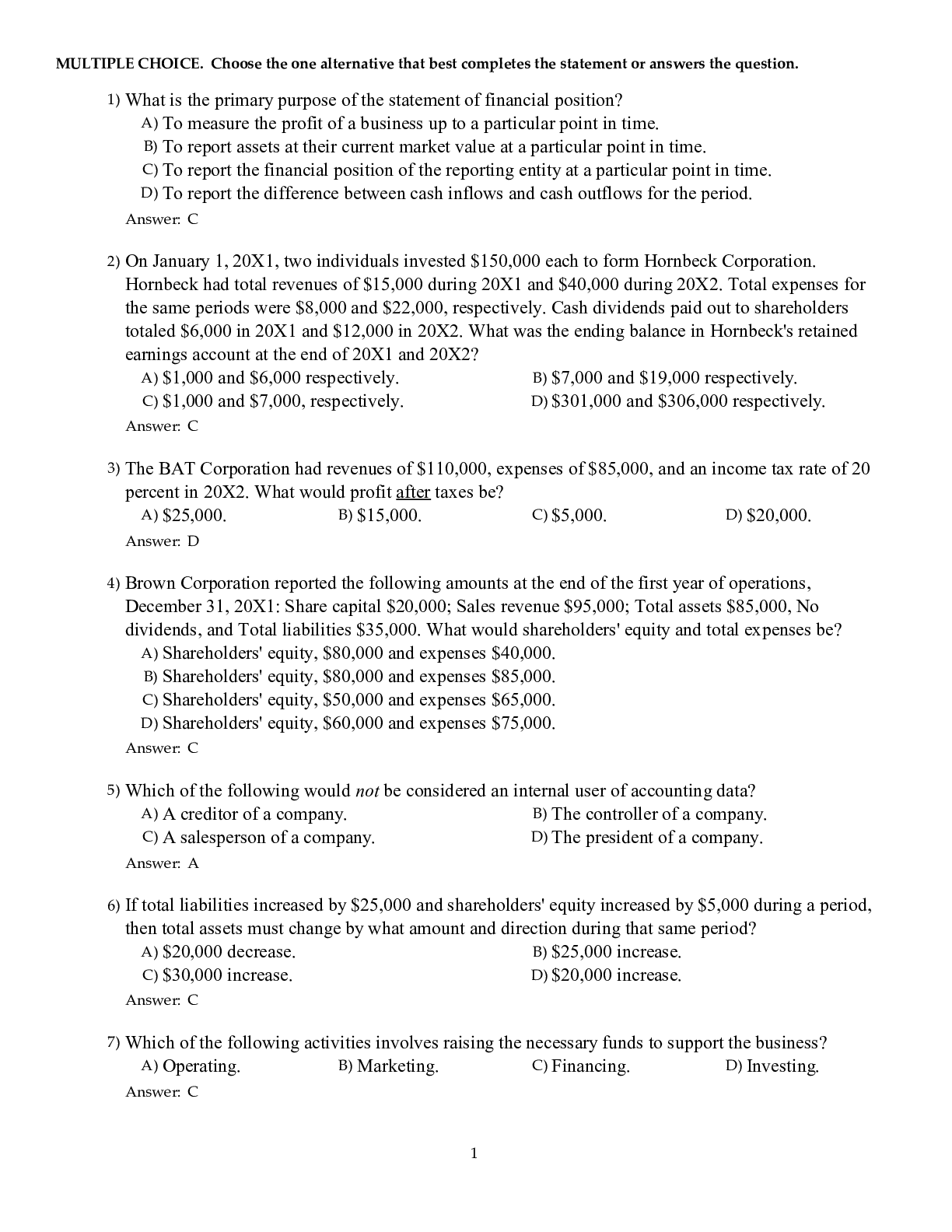

CHAPTER 1—INTRODUCTION TO COST ACCOUNTING

MULTIPLE CHOICE

1. The business entity that converts purchased raw materials into finished goods by using labor,

technology, and facilities is a:

a. Manufacturer.

b. Merchan

...

CHAPTER 1—INTRODUCTION TO COST ACCOUNTING

MULTIPLE CHOICE

1. The business entity that converts purchased raw materials into finished goods by using labor,

technology, and facilities is a:

a. Manufacturer.

b. Merchandiser.

c. Service business.

d. Not-for-profit service agency.

ANS: A

The business entity that converts purchased raw materials into finished goods by using labor,

technology, and facilities is a manufacturer.

PTS: 1 DIF: Easy REF: P. OBJ: Introduction

NAT: IMA 4 - Business Applications TOP: AACSB - Analytic

2. The business entity that purchases finished goods for resale is a:

a. Manufacturer.

b. Merchandiser.

c. Service business.

d. For-profit service business.

ANS: B

The business entity that purchases finished goods for resale is a merchandiser.

PTS: 1 DIF: Easy REF: P. OBJ: Introduction

NAT: IMA 4 - Business Applications TOP: AACSB - Analytic

3. The type of merchandiser who purchases goods from the producer and sells to stores who sell to the

consumer is a:

a. Manufacturer.

b. Retailer.

c. Wholesaler.

d. Service business.

ANS: C

The type of merchandiser that purchases goods from the producer and sells to the retailer is a

wholesaler.

PTS: 1 DIF: Easy REF: P. OBJ: Introduction

NAT: IMA 4 - Business Applications TOP: AACSB - Analytic

4. Examples of service businesses include:

a. Airlines, architects, and hair stylists.

b. Department stores, poster shops, and wholesalers.

c. Aircraft producers, home builders, and machine tool makers.

d. None of these are correct.

ANS: A

Examples of service businesses include airlines, architects, and hair stylists.

PTS: 1 DIF: Moderate REF: P. OBJ: Introduction

NAT: IMA 4 - Business Applications TOP: AACSB - Reflective

5. ISO 9000 is a set of international standards for:

a. determining the selling price of a product.

b. cost control.

c. quality management.

d. planning,

ANS: C

ISO 9000 is a set of international standards for quality management.

PTS: 1 DIF: Easy REF: P. OBJ: Introduction

NAT: IMA 3A - Strategic Planning TOP: AACSB - Analytic

6. Unit cost information is important for making all of the following marketing decisions except:

a. Determining the selling price of a product.

b. Bidding on contracts.

c. Determining the amount of advertising needed to promote the product.

d. Determining the amount of profit that each product earns.

ANS: C

Unit cost information is used in determining selling price, bidding on contracts and determining

product profitability, but would not have a bearing on determining how much the product would need

to be advertised.

PTS: 1 DIF: Moderate REF: P. OBJ: 1

NAT: IMA 3B - Strategic Marketing TOP: AACSB - Analytic

7. The process of establishing objectives or goals for the firm and determining the means by which they

will be met is:

a. controlling.

b. analyzing profitability.

c. planning.

d. assigning responsibility.

ANS: C

The process of establishing goals and objectives for a firm is planning. Controlling, analyzing

profitability and assigning responsibility are functions that take place after the planning process to

determine whether or how successfully goals have been obtained.

PTS: 1 DIF: Easy REF: P. OBJ: 1

NAT: IMA 2A - Budget Preparation TOP: AACSB - Analytic

8. Control is the process of monitoring the company’s operations to determine whether the company’s

objectives are being achieved. Effective control is achieved through all of the following except:

a. periodically measuring and comparing company results.

b. assigning responsibility for costs to employees responsible for those costs.

c. constantly monitoring employees to ensure they do exactly as they are told.

d. taking necessary corrective action when variances warrant doing so.

ANS: C

While periodically measuring and comparing company results, assigning responsibility for those

results to employees and taking necessary corrective action are all part of control; it does not include

constantly monitoring employees to make sure they are following directions.

PTS: 1 DIF: Moderate REF: P. OBJ: 1

NAT: IMA 2D - Performance Measurement TOP: AACSB - Analytic

9. Aaron Smith is the supervisor of the Machining Department of Bennett Corporation. He has control

over and is responsible for manufacturing costs traced to the department. The Machining Department

is an example of a(n):

a. cost center.

b. inventory center.

c. supervised work center.

d. worker’s center.

ANS: A

The criteria for a cost center are 1) a reasonable basis on which manufacturing costs may be traced and

2) a person who has control over and is accountable for many of the costs charged to that center.

PTS: 1 DIF: Moderate REF: P. OBJ: 1

NAT: IMA 2D - Performance Measurement TOP: AACSB - Reflective

10. Which of the following items of cost would be least likely to appear on a performance report based on

responsibility accounting for the supervisor of an assembly line in a large manufacturing situation?

a. Direct labor

b. Indirect materials

c. Selling expenses

d. Repairs and maintenance

ANS: C

Selling expenses would be least likely to appear on a performance report, because the supervisor

would not have responsibility for the sales function.

