Mississippi State University INS 3503 LI Exam 2 Ch 9 11-19 22

Document Content and Description Below

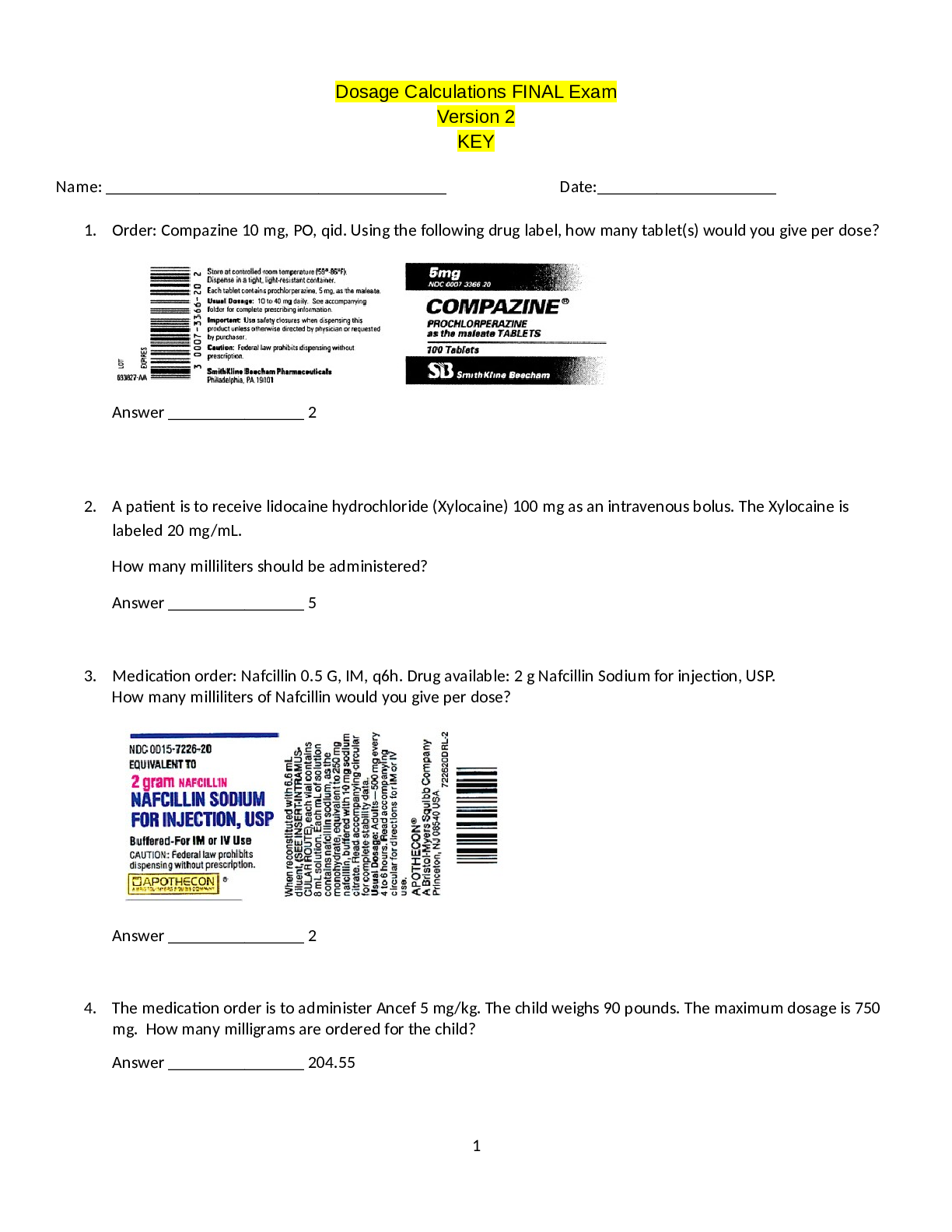

A policy that originally is not a modified endowment contract will be subject to re-testing if there is a "material change" in the contract. Which of the following would likely be a material change?... Answer Selected Answer: Increases in death benefits because of premiums paid for the policy to support the first seven contract years of benefits. Correct Answer: An exchange of one policy for another policy in a 1035 exchange. • Question 2 0 out of 5 points A policy that automatically increases the death benefit without evidence of insurability will typically violate the MEC rules. Answer Selected Answer: True Correct Answer: False • Question 3 5 out of 5 points A modified endowment contract is a life insurance policy that has failed Answer Selected Answer: the seven-pay test Correct Answer: the seven-pay test • Question 4 5 out of 5 points Which item is not a key factor to be weighed in choosing the best variable life or variable universal life policy? Answer Selected Answer: the amount of the cash value guarantees Correct Answer: the amount of the cash value guarantees • Question 5 5 out of 5 points Which of the following could never be treated as a modified endowment contract?Answer Selected Answer: A single-premium policy that was entered into on June 1, 1988. Correct Answer: A single-premium policy that was entered into on June 1, 1988. • Question 6 0 out of 5 points All universal life policies have a guaranteed minimum interest rate, generally ranging from four to six percent. Answer Selected Answer: False Correct Answer: True • Question 7 0 out of 5 points Once a policy is classified as a modified endowment contract, with certain corrections, it can be later treated as not a modified endowment contract. Answer Selected Answer: True Correct Answer: False • Question 8 0 out of 5 points Variable life or variable universal life insurance is well-suited to individuals desiring a minimum basic level of coverage. Answer Selected Answer: True Correct Answer: False • Question 9 5 out of 5 points Variable life is a whole life policy where the policyowners bear all investment risk. Answer Selected Answer: True Correct Answer: True • Question 10 5 out of 5 points One disadvantage of universal life is that policy owners bear more risk of adverse trends in mortality or expenses than if they owned traditional wholelife policies. Answer Selected Answer: True Correct Answer: True • Question 11 5 out of 5 points Variable Life and Variable Universal Life are especially suited for many business insurance situations where flexibility and growth of cash value are attractive features. Answer Selected Answer: True Correct Answer: True • Question 12 0 out of 5 points Which of the following is true regarding the interest credited to universal life policies? Answer Selected Answer: Insurance companies are no longer allowed complete freedom in interest crediting due to some companies abusing such discretion in the past. Correct Answer: The rate used may be linked to a well-known index of yields if it exceeds a minimum rate guaranteed in the policy. • Question 13 0 out of 5 points Which of the following statements regarding universal life insurance is true? Answer Selected Answer: Because