Financial Accounting > QUESTIONS & ANSWERS > University of Phoenix ACC 422. Week-4-Assignment wiley Final. All Questions answered with Calculatio (All)

University of Phoenix ACC 422. Week-4-Assignment wiley Final. All Questions answered with Calculations.

Document Content and Description Below

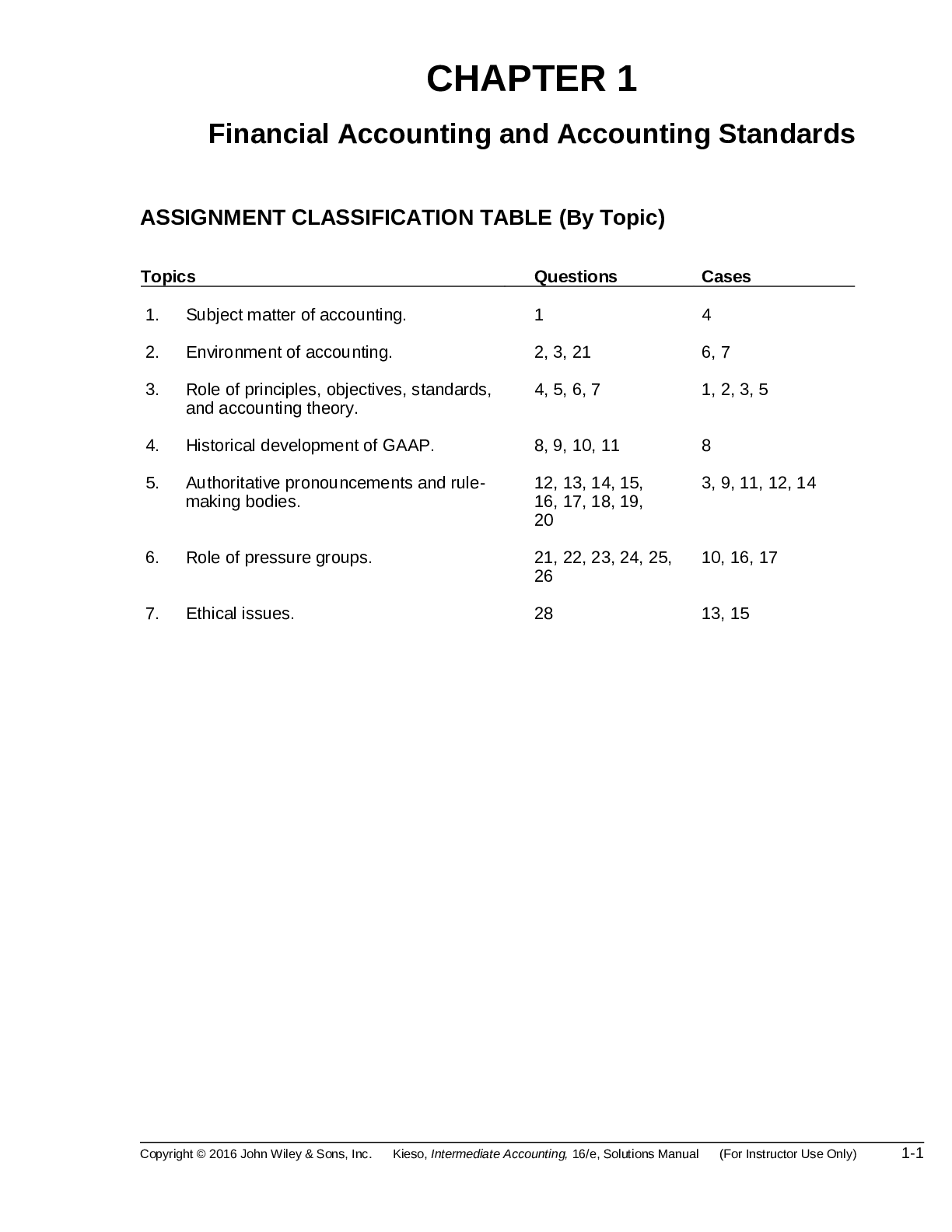

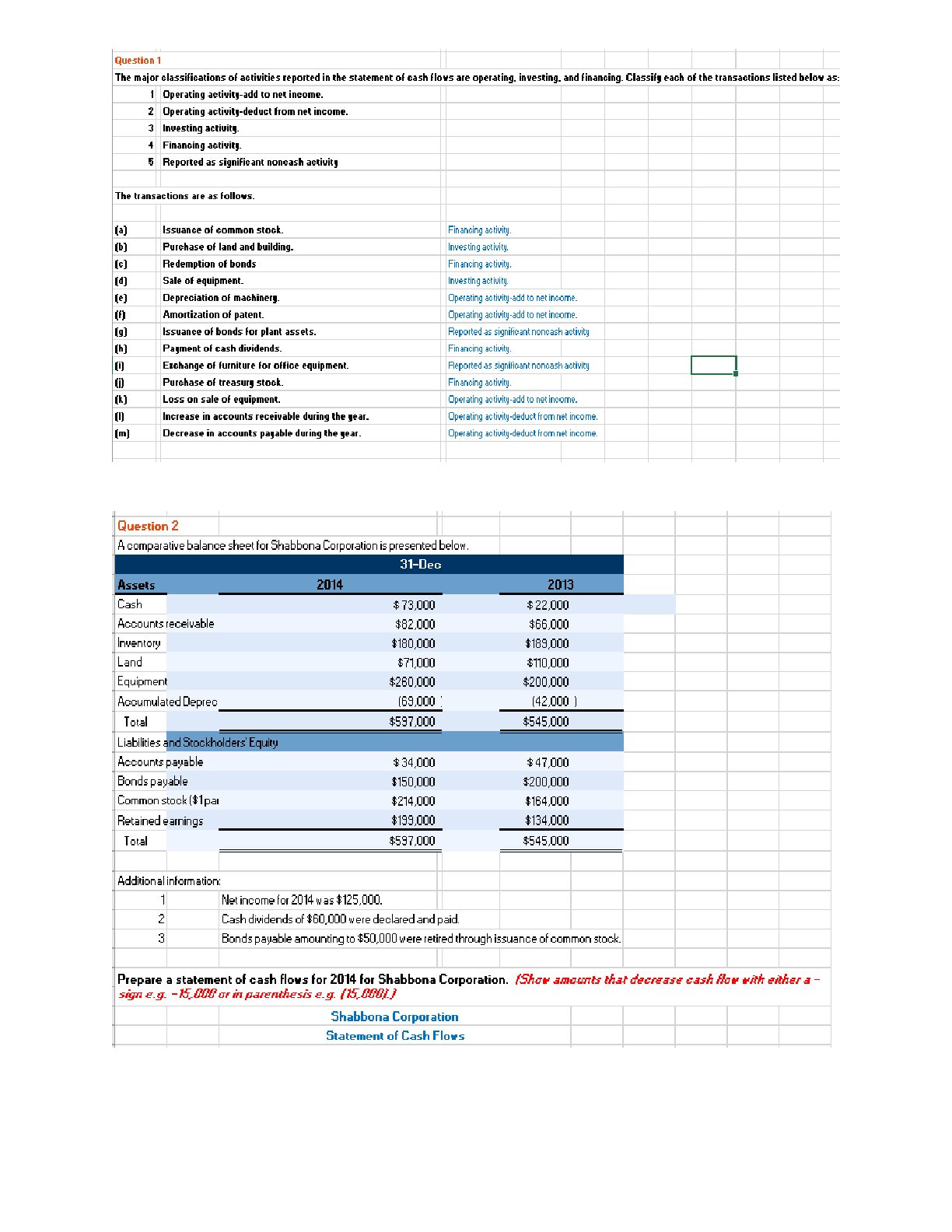

Question 1 Your answer is correct. The major classifications of activities reported in the statement of cash flows are operating, investing, and financing. Classify each of the transactions listed ... below as: 1. Operating activity-add to net income. 2. Operating activity-deduct from net income. 3. Investing activity. 4. Financing activity. 5. Reported as significant noncash activity The transactions are as follows. Transactions Classifications of Activities (a) Issuance of common stock. Financing Activity (b) Purchase of land and building. Investing Activity (c) Redemption of bonds Financing Activity (d) Sale of equipment. Investing Activity (e) Depreciation of machinery. Operating Activity-Add to Net Income (f) Amortization of patent. Operating Activity-Add to Net Income (g) Issuance of bonds for plant assets. Reported as Significant Noncash Activity (h) Payment of cash dividends. Financing Activity (i) Exchange of furniture for office equipment. Reported as Significant Noncash Activity (j) Purchase of treasury stock. Financing Activity (k) Loss on sale of equipment. Operating Activity-Add to Net Income (l) Increase in accounts receivable during the year. Operating Activity-Deduct from Net Income (m) Decrease in accounts payable during the year. Operating Activity-Deduct from Net Income Question 2 A comparative balance sheet for Shabbona Corporation is presented below. December 31 Assets 2014 2013 Cash $ 73,000 $ 22,000 Accounts receivable 82,000 66,000 Inventory 180,000 189,000 Land 71,000 110,000 