Financial Accounting > QUESTIONS & ANSWERS > Foothill College - ACTG 59 Midterm 1 Midterm 1. 100 Questions and Answers. 100% Score. (All)

Foothill College - ACTG 59 Midterm 1 Midterm 1. 100 Questions and Answers. 100% Score.

Document Content and Description Below

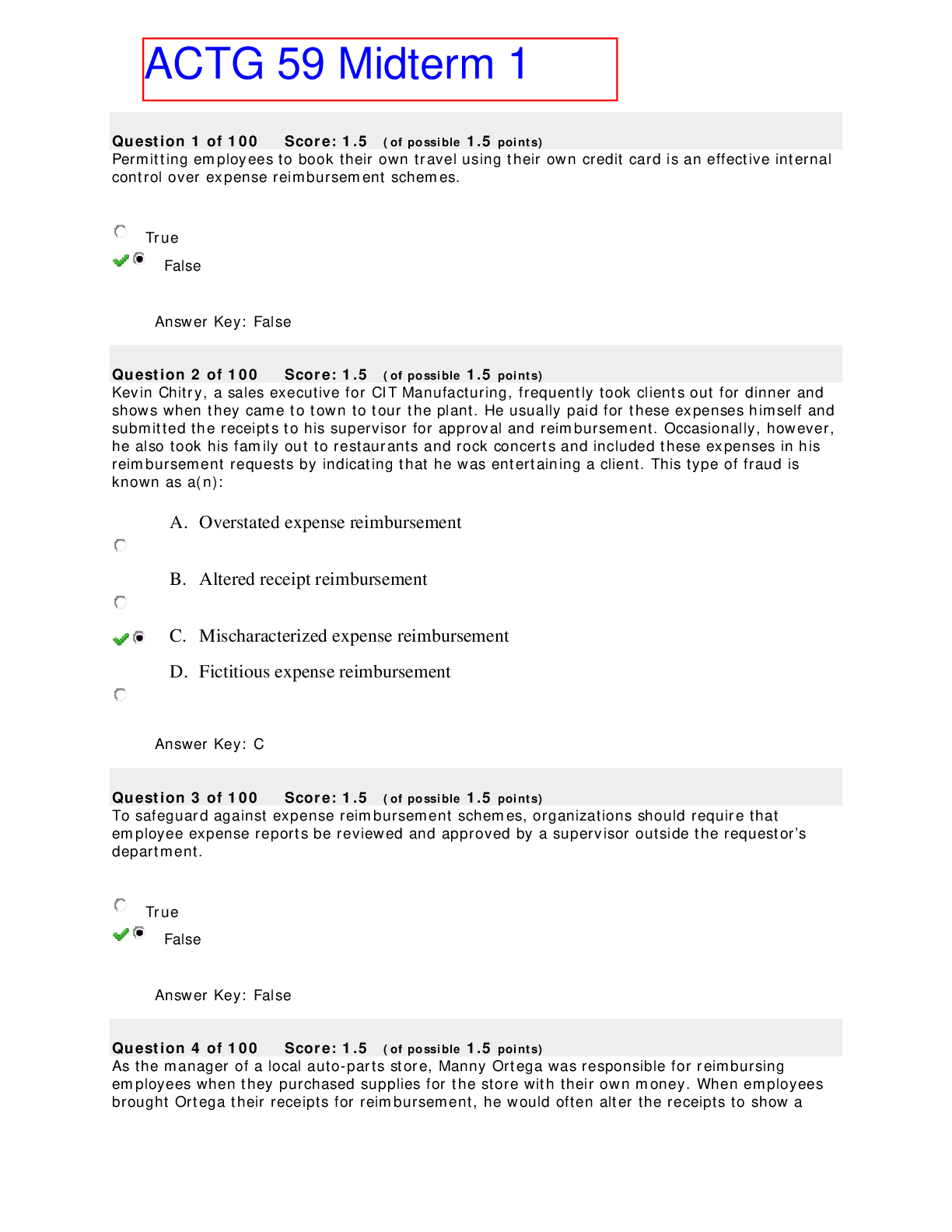

Question 1 of 100 Score: 1.5 (of possible 1.5 points) Permitting employees to book their own travel using their own credit card is an effective internal control over expense reimbursement schemes. ... True False Answer Key: False Question 2 of 100 Score: 1.5 (of possible 1.5 points) Kevin Chitry, a sales executive for CIT Manufacturing, frequently took clients out for dinner and shows when they came to town to tour the plant. He usually paid for these expenses himself and submitted the receipts to his supervisor for approval and reimbursement. Occasionally, however, he also took his family out to restaurants and rock concerts and included these expenses in his reimbursement requests by indicating that he was entertaining a client. This type of fraud is known as a(n): A. Overstated expense reimbursement B. Altered receipt reimbursement C. Mischaracterized expense reimbursement D. Fictitious expense reimbursement Question 3 of 100 Score: 1.5 (of possible 1.5 points) To safeguard against expense reimbursement schemes, organizations should require that employee expense reports be reviewed and approved by a supervisor outside the requestor’s department. True False Answer Key: False Question 4 of 100 Score: 1.5 (of possible 1.5 points) As the manager of a local auto-parts store, Manny Ortega was responsible for reimbursing employees when they purchased supplies for the store with their own money. When employees brought Ortega their receipts for reimbursement, he would often alter the receipts to show alarger amount. Then he would ring a “no sale” on the cash register, remove the full amount per the altered receipt, and pocket the excess. Because the employee received the expected amount and the register totals remained in balance, Ortega was able to continue this scheme for nearly 2 years before being caught. What type of fraud did Ortega commit? A. Overstated expense reimbursement scheme B. Mischaracterized expense reimbursement scheme C. None of the above D. Register disbursement scheme Question 5 of 100 Score: 1.5 (of possible 1.5 points) Daniel Isley works as an internal auditor for Atlantic Insurance Co. While reviewing the company’s travel and entertainment expenses, Isley noticed that one employee had submitted several receipts from Chase’s Restaurant for round-dollar amounts just under the company’s reimbursement limit. Further, the receipts were consecutively numbered, but were submitted over a six-month period. What type of scheme did Isley most likely uncover? A. Fictitious expense reimbursement B. None of the above C. Multiple reimbursement D. Mischaracterized reimbursement Question 6 of 100 Score: 0 (of possible 1.5 points) Expense reimbursement schemes include which of the following? A. All of the above B. Mischaracterized expenses C. Overstated expensesD. Multiple reimbursements Question 7 of 100 Score: 1.5 (of possible 1.5 points) Claiming personal travel as a business expense is an example of what type of expense reimbursement scheme? A. Altered expense reimbursements B. Multiple reimbursements C. Overstated expense reimbursements D. Mischaracterized expense reimbursements Question 8 of 100 Score: 1.5 (of possible 1.5 points) Charlene DiAngelo is a sales manager for Northwest Paper & Plastics. On April 11, she took some clients out for a business lunch to discuss a potential contract. When she returned to the office, she made a photocopy of her restaurant receipt. Using correction fluid, she changed the date on the photocopy to read June 11. She submitted the original restaurant receipt with a reimbursement request on April 11 and held on to the photocopy for 2 months. On June 12, she submitted the altered photocopy along with a second reimbursement request. What type of fraud scheme did DiAngelo commit? A. Fictitious expense reimbursement B. Altered receipt C. Billing D. Multiple reimbursement Question 9 of 100 Score: 1.5 (of possible 1.5 points) Which of the following best describes what is meant by “the tone at the top.” A. fraud perpetrators are given a second chance.B. fraud perpetrators are severely punished. C. expectations of honesty are implied. D. a proper example is set by management. Question 10 of 100 Score: 1.5 (of possible 1.5 points) _____________ is gathered from individuals using