Financial Accounting > EXAM > MGAB03 Managerial Accounting – Midterm Exam Review Q&As (All)

MGAB03 Managerial Accounting – Midterm Exam Review Q&As

Document Content and Description Below

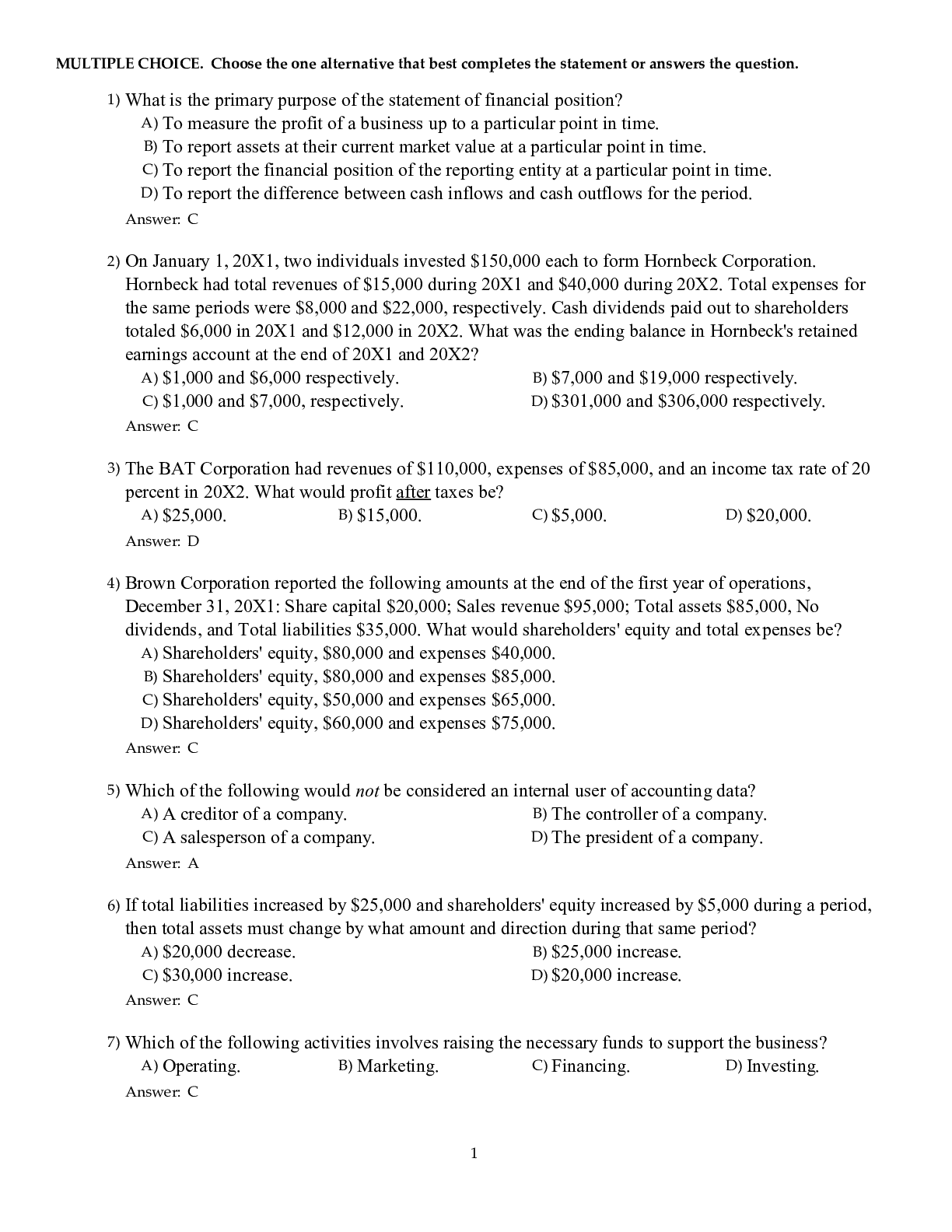

Question 1: Contribution Margin vs. Gross Margin FongFone Ltd. manufactures cell phones, which are priced at $250. Mr. Fong, the president of FongFone, has come to you for help in terms of the compa ... ny’s cost structure. You are troubled because the data produced by the accounting system of FongFone do not distinguish between variable and fixed costs. After some analysis, you have identified various cost behaviour patterns. You have determined that the margin of safety is $75,000 and sales in break-even units are 2,700; your analysis was made easier by the fact that it is FongFone’s policy not to carry any inventories. Instead, the company finishes pending orders sometime in December and gives employees vacations that end in early January of the following year. You have also collected the following information for the 2017 fiscal year: 2017 Direct labour $ 170,000 Direct material 210,000 Variable manufacturing overhead 80,000 Gross margin % 22.50% Contribution margin % 30.00% Income Tax Rate 25.00% REQUIRED: A. Calculate the following costs for 2017: 1. Sales in dollars 2. Variable Selling and Administrative Expenses 3. Fixed Manufacturing Overhead 4. Fixed Selling and Administrative Expenses 5. Earnings (Income) Before Taxes B. Determine the sales volume in dollars and in units that FongFone must achieve to earn a $36,000 income after taxes. Calculate the degree of operating leverage. If sales increase by 8%, what is the impact on the operating income? Question 2: Traditional Costing, Cost Hierarchy Classification, ABC Costing, ABM Weston Ltd., manufactures two models of automotive parts – LD and XD. Weston has been using the normal costing based on machine hours to allocate manufacturing overhead. Last year, the manufacturing overhead was $960,000, and machine hours used were 40,000 hours. Fortyfive percent of the machine hours were done for LD. Weston produced 12,000 units of LD, and 8,000 units of XD. Weston is concerned that their costs may be too high for XD, as XD is priced higher than their main competitor, and the sales volume is significantly lower than LD. The sales manager is discussing with the production manager and the cost accountant to see if there is another way to cost the manufacturing overhead. The cost accountant suggests using ABC costing, and gathers the following information from the production manager: Activity Cost Cost Driver LD XD Product design $ 210,000 number of designs 125 175 Equipment setup 180,000 number of setups 500 700 Machine process 500,000 number of units 12,000 8,000 Inspection & testing 70,000 number of inspections 220 180 $ 960,000 REQUIRED: A. Identify the cost hierarchy level for each activity. B. What is the overhead rate based on the machine hours? How much total overhead cost was allocated to LD and XD? What is the unit overhead cost for LD and XD? C. What is the overhead rate for each activity, using ABC costing? How much total overhead cost was allocated to LD and XD? What is the unit overhead cost for LD and XD? D. Comparing the findings from (B) and (C), what should Weston do to address the costing issue of XD? Provide explanations to support your recommendations. [Show More]

Last updated: 3 years ago

Preview 1 out of 11 pages

Buy this document to get the full access instantly

Instant Download Access after purchase

Buy NowInstant download

We Accept:

Reviews( 0 )

$10.00

Can't find what you want? Try our AI powered Search

Document information

Connected school, study & course

About the document

Uploaded On

Jul 14, 2022

Number of pages

11

Written in

All

Additional information

This document has been written for:

Uploaded

Jul 14, 2022

Downloads

0

Views

216