Equipment 260,000 200,000 Accumulated Depreciation-Equipment (69,000 ) (42,000 ) Total $597,000 $545,000 Liabilities and Stockholders' Equity Accounts payable $ 34,000 $ 47,000 Bonds payable 150,000 200,000 Common stock ($1 par) 214,000 164,000 Retained earnings 199,000 134,000 Total $597,000 $545,000 Additional information: 1. Net income for 2014 was $125,000. 2. Cash dividends of $60,000 were declared and paid. 3. Bonds payable amounting to $50,000 were retired through issuance of common stock. Your answer is correct. Prepare a statement of cash flows for 2014 for Shabbona Corporation. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Shabbona Corporation Determine Shabbona Corporation’s current cash debt coverage ratio, cash debt coverage ratio, and free cash flow. (Round ratios to 2 decimal places., e.g. 0.67.) Current cash debt coverage ratio 3.26 :1 Cash debt coverage ratio 0.61 :1 Free cash flow $ 12000 Comment on its liquidity and financial flexibility. Shabbona has excellent liquidity. Its financial flexibility is good. Question 3 Your answer is correct. Question 4 Your answer is correct. Condensed financial data of Pat Metheny Company for 2014 and 2013 are presented below. PAT METHENY COMPANMPARATIVE BALANCE SHEETS OF DECEMBER 31, 2014 AND 2013 2014 2013 Cash $1,800 $1,150 Receivables 1,750 1,300 Inventory 1,600 1,900 Plant assets 1,900 1,700 Accumulated depreciation (1,200 ) (1,170 ) Long-term investments (held-to-maturity) 1,300 1,420 $7,150 $6,300 Accounts payable $1,200 $900 Accrued liabilities 200 250 Bonds payable 1,400 1,550 Capital stock 1,900 1,700 Retained earnings 2,450 1,900 $7,150 $6,300 PAT METHENY COMPANY INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2014 Sales revenue $6,900 Cost of goods sold 4,700 Gross margin 2,200 Selling and administrative expenses 930 Income from operations 1,270 Other revenues and gains Gain on sale of investments 80 Income before tax 1,350 Income tax expense 540 Net income $810 Cash dividends 260 Income retained in business $550 Additional information: During the year, $70 of common stock was issued in exchange for plant assets. No plant assets were sold in 2014. Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Question 5 Your answer is correct. Condensed financial data of Pat Metheny Company for 2014 and 2013 are presented below. PAT METHENY COMPANY COMPARATIVE BALANCE SHEET AS OF DECEMBER 31, 2014 AND 2013 2014 2013 Cash $1,800 $1,150 Receivables 1,750 1,300 Inventory 1,600 1,900 Plant assets 1,900 1,700 Accumulated depreciation (1,200 ) (1,170 ) Long-term investments (held-to-maturity) 1,300 1,420 $7,150 $6,300 Accounts payable $1,200 $900 Accrued liabilities 200 250 Bonds payable 1,400 1,550 Capital stock 1,900 1,700 Retained earnings 2,450 1,900 $7,150 $6,300 PAT METHENY COMPANY INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2014 Sales revenue $6,900 Cost of goods sold 4,700 Gross margin 2,200 Selling and administrative expenses 930 Income from operations 1,270 Other revenues and gains Gain on sale of investments 80 Income before tax 1,350 Income tax expense 540 Net income $810 Cash dividends 260 Income retained in business $550 Additional information: During the year, $70 of common stock was issued in exchange for plant assets. No plant assets were sold in 2014. Prepare a statement of cash flows using the direct method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) PAT METHENY COMPANY Statement of Cash Flows For the Year Ended December 31, 2014 (Direct Method) [Show More]

Last updated: 2 years ago

Preview 1 out of 8 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$14.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Apr 04, 2022

Number of pages

8

Written in

Additional information

This document has been written for:

Uploaded

Apr 04, 2022

Downloads

0

Views

149