PTS: 1 DIF: Moderate REF: P. OBJ: 1

NAT: IMA 2D - Performance Measurement TOP: AACSB - Reflective

11. Which of the following items of cost would be least likely to appear on a performance report based on

responsibility accounting for the supervisor of an assembly line in a large manufacturing situation?

a. Direct labor

b. Supervisor's salary

c. Materials

d. Repairs and maintenance

ANS: B

A supervisor's salary would be least likely to appear on a performance report, because that person's

salary is determined by the company and is not controllable by the supervisor.

PTS: 1 DIF: Hard REF: P. OBJ: 1

NAT: IMA 2D - Performance Measurement TOP: AACSB - Reflective

12. Responsibility accounting would most likely hold a manager of a manufacturing unit responsible for:

a. cost of raw materials.

b. quantity of raw materials used.

c. the number of units ordered.

d. amount of taxes incurred.

ANS: B

In responsibility accounting the manager of a cost center is only responsible for those costs and

activities that manager controls. A manufacturing manager would not likely be responsible for the

cost of the materials (the purchasing manager would have that responsibility), the number of units

ordered (that would be driven by demand) or the taxes incurred.

PTS: 1 DIF: Moderate REF: P. OBJ: 1

NAT: IMA 2D - Performance Measurement TOP: AACSB - Reflective

13. Which of the following statements best describes a characteristic of a performance report prepared for

use by a production line department head?

a. The costs in the report should include only those controllable by the department head.

b. The report should be stated in dollars rather than in physical units so the department head

knows the financial magnitude of any variances.

c. The report should include information on all costs chargeable to the department, regardless

of their origin or control.

d. It is more important that the report be precise than timely.

ANS: A

The performance report should include only those costs controllable by the department head. It should

also be timely and should include production data as well as dollar amounts.

PTS: 1 DIF: Easy REF: P. OBJ: 1

NAT: IMA 2D - Performance Measurement TOP: AACSB - Analytic

14. Joshua Company prepares monthly performance reports for each department. The budgeted amounts

of wages for the Finishing Department for the month of August and for the eight-month period ended

August 31 were $12,000 and $100,000, respectively. Actual wages paid through July were $91,500,

and wages for the month of August were $11,800. The month and year-to-date variances, respectively,

for wages on the August performance report would be:

a. $200 F; $8,500 F

b. $200 F; $3,300 U

c. $200 U; $3,300 U

d. $200 U; $8,500 F

ANS: B

Calculation of monthly variance:

Budgeted wages for August $12,000

Actual wages for August 11,800

Variance for August $ 200 F

Calculation of year-to-date variance:

Budgeted wages for the eight-month period ended August 31 $100,000

Actual wages for the eight-month period ended August 31 (91,500 + 11,800) 103,300

Variance for eight-month period ended August 31 $ 3,300 U

PTS: 1 DIF: Moderate REF: P. OBJ: 1

NAT: IMA 2D - Performance Measurement TOP: AACSB - Analytic

15. As a result of recent accounting scandals involving companies such as Enron and World Com, the

Sarbanes-Oxley Act of 2002 was written to protect shareholders of public companies by improving

a. management accounting.

b. corporate governance.

c. professional competence.

d. the corporate legal process.

ANS: B

The Sarbanes-Oxley act was written primarily to improve the corporate governance of publicly held

companies.

PTS: 1 DIF: Moderate REF: P. OBJ: 2

NAT: IMA 4 - Business Applications TOP: AACSB - Ethics

16. Which of the following is not a key element of the Sarbanes Oxley Act to improve corporate

governance?

a. The establishment of the Public Company Accounting Oversight Board

b. Requiring a company’s annual report to contain an internal control report that includes

management’s opinion on the effectiveness of internal control

c. Severe criminal penalties for retaliation against “whistleblowers”

d. Requiring that the company’s performance reports are prepared in accordance with

generally accepted accounting principles

ANS: D

The Sarbanes-Oxley Act does not require that companies prepare performance reports in accordance

with generally accepted accounting principles.

PTS: 1 DIF: Moderate REF: P. OBJ: 2

NAT: IMA 4 - Business Applications TOP: AACSB - Ethics

17. Cost accounting differs from financial accounting in that financial accounting:

a. Is mostly concerned with external financial reporting.

b. Is mostly concerned with individual departments of the company.

c. Provides the additional information required for special reports to management.

d. Puts more emphasis on future operations.

ANS: A

Items (b) through (d) are characteristics of cost accounting, whereas Item (a) is a feature of financial

accounting.

PTS: 1 DIF: Moderate REF: P. OBJ: 3

NAT: IMA 2E - External Financial Reporting TOP: AACSB - Reflective

18. Taylor Logan is an accountant with the Tanner Corporation. Taylor’s duties include preparing reports

that focus on both historical and estimated data needed to conduct ongoing operations and do longrange planning. Taylor is a(n)

a. certified financial planner.

b. management accountant.

c. financial accountant.

d. auditor.

ANS: B

A management accountant prepares reports that focus on both historical and estimated data that are

used to conduct ongoing operations and do long-range planning. Financial accountants prepare

financial statements needed by external users to evaluate a business, while auditors conduct

examinations on those financial statements. A certified financial planner is a consultant that helps

individuals with financial planning, including investment advice.

PTS: 1 DIF: Easy REF: P. OBJ: 3

NAT: IMA 4 - Business Applications TOP: AACSB - Reflective

19. The following data were taken from Mansfield Merchandisers on January 31:

Merchandise inventory, January 1 $ 90,000

Sales salaries 35,000

Merchandise inventory, January 31 65,000

Purchases 560,000

What was the Cost of goods sold in January?

a. $585,000

b. $650,000

c. $620,000

d. $535,000

ANS: A

Merchandise Inventory, January 1 $ 90,000

Plus Purchases 560,000

Merchandise Available for Sale $650,000

Less Merchandise Inventory, January 31 65,000

Cost of Goods Sold $585,000

PTS: 1 DIF: Moderate REF: P. OBJ: 3

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

20. Umberg Merchandise Company’s cost of goods sold last month was $1,350,000. the Merchandise

Inventory at the beginning of the month was $250,000 and there was $325,000 of Merchandise

Inventory at the end of the month. Umberg’s merchandise purchases were:

a. $1,350,000

b. $1,275,000

c. $1,425,000

d. $1,675,000

ANS: C

Merchandise purchases added to Merchandise Inventory at the beginning of the month results in the

merchandise available for sale. At the end of the month, these goods either remain in Merchandise

Inventory or are sold, which results in Cost of Goods Sold, so the total of ending Merchandise

Inventory and Cost of Goods Sold is also the merchandise available for sale. Therefore, the equation

can be rearranged to compute the merchandise purchases as follows:

Cost of Goods Sold $1,350,000

Plus Ending Merchandise Inventory 325,000

Merchandise Available for Sale 1,675,000

Less Beginning Merchandise Inventory 250,000

Merchandise Purchases $1,425,000

PTS: 1 DIF: Hard REF: P. OBJ: 3

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

21. Ashley Corp. had finished goods inventory of $50,000 and $60,000 at April 1 and April 30,

respectively, and cost of goods manufactured of $175,000 in April. Cost of goods sold in April was:

a. $165,000

b. $175,000

c. $185,000

d. $225,000

ANS: A

Finished Goods Inventory, April 1 $ 50,000

Plus Cost of Goods Manufactured 175,000

Finished Goods Available for Sale 225,000

Finished Goods Inventory, April 30 60,000

Cost of Goods Sold $165,000

PTS: 1 DIF: Moderate REF: P. OBJ: 3

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

22. The balance in Kayser Manufacturing Company’s Finished Goods account at November 30 was

$825,000. Its November cost of goods manufactured was $2,350,000 and its cost of goods sold in

November was $2,455,000. What was the balance in Kayser’s Finished Goods at November 1?

a. $435,000

b. $640,000

c. $710,000

d. $930,000

ANS: D

Cost of goods manufactured added to Finished Goods at the beginning of the month results in the

finished goods available for sale. At the end of the month, these goods either remain in Finished

Goods or are sold, which results in Cost of Goods Sold, so the total of ending Finished Goods and Cost

of Goods Sold is also the finished goods available for sale. Therefore, the equation can be rearranged

to compute the beginning balance in Finished Goods as follows:

Cost of Goods Sold $2,455,000

Plus Finished Goods Inventory, November 30 825,000

Finished Goods Available for Sale 3,280,000

Less Cost of Goods Manufactured 2,350,000

Finished Goods Inventory, November 1 $ 930,000

PTS: 1 DIF: Hard REF: P. OBJ: 3

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

23. Inventory accounts for a manufacturer include all of the following except:

a. Merchandise Inventory.

b. Finished Goods.

c. Work in Process.

d. Materials.