universal life is a current-assumption policy universal life is a security and a prospectus must be provided before each sale. Correct Answer: Universal life allows policyowners to participate in favorable investment, mortality and expense experience of the company. insurance policies. • Question 14 5 out of 5 points A key feature of variable life insurance is AnswerSelected Answer: there is no guaranteed minimum cash value Correct Answer: there is no guaranteed minimum cash value • Question 15 0 out of 5 points Which of the following problems could be caused by the flexibility offered by a universal life insurance policy? Answer Selected Answer: Skipping even one premium payment will cause the policy to lapse. Correct Answer: A death benefit reduction may cause the policy to be classified as a modified endowment contract. • Question 16 5 out of 5 points Most universal life policies are issued with front-end load charges rather than back-end load charges. Answer Selected Answer: False Correct Answer: False • Question 17 5 out of 5 points As long as cash values are sufficient to cover policy charges, a universal life policy owner may skip premium payments. Answer Selected Answer: True Correct Answer: True • Question 18 0 out of 5 points Which of the following statements regarding universal life insurance is not true? Answer Selected Answer: If the policyowner skips a premium payment the policy will not lapse. CorrectAnswer: The policy is not susceptible to inadvertently becoming a modified endowment contract. • Question 19 5 out of 5 points Which of the following items are NOT treated as income-first when distributed from a modified endowment contract? Answer Selected Answer: dividends retained by the insurer to premiums or other consideration for the contract Correct Answer: dividends retained by the insurer to premiums or other consideration for the contract • Question 20 5 out of 5 points Which of the following statements about the tax aspects of ownership of variable life insurance is false? Answer Selected Answer: Gains received are taxable at capital gains rates. Correct Answer: Gains received are taxable at capital gains rates. • 5 out of 5 points If a term policy is convertible it means the policy: Answer Selected Answer: gives the policyholder a contractual right to change the term policy for some other type of life insurance policy without evidence of insurability Correct Answer: gives the policyholder a contractual right to change the term policy for some other type of life insurance policy without evidence of insurability • Question 2 5 out of 5 points Advantages of ordinary level-premium whole life include all of the following except AnswerSelected Answer: Interest on policy loans is generally non deductible Correct Answer: Interest on policy loans is generally non deductible • Question 3 5 out of 5 points Level-premium whole life insurance policies allow policyowners to borrow amounts under the policy. Typical loan provisions include which of the following requirements? [Show More]

Last updated: 2 years ago

Preview 1 out of 15 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$15.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Sep 12, 2021

Number of pages

15

Written in

Additional information

This document has been written for:

Uploaded

Sep 12, 2021

Downloads

0

Views

105

.png)

.png)