investigative techniques such as interviewing, interrogation, and honesty tests. A. Personal observation B. Physical evidence C. Testimonial evidence D. Documentary evidence Question 11 of 100 Score: 0 (of possible 1.5 points) An investigator is conducting a surveillance operation on an individual. Surveillance is what type of fraud investigation evidence? A. Testimonial evidence B. Physical evidence C. Personal observation D. Documentary evidence Question 12 of 100 Score: 1.5 (of possible 1.5 points) What is the term that would lead a reasonable, prudent professional to believe a fraud has occurred, is occurring, or will incur? A. Probation B. Suspension C. Predication D. Retaliation Question 13 of 100 Score: 1.5 (of possible 1.5 points) John Pearson (CPA) is investigating a possible management fraud. He found an email on an employee's computer to use as evidence in the case. This email is an example of __________? A. Physical evidence B. Testimonial evidence C. Personal observation D. Documentary evidence Question 14 of 100 Score: 1.5 (of possible 1.5 points) For a fraud investigation to be conducted, the following is a prerequisiteA. Rationalization B. A specific allegation of fraud against another party C. Consistent bottom-line improvementD. Predication Question 15 of 100 Score: 1.5 (of possible 1.5 points) Use Benford’s Law to answer the following question. 5 will be the first digit of a random number set______ A. about the same as 6. B. more often than 1. C. more often than 3. D. less often than 4. Question 16 of 100 Score: 1.5 (of possible 1.5 points) Use Benford’s law to answer the following question. The first digit of random data sets will begin with a ______ more often than 2. A. 3 B. 4 C. 7 D. 1 Question 17 of 100 Score: 1.5 (of possible 1.5 points) Use Benford’s law to answer the following question.The first digit of random data sets will begin with a ______ more often than 2. A. 3 B. 1 C. 4 D. 7 Question 18 of 100 Score: 1.5 (of possible 1.5 points) You are a fraud investigator working with complex data sets. You decide to the split the data sets into case-specific tables. This process is known as_______ A. Stratification B. Deviation C. Soundex D. Data mining Question 19 of 100 Score: 0 (of possible 1.5 points) How can Benford's law help detect fraud? A. By focusing on unexplained changes. B. By establishing weaknesses in the accounting control system. C. By identifying accounting anomalies. D. By showing attempts by fraudsters to make stolen amounts look random. Question 20 of 100 Score: 1.5 (of possible 1.5 points) The most important factor in preventing cash larceny from the deposit is: A. None of the above B. Having a visible management presence in the mailroom C. Separating the duties of the deposit function D. Having two employees deliver the deposit to the bank Question 21 of 100 Score: 1.5 (of possible 1.5 points) To prevent cash larceny through falsification of cash counts, an independent employee should verify the cash count in each register or cash box at the end of each shift. True False Question 22 of 100 Score: 1.5 (of possible 1.5 points) The central weakness of a cash larceny scheme is the resulting imbalance in the organization’s accounting records. True False Question 23 of 100 Score: 1.5 (of possible 1.5 points) According to the 2012 Report to the Nations on Occupational Fraud and Abuse, cash larceny schemes had the largest median loss of all cash misappropriations.True False Answer Key: False Question 24 of 100 Score: 1.5 (of possible 1.5 points) Which of the following antifraud controls can help prevent and detect cash larceny from the deposit? A. Preparing the deposit slip to show each individual check and money order along with currency receipts B. All of the above C. Comparing the bank authenticated deposit slip with the general ledger posting of the day’s receipts D. Having two copies of the bank statement delivered to different persons in an organization Question 25 of 100 Score: 1.5 (of possible 1.5 points) According to the 2012 Report to the Nations on Occupational Fraud and Abuse, cash larceny schemes were the least common form of cash misappropriations. True False Question 26 of 100 Score: 1.5 (of possible 1.5 points) Dorothy McNally stole $232 from the company deposit while on the way to the bank. She can conceal the theft by recording the missing amount on the bank reconciliation as a(n): A. None of the above B. Credit memo C. Outstanding check D. Deposit in transit Question 27 of 100 Score: 1.5 (of possible 1.5 points) In one of the case studies in the textbook, Laura Grove