ANS: A

Inventory accounts for a manufacturer include Materials, Work in Process, and Finished Goods.

Merchandise Inventory is the inventory account for a merchandiser.

PTS: 1 DIF: Easy REF: P. OBJ: 3

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

24. For a manufacturer, the total cost of manufactured goods completed but still on hand is:

a. Merchandise Inventory.

b. Finished Goods.

c. Work in Process.

d. Materials.

ANS: B

Merchandise Inventory refers to inventory held by a merchandising operation. Finished goods are

goods completed, but still on hand, while Work in Process are goods which have been started and are

in various stages of production, but are not yet completed. Materials are items which have been

purchased and on hand to be used in the manufacturing process, but have not yet been issued into

production.

PTS: 1 DIF: Easy REF: P. OBJ: 3

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

25. For a manufacturer, manufacturing costs incurred to date for goods in various stages of production, but

not yet completed is:

a. Merchandise Inventory.

b. Finished Goods.

c. Work in Process.

d. Materials.

ANS: C

Merchandise Inventory refers to inventory held by a merchandising operation. Finished goods are

goods completed, but still on hand, while Work in Process are goods which have been started and are

in various stages of production, but are not yet completed. Materials are items which have been

purchased and on hand to be used in the manufacturing process, but have not yet been issued into

production.

PTS: 1 DIF: Easy REF: P. OBJ: 3

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

26. For a manufacturer, the cost of all materials purchases and on hand to be used in the manufacturing

process is:

a. Merchandise Inventory.

b. Finished Goods.

c. Work in Process.

d. Materials.

ANS: D

Merchandise Inventory refers to inventory held by a merchandising operation. Finished goods are

goods completed, but still on hand, while Work in Process are goods which have been started and are

in various stages of production, but are not yet completed. Materials are items which have been

purchased and on hand to be used in the manufacturing process, but have not yet been issued into

production.

PTS: 1 DIF: Easy REF: P. OBJ: 3

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

27. In the financial statements, Materials should be categorized as:

a. Revenue.

b. Expenses.

c. Assets.

d. Liabilities.

ANS: C

Materials are included in inventory, which is an asset on the balance sheet because it has a future

benefit.

PTS: 1 DIF: Moderate REF: P. OBJ: 3

NAT: IMA 2E - External Financial Reporting TOP: AACSB - Reflective

28. A(n) __________ requires estimating inventory balances during the year for interim financial

statements and shutting down operations to count all inventory items at the end of the year.

a. periodic inventory system

b. inventory control account

c. perpetual inventory system

d. inventory cost method

ANS: A

A periodic inventory system requires a company to make estimates of inventory balances throughout

the year, and a complete physical count of inventory at the end of the year. A perpetual inventory

system provides a continuous record of purchases, issues and inventory balances. The inventory

balances are verified with periodic counts of selected inventory items throughout the year.

PTS: 1 DIF: Easy REF: P. OBJ: 3

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

29. Witt Company, like most manufacturers, maintains a continuous record of purchases, materials issued

into production and balances of all goods in stock, so that inventory valuation data is available at any

time. This is an example of a(n)

a. perpetual inventory system.

b. inventory control account.

c. periodic inventory system.

d. inventory cost method.

ANS: A

A perpetual inventory system maintains a continuous record of purchases, issues and inventory

balances. A periodic inventory system requires a physical count of all inventory at the end of the year

and estimates of inventory balances throughout the year when preparing interim financial statements.

PTS: 1 DIF: Easy REF: P. OBJ: 3

NAT: IMA 2B - Cost Management TOP: AACSB - Reflective

30. Which of the following is most likely to be considered an indirect material in the manufacture of a

sofa?

a. Lumber

b. Glue

c. Fabric

d. Foam rubber

ANS: B

While glue would be included in the finished product, its cost would be relatively insignificant,

therefore, it would not be cost effective to trace its cost to specific products.

PTS: 1 DIF: Moderate REF: P. OBJ: 4

NAT: IMA 2B - Cost Management TOP: AACSB - Reflective

31. The Macke Company’s payroll summary showed the following in November:

Sales department salaries $10,000

Supervisor salaries 20,000

Assembly workers’ wages 25,000

Machine operators’ wages 35,000

Maintenance workers’ wages 15,000

Accounting department salaries 5,000

What is the amount that would be included in direct labor in November?

a. $25,000

b. $60,000

c. $95,000

d. $120,000

ANS: B

Assembly workers and machine operators would be considered direct labor.

Assembly workers’ wages $25,000

Machine operators’ wages 35,000

Total direct labor $60,000

The supervisors and maintenance workers would be included in overhead, while the sales and

accounting department salaries would be included in selling and administrative expense.

PTS: 1 DIF: Moderate REF: P. OBJ: 4

NAT: IMA 2B - Cost Management TOP: AACSB - Reflective

32. The Macke Company’s payroll summary showed the following in November:

Sales department salaries $10,000

Supervisor salaries 20,000

Assembly workers’ wages 25,000

Machine operators’ wages 35,000

Maintenance workers’ wages 15,000

Accounting department salaries 5,000

What is the amount that would be included in factory overhead in November?

a. $20,000

b. $35,000

c. $95,000

d. $120,000

ANS: B

The supervisors’ salaries and maintenance workers’ wages would be included in factory overhead.

Supervisors’ salaries $20,000

Maintenance workers’ wages 15,000

Total direct labor $35,000

The wages of the assembly workers and machine operators would be included in direct labor, while the

sales and accounting department salaries would be included in selling and administrative expense.

PTS: 1 DIF: Moderate REF: P. OBJ: 4

NAT: IMA 2B - Cost Management TOP: AACSB - Reflective

33. Factory overhead includes:

a. Indirect labor but not indirect materials.

b. Indirect materials but not indirect labor.

c. All manufacturing costs, except indirect materials and indirect labor.

d. All manufacturing costs, except direct materials and direct labor.

ANS: D

Factory overhead includes all manufacturing costs except direct materials and direct labor.

PTS: 1 DIF: Easy REF: P. OBJ: 4

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

34. A typical factory overhead cost is:

a. Freight out.

b. Stationery and printing.

c. Depreciation on machinery and equipment.

d. Postage.

ANS: C

Depreciation on machinery and equipment is a factory overhead cost because it is a manufacturing cost

that is not direct labor or direct material. The other three items are marketing or administrative

expenses.

PTS: 1 DIF: Moderate REF: P. OBJ: 4

NAT: IMA 2B - Cost Management TOP: AACSB - Reflective

35. Factory overhead would include:

a. Wages of office clerk.

b. Sales manager’s salary.

c. Supervisor’s salary.

d. Tax accountant’s salary.

ANS: C

The supervisor’s salary is considered indirect labor because the supervisor is required for the

manufacturing process, but does not work directly on the units being manufactured. Indirect labor is

included in factory overhead. The office clerk’s wages, sales manager’s salary and tax accountant’s

salary are marketing or administrative costs.

PTS: 1 DIF: Moderate REF: P. OBJ: 4

NAT: IMA 2B - Cost Management TOP: AACSB - Reflective

36. The term "prime cost" refers to:

a. The sum of direct labor costs and all factory overhead costs.

b. The sum of direct material costs and direct labor costs.

c. All costs associated with manufacturing other than direct labor costs and direct material

costs.

d. Manufacturing costs incurred to produce units of output.

ANS: B

The term "prime cost" refers to the sum of direct materials costs and direct labor costs.

PTS: 1 DIF: Easy REF: P. OBJ: 4

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

37. The following data are from Burton Corporation, a manufacturer, for the month of September:

Direct materials used $135,000

Supervisors’ salaries 6,000

Machine operators’ wages 200,000

Sales office rent and utilities 22,000

Machine depreciation 35,000

Secretary to the Chief Executive Officer salary 3,000

Factory insurance 15,000

Compute the prime costs.

a. $344,000

b. $135,000

c. $335,000

d. $256,000

ANS: C

Prime costs include direct materials and direct labor. Of the salaries and wages listed, only the wages

of the machine operators would be considered direct labor as they are the only employees listed who

would actually work on the products themselves.

Direct materials used $135,000

Machine operators’ wages 200,000

Total prime costs $335,000

PTS: 1 DIF: Moderate REF: P. OBJ: 4

NAT: IMA 2B - Cost Management TOP: AACSB - Reflective

38. The term "conversion costs" refers to:

a. The sum of direct labor costs and all factory overhead costs.

b. The sum of direct material costs and direct labor costs.

c. All costs associated with manufacturing other than direct labor costs.

d. Direct labor costs incurred to produce units of output.

ANS: A

The term "conversion costs" refers to the sum of direct labor costs and all factory overhead costs.

