Accounting_exam_2.docm.pdf

Document Content and Description Below

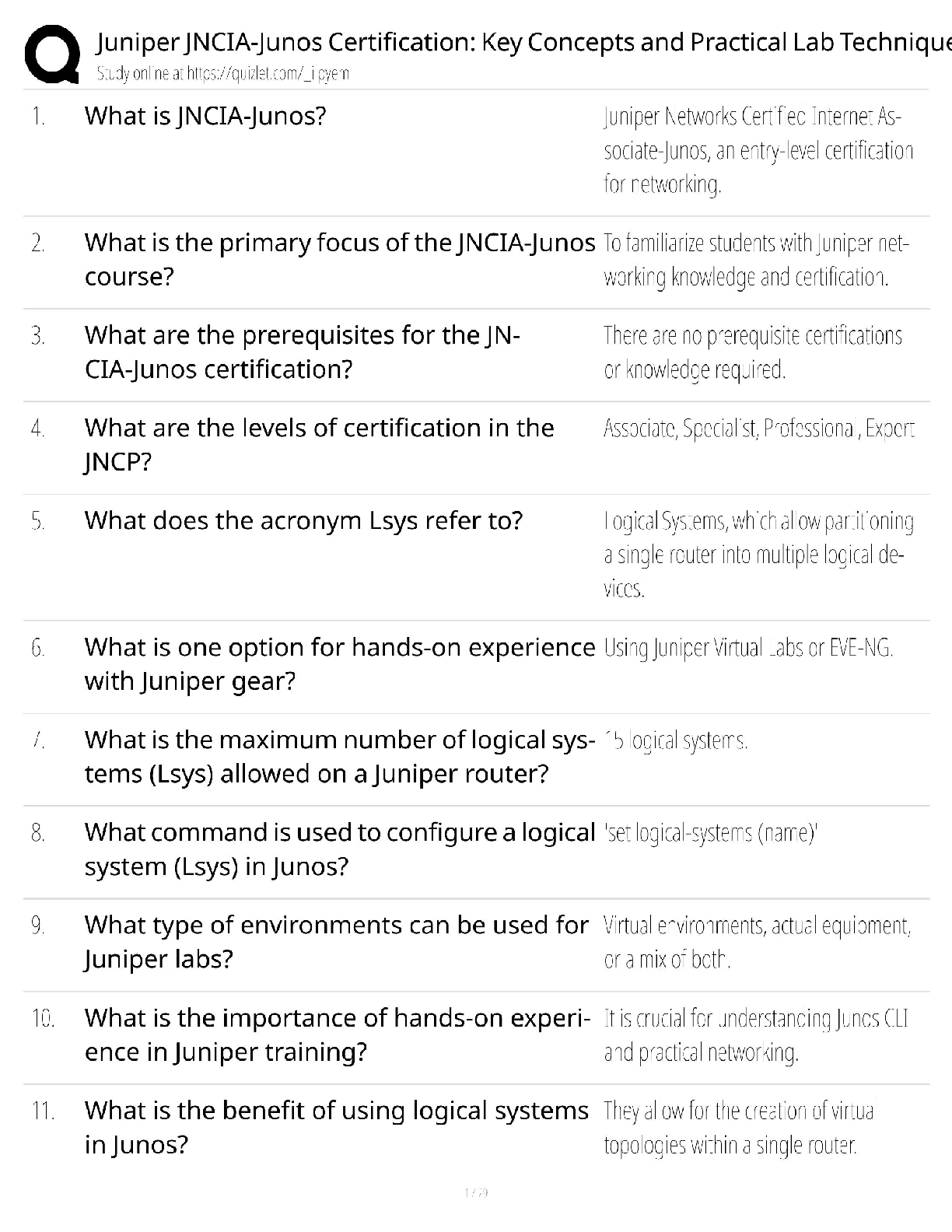

Prepare journal entries to record the following merchandising transactions of Cabela’s,

which uses the perpetual inventory system and the gross method. (Hint: It will help to

identify each receiva

...

ble and payable; for example, record the purchase on July 1 in

Accounts Payable—Boden.)

L'Oréal reports the following income statement accounts for the year ended December 31, 2014 (euros in millions).

Net profit € 5,137.4 Income tax expense € 1,163.0

Finance costs 32.6 Profit before tax expense 6,300.4

Net sales 23,282.0 Research and development expense 792.4

Gross profit 16,480.1 Selling, general and administrative expense 4,908.1

Other income 2,148.0 Advertising and promotion expense 6,638.1

Cost of sales 6,801.9 Finance income 43.5

L’Oréal

Income Statement (€ millions)

For Year Ended December 31, 2014

Net sales €23,282.0

Cost of sales 6,801.9

Gross profit 16,480.1

Research and development expense (792.4)

Advertising and promotion expense (6,638.1)

Selling, general and administrative expense (4,908.1)

Finance costs (32.6)

Finance income 43.5

Other income 2,148.0

Profit before tax expense 6,300.4

Income tax expense 1,163.0

Net profit €5,137.4

Prepare the income statement for this company for the year ended December 31, 2014, following usual IFRS

practices. (Enter your answers in millions. Amounts to be deducted should be indicated by a

minus sign. Round your answers to 1 decimal place.)

3.)

Chico Company allows its customers to return merchandise within 30 days of purchase.

At December 31, 2017, the end of its first year of operations, Chico estimates

future-period merchandise returns of $67,000 (cost of $26,000) related to its

2017 sales.

On January 3, 2018, a customer returns merchandise with a selling price of

$2,350 for a cash refund; the returned merchandise cost $820 and is returned

to inventory as it is not defective.

No Date General Journal Debit Credit

1 Dec 31 Sales returns and allowances 67,000

Sales refund payable 67,000

2 Dec 31 Inventory returns estimated 26,000

Cost of goods sold 26,000

3 Jan 03 Sales returns and allowances 2,350

Cash 2,350

4 Jan 03 Merchandise inventory 820

Cost of goods sold 820

This study source was downloaded by 100000849331226 from CourseHero.com on 07-04-2022 16:14:47 GMT -05:00

https://www.coursehero.com/file/34043264/Accounting-exam-1docm/a. Prepare the December 31, 2017, year-end adjusting journal entry for estimated future sales

returns and allowances (revenue side).

b. Prepare the December 31, 2017, year-end adjusting journal entry for estimated future

inventory returns and allowances (cost side).

c. Prepare the January 3, 2018, journal entry(ies) to record the merchandise returned.

4.)

Med Labs has the following December 31, 2017, year-end unadjusted balances: Allowance for Sales

Discounts, $0; and Accounts Receivable, $5,800. Of the $5,800 of receivables, $1,400 are within a 3%

discount period, meaning that it expects buyers to take $42 in future-period discounts arising from this

period's sales.

a. Prepare the December 31, 2017, year-end adjusting journal entry for future sales discounts.

b. Assume the same facts above and that there is a $8 year-end unadjusted credit balance in the

Allowance for Sales Discounts. Prepare the December 31, 2017, year-end adjusting journal entry for

future sales discounts.

No Date General Journal Debit Credit

1 Dec 31 Sales discounts 42

Allowance for sales discounts 42

2 Dec 31 Sales discounts 34

Allowance for sales discounts 34

c. Is allowance for sales discounts a contra asset or a contra liability account?

A contra liability account

A contra asset account: Correct

5.)

[Show More]

Last updated: 3 years ago

Preview 1 out of 6 pages