was the head teller at a bank in Tennessee. As the head teller, she had the authority to open the night depository along with another teller. For security reasons, each teller only had half of the combination to the vault. In the end, Grove opened the vault and stole two deposit bags worth approximately $16,000. How was the case settled? A. She was prosecuted but received probation in lieu of prison time. B. She paid the bank back in lieu of prosecution. C. She was prosecuted and sentenced to eighteen months in jail. D. She was dismissed and signed a promissory note to repay the money. Question 28 of 100 Score: 1.5 (of possible 1.5 points) If an employee had the responsibility of both writing checks and making deposits to a bank, they would have ____. A. Financial pressure B. Perceived opportunity C. Rationalization Question 29 of 100 Score: 1.5 (of possible 1.5 points) A fraud perpetrator named Maximus is able to convince a potential victim that she will receive a job promotion if she supports him in a fraud scheme. Maximus is using which type of power? A. Expert power B. Coercive powerC. Reward power D. Legitimate power Question 30 of 100 Score: 1.5 (of possible 1.5 points) Which of the following statements is true? A. Research shows that only people with a criminal mind set can commit fraud. B. When fraud does occur, the most common reaction by those around the fraud is confession. C. Most fraud perpetrators have profiles that look like those of other honest people. D. Fraud perpetrators usually can be distinguished from others on the basis of demographic characteristics. Question 31 of 100 Score: 1.5 (of possible 1.5 points) Financial pressures associated with fraud include all but which statement? A. Personal financial losses B. High bills or personal debt C. Living beyond one's means D. Getting even with the employer Question 32 of 100 Score: 1.5 (of possible 1.5 points) Sam is persuaded by a trusted friend to participate in fraud. Sam rationalizes the actions as being justifiable. Which type of power is being employed on Sam? A. Coercive powerB. Referent power C. Reward power D. Legitimate power Question 33 of 100 Score: 1.5 (of possible 1.5 points) Which control structure components are "modeling" and "labeling" sub-components of? A. Review B. Accounting system C. Control procedure D. Control environment Question 34 of 100 Score: 1.5 (of possible 1.5 points) You are a fraud investigator just hired to begin an engagement. You create a tool that considers all the aspects of the fraud that are currently known to you. With this tool you also establish different fraud theories. This tool is also known as a ______________ A. Vulnerability chart B. Surveillance log C. Perceptual map D. Pareto chart Question 35 of 100 Score: 1.5 (of possible 1.5 points) You are an investigator on an engagement. You will use surveillance to investigate ________ A. key internal controls. B. conversion possibilities. C. theft acts. D. concealment possibilities. Question 36 of 100 Score: 1.5 (of possible 1.5 points) From the options below, which is not a type of surveillance? A. Electronic surveillance B. Stationary or fixed point C. Audit D. Tailing Question 37 of 100 Score: 1.5 (of possible 1.5 points) Which amendment to the US constitution protects subjects of covert operations against unreasonable breaches of privacy? A. Fifth Amendment B. Seventh AmendmentC. Second Amendment D. Fourth Amendment Question 38 of 100 Score: 1.5 (of possible 1.5 points) You are an investigator on an engagement. You will use surveillance to investigate ________ A. theft acts. B. conversion possibilities. C. concealment possibilities. D. key internal controls. Question 39 of 100 Score: 1.5 (of possible 1.5 points) From the options below, which is not an analytical fraud symptom? A. Consistent cash shortages B. Overriding of existing controls C. Unreasonably high expenses D. Excess purchases Question 40 of 100 Score: 1.5 (of possible 1.5 points) Identify the stress coping behavior sequence that an individual will often exhibit after committing fraud. A. Fear - Guilt - Stress - Behavior changesB. Guilt - Fear - Stress - Behavior changes C. Fear - Guilt - Behavior changes - Stress D. Guilt - Stress - Fear - Behavior changes Question 41 of 100 Score: 0 (of possible 1.5 points) An accounting anomaly fraud symptom would include the following exampleA. Excess purchases B. Too many debit or credit memos C. Missing documents D. Inadequate accounting system Question 42 of 100 Score: 1.5 (of possible 1.5 points) A Sr. Accountant makes a fictitious journal entry (an