A-level PSYCHOLOGY 7182/1 Paper 1 Introductory topics in psychology Mark scheme June 2021 Version: 1.0 Final Mark Scheme

$ 7

WGU C202 Managing Human Capital Questions and Answers with Complete Solutions

$ 13

American Red Cross ACLS Final Exam (Exam Elaborations questions and Answers 2023)

$ 12.5

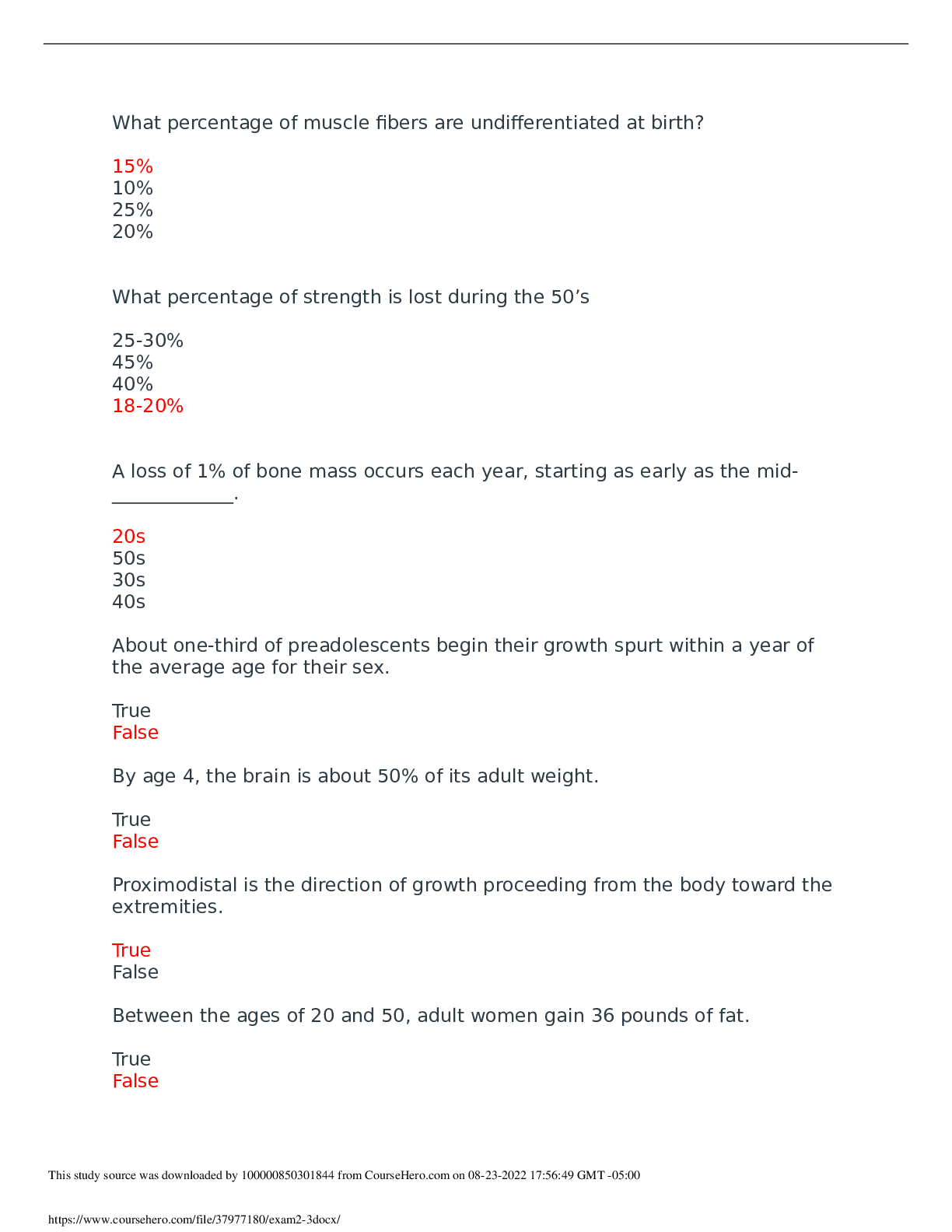

Questions and Answers > California State University, Northridge KIN 477 Developmental Exam 2-3

$ 7

eBook Design Research The Sociotechnical Aspects of Quality, Creativity and Innovation 1st Edition By Dorian Marjanović, Mario Štorga, Stanko Škec

$ 30

.png)

Pearson Edexcel Level 3 GCE Biology A (Salters Nuffield) Advanced Subsidiary PAPER 1: Lifestyle, Transport, Genes and Health/.;

$ 13.5

(2).png)

Stuvia-1560089-edexcel-maths-a-level-paper-32-mechanics-ms (1) (2).pdf