PTS: 1 DIF: Easy REF: P. OBJ: 4

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

39. The following data are from Burton Corporation, a manufacturer, for the month of September:

Direct materials used $135,000

Supervisors’ salaries 6,000

Machine operators’ wages 200,000

Sales office rent and utilities 22,000

Machine depreciation 35,000

Secretary to the Chief Executive Officer salary 3,000

Factory insurance 15,000

Compute the conversion costs.

a. $335,000

b. $209,000

c. $281,000

d. $256,000

ANS: D

Conversion costs include direct labor and factory overhead costs, including indirect labor. Of the

salaries and wages listed, only the machine operators are considered direct labor as they are the only

employees listed who would actually work on the products themselves. The supervisors are

considered factory overhead because their efforts are essential to the manufacturing process, however

they do not actually work on the products themselves. The sales office costs and the salary of the

secretary would be marketing and administrative expenses as they do not contribute to the

manufacturing process.

Machine operators’ wages $200,000

Supervisors’ salaries 6,000

Machine depreciation 35,000

Factory insurance 15,000

Total conversion costs $256,000

PTS: 1 DIF: Moderate REF: P. OBJ: 4

NAT: IMA 2B - Cost Management TOP: AACSB - Reflective

40. Payroll is debited and Wages Payable is credited to:

a. Pay the payroll taxes.

b. Record the payroll.

c. Pay the payroll.

d. Distribute the payroll.

ANS: B

When the payroll is recorded, Payroll is debited and Wages Payable is credited. When payroll taxes

are paid, the various liability accounts are debited and Cash is credited. When the payroll is paid,

Wages Payable is debited and Cash is credited. When the payroll is distributed, Work in Process,

Factory Overhead, and Selling and Administrative Expenses are debited and Payroll is credited.

PTS: 1 DIF: Moderate REF: P. OBJ: 5

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

41. Which of the following is not a cost that is accumulated in Work in Process?

a. Direct materials

b. Administrative expense

c. Direct labor

d. Factory overhead

ANS: B

Administrative expense is not a manufacturing cost, so it would not be included in Work in Process.

PTS: 1 DIF: Easy REF: P. OBJ: 5

NAT: IMA 2B - Cost Management TOP: AACSB - Reflective

42. At a certain level of operations, per unit costs and selling price are as follows: manufacturing costs,

$50; selling and administrative expenses, $10; selling price, $80. Given this information, the mark-on

percentage to manufacturing cost used to determine selling price must have been:

a. 40 percent.

b. 60 percent.

c. 33 percent.

d. 25 percent.

ANS: B

Selling price - Manufacturing costs = Mark-on percentage

Manufacturing costs

$80 - $50 = 60% $50

PTS: 1 DIF: Moderate REF: P. OBJ: 5

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

43. Mountain Company produced 20,000 blankets in June to be sold during the holiday season. The

manufacturing costs were:

Direct materials $125,000

Direct labor 55,000

Factory overhead 60,000

Selling expense 25,000

Administrative expense 30,000

The cost per blanket is:

a. $6.25.

b. $9.00.

c. $12.00.

d. $14.75.

ANS: C

Direct materials $125,000

Direct labor 55,000

Factory overhead 60,000

Total manufacturing costs $240,000

$240,000 / 20,000 units = $12.00 cost per unit

PTS: 1 DIF: Moderate REF: P. OBJ: 5

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

44. Mountain Company produced 20,000 blankets in June to be sold during the holiday season. The

manufacturing costs were:

Direct materials $125,000

Direct labor 55,000

Factory overhead 60,000

Management has decided that the mark-on percentage necessary to cover the product’s share of selling

and administrative expenses and to earn a satisfactory profit is 30%. The selling price per blanket

should be:

a. $12.00.

b. $15.60.

c. $23.60.

d. $31.20.

ANS: B

Direct materials $125,000

Direct labor 55,000

Factory overhead 60,000

Total manufacturing costs $240,000

$240,000 / 20,000 units = $12.00 cost per unit

$12.00 x 30% = $3.60 + $12.00 = $15.60

PTS: 1 DIF: Hard REF: P. OBJ: 5

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

45. The statement of costs of goods manufactured shows:

a. Office supplies used in accounting office.

b. Deprecation of factory building.

c. Salary of sales manager.

d. Rent paid on finished goods warehouse.

ANS: B

The depreciation of the factory building is a cost necessary to manufacture goods. The office supplies,

sales manager’s salary and warehouse rent are marketing and administrative costs and would not be

included in the Statement of Cost of Goods Manufactured.

PTS: 1 DIF: Hard REF: P. OBJ: 5

NAT: IMA 2B - Cost Management TOP: AACSB - Reflective

46. Selected data concerning the past fiscal year's operations (000's omitted) of the Stanley Manufacturing

Company are presented below:

INVENTORIES

Beginning Ending

Materials $ 90 $ 85

Work in process 50 65

Finished goods 100 90

Other data:

Direct materials used $365

Total manufacturing costs charged to production during

the year (includes direct materials, direct labor, and factory

overhead) 680

Cost of goods available for sale 765

Selling and general expenses 250

Assuming Stanley does not use indirect materials, the cost of materials purchased during the year

amounted to:

a. $455.

b. $450.

c. $365.

d. $360.

ANS: D

Materials purchased added to Materials inventory at the beginning of the month results in the materials

available for use. During the year, the materials are used or they remain in the Materials inventory at

the end of the year, so the total of materials used and ending Materials inventory is also the total of the

amount of materials available. Therefore, the equation can be rearranged to compute the materials

purchases as follows:

Direct materials used $365

Add ending inventory of materials 85

Materials available during the year $450

Less beginning inventory of materials 90

Purchases of materials during the year $360

PTS: 1 DIF: Hard REF: P. OBJ: 5

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

47. Selected data concerning the past fiscal year's operations (000's omitted) of the Stanley Manufacturing

Company are presented below:

INVENTORIES

Beginning Ending

Materials $ 90 $ 85

Work in process 50 65

Finished goods 100 90

Other data:

Direct materials used $365

Total manufacturing costs charged to production during

the year (includes direct materials, direct labor, and factory

overhead) 680

Cost of goods available for sale 765

Selling and general expenses 250

The cost of goods manufactured during the year was:

a. $735.

b. $710.

c. $665.

d. $705.

ANS: C

Beginning work in process inventory $ 50

Add total manufacturing costs during the year 680

Total $730

Less ending work in process inventory 65

Cost of goods manufactured during the year $665

PTS: 1 DIF: Moderate REF: P. OBJ: 5

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

48. Selected data concerning the past fiscal year's operations (000's omitted) of the Stanley Manufacturing

Company are presented below:

INVENTORIES

Beginning Ending

Materials $ 90 $ 85

Work in process 50 65

Finished goods 100 90

Other data:

Direct materials used $365

Total manufacturing costs charged to production during

the year (includes direct materials, direct labor, and factory

overhead) 680

Cost of goods available for sale 765

Selling and general expenses 250

The cost of goods sold during the year was:

a. $730.

b. $775.

c. $675.

d. $765.

ANS: C

Beginning finished goods inventory $100

Add cost of goods manufactured during the year ($680 + $50 - $65) 665

Total cost of goods available for sale $765

Less ending finished goods inventory 90

Cost of goods sold during the year $675

PTS: 1 DIF: Hard REF: P. OBJ: 5

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

49. Which of the following production operations would be most likely to employ a job order system of

cost accounting?

a. Candy manufacturing

b. Crude oil refining

c. Printing text books

d. Flour Milling

ANS: C

Printing would be most likely to employ a job order system of cost accounting due to the number of

custom jobs involved. The manufacture of candy, the vulcanizing of rubber, and the refining of crude

oil would normally be a continuous process of producing like goods and would be accounted for under

the process cost system.

PTS: 1 DIF: Moderate REF: P. OBJ: 6

NAT: IMA 2B - Cost Management TOP: AACSB - Reflective

50. A law firm wanting to track the costs of serving different clients may use a:

a. process cost system.

b. job order cost system.

c. cost control system.

d. standard cost system.

ANS: B

Professional firms use job order cost systems to track the costs of serving different clients.

PTS: 1 DIF: Moderate REF: P. OBJ: 6

NAT: IMA 2B - Cost Management TOP: AACSB - Reflective

51. When should process costing techniques be used in assigning costs to products?

a. In situations where standard costing techniques should not be used

b. If products manufactured are substantially identical

c. When production is only partially completed during the accounting period

d. If products are manufactured on the basis of each order received

ANS: B

Process costing techniques should be used in assigning costs to products if the product is composed of

mass-produced units that are substantially identical.

PTS: 1 DIF: Easy REF: P. OBJ: 6

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

52. An industry that would most likely use process costing procedures is:

a. Beverage.

b. Home Construction.

c. Printing.

d. Shipbuilding.