expense transaction) to conceal fraud. This journal entry is an example of which fraud symptom? A. Analytical anomaly B. Unusual behavior C. Internal control weakness D. Accounting anomaly Question 43 of 100 Score: 1.5 (of possible 1.5 points)An individual commits fraud and does not feel stress. This person may be a___________ A. Utilitarian B. Agnostic C. Altruist D. Psychopath Question 44 of 100 Score: 1.5 (of possible 1.5 points) ____________________ is the theft of cash from a victim entity prior to its entry in an accounting system. A. Skimming B. A fictitious disbursement C. Larceny D. Conversion Question 45 of 100 Score: 1.5 (of possible 1.5 points) Which of the following computer audit tests can be used to detect skimming schemes? A. Identifying unique journal entries to the cash account B. Summarizing by employee the difference between the cash receipt report and the sales register system C. Joining the customer statement report file to the accounts receivable and reviewing for balance differences D. Extracting invoices paid by cash Question 46 of 100 Score: 1.5 (of possible 1.5 points) Which of the following techniques is not used to conceal sales skimming schemes? A. Inventory padding B. Recording false voids C. Lapping D. Destroying records of transaction Question 47 of 100 Score: 1.5 (of possible 1.5 points) To cover up a skimming scheme in which the employee takes cash from the register, the employee must make a voided sale in order for the register to balance. True False Answer Key: False Question 48 of 100 Score: 1.5 (of possible 1.5 points) Computing the percentage of assigned time to unassigned time for employees is one method to detect an employee skimming scheme. True False Question 49 of 100 Score: 1.5 (of possible 1.5 points) The concealment of receivables skimming can be difficult because: A. The audit trail must be destroyed. B. The incoming payments are expected. C. All of the aboveD. Inventory must be padded to conceal shrinkage. Question 50 of 100 Score: 1.5 (of possible 1.5 points) In the Fraud Tree, asset misappropriations are broken down into cash and non-cash schemes. Which of the following is not considered a misappropriation of cash? A. Concealed expenses B. Larceny C. Skimming D. Fraudulent disbursements Question 51 of 100 Score: 1.5 (of possible 1.5 points) In one of the case studies in the textbook, Brian Lee, a top-notch plastic surgeon, collected payments from his patients without giving a cut to the clinic where he practiced. How was he punished? A. He was convicted of grand larceny and sentenced to probation. B. He was sued in civil court for the amount of the loss. C. He was terminated from the practice and was required to make full restitution in lieu of prosecution. D. He was allowed to continue to practice at the clinic but was required to make full restitution. Question 52 of 100 Score: 1.5 (of possible 1.5 points) In one of the case studies in the textbook, Jerry Harkanell worked as an administrative assistant for a large San Antonio hospital, where his clerical duties included the submission of the payroll information for his unit. He found that he could add hours to the timesheets and receive extrapay. He continued to alter his timesheets until he was finally caught. How was his scheme detected? A. The payroll department sent the timesheets for one pay period back to the supervisor for review when a suspicious number of hours had been indicated. B. An overtime audit was conducted revealing that Harkanell had worked an unusual number of hours compared to others in the department. C. An exception report showed that Harkanell had claimed overtime hours for a period when there was no need to work overtime. D. The internal auditors received an anonymous tip. Question 53 of 100 Score: 1.5 (of possible 1.5 points) Which of the following controls will help prevent and detect falsified hours and salary schemes? A. Supervisors return authorized timecards to the employees for review before they are sent to the payroll department. B. All of the above C. The duties of payroll preparation, authorization, and distribution are segregated. D. Sick leave and vacation time are monitored for excesses by the payroll department. Question 54 of 100 Score: 1.5 (of possible 1.5 points) Which of the following computer audit tests can be used to detect ghost employee schemes? A. Compare employees reported per timecard system to the payroll system. B. Extract all employees without a social security number. C. All of the above D. Extract users who can write checks and also add new employees in the