEST B. E. Semester: III Automobile Engineering

$ 22.5

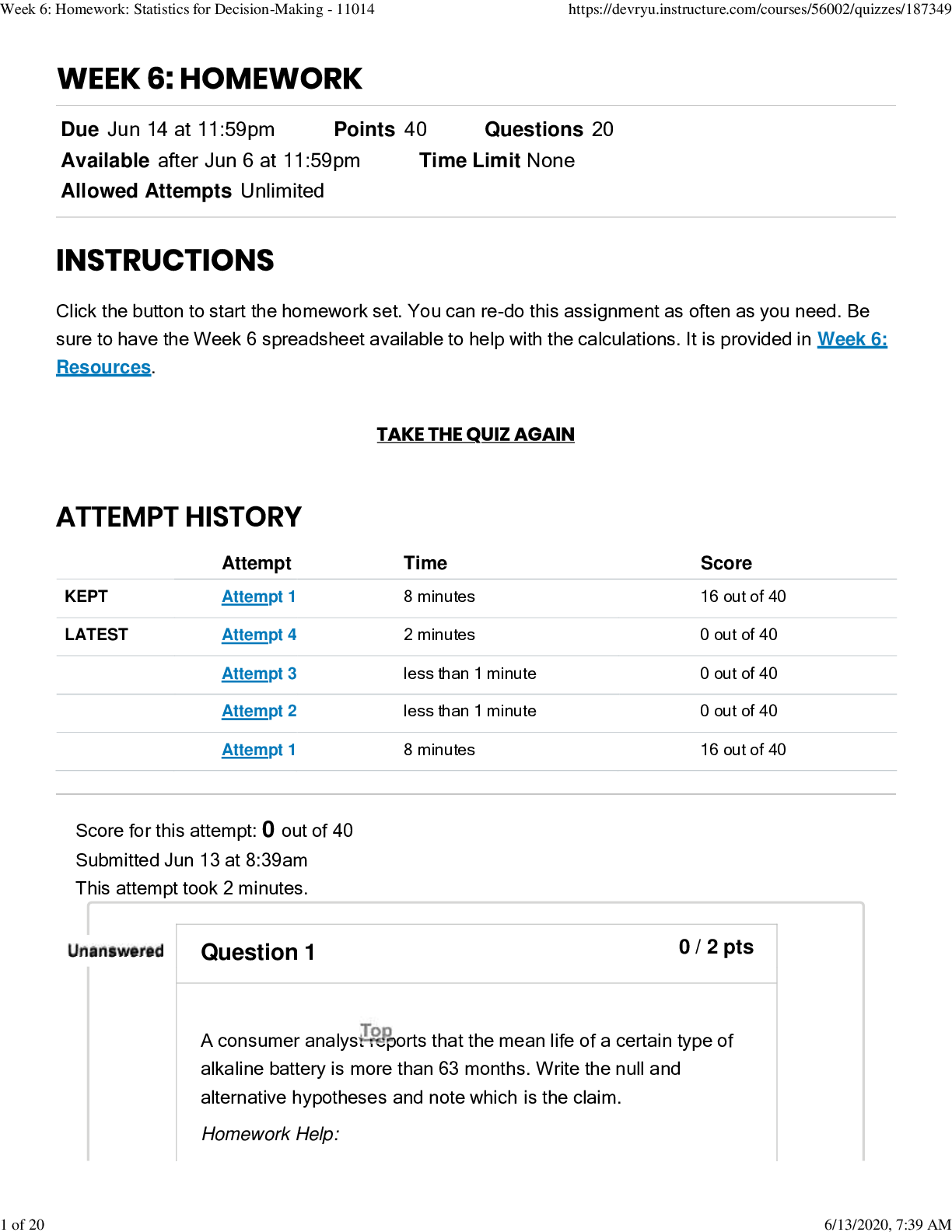

Maternal Child Nursing Care Test Bank

$ 40

ENGLISH 101Assignment 3R question and verified answers,100% score

$ 7

SH Focused Exam Chest Pain Brian Foster

$ 10

Pearson Edexcel International GCSE In Physics (4PH1) Paper 1P and Science (Double Award) (4SD0) Paper 1P Mark Scheme (Results) January 2022

$ 7

TEST BANK for Managerial Accounting 6th Edition by James Jiambalvo | All 14 Chapters

$ 24

Master sales series Part 1 Questions and Answers Graded A

$ 8

NUR 211 FINAL EXAM HEALTH ASSESSMENT

$ 10

CMN 150V Midterm # 1 (Answered)

$ 14

iHuman Case 4 Scratch Sheet Justin Johnson

$ 8

(answered with rationales)Learning System RN 3.0 Maternal Newborn Final Quiz