ANS: A

Beverage production usually consists of continuous output of homogeneous products for which

process costing is used. The other three industries would utilize job order costing because each

product or group of products is made to order.

PTS: 1 DIF: Moderate REF: P. OBJ: 6

NAT: IMA 2B - Cost Management TOP: AACSB - Reflective

53. A standard cost system is one:

a. that provides a separate record of cost for each special-order product.

b. that uses predetermined costs to furnish a measurement that helps management make

decisions regarding the efficiency of operations.

c. that accumulates costs for each department or process in the factory.

d. where costs are accumulated on a job cost sheet.

ANS: B

A standard cost system uses predetermined standard costs to furnish a measurement that helps

management make decisions regarding the efficiency of operations.

PTS: 1 DIF: Moderate REF: P. OBJ: 6

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

54. In job order costing, the basic document for accumulating the cost of each job is the:

a. Job cost sheet.

b. Requisition sheet.

c. Purchase order.

d. Invoice.

ANS: A

In job order costing, the basic document to accumulate the cost of each job is the job cost sheet.

PTS: 1 DIF: Easy REF: P. OBJ: 7

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

55. Under a job order cost system of accounting, the entry to distribute payroll to the appropriate accounts

would be:

a. Debit-Payroll

Credit-Wages Payable

b. Debit-Work in Process

Debit-Factory Overhead

Debit-Selling and Administrative Expense

Credit-Payroll

c. Debit-Work in Process

Debit-Finished Goods

Debit-Cost of Goods Sold

Credit-Payroll

d. Debit-Work in Process

Debit-Factory Overhead

Debit-Selling and Administrative Expense

Credit-Wages Payable

ANS: B

Payroll is credited when the amounts are distributed to the appropriate accounts. Those accounts

include Work in Process for direct labor, Factory Overhead for indirect labor and Selling and

Administrative Expense for salaries and wages incurred outside of the factory.

PTS: 1 DIF: Moderate REF: P. OBJ: 7

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

56. Under a job order system of cost accounting, the dollar amount of the entry to transfer inventory from

Work in Process to Finished Goods is the sum of the costs charged to all jobs:

a. In process during the period.

b. Completed and sold during the period.

c. Completed during the period.

d. Started in process during the period.

ANS: C

When jobs are completed during the period, Finished Goods is debited and Work in Process is credited

for the cost of the completed jobs.

PTS: 1 DIF: Moderate REF: P. OBJ: 7

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

57. Under a job order system of cost accounting, Cost of Goods Sold is debited and Finished Goods is

credited for a:

a. Transfer of materials to the factory.

b. Shipment of completed goods to the customer.

c. Transfer of completed production to the finished goods storeroom.

d. Purchase of goods on account.

ANS: B

When completed goods are shipped to customers, Cost of Goods Sold is debited and Finished Goods is

credited.

PTS: 1 DIF: Easy REF: P. OBJ: 7

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

58. The Institute of Management Accountants (IMA) Statement of Professional Practice includes all of the

following standards except:

a. Confidentiality.

b. Commitment.

c. Integrity.

d. Competence.

ANS: B

The four IMA Professional Standards are: Competence, Confidentiality, Integrity and Credibility.

PTS: 1 DIF: Easy REF: Appendix OBJ: 2

NAT: IMA 4 - Business Applications TOP: AACSB - Ethics

59. According to the Institute of Management Accountants (IMA) Statement of Ethical Professional

Practice, performing professional duties in accordance with relevant laws, regulations and technical

standards is a component of which standard?

a. Competence

b. Confidentiality

c. Integrity

d. Credibility

ANS: A

Performing technical duties in accordance with relevant laws, regulations and technical standards is a

component of the competence standard.

PTS: 1 DIF: Moderate REF: Appendix OBJ: 2

NAT: IMA 4 - Business Applications TOP: AACSB - Ethics

60. According to the Institute of Management Accountants (IMA) Statement of Ethical Professional

Practice, under the Integrity Standard, each member has the responsibility to:

a. Communicate information fairly and objectively.

b. Keep information confidential.

c. Mitigate actual conflicts of interest.

d. Maintain an appropriate level of professional competence.

ANS: C

Under the Integrity Standard, IMA members have the responsibility to mitigate actual conflicts of

interest and avoid apparent conflicts of interest.

PTS: 1 DIF: Moderate REF: Appendix OBJ: 2

NAT: IMA 4 - Business Applications TOP: AACSB - Ethics

61. Tom Jones, a management accountant, was faced with an ethical conflict at the office. According to

the Institute of Management Accountants’ Statement of Professional Practice, the first action Tom

should pursue is to:

a. follow his organization’s established policies on the resolution of such conflict.

b. contact the local newspaper.

c. contact the company’s audit committee.

d. consult an attorney.

ANS: A

When faced with ethical issues, one should follow the organization’s established policies on the

resolution of such conflict. If these policies do not resolve the ethical conflict, one should consider

discussing the matter with one’s supervisor or, if it appears he or she is involved, other internal

sources. It is not appropriate to contact parties outside the organization unless it is the authorities if

one believes there is a violation of the law.

PTS: 1 DIF: Moderate REF: Appendix OBJ: 2

NAT: IMA 4 - Business Applications TOP: AACSB - Ethics

PROBLEM

1. Prepare a performance report showing both month and year-to-date data for Post Manufacturing’s

Machining Department for February, 2011 using the following data:

January February

Budgeted Data:

Machinists’ wages $6,200 $5,600

Supplies 3,200 3,000

Depreciation 2,000 2,000

Utilities 1,500 1,400

Actual Data:

Machinists’ wages $6,120 $5,650

Supplies 3,300 3,180

Depreciation 2,000 2,000

Utilities 1,580 1,390

ANS:

Post Manufacturing - Machining Department

Performance Report

For Period Ended February 28, 2011

Expense Budget Actual Variance

February

Year-toDate

February

Year-toDate

February

Year-toDate

Machinists’ wages $ 5,600 $11,800 $ 5,650 $11,700 $ 50 U $ 100 F

Supplies 3,000 6,200 3,180 6,480 180 U 280 U

Depreciation 2,000 4,000 2,000 4,000 -- --

Utilities 1,400 2,900 1,390 2,970 10 F 70 U

Total $12,000 $24,900 $12,220 $25,150 $ 220 U $ 250 U

PTS: 1 DIF: Hard REF: P. OBJ: 1

NAT: IMA 2D - Performance Measurement TOP: AACSB - Analytic

2. The following data were taken from the general ledger of Data Corp., a retailer of computers and

accessories:

Merchandise Inventory, August 1 $ 323,000

Merchandise Inventory, August 31 296,000

Purchases 1,684,000

Compute the cost of goods sold for the month of August.

ANS:

Merchandise Inventory, August 1 $ 323,000

Plus Purchases 1,684,000

Merchandise Available for Sale 2,007,000

Less Merchandise Inventory, August 31 296,000

Cost of Goods Sold $1,711,000

PTS: 1 DIF: Easy REF: P. OBJ: 2

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

3. The following data were taken from the general ledger and other data of Spargus Manufacturing on

May 31:

Work in Process, May 1 $ 75,000

Finished Goods, May 1 82,000

Materials purchased in May 122,000

Cost of goods manufactured in May 455,000

Marketing and administrative costs in May 64,000

Finished Goods, May 31 78,000

Work in Process, May 31 94,000

Compute the cost of goods sold for Spargus Manufacturing, selecting the appropriate items from the

list provided.

ANS:

Finished Goods Inventory, May 1 $ 82,000

Plus Cost of Goods Manufactured 455,000

Cost of Goods Available for Sale 537,000

Less Finished Goods Inventory, May 31 78,000

Cost of Goods Sold $459,000

PTS: 1 DIF: Moderate REF: P. OBJ: 2

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

4. The following data were taken from Middletown Merchandisers on July 31, for the first month of its

fiscal year:

Merchandise Inventory, July 31 $ 25,000

Purchases 735,000

Cost of Goods Sold 750,000

Compute the inventory at July 1.

ANS:

Cost of Goods Sold $750,000

Plus Merchandise Inventory, July 31 25,000

Equals Cost of Goods Available for Sale $775,000

Less Purchases 735,000

Equals Merchandise Inventory, July 1 $ 40,000

PTS: 1 DIF: Moderate REF: P. OBJ: 3

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

5. Campus Carriers Co. manufactures and sells backpacks to college students. Campus Carriers operates

a factory in Small Town and two stores in College Town and University City. Classify the following

costs incurred by Campus Carriers as Direct Materials, Direct Labor, Factory Overhead or Selling and

Administrative Expense.

a. Rent paid to lease the store in College Town.

b. Canvas fabric.

c. Wages paid to students distributing advertising fliers in University City.

d. Sewing machine operator’s wages.

e. Building depreciation on the factory building.

f. Thread.

g. The cost of transporting the backpacks from the factory in Small Town to the

University City store.

h. Depreciation of the racks and shelves at the College Town Store.

i. Factory manager’s salary.

j. Security guard at the factory.

k. Store manager’s salary.

l. Electricity to power sewing machines.

m. Electricity to light the College Town store.