payroll and timecard system. Question 55 of 100 Score: 1.5 (of possible 1.5 points) Orange Publishing hired Moe McDonnell, CFE, to investigate some large variances in the company’s labor costs. While looking through the payroll records for the shipping department, McDonnell noticed several employees who claimed extensive overtime during pay periods in which the company’s incoming and outgoing shipments were minimal. McDonnell pulled the timesheets for these pay periods and noticed that those belonging to the suspect employees had signatures that didn’t match the signatures on the other timesheets. What type of fraud might these findings indicate? A. Commission scheme B. Falsified hours and salary scheme C. Ghost employee scheme D. Overstated expenses scheme Question 56 of 100 Score: 1.5 (of possible 1.5 points) Comparing actual payroll expenses to budget projections can help identify falsified hours and salary schemes. True False Question 57 of 100 Score: 1.5 (of possible 1.5 points) Which of the following is not a type of payroll scheme? A. Falsified hours and salary scheme B. Ghost employee scheme C. False deduction scheme D. Commission scheme Question 58 of 100 Score: 1.5 (of possible 1.5 points) Salaried ghost employees are generally easier to create and more difficult to conceal than hourly ghost employees True False Question 59 of 100 Score: 1.5 (of possible 1.5 points) Comparing salaried employees’ gross pay from one pay period to the next is one way of testing for payroll fraud. True False Question 60 of 100 Score: 1.5 (of possible 1.5 points) Which group is the primary victim of financial statement fraud? A. Analysts B. Organizations that buy goods or services C. Stockholders D. Middle management Question 61 of 100 Score: 1.5 (of possible 1.5 points) Why does one party usually file a complaint against another in a civil case? A. penalty.B. financial restitution. C. imprisonment. D. proving the other party wrong. Question 62 of 100 Score: 1.5 (of possible 1.5 points) By what other name is "management fraud" referred to as? A. investment fraud. B. financial statement fraud. C. affinity fraud. D. stockholder fraud. Question 63 of 100 Score: 1.5 (of possible 1.5 points) What is the burden of proof in a criminal case? A. the preponderance of evidence. B. beyond a reasonable doubt. C. the preponderance of knowledge and power. D. it lies with the defendant. Question 64 of 100 Score: 1.5 (of possible 1.5 points) What is the burden of proof for a plaintiff to be successful in a civil case?A. To a degree of reasonable mitigation. B. To the standard of prima facie. C. Beyond a reasonable doubt. D. Preponderance of evidence. Question 65 of 100 Score: 1.5 (of possible 1.5 points) In one of the case studies in the textbook, Melissa Robinson, who worked as an executive secretary for a worldwide charitable organization and was active in her children’s school, was also a thief. As one of two people allowed to sign checks on the organization’s bank accounts, she learned early on that she could forge the second person’s signature without anyone becoming suspicious. How was she finally caught? A. The auditors discovered her fraud during an annual audit of the books. B. New officers were elected, and they took the accounting books from her. C. A co-worker contacted the organization’s executive director when she found that a company check had been written to the children’s school for Robinson’s personal items. D. Robinson’s husband tipped off the audit committee after he became suspicious of some of Robinson’s purchases. Question 66 of 100 Score: 1.5 (of possible 1.5 points) In one of the case studies in the textbook, Ernie Phillips was a CPA who had fallen on hard times both financially and personally. He eventually got a job as a controller for a friend who had just been named as the receiver for a financial services company. Within a short period of time Phillips began writing checks to himself that had nothing to do with payroll. How was the fraud discovered? A. The receiver received a call from the bank asking him to verify a check. B. The president received a bank statement containing canceled checks that had been written to Phillips. C. The operations manager found a check made payable to Phillips while searching Phillips’ desk for some accounting records.D. A vendor received a check in error and reported it to the operations manager. Question 67 of 100 Score: 1.5 (of possible 1.5 points) Mary Duncan is an internal auditor for the Western Realty Group. Recently, she ran a program that extracted checks that were out of the