Laker Company reported the following January purchases and sales data for its only product.

Date

Jan. 1 Beginning inventory $840

Jan. 10 Sales 100 units @ $15.00 = $1,500

Jan. 20 Purchase 300

Jan. 25 Sales 80 units

...

Laker Company reported the following January purchases and sales data for its only product.

Date

Jan. 1 Beginning inventory $840

Jan. 10 Sales 100 units @ $15.00 = $1,500

Jan. 20 Purchase 300

Jan. 25 Sales 80 units @ $15.00 = $1,200

Jan. 30 Purchase 810

380 units $1,950 180 units $2,700

60 units @ $5.00 =

180 units @ $4.50 =

Activities Units Acquired at Cost Units sold at Retail

140 units @ $6.00 =

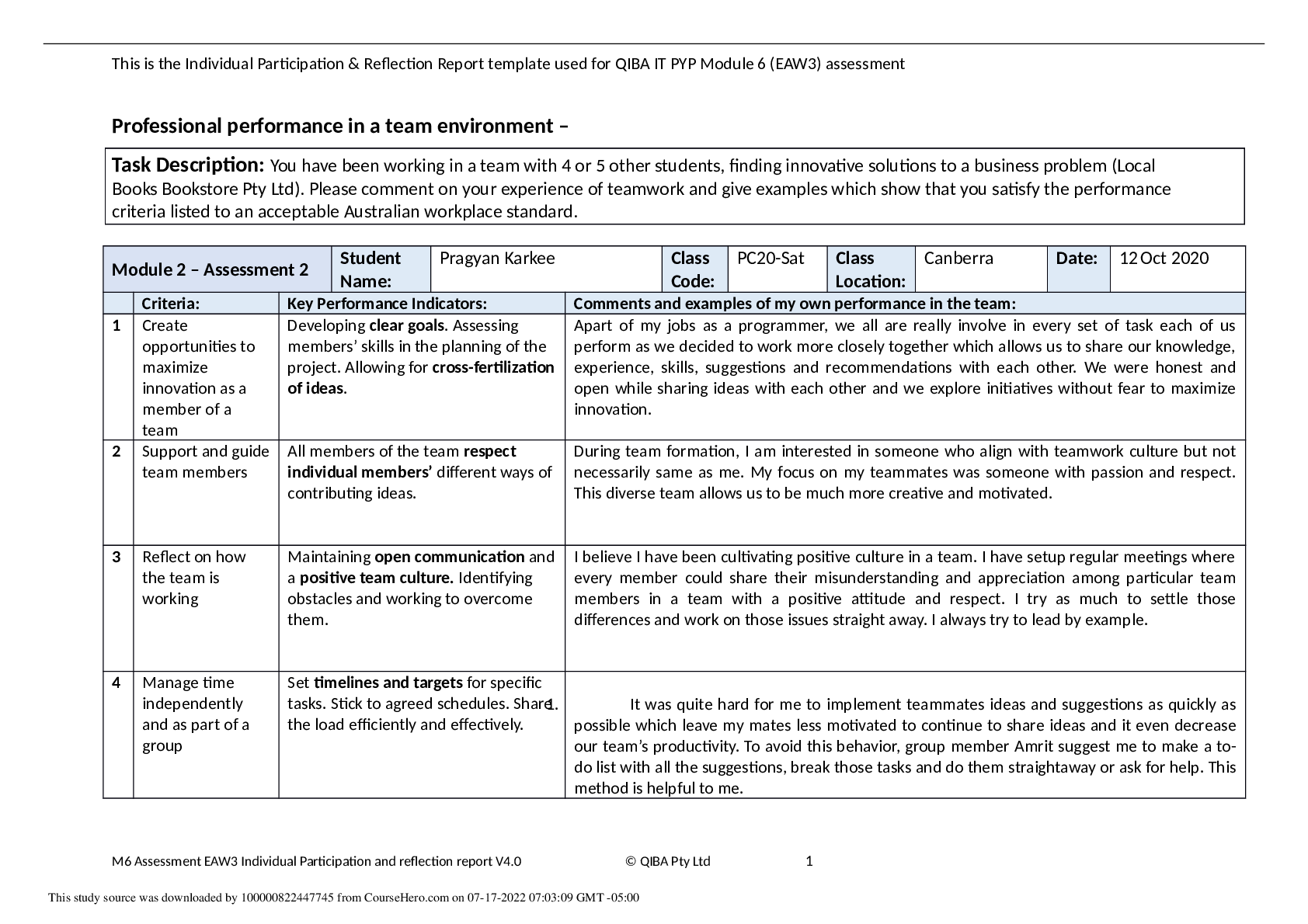

Laker uses a perpetual inventory system. Complete comparative income statements for the month of January for Laker

Company for the four inventory methods. Assume expenses are $1,250, and that the applicable income tax rate is 40%.