ANS:

a. Selling and administrative expense would include costs related to stores.

b. Direct material - canvas would be used to make back packs.

c. Selling and administrative expense would include advertising.

d. Direct labor - sewing machine operators are “touch” labor.

e. Factory overhead - depreciation is a factory expense that cannot be traced directly to the

products.

f. Factory overhead. While thread is included in the final product, the cost is

insignificant and would be accounted for as an indirect cost.

g. Selling and administrative expense. Transportation is incurred outside of the factory.

h. Selling and administrative expense would include costs relating to the stores.

i. Factory overhead - the factory manager’s salary is a factory cost that cannot be traced directly

to products.

j. Factory overhead - the security guard’s salary is a factory cost that cannot be traced directly to

products.

k. Selling and administrative expense would include all costs related to the stores.

l. Factory overhead - electricity to run the machines is a factory cost that cannot be traced

directly to products..

m. Selling and administrative expense would include all costs related to the stores.

PTS: 1 DIF: Moderate REF: P. OBJ: 4

NAT: IMA 2B - Cost Management TOP: AACSB - Reflective

6. The following inventory data relate to the Reta Company:

INVENTORIES

Beginning Ending

Finished goods $80,000 $100,000

Work in process 65,000 70,000

Direct materials 60,000 64,000

Revenues and costs for the period:

Sales $740,000

Cost of goods available for sale 650,000

Total manufacturing costs 575,000

Factory overhead 154,000

Direct materials used 164,000

Selling and administrative expenses 51,000

Compute the following for the year:

a. Direct materials purchased

b. Direct labor costs incurred

c. Cost of goods sold

d. Gross profit

ANS:

(a)

Direct materials used during the period $164,000

Add inventory of direct materials at the end of the period 64,000

Direct materials available during the period $228,000

Less inventory of direct materials at the beginning of the period 60,000

Direct materials purchased during the period $168,000

(b)

Total manufacturing costs incurred during the period $575,000

Less: Direct materials used $164,000

Factory overhead incurred 154,000 318,000

Direct labor costs incurred during the period $257,000

(c)

Cost of goods available for sale $650,000

Less finished goods inventory at the end of the period 100,000

Cost of goods sold during the period $550,000

(d)

Sales $740,000

Cost of goods sold 550,000

Gross profit $190,000

PTS: 1 DIF: Hard REF: P. OBJ: 4,5

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

7. The following inventory data relate to the Reta Company:

INVENTORIES

Beginning Ending

Finished goods $80,000 $100,000

Work in process 65,000 70,000

Direct materials 60,000 64,000

Revenues and costs for the period:

Sales $740,000

Cost of goods available for sale 650,000

Total manufacturing costs 575,000

Factory overhead 154,000

Direct materials used 164,000

Selling and administrative expenses 51,000

Prepare journal entries for the following, making any necessary computations:

a. Purchase of materials on account

b. Issuance of materials into production

c. Transfer the cost of completed work to Finished Goods

d. Record the sale of the goods on account and the related cost of goods sold.

ANS:

(a)

Direct materials used during the period $164,000

Add inventory of direct materials at the end of the period 64,000

Direct materials available during the period $228,000

Less inventory of direct materials at the beginning of the period 60,000

Direct materials purchased during the period $168,000

Materials 168,000

Accounts Payable 168,000

(b)

Work in Process 164,000

Materials 164,000

(c)

Work in Process Inventory, beginning of the period $ 65,000

Plus Total Manufacturing Costs 575,000

$640,000

Less Work in Process Inventory, end of the period 70,000

Cost of Goods Manufactured $570,000

Finished Goods 570,000

Work in Process 570,000

(d)

Finished Goods Inventory, beginning of the period $ 80,000

Plus Cost of Goods Manufactured 570,000

Cost of Goods Available for Sale $650,000

Less Finished Goods Inventory, end of the period 100,000

Cost of Goods Sold $550,000

Accounts Receivable 740,000

Sales 740,000

Cost of Goods Sold 550,000

Finished Goods 550,000

PTS: 1 DIF: Hard REF: P. OBJ: 4,5

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

8. Following is a list of costs incurred by the Sitka Products Co. during the month of June:

Direct materials used $12,000 Expired insurance $3,000

Indirect materials used 3,000 Utilities 800

Direct labor employed 20,000 Repairs 700

Indirect labor employed 4,500 Depreciation expense

Selling expenses 6,000 --Machinery and equipment 1,200

Prepare the journal entries necessary to record the issuance of materials, the distribution of labor cost,

the recording of factory overhead, and the entry transferring Factory Overhead to Work in Process.

ANS:

Work in Process (Direct Materials) 12,000

Factory Overhead (Indirect Materials) 3,000

Materials 15,000

Work in Process (Direct Labor) 20,000

Factory Overhead (Indirect Labor) 4,500

Payroll 24,500

Factory Overhead 5,700

Prepaid Insurance 3,000

Accounts Payable (Utilities) 800

Accounts Payable (Repairs) 700

Accumulated Depreciation (Machinery and Equipment) 1,200

Work in Process 13,200

Factory Overhead 13,200

PTS: 1 DIF: Moderate REF: P. OBJ: 5

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

9. The following data was taken from the general ledger and other records of Martinez Manufacturing

Co. at July 31, the end of the first month of operations in the current fiscal year:

Sales $50,000

Materials inventory (July 1) 15,000

Work in process inventory (July 1) 20,000

Finished goods inventory (July 1) 28,000

Materials purchased 21,000

Direct labor cost 12,500

Factory overhead (including $5,000 of indirect materials used and $2,500 of

indirect labor cost) 11,500

Selling and administrative expense 8,000

Inventories at July 31:

Materials 16,000

Work in process 18,000

Finished goods 30,000

a. Prepare a statement of cost of goods manufactured.

b. Determine the cost of goods sold for the month.

ANS:

(a)

Martinez Manufacturing Co.

Statement of Cost of Goods Manufactured

For the Month Ended July 31, 20--

Direct Materials:

Inventory, July 1 $15,000

Purchases 21,000

Total cost of available materials $36,000

Less inventory, July 31 16,000

Cost of materials used $20,000

Less indirect materials used 5,000

Cost of direct materials used in production $15,000

Direct labor 12,500

Factory overhead:

Indirect materials $ 5,000

Indirect labor 2,500

Other 4,000

Total factory overhead 11,500

Total manufacturing cost $39,000

Add work in process inventory, July 1 20,000

Total $59,000

Less work in process inventory, July 31 18,000

Cost of goods manufactured during the month $41,000

(b)

Finished goods inventory, July 1 $28,000

Add cost of goods manufactured during July 41,000

Goods available for sale $69,000

Less finished goods inventory, July 31 30,000

Cost of goods sold $39,000

PTS: 1 DIF: Moderate REF: P. OBJ: 5

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

10. The following data was taken from the general ledger and other records of Marwick Manufacturing

Co. at January31, the end of the first month of operations in the current fiscal year:

Sales $650,000

Inventories at January 31:

Materials inventory 20,000

Work in process inventory 32,000

Finished goods inventory 54,000

Inventories at January 1:

Materials 25,000

Work in process 29,000

Finished goods 48,000

Materials purchased 154,000

Labor Costs:

Assembly workers’ wages 185,000

Supervisors’ salaries 30,000

Sales personnel salaries 52,000

Depreciation:

Factory building 73,000

Sales office 28,000

Indirect materials used 3,000

Factory utilities 67,000

a. Prepare a statement of cost of goods manufactured.

b. Determine the cost of goods sold for the month.

ANS:

(a)

Marwick Manufacturing Co.

Statement of Cost of Goods Manufactured

For the Month Ended January 31, 20--

Direct Materials:

Inventory, January 1 $25,000

Purchases 154,000

Total cost of available materials $179,000

Less inventory, July 31 20,000

Cost of materials used $159,000

Less indirect materials used 3,000

Cost of direct materials used in production $156,000

Direct labor 185,000

Factory overhead:

Indirect materials $ 3,000

Indirect labor (Supervisors) 30,000

Depreciation 73,000

Utilities 67,000

Total factory overhead 173,000

Total manufacturing cost $514,000

Add work in process inventory, January 1 29,000

Total $543,000

Less work in process inventory, January 31 32,000

Cost of goods manufactured during the month $511,000

(b)

Finished goods inventory, January 1 $48,000

Add cost of goods manufactured during July 511,000

Goods available for sale $559,000

Less finished goods inventory, January 31 54,000

Cost of goods sold $505,000

PTS: 1 DIF: Hard REF: P. OBJ: 5

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

11. Custom Cabinets Inc. manufactures goods on a job order basis. During the month of November, three

jobs were started. (There was no work in process at the beginning of the month.) Jobs 401 and 402

were completed and sold for $14,500 and $19,000, respectively, during the month; Job 403 was still in

process at the end of November.