normal sequence. She found that four or five checks were written every month that fit this category. Based on the information given, which of the following schemes is likely occurring? A. Personal purchases scheme B. Shell company scheme C. Forged maker scheme D. Multiple reimbursement scheme Question 68 of 100 Score: 1.5 (of possible 1.5 points) In one of the case studies in the textbook, Ernie Phillips was a CPA who had fallen on hard times both financially and personally. He eventually got a job as a controller for a friend who had just been named as the receiver for a financial services company. Within a short period of time Phillips began writing checks to himself that had nothing to do with payroll. What happened to Phillips? A. He pleaded guilty to fraud and grand theft and spent 24 months in prison. B. He paid the money back by mortgaging his home. C. He quit his job and moved to another state. D. He was charged criminally, and while out on bail, he fled with his family. Question 69 of 100 Score: 1.5 (of possible 1.5 points) In one of the case studies in the textbook, Melissa Robinson, who worked as an executive secretary for a worldwide charitable organization and was active in her children’s school, was also a thief. As one of two people allowed to sign checks on the organization’s bank accounts,she learned early on that she could forge the second person’s signature without anyone becoming suspicious. What red flags were present that indicated that something wasn’t appropriate? A. Robinson would not take vacation leave. B. There were a lot of missing files that the auditors couldn’t locate during their annual audit. C. All of the above D. Robinson would not release any financial information when requested and gave excuses for why it wasn’t available. Question 70 of 100 Score: 1.5 (of possible 1.5 points) In one of the case studies in the textbook, Melissa Robinson, who worked as an executive secretary for a worldwide charitable organization and was active in her children’s school, was also a thief. As one of two people allowed to sign checks on the organization’s bank accounts, she learned early on that she could forge the second person’s signature without anyone becoming suspicious. How was Robinson punished? A. She resigned, and a civil suit was filed to recover the loss. B. She was found guilty and ordered to make restitution to the organization and its insurance company. C. Charges were dismissed with prejudice when the evidence was thrown out on a technicality. D. She was allowed to resign and agreed to pay the money back. Question 71 of 100 Score: 1.5 (of possible 1.5 points) Mavis Bosman works as an accounts receivable clerk at Brooks Publishing. She steals an incoming check from a customer and cashes it at a grocery store by forging the endorsement on the back of the check. This is an example of a check tampering scheme. True FalseAnswer Key: False Question 72 of 100 Score: 1.5 (of possible 1.5 points) Producing a counterfeit check using the company’s logo and bank account number is one type of concealed check scheme. True False Answer Key: False Question 73 of 100 Score: 1.5 (of possible 1.5 points) In one of the case studies in the textbook, Bob Walker was the head cashier for a discount drug store who perpetrated his fraud scheme by issuing fictitious refunds. How was the fraud discovered? A. The bookkeeper noticed an unusually large number of policy overrides by Walker. B. The internal auditor developed a computer program that identified cashiers with an unusually high number of returns. C. An anonymous tip from the company’s hotline came into the asset protection department. D. The store manager caught Walker pocketing cash. Question 74 of 100 Score: 1.5 (of possible 1.5 points) According to the 2012 Report to the Nations on Occupational Fraud and Abuse, register disbursement schemes were the most frequently reported type of fraudulent disbursement scheme. True False Answer Key: False Question 75 of 100 Score: 1.5 (of possible 1.5 points) When an employee perpetrates a credit card refund scheme, the perpetual inventory will show a greater amount than the physical inventory.True False Question 76 of 100 Score: 1.5 (of possible 1.5 points) Nicolas Barrens conspired with his manager to steal nearly $6,000 over 2 months from the grocery store where they worked. Each time Nicolas rang up a customer at the register, he asked the customer if he’d like a receipt. When a customer said no, Nicolas pretended to discard the receipt in the trash, but actually slipped the receipt into his pocket. At the end