For specific identification, ending inventory consists of 200 units, where 180 are from the January 30 purchase, 5 are from

the January 20 purchase, and 15 are from the beginning inventory.

Exercise

5-‐4

5-2

Date

Jan. 1 Beginning inventory $840

Jan. 10 Sales 100 units @ $15.00 = $1,500

Jan. 20 Purchase 300

Jan. 25 Sales 80 units @ $15.00 = $1,200

Jan. 30 Purchase 810

380 units $1,950 180 units $2,700

60 units @ $5.00 =

180 units @ $4.50 =

For specific identification, ending inventory consists of 200 units, where 180 are from the January 30 purchase,

5 are from the January 20 purchase, and 15 are from beginning inventory.

Activities Units Acquired at Cost Units sold at Retail

140 units @ $6.00 =

Date Activity Units Unit

Cost

Units

Sold

Unit

Cost

COGS Ending

Inventory

Units

Cost per

Unit

Ending

Inventory

Cost

Jan. 1 Beg. Inv. 140 $6.00 125 $6.00 $750 15 $6.00 $90

Jan. 20 Purchase 60 $5.00 55 $5.00 275 5 $5.00 25

Jan. 30 Purchase 180 $4.50 0 $4.50 0 180 $4.50 810

$1,025 $925

Specific identification.

Available for Sale Cost of Goods Sold Ending Inventory

Specific Weighted

Identification Average FIFO LIFO

Sales $2,700

Cost of goods sold 1,025

Gross profit 1,675

Operating expenses 1,250

Income before tax 425

Income tax expense (40%) 170

Net income $255

Income Statements

For Month Ended January 31

Laker Company

Exercise

5-‐4

5-3

Date # of units Cost per

unit

Inventory

Value

Units

Sold

Unit

Cost

COGS

Beginning inventory 140 $6.000 $840

Sale - Jan. 10 (100) $6.000 (600) 100 $6.000 $600

Subtotal Average Cost 40 $6.000 240

Purchase - January 20 60 $5.000 300

Subtotal Average Cost 100 $5.400 540

Sale - Jan. 25 (80) $5.400 (432) 80 $5.400 432

Subtotal Average Cost 20 $5.400 108

Purchase - January 30 180 $4.500 810

Total 200 $4.590 $918 180 $1,032

Weighted average

Inventory on hand Cost of Goods Sold

Date

Jan. 1 Beginning inventory $840

Jan. 10 Sales 100 units @ $15.00 = $1,500

Jan. 20 Purchase 300

Jan. 25 Sales 80 units @ $15.00 = $1,200

Jan. 30 Purchase 810

380 units $1,950 180 units $2,700

60 units @ $5.00 =

180 units @ $4.50 =

Activities Units Acquired at Cost Units sold at Retail

140 units @ $6.00 =

Specific Weighted

Identification Average FIFO LIFO

Sales $2,700 $2,700

Cost of goods sold 1,025 1,032

Gross profit 1,675 1,668

Operating expenses 1,250 1,250

Income before tax 425 418

Income tax expense (40%) 170 167

Net income $255 $251

Income Statements

For Month Ended January 31

Laker Company

Exercise

5-‐4

5-4

Available for Sale

Date Units Unit

Cost

Units

Sold

Unit

Cost

COGS Units

Sold

Unit

Cost

COGS Units in

Ending

Inventory

Unit

Cost

Ending

Inventory

Value

Beginning Inv. 140 $6.00 100 $6.00 $600 40 $6.00 $240 0 $6.00 $0

Purchases:

Jan. 20 60 $5.00 40 $5.00 200 20 $5.00 100

Jan. 30 180 $4.50 180 $4.50 810

$600 $440 200 $910

Cost of Goods Sold - January 10 Cost of Goods Sold - January 25 Ending Inventory

Perpetual FIFO

Date

Jan. 1 Beginning inventory $840

Jan. 10 Sales 100 units @ $15.00 = $1,500

Jan. 20 Purchase 300

Jan. 25 Sales 80 units @ $15.00 = $1,200

Jan. 30 Purchase 810

380 units $1,950 180 units $2,700

60 units @ $5.00 =

180 units @ $4.50 =

Activities Units Acquired at Cost Units sold at Retail

140 units @ $6.00 =

Specific Weighted

Identification Average FIFO LIFO

Sales $2,700 $2,700 $2,700

Cost of goods sold 1,025 1,032 1,040

Gross profit 1,675 1,668 1,660

Operating expenses 1,250 1,250 1,250

Income before tax 425 418 410

Income tax expense (40%) 170 167 164

Net income $255 $251 $246

[Show More]

.png)