The following data are taken from the job cost sheets for each job. Factory overhead charges include a

total of $900 of indirect materials and $600 of indirect labor. One work in process control account is

used.

Job 401 Job 402 Job 403

Direct materials $3,200 $3,800 $2,000

Direct labor 2,400 3,500 1,500

Factory overhead 1,250 2,000 850

Prepare a journal entry to record each of the following:

a. Materials used

b. Factory wages and salaries earned

c. Factory Overhead transferred to Work in Process

d. Jobs completed

e. Jobs sold

ANS:

(a)

Work in Process (3,200 + 3,800 + 2,000) 9,000

Factory Overhead 900

Materials 9,900

(b)

Work in Process (2,400 + 3,500 + 1,500) 7,400

Factory Overhead 600

Payroll 8,000

(c)

Work in Process (1,250 + 2,000 + 850) 4,100

Factory Overhead 4,100

(d)

Finished Goods 16,150

Work in Process* 16,150

* Jobs completed:

401 (3,200 + 2,400 + 1,250) $ 6,850

402 (3,800 + 3,500 + 2,000) 9,300

Total $16,150

(e)

Cost of Goods Sold 16,150

Finished Goods 16,150

Accounts Receivable (14,500 + 19,000) 33,500

Sales 33,500

PTS: 1 DIF: Moderate REF: P. OBJ: 7

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

12. The Shawshank Manufacturing Co. uses a job order cost system of accounting. The following

information was taken from the books of the company after all posting had been completed at the end

of January:

Jobs

Completed

Direct

Materials Cost

Direct

Labor Cost

Factory

Overhead

Units

Completed

101 $1,800 $2,000 $1,000 200

102 1,235 1,250 890 150

104 900 850 350 100

a. Prepare the journal entries to allocate the costs of materials, labor, and factory

overhead to each job and to transfer the costs of jobs completed to Finished Goods.

b. Compute the total production cost of each job.

c. Compute the unit cost of each job.

d. Compute the selling price per unit for each job, assuming a mark-on percentage of 40

percent.

ANS:

(a)

Work in Process--Job 101 1,800

Work in Process--Job 102 1,235

Work in Process--Job 104 900

Materials 3,935

Work in Process--Job 101 2,000

Work in Process--Job 102 1,250

Work in Process--Job 104 850

Payroll 4,100

Work in Process--Job 101 1,000

Work in Process--Job 102 890

Work in Process--Job 104 350

Factory Overhead 2,240

Finished Goods 10,275

Work in Process--Job 101 4,800

Work in Process--Job 102 3,375

Work in Process--Job 104 2,100

(b)

Jobs

Completed

Direct

Materials Cost

Direct

Labor Cost

Factory

Overhead

Total

Production

Cost

101 $1,800 $2,000 $1,000 $4,800

102 1,235 1,250 890 3,375

104 900 850 350 2,100

Total $3,935 $4,100 $2,240 $10,275

(c)

Unit Cost:

Job 101 ($4,800 / 200) $24.00

Job 102 ($3,375 / 150) $22.50

Job 104 ($2,100 / 100) $21.00

(d)

Selling Price Per Unit:

Job 101 ($24.00 40%) + $24.00 $33.60

Job 102 ($22.50 40%) + $22.50 $31.50

Job 104 ($21.00 40%) + $21.00 $29.40

PTS: 1 DIF: Hard REF: P. OBJ: 7

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

CHAPTER 2—ACCOUNTING FOR MATERIALS

MULTIPLE CHOICE

1. An effective cost control system should include:

a. An established plan of objectives and goals to be achieved.

b. Regular reports showing the difference between goals and actual performance.

c. Specific assignment of duties and responsibilities.

d. All of these are correct.

ANS: D

An effective cost control system should include an established plan of goals and objectives, reports

comparing budgeted goals to actual performance, and assignment of specific duties and responsibilities

to operating personnel.

PTS: 1 DIF: Easy REF: P. OBJ: Introduction

NAT: IMA 1C - Internal Controls TOP: AACSB - Analytic

2. To effectively control materials, a business must maintain:

a. Limited access.

b. Combination of duties.

c. Safety stock.

d. None of these are correct.

ANS: A

To control materials a business must maintain limited access, segregation of duties, and accuracy in

recording.

PTS: 1 DIF: Moderate REF: P. OBJ: 1

NAT: IMA 1C - Internal Controls TOP: AACSB - Analytic

3. Janet is the purchasing agent at Frameco Manufacturing. Her duties include vendor selection and

ordering materials. Due to a recent economic downturn and resulting cut backs, Janet has been

assigned the additional duty or preparing receiving reports after comparing the goods received to the

purchase order. This is an example of:

a. unlimited access to materials.

b. independence of assigned functions.

c. misappropriation of assets.

d. a lack of segregation of duties.

ANS: D

Because Janet’s job as a purchasing agent involves preparing the purchase orders and she is also

comparing items received to the purchase orders, there is a lack of segregation of duties. This

increases the potential for the misappropriation of assets, but there is not enough information given to

determine that a misappropriation has indeed occurred.

PTS: 1 DIF: Hard REF: P. OBJ: 1

NAT: IMA 1C - Internal Controls TOP: AACSB - Reflective

4. Marley Company hired a consultant to help improve its operations. The consultant’s report stated that

Marley’s inventory levels are excessive and cited several negative consequences to Marley as a result.

Which of the following was not cited in the report?

a. Possible other uses for working capital now tied up in inventory

b. Production stoppages due to parts not being available

c. Higher property taxes and insurance costs

d. Large quantities of obsolete materials

ANS: B

It is important to maintain inventories of sufficient size and variety to meet production needs.

However, if Marley’s inventories are excessive, it is likely that parts are available for production, but

the excess inventory is resulting in higher costs related to holding those items such as property taxes

and insurance and potential losses from obsolescence or deterioration. Funds invested in inventories

could be used for other purposes.

PTS: 1 DIF: Moderate REF: P. OBJ: 1

NAT: IMA 3A - Strategic Management TOP: AACSB - Reflective

5. The data used to calculate the order point include all of the following except:

a. the costs of placing an order.

b. the rate at which the material will be used.

c. the estimated time interval between the placement and receipt of an order.

d. the estimated minimum level of inventory needed to protect against stockouts.

ANS: A

Calculating an order point is based on usage, lead time and safety stock. The cost of placing an order

is used in determining the economic order quantity.

PTS: 1 DIF: Moderate REF: P. OBJ: 1

NAT: IMA 3A - Strategic Management TOP: AACSB - Reflective

6. Sully Company uses 3,000 yards of canvas each day to make tents. It usually takes ten days from the

time Sully orders the material to when it is received. If Sully’s desired safety stock is 12,000 yards,

what is Sully’s order point?

a. 12,000 yards

b. 21,000 yards

c. 30,000 yards

d. 42,000 yards

ANS: D

3,000 (daily usage) x 10 (lead time) 30,000

Safety stock 12,000

Order point 42,000

PTS: 1 DIF: Moderate REF: P. OBJ: 1

NAT: IMA 3A - Strategic Management TOP: AACSB - Analytic

7. What is the objective of the economic order quantity (EOQ) model for inventory?

a. To minimize order costs or carrying costs, whichever are higher

b. To minimize order costs or carrying costs and maximize the rate of inventory turnover

c. To minimize the total order costs and carrying costs over a period of time

d. To order sufficient quantity to economically meet the next period's demand

ANS: C

If the demand for the product can be determined because it is predictable, the essence of any EOQ

model for inventory is to minimize the total order costs and also minimize the total carrying costs.

PTS: 1 DIF: Easy REF: P. OBJ: 1

NAT: IMA 3A - Strategic Planning TOP: AACSB - Analytic

8. Order costs would include all of the following except:

a. Receiving clerk’s wages.

b. Storeroom keeper’s wages.

c. Purchasing department’s telephone bill.

d. Transportation in.

ANS: B

Costs related to the purchase and receipt of materials are considered order costs while costs related to

the storage and maintenance of materials are considered storage costs. The storeroom keeper’s wages

would be a storage cost.

PTS: 1 DIF: Moderate REF: P. OBJ: 1

NAT: IMA 3A - Strategic Management TOP: AACSB - Analytic

9. Expected annual usage of a particular raw material is 1,200,000 units, and standard order size is

10,000 units. The invoice cost of each unit is $145, and the cost to place one purchase order is $105.