of his shift, he filled out a void slip for each of these sales and submitted them to his supervisor for approval. With the original receipt and the approved void slip, Nicolas removed cash from the register in the amount of the voided sales and split the proceeds with his supervisor. Nicolas committed what type of fraud scheme? A. Skimming B. None of the above C. False voids D. Fictitious expenses Question 77 of 100 Score: 1.5 (of possible 1.5 points) Leslie White, CFE, was called in to investigate suspicious activity at Anderson’s Department Store. During her investigation, she ran a test to search for customer sales and refunds that occurred on the same day. She also summarized refunds by employee and extracted the names of all employees who can post both refunds and inventory adjustments. What type of scheme is Leslie most likely looking for? A. Skimming B. Unconcealed larceny C. Fictitious refunds D. Fraudulent reimbursements Question 78 of 100 Score: 1.5 (of possible 1.5 points) According to the 2012 Report to the Nations on Occupational Fraud and Abuse, median losses due to register disbursement schemes were the highest of all the fraudulent disbursement schemes. True False Answer Key: False Question 79 of 100 Score: 1.5 (of possible 1.5 points) An excessive number of reversing sales transactions at the register is an indicator of which of the following schemes? A. Register disbursement B. Multiple reimbursements C. Skimming D. Pass-through scheme Question 80 of 100 Score: 1.5 (of possible 1.5 points) In one of the case studies in the textbook, Bob Walker was the head cashier for a discount drug store who perpetrated his fraud scheme by issuing fictitious refunds. What happened to Walker? A. The store terminated his employment and accepted a promissory note for the amount stolen in return for not turning him over to the police. B. His parole for a previous conviction was revoked and he was returned to prison. C. He was arrested, but disappeared after making bail. D. He was placed on probation and ordered to make full restitution. Question 81 of 100 Score: 1.5 (of possible 1.5 points)What is the last stage in the current (default) model that most organizations typically use for dealing with fraud? A. Investigation B. Fraud incident C. Action D. Resolution Question 82 of 100 Score: 1.5 (of possible 1.5 points) Control activities can be either a preventive control or a detective control. From the options below, which is a detective control? A. Segregation of duties B. System of authorizations C. Independent checks D. Physical safeguards Question 83 of 100 Score: 1.5 (of possible 1.5 points) The most common way in which fraud is detected is through … A. auditors. B. discouraging collusion. C. monitoring employees. D. tips and complaints. Question 84 of 100 Score: 1.5 (of possible 1.5 points) The overall tone of the organization that management establishes through its modeling and labeling, organization, communication, and other activities is called the________ A. support network B. risk mitigation channel C. control environment D. detection framework Question 85 of 100 Score: 1.5 (of possible 1.5 points) From the options below, which allows managers to become aware of employees’ pressures, problems, and rationalizations thereby enabling them to take fraud prevention steps? A. Pygmalion effect B. Office grapevine C. Open door policies D. Code of ethics Question 86 of 100 Score: 1.5 (of possible 1.5 points) Which of the following actions is least likely to help prevent and detect schemes involving fraudulent invoices from non-accomplice vendors? A. Separating the duties of purchasing, authorizing, and distributing payments B. Matching all bank statement items to canceled checksC. Marking “paid” on every voucher that has been paid D. Verifying vendor address changes before disbursements are issued Question 87 of 100 Score: 1.5 (of possible 1.5 points) Warning signs of a shell company scheme include which of the following? A. Invoices lacking details of the items purchased B. A vendor that is not listed in the phone book C. An unexpected and significant increase in “consulting expenses” D. All of the above Question 88 of 100 Score: 1.5 (of possible 1.5 points) In a shell company scheme, which of the following methods might a fraudster use to get a phony invoice approved for payment? A. Any of the above B. Collusion C. Falsification of purchase orders and receiving reports D. A “rubber stamp” supervisor Question 89 of 100 Score: 1.5 (of possible 1.5 points) In one of the case studies in the textbook, Albert Miano, the facilities supervisor for a popular magazine, submitted phony invoices. When Miano received the checks for the phony invoices, he forged the contractor’s signature. He then endorsed the check in his own name. What controls weaknesses did the company have that facilitated Miano’s scheme?A. Accounts payable never checked signatures on the invoices against the authorized signatures on file. B. Miano was allowed to pick up the approved invoices from the administrative vicepresident’s office and deliver them to the accounts payable department. C. Employees in the accounts payable department did not follow departmental procedures. D. All of the above Question 90 of 100 Score: 1.5 (of possible 1.5 points) Which of the following computer audit tests can be used to detect billing schemes? A. Extracting delivery addresses that do not correspond to company locations B. Extracting a sample of vendor open invoices for confirmation with the vendor C. Extracting manual checks and summarizing by vendor and issuer D. All of the above Question 91 of 100 Score: 1.5 (of possible 1.5 points) Purchasing personal items using an organization’s money is what type of scheme? A. Billing scheme B. Skimming scheme C. Pay-and-return scheme D. Larceny scheme Question 92 of 100 Score: 1.5 (of possible 1.5 points) According to the 2012 Report to the Nations on Occupational Fraud and Abuse, the most common fraudulent disbursement schemes were:A. Billing schemes B. Payroll schemes C. Register disbursement schemes D. Check tampering schemes Question 93 of 100 Score: 1.5 (of possible 1.5 points) Sally Fuller is a buyer for GWA publishing company. Her job is to purchase supplies and services for the printing of technical manuals. Her brother sets up a printing company, and Sally hires him to print most of these manuals for GWA. However, rather than actually printing the manuals, her brother hires another printer to do the work, then sells the printed manuals to GWA at a 50 percent markup. As a result, his prices are much higher than the other printers who serve GWA. This type of scheme is most likely a: A. Non-accomplice vendor scheme B. Pay-and-return scheme C. Pass-through scheme D. Inventory-markup scheme Question 94 of 100 Score: 1.5 (of possible 1.5 points) Once sufficient predication has been established, what is the first step a fraud examiner following the fraud theory approach should take? A. Create a hypothesis. B. Interview the suspect. C. Analyze data. D. Interview witnesses. Question 95 of 100 Score: 1.5 (of possible 1.5 points) Research in the Hollinger-Clark study suggests that the best way to deter employee theft is by: A. Strengthening internal controls B. Communicating the organization’s fraud policies to employees C. Increasing sanctions imposed on occupational fraudsters D. Increasing the perception of detection Question 96 of 100 Score: 1.5 (of possible 1.5 points) In the 2012 Report to the Nations on Occupational Fraud and Abuse, financial statement fraud had a higher median loss than asset misappropriation and corruption schemes. True False Question 97 of 100 Score: 1.5 (of possible 1.5 points) When Jill Michaels, an assistant to the director of procurement, moved into her new home, she used the company’s flat bed truck to move her furnishings on an afternoon when her boss was out of town. Which of the following best describes Michael’s act? A. Larceny B. Fraud C. Abuse D. Embezzlement Question 98 of 100 Score: 1.5 (of possible 1.5 points) Richard Moore is the controller for Ajax Company. Recently, he suffered several large losses at the race track, causing him to incur enormous personal debts. Which type of non-sharable financial problem best describes Richard’s situation? A. Business reversal B. Violation of ascribed obligations C. Status gaining D. Physical isolation Question 99 of 100 Score: 1.5 (of possible 1.5 points) Who developed the Fraud Scale? A. Richard C. Hollinger B. Donald R. Cressey C. W. Steve Albrecht D. Joseph T. Wells Question 100 of 100 Score: 1.5 (of possible 1.5 points) The basic tenet of Edwin Sutherland’s theory of differential association is that crime is passed on genetically; that is, the offspring of criminals commit crimes because their parents did. True False Answer Key: False [Show More]

Last updated: 2 years ago

Preview 1 out of 35 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$11.50

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Oct 12, 2020

Number of pages

35

Written in

Additional information

This document has been written for:

Uploaded

Oct 12, 2020

Downloads

0

Views

101