The estimated annual order cost is:

a. $12,000.

b. $17,400.

c. $12,600.

d. $800,000.

ANS: C

Annual order cost = Number of orders Per order cost

= 1,200,000 units $105

10,000 units

= 120 orders $105

= $12,600

PTS: 1 DIF: Moderate REF: P. OBJ: 1

NAT: IMA 3A - Strategic Planning TOP: AACSB - Analytic

10. Carrying costs would include all of the following except:

a. Warehouse rent.

b. Inspection employees’ wages.

c. Losses due to obsolescence.

d. Property taxes.

ANS: B

Costs related to the purchase and receipt of materials are considered order costs while costs related to

the storage and maintenance of inventory are considered storage costs. Inspection would typically

happen upon receipt of goods making this an order cost.

PTS: 1 DIF: Moderate REF: P. OBJ: 1

NAT: IMA 3A - Strategic Planning TOP: AACSB - Analytic

11. The following data refer to various annual costs relating to the inventory of a single-product company

that requires 10,000 units per year:

Cost per unit

Order cost $ .05

Transportation-in on purchases .18

Storage .16

Insurance .10

Total per year

Interest that could have been earned on alternate investment of funds $800

What is the annual carrying cost per unit?

a. $ .21

b. $ .29

c. $ .34

d. $ .44

ANS: C

The carrying costs will consist of the per unit costs for storage, insurance, and interest on the inventory

investment.

Carrying costs:

Storage $.16

Insurance .10

Interest

=

$800

.08

Units required 10,000

Carrying costs $.34

PTS: 1 DIF: Hard REF: P. OBJ: 1

NAT: IMA 3A - Strategic Planning TOP: AACSB - Analytic

12. The following data pertains to Western Company’s materials inventory:

Number of pounds required annually 16,000

Cost of placing an order $20

Annual carrying cost per pound of material $4

What is Western Company’s EOQ?

a. 4,000 pounds

b. 800 pounds

c. 400 pounds

d. 200 pounds

ANS: C

= 400

PTS: 1 DIF: Hard REF: P. OBJ: 1

NAT: IMA 3A - Strategic Management TOP: AACSB - Analytic

13. Expected annual usage of a particular raw material is 180,000 units, and standard order size is 12,000

units. The invoice cost of each unit is $300, and the cost to place one purchase order is $80. Assuming

the company does not maintain safety stock, the average inventory is:

a. 10,000 units.

b. 7,500 units.

c. 15,000 units.

d. 6,000 units.

ANS: D

Average inventory = 12,000 (standard-size order)

2

= 6,000 units

PTS: 1 DIF: Moderate REF: P. OBJ: 1

NAT: IMA 3A - Strategic Planning TOP: AACSB - Analytic

14. Gedye Company has correctly computed its economic order quantity at 500 units; however,

management feels it would rather order in quantities of 600 units. How should Gedye's total annual

order cost and total annual carrying cost for an order quantity of 600 units compare to the respective

amounts for an order quantity of 500 units?

a. Higher total order cost and lower total carrying cost

b. Lower total order cost and higher total carrying cost

c. Higher total order cost and higher total carrying cost

d. Lower total order cost and lower total carrying cost

ANS: B

If orders were placed for 600 units instead of EOQ of 500 units, fewer purchase orders would have to

be placed to acquire the total units required for production, thereby reducing the total order cost.

However, due to the larger number of units ordered each time, the number of units stored would be

greater and a higher total carrying cost would result.

PTS: 1 DIF: Hard REF: P. OBJ: 1

NAT: IMA 3A - Strategic Planning TOP: AACSB - Reflective

15. The personnel involved in the physical control of materials includes all of the following except the:

a. Purchasing agent.

b. Receiving clerk.

c. Cost accountant.

d. Production department supervisor.

ANS: C

The cost accountant has the responsibility for the accounting records pertaining to inventory valuation

but not for the physical materials.

PTS: 1 DIF: Moderate REF: P. OBJ: 2

NAT: IMA 1C - Internal Controls TOP: AACSB - Reflective

16. The employee who is responsible for preparing purchase requisitions is most likely the:

a. Storeroom keeper.

b. Purchasing agent.

c. Production supervisor.

d. Receiving clerk.

ANS: A

The storeroom keeper is usually the employer responsible for preparing purchase requisitions when the

stock is running low to notify the purchasing agent that the inventory needs to be replenished.

PTS: 1 DIF: Moderate REF: P. OBJ: 2

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

17. Sam Jones works at Seeker, Inc. Sam’s duties include identifying where materials can be obtained

most economically, placing orders and verifying invoices and approving them for payment. Sam is

a(n):

a. receiving clerk.

b. accounts payable clerk.

c. purchasing agent.

d. production supervisor.

ANS: C

The duties described are those of a purchasing agent. The receiving clerk counts and identifies

materials received and prepares a receiving report. The accounts payable clerk is responsible for

issuing payment to vendors. The production supervisor is responsible for preparing materials

requisitions for materials needed for production.

PTS: 1 DIF: Moderate REF: P. OBJ: 2

NAT: IMA 2B - Cost Management TOP: AACSB Reflective

18. The form used to notify the purchasing agent that additional materials are needed is known as a:

a. Purchase order.

b. Vendor's invoice.

c. Receiving report.

d. Purchase requisition.

ANS: D

The storeroom keeper prepares a purchase requisition to notify the purchasing agent that additional

materials are needed.

PTS: 1 DIF: Easy REF: P. OBJ: 2

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

19. The form prepared by the purchasing agent and sent to the vendor to obtain materials is known as a:

a. Materials requisition.

b. Purchase requisition.

c. Purchase order.

d. Vendor's invoice.

ANS: C

The purchase order is prepared by the purchasing agent and sent to the vendor to order materials.

PTS: 1 DIF: Easy REF: P. OBJ: 2

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

20. A receiving report would include all of the following information except:

a. What the shipment contained.

b. The purchase order number.

c. The customer.

d. The date the materials were received.

ANS: C

It is unlikely the receiving report would contain the customer name; however, a listing of what the

shipment contained, the purchase order number and the date of the receipt would be necessary

information used in matching the receiving report to the vendor’s invoice and the purchase order.

PTS: 1 DIF: Moderate REF: P. OBJ: 2

NAT: IMA 2B - Cost Management TOP: AACSB - Reflective

21. Listed below are steps of purchasing and receiving materials:

1. The receiving clerk prepares a receiving report.

2. Purchase requisitions are prepared to notify the purchasing agent that additional

materials are needed.

3. The purchase of merchandise is recorded by the accounting department.

4. The purchasing agent completes a purchase order.

In which order would these events typically happen?

a. 4, 2, 3, 1

b. 2, 4, 3, 1

c. 2, 4, 1, 3

d. 4, 2, 1, 3

ANS: C

The storeroom keeper will prepare a purchase requisition to notify the purchasing agent that additional

materials are needed. The purchasing agent will then complete a purchase order and send it to the

vendor. When the goods are received, the receiving clerk will prepare a receiving report which is

compared to the vendor’s invoice and the purchase order. At that time, the accounting department will

record the purchase of the inventory items in the general ledger.

PTS: 1 DIF: Moderate REF: P. OBJ: 2

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

22. The duties of the purchasing agent would include all of the following except:

a. Placing purchase orders.

b. Counting and identifying materials received.

c. Compiling information that identifies vendors and prices.

d. Verifying invoices and approving them for payment.

ANS: B

The receiving clerk is responsible for counting and identifying the materials received.

PTS: 1 DIF: Moderate REF: P. OBJ: 2

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic

23. The form that serves as authorization to withdraw materials from the storeroom is known as the:

a. Materials requisition.

b. Purchase order.

c. Purchase requisition.

d. Returned materials report.

ANS: A

The materials requisition is prepared by the production department supervisor or an assistant and is

presented to the storeroom keeper as authorization for the withdrawal of materials.

PTS: 1 DIF: Easy REF: P. OBJ: 2

NAT: IMA 1C - Internal Controls TOP: AACSB - Analytic

24. If a company receives a larger quantity of goods than had been ordered and keeps the excess for future

use, a(n)______________ is prepared to notify the vendor of the amount of increase to accounts

payable in the invoice.

a. credit memorandum

b. return shipping order

c. debit memorandum

d. additional purchase order

ANS: A

A Debit or credit memorandum may be issued when the shipment of materials does not match the

purchase order and the invoice. In this case, since more materials than ordered and billed were

received, the company would issue a credit memorandum to increase accounts payable.

PTS: 1 DIF: Moderate REF: P. OBJ: 2

NAT: IMA 2B - Cost Management TOP